Setting up a Precious Metals IRA to Purchase Silver or Gold

A Precious Metals IRA is an IRA in which you can direct the account to be invested into physical precious metals, such as gold and silver, however, most Banks and Brokerage firms do not hold Precious Metals IRA. Golden State Mint works with various administrators of Precious Metals IRAs for our clients. The IRS prohibits retirement plans from purchasing any type of collectible, including coins. However, precious metals including silver or gold, with a fineness of .999 are eligible investments inside a retirement account. Silver and Gold can be purchased in round, bar or coin form as well as in bullion form. Golden State Mint offers many products that meet the specified IRS guidelines.

|

|

|

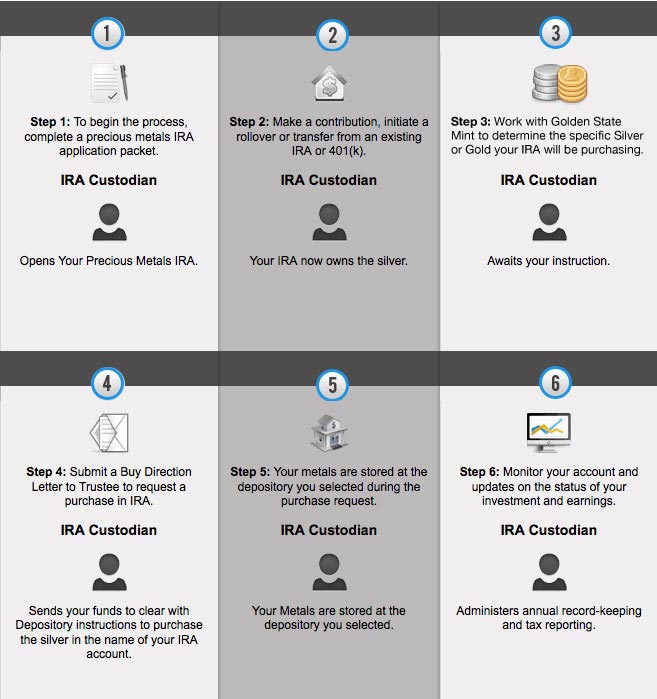

Steps to Opening a Precious Metals IRA

Follow this simple, step-by-step process, and you’ll be on your way to saving precious metals!

Buying Silver & Gold for IRA

For the average investor, silver and gold can be an effective means of diversifying investment assets and preserving wealth against the ravages of inflation. Although the value of these metals may vary, it has an intrinsic value that is immutable and permanent. Accordingly, many experts suggest that investors should include it among their investment assets and as such, many financial advisors would recommend diversifying 10% of your retirement portfolio into precious metals.

Through most banks and brokerages, retirement account holders only options to invest in gold and silver is through ETFs or stock purchases in mining companies. While those investments may move in a similar range with the price of physical metals, they are considered a paper asset and do not represent the physical ownership of the metals, nor could you take delivery of the metals (Unless you own over $100,000 of shares of the ETF). By establishing a Precious Metals IRA, the account holder can direct the account into Physical Silver & Gold – instead of a paper based investment!

All silver and gold rounds and bars minted by the Golden State Mint are IRA Approved/ Certified. Gold and silver bullion rounds and bars are a safe, low cost and convenient way to own precious metals. Rounds and bars are easy to buy, sell, count and stack. They are especially convenient when measured against coin investments. When measured against silver & gold coins, they have the same weight and purity, but can be bought for a much lower premium. Since IRA accounts are based upon the intrinsic value of the silver and gold, the additional premium paid for coins will never be reflected or gained. It will simply be lost funds.