Gold and silver deliveries on the Comex have surged since March 2020. While delivery volume in 2021 and 2022 are below the massive amount seen in 2020, overall volume is very elevated compared to pre-Covid levels.

This analysis focuses on gold and silver within the Comex/CME futures exchange. See the article What is the Comex? for more detail. The charts and tables below specifically analyze the physical stock/inventory data at the Comex to show the physical movement of metal into and out of Comex vaults.

Registered = Warrant assigned and can be used for Comex delivery, Eligible = No warrant attached – owner has not made it available for delivery.

Current Trends

Delivery activity is tracked monthly and recently showed a major surge in volume for August gold.

A “delivery” on the Comex means that a trader is short a futures contract but (presumably) holds physical metal at the Comex with a warrant assigned. This warrant is reassigned to a long contract holder when they “take delivery” by making their intentions known and then posting the full amount of the contract based on the bar weight (not all bars are exactly 100oz).

Current margin requirements are $6,500 for every 100 ounces of gold (about 3.5%). Thus, when someone takes delivery, they post the remaining $173.5k and the warrant becomes theirs, but the metal stays within a Comex vault. To take physical delivery, the warrant holder must then arrange to load out the metal. Otherwise, the metal stays within a Comex vault, and the holder is charged storage fees.

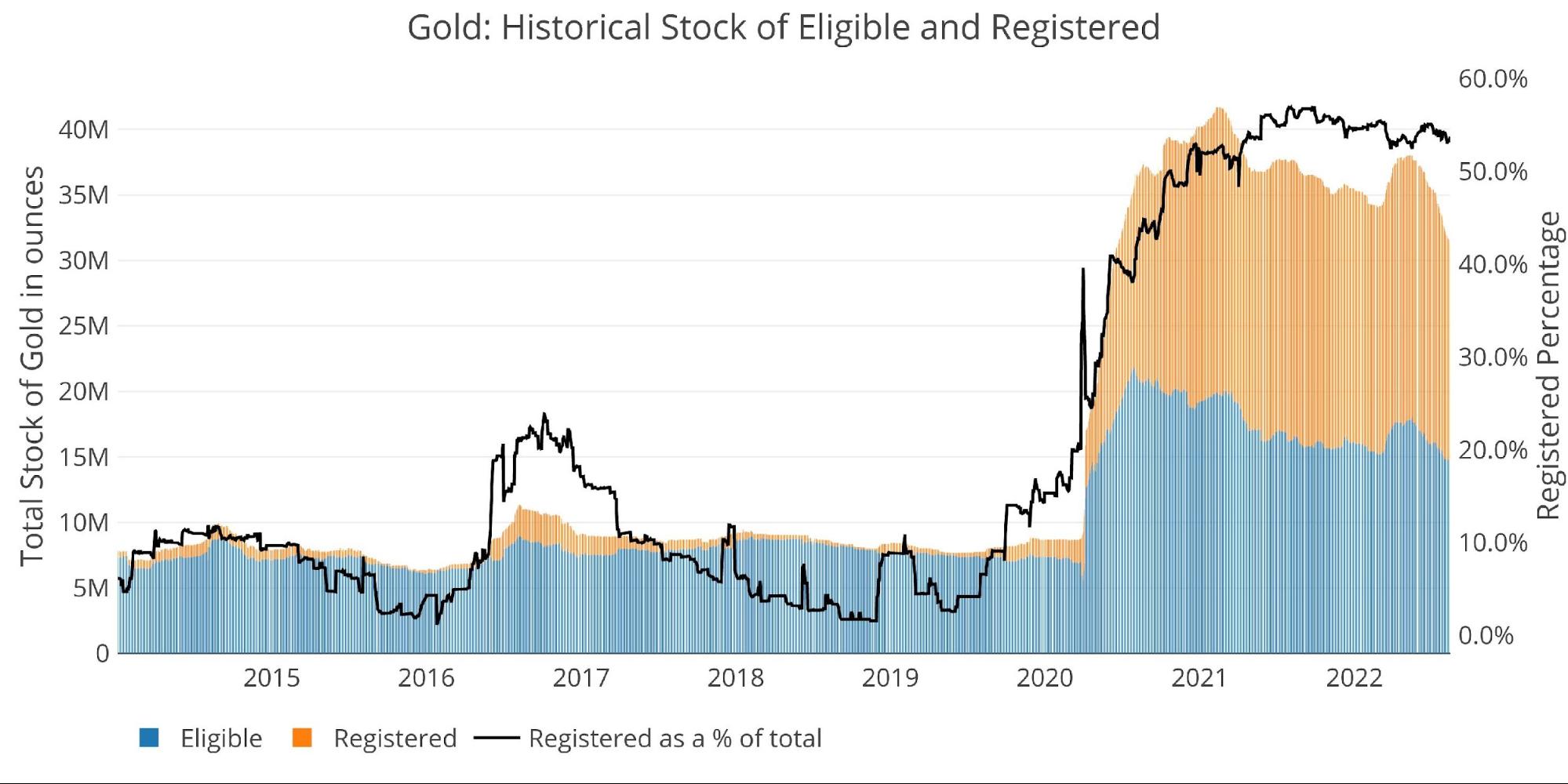

While Comex deliveries have been very elevated for over two years, most of the metal was going back and forth within the Comex vaults. There was not a major extraction of metal. In fact, at the beginning of Covid, a dislocation in the market brought a massive surge of inventory into Comex gold vaults (see figure 1 below), even while delivery volume was breaking records.

In 2021, gold did start physically moving out of the vault, albeit from much higher stock levels. After a decent amount was extracted, there was then an inventory surge during the Ukraine/Russia crisis to replenish stock. However, that surge has been completely undone and inventories are now well below where they were before May, though well above pre-Covid levels. Since May 2022, total inventories are down 17.7% and down 24.9% since February 2021. The past few months have seen a major acceleration of gold leaving the Comex. This is shown below with the big spike down on the right side.

