Summary

- Gold prices have corrected to $3000 per ounce, but are expected to rise to $4000 by 2025 due to economic uncertainties and potential Fed easing.

- Trump’s tariffs and geopolitical tensions are causing market volatility, which is bearish in the short term, but bullish for gold in the mid to long term.

- Higher tariffs can lead to inflation and economic crises, prompting the Fed to ease monetary policies, which will support gold prices.

- Despite short-term volatility, gold has substantial upside potential due to the Fed’s potential quantitative easing and the economic impact of tariffs.

Anthony Bradshaw

A lot has happened since my last article about gold even though it was only written in March this year. President Trump’s tariffs have only gotten worse; gold has risen past $3150 per ounce, only to correct to about $3000 as I am writing this. But are Trump’s tariffs and rising geopolitical uncertainty ahead so bearish for the prices of gold?

In my view, just the opposite is true in the mid-to-long term. The more likely the U.S. economy will enter an economic crisis in the near future, the more likely the gold prices will soar thanks to the Fed’s money printing and the government’s fiscal stimuli. But let me talk more of the upside and downside factors. I will also explain how I came up with a price target of $4000 per ounce in 2025.

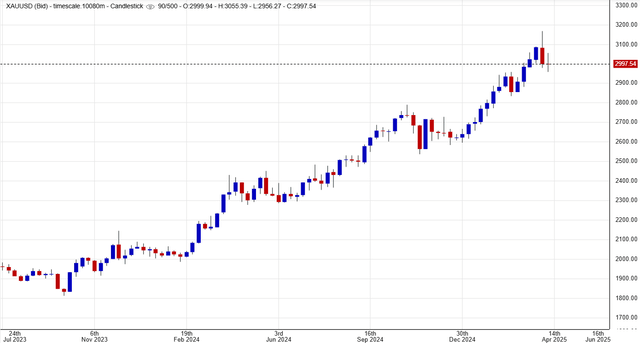

Gold’s wonderful rally and its short-term correction

Goldprice.org

Gold prices have decreased due to stock market volatility caused by higher tariffs and rising geopolitical tensions between the U.S. and China. However, I believe this is a short-term correction that can be used to build a bigger position in gold. I will explain why this has happened and why gold prices will only rise.

Trump’s tariffs—what do they mean for the U.S. economy

This Monday, rumors about a potential trade war pause quickly disappeared after Trump threatened to raise tariffs on Chinese imports by another 50% unless China canceled retaliatory duties. Last week the Chinese government imposed a 34% tariff on American imports due to Trump announcing his list of so-called “reciprocal tariffs.” Soon after that, China’s Commerce Ministry protested against the US threat of increasing tariffs and promised to take countermeasures to protect China’s own rights and interests. That is why since this Monday the asset markets all over the world have been trading in the red.

The new tariffs were in addition to the escalating trade relations between the US and other countries. So far, since Trump’s January inauguration, the US has imposed tariffs on goods from Canada, Mexico, and China. But why exactly did the markets start panicking? After all, not just gold and precious metals have depreciated, but most of the global stock indices have reacted negatively to the rising tariffs.

To start with, tariffs discourage multilateral trade and lead to geopolitical uncertainty. The deteriorating international relations between two superpowers, namely China and the U.S., mean that an economic conflict can expand to a political one. For example, there are tensions around Taiwan that can possibly intensify, thus expanding to a military conflict.

Then, higher tariffs on Chinese goods would discourage Chinese companies from supplying their products to the U.S. Even if they continue selling goods to U.S. consumers, then the demand for these will decrease to multi-year lows thanks to the substantially higher prices. For example, 50% tariffs mean that the very same Chinese products would cost U.S. consumers 50% more. This is even more the case, given the fact Chinese goods generally do not have a reputation for exclusive quality. Instead, many people buy them because of their low prices. But despite falling demand for Chinese goods, the tariff hike would still lead to a rise in the general price level, thus raising official inflation readings.

The U.S. is not self-sufficient, and most of its GDP is due to the services sector. For example, in 2021, the agricultural sector contributed less than one percent to the U.S. GDP. In that same year, 17.61% came from the manufacturing sector, while the services sector contributed a whopping 76.4% to the U.S. GDP.

The U.S. is the largest importing nation. In January 2025 U.S. exported $164 billion and imported $317 billion, leading to a negative trade balance of $153 billion. Between January 2024 and January 2025, U.S. exports have risen by $3.35 billion or 2.08%, from $161 billion to $164 billion, while imports increased by a whopping $63.5 billion or 25%, from $254 billion to $317 billion. One of the reasons why Trump keeps raising tariffs is because of the U.S. negative trade balance with other nations.