Figure: 1 Historical Eligible and Registered

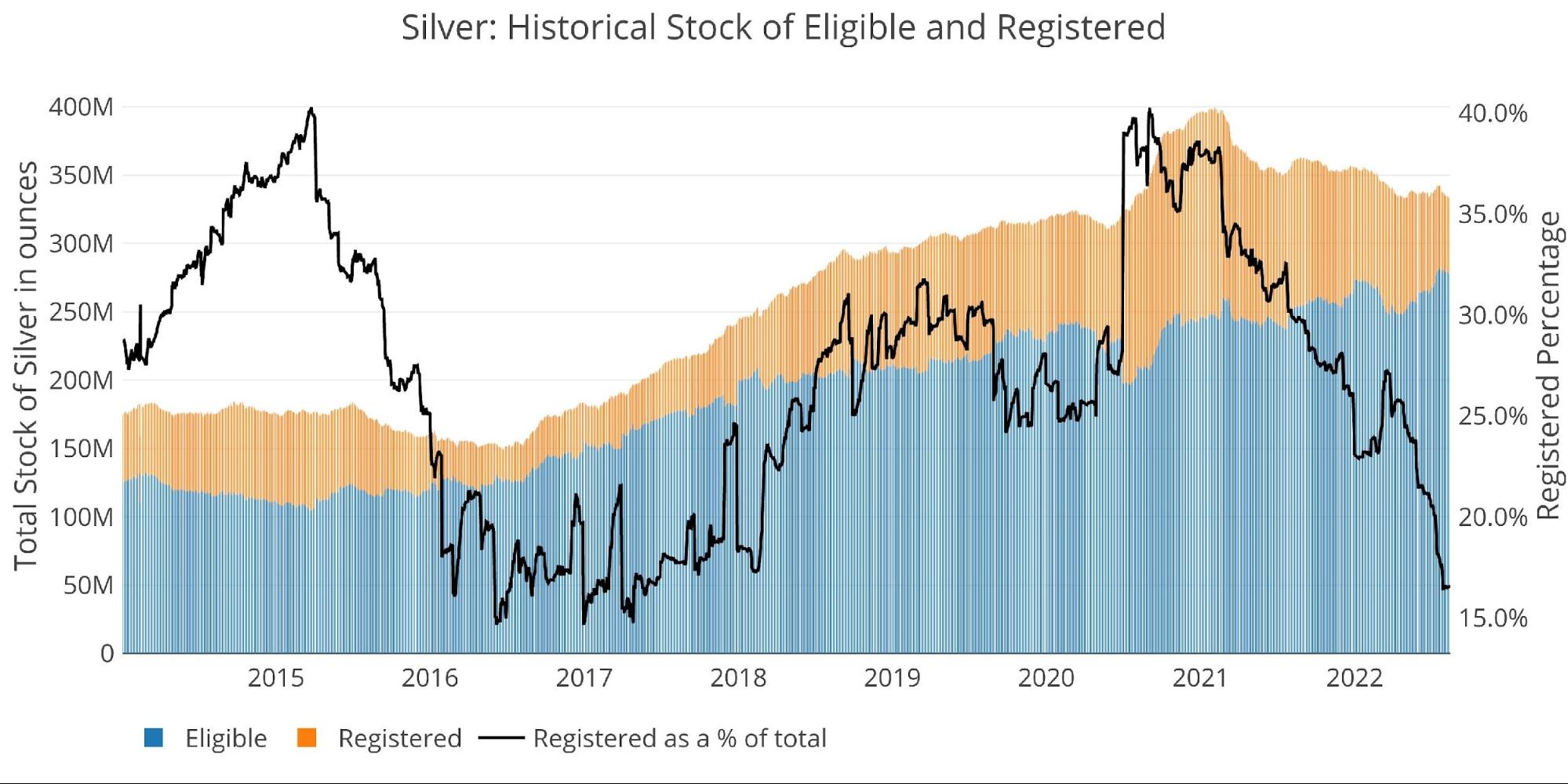

Silver is also seeing a major change in inventory. Unlike gold, the metal has not yet started leaving the Comex system in droves, but the amount of Registered has fallen off a cliff (Registered is metal available for delivery). Silver Registered is down 41% since March 15, 2022, and down 65.7% since Feb 4, 2021, which was the start of the Reddit Silver Squeeze last year.

This is a massive drawdown in metal available for delivery. For now, the metal is staying in the Comex vaults, but if gold is a leading indicator, metal might start leaving Eligible in a big way. As can be seen below, the amount of Registered has fallen to 16.6%, down from 40% in 2020. This is the lowest ratio since June 2017.

Figure: 2 Historical Eligible and Registered

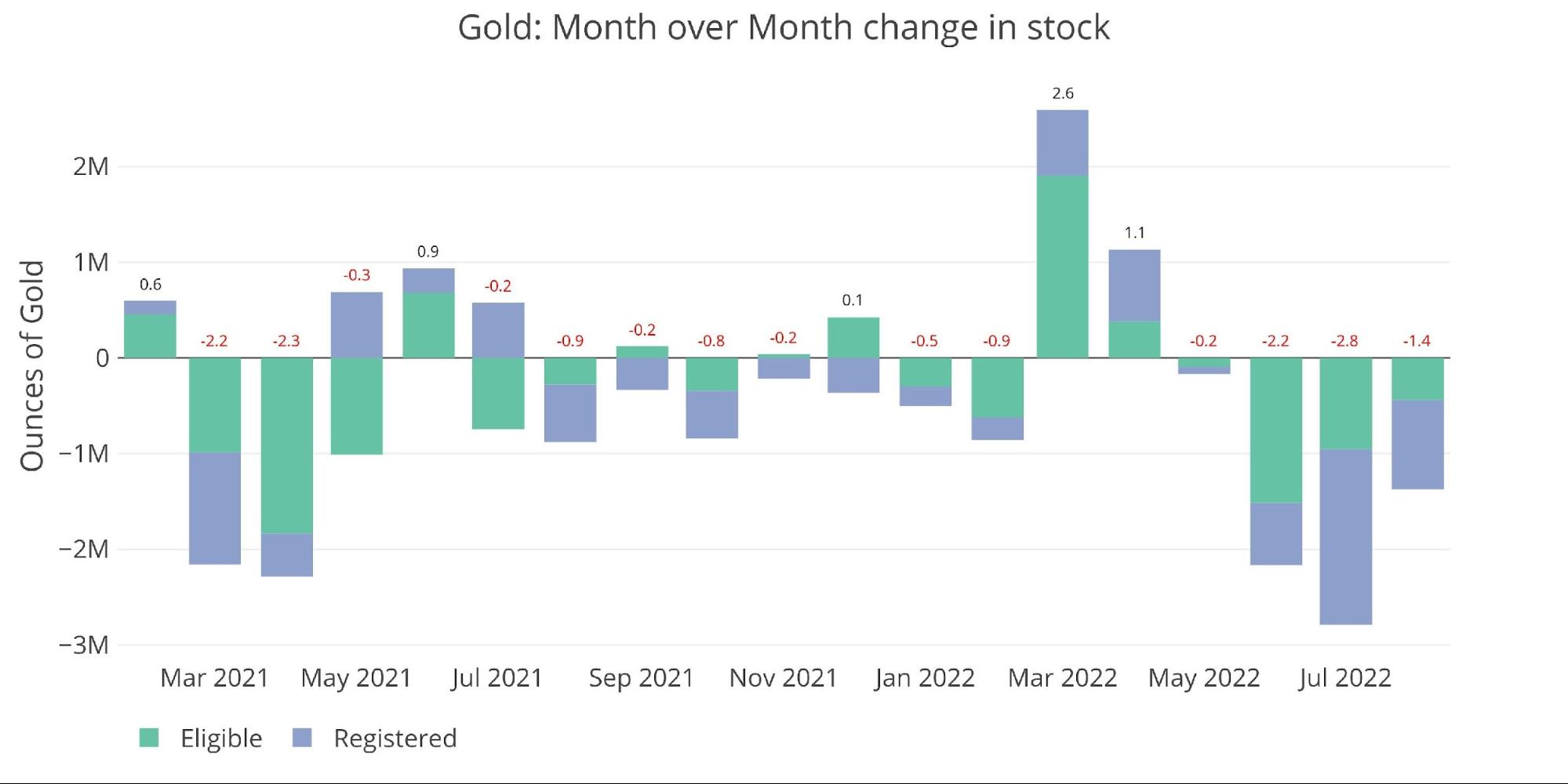

Gold

Zooming in on the month-over-month change shows the acceleration in metal leaving the vault. 3.7M ounces were added in March and April. Since then, 6.6M ounces have left the Comex system. Current outflows have exceeded the outflows during the height of the squeeze in 2021.

Figure: 3 Recent Monthly Stock Change

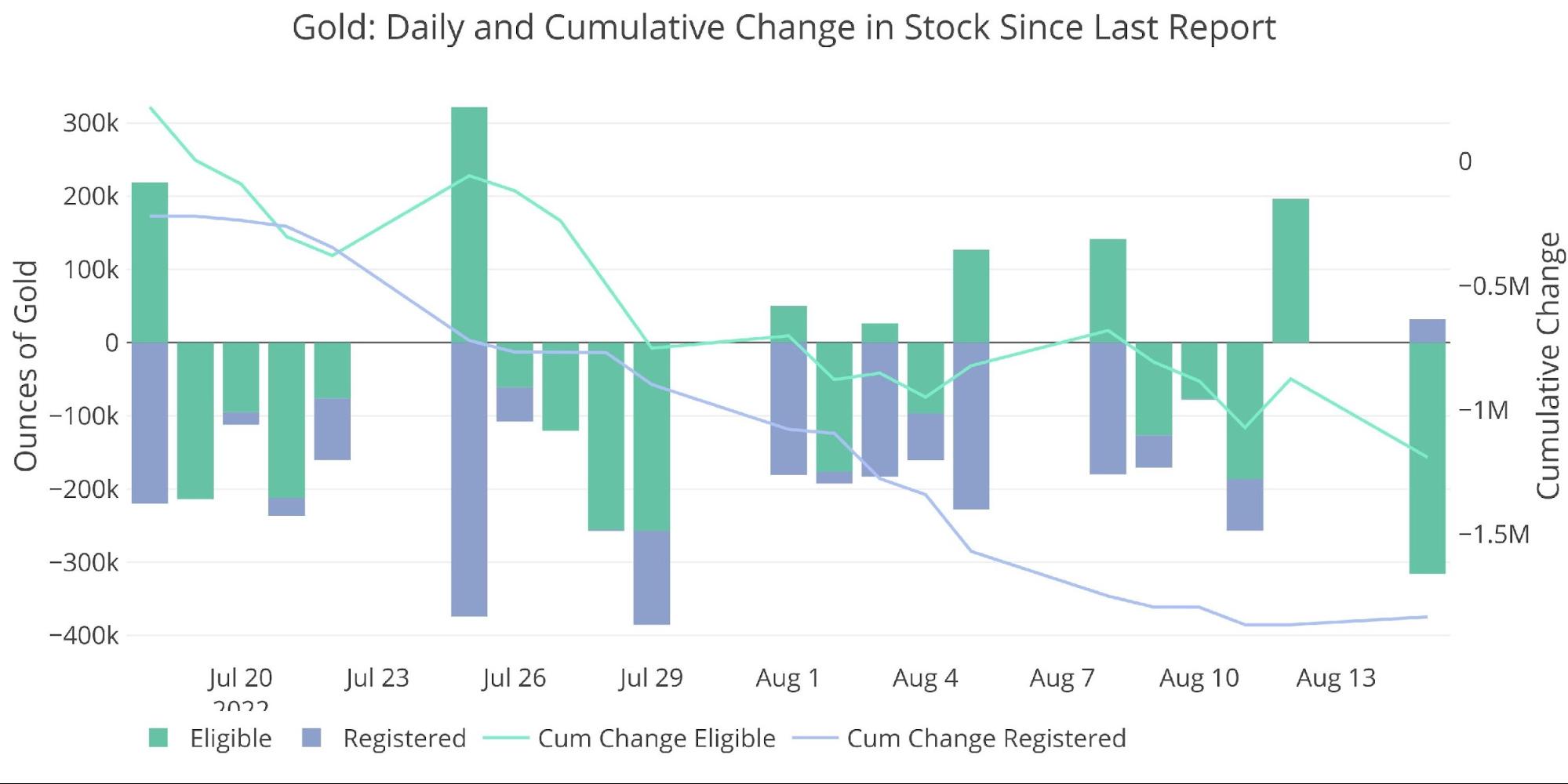

The daily activity since the last stock report shows a very steady outflow of metal from both Registered and Eligible. This has not been one or two days of big outflows; it has been a relentless removal day after day. Last Friday was the only day of net inflows over the last month.

Figure: 4 Recent Monthly Stock Change

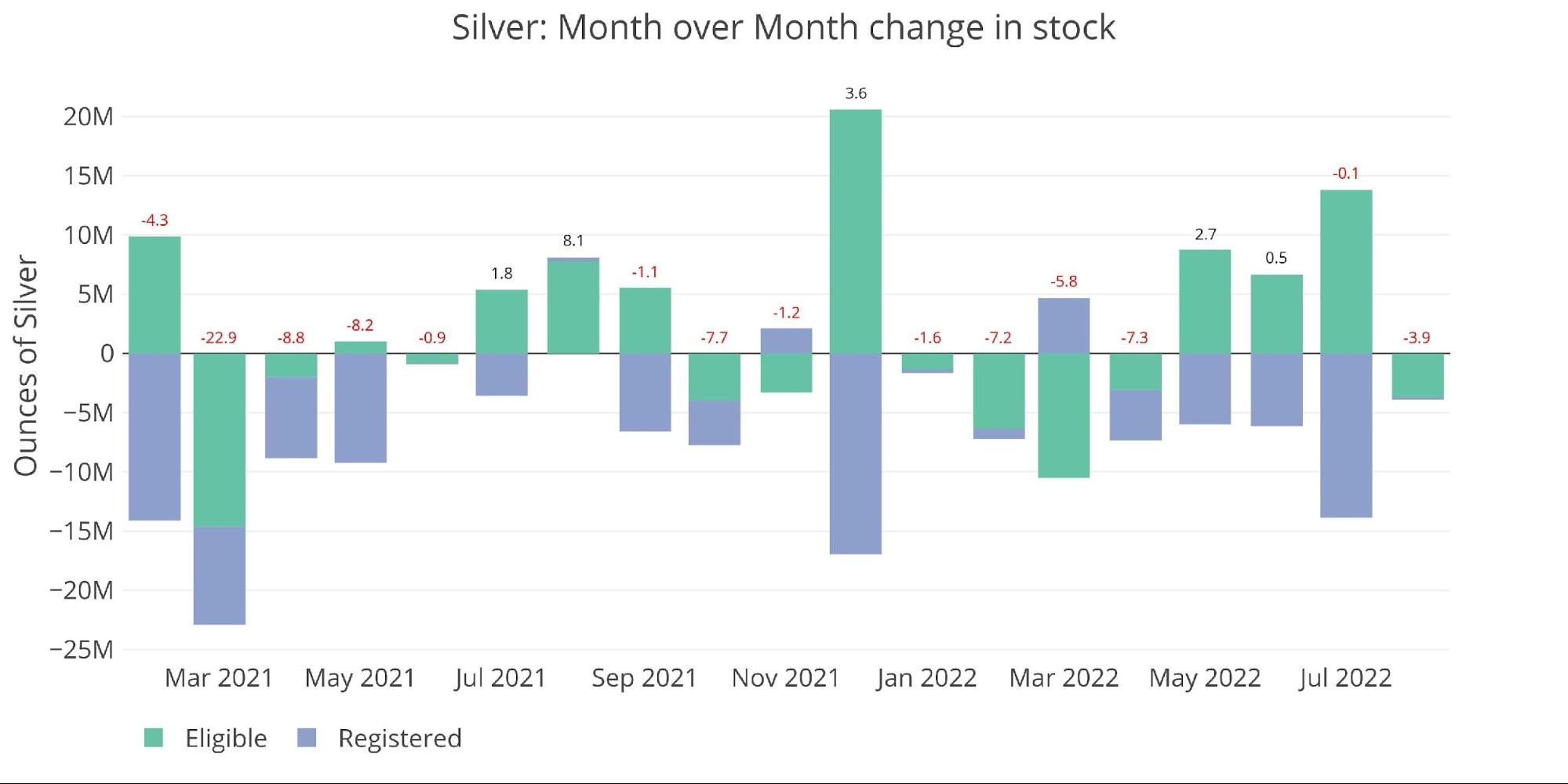

Silver

Again, the action in silver is a bit more nuanced. Investors are taking delivery and then moving Registered metal to Eligible. They are taking it out of the available supply for delivery but are still keeping it in the Comex system. If the current pace keeps up, eventually that silver will start to leave the system.

Figure: 5 Recent Monthly Stock Change

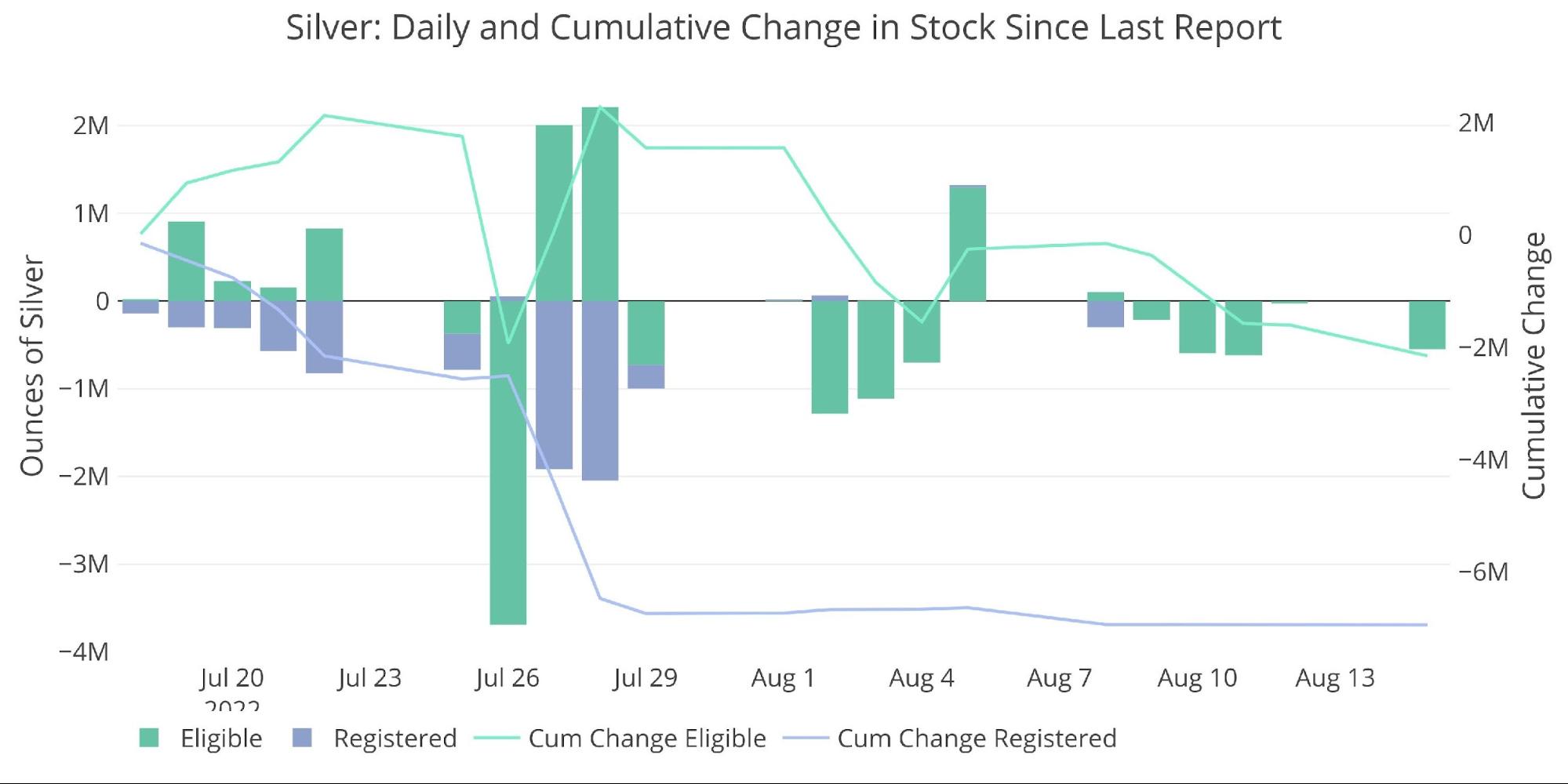

The daily activity is a bit more erratic in silver than in gold. July saw a very continuous outflow of Registered, but since August started the outflows have been in Eligible with Registered remaining fairly flat.