The U.S.’s largest trading partners are Mexico, Canada, and China. So, fewer imported goods from these countries substantially decrease consumer choice, thus worsening consumers’ living quality. It is highly unlikely the U.S. manufacturers would be able to compensate for the imported production. All this leads to uncertainty, thus raising the demand for safe-haven investments, namely precious metals.

Consequences of higher tariffs for gold

As follows from my inflation argument, higher tariffs can lead to the Fed’s tighter monetary policies, which is bearish for gold. However, higher rates for longer provoke economic crises, which is a big plus for the prices of gold in the long run.

But would higher tariffs really lead to rising inflation before provoking a recession? After all, reciprocal tariffs make the economies of all the countries involved struggle. U.S. companies also suffer because of China imposing tariffs on U.S. goods. In fact, some U.S. companies involved can make their employees redundant. That is because the businesses would not need to produce as many goods due to the Chinese markets becoming much less profitable. Also, some companies might even go bankrupt as a result, thus further contributing to unemployment and therefore lower consumer demand. If all that happens, then the Fed would probably have to ease faster than planned. This would make gold prices soar.

However, in the short term, gold is likely to stay negatively affected by extra market volatility and the general selloffs. When there are market selloffs, the USD strengthens, which is a negative for the prices of both gold and silver. But as I have mentioned above, in the middle to long term, gold has substantial upside potential.

Price target for gold

Now, how have I come up with a price target of $4000 for an ounce of gold?

Since January 2024, gold prices have risen from $2000 per ounce to $3150 in March this year. So, it took gold about a year to appreciate by $1000.

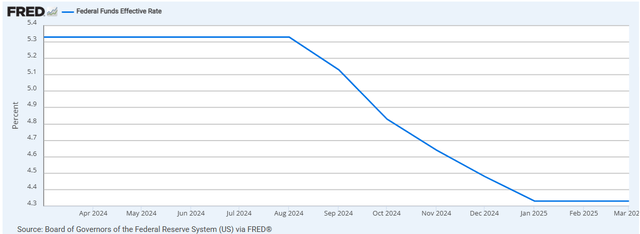

But apart from market volatility, what has made gold prices rise by so much? Well, it was the change of the monetary course by the Federal Reserve.

The interest rates have decreased by one percent over the period, namely from 5.3% to 4.3%.

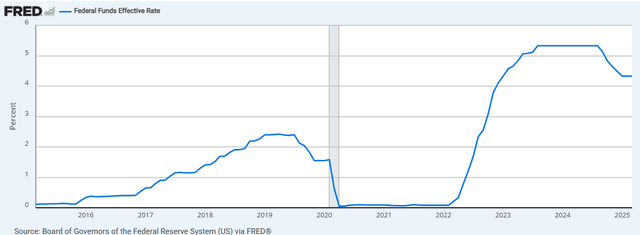

However, this is not as significant if we see the interest rate history. In 2019, the interest rates were just over 2%. During the pandemic between 2020 and 2022, the interest rates were pegged to 0%.

Even though the principal policy change in 2024 was important, the rate cut was not impressive in itself. Moreover, the Fed only promised to slow its pace of balance sheet reduction during the March 2025 meeting. In plain terms, it only means less quantitative tightening (QT). So, provided the Fed keeps easing its monetary policies and even starts its quantitative easing (QE) program, more gains can be seen by gold prices.

Since 2024, gold prices have risen by 50%, from $2000 per ounce to about $3000 per ounce. If they rise by another $1000 to $4000 in 2025, the gain will only total 33% or a third. So, under the easing scenario, this is quite a conservative price target.

Conclusion

Gold prices have decreased temporarily, only to rally further in 2025, in my opinion. Tariffs are likely to provoke an economic crisis, thus making the Fed ease. The Fed has neither decreased the rates significantly nor started its quantitative easing program. So, a large arsenal of measures to support the U.S. economy is still available to the Fed.

Written by Anna Sokolidou

A research analyst and a freelance writer looking for value investment opportunities. I have several years of investing experience. I am mostly interested in writing about bargain stocks of large companies. My interest is not limited to American companies but extends to firms operating in other countries but listed on US stock exchanges.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Shared by Golden State Mint on GoldenStateMint.com