Figure: 6 Recent Monthly Stock Change

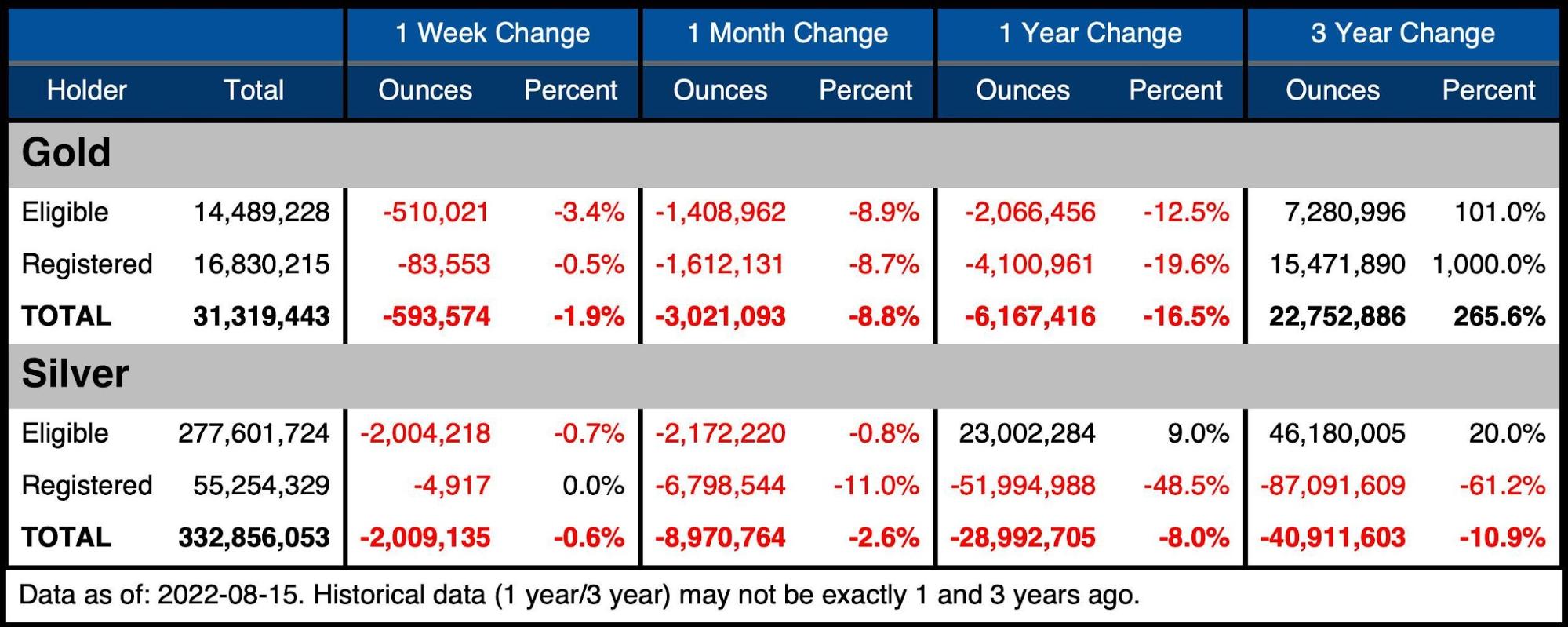

The table below shows the changes over more standard time periods.

Gold

-

- In the last week, Eligible lost 3.4%!

- Over the last month, gold has lost 8.8% of total stock, spread evenly between Eligible and Registered

- Over the last year, total inventory is down 16.5% with Registered down 19.6%

-

- More than half the YoY net outflows in gold have occurred in the last month!

-

Silver

-

- Silver Registered is down by 11% in the last month alone

- The last week has been very quiet

- Over the last year, Registered has lost over 50M ounces or 48.5%

-

- A repeat of the last year would see Comex Registered fully exhausted!

-

Figure: 7 Stock Change Summary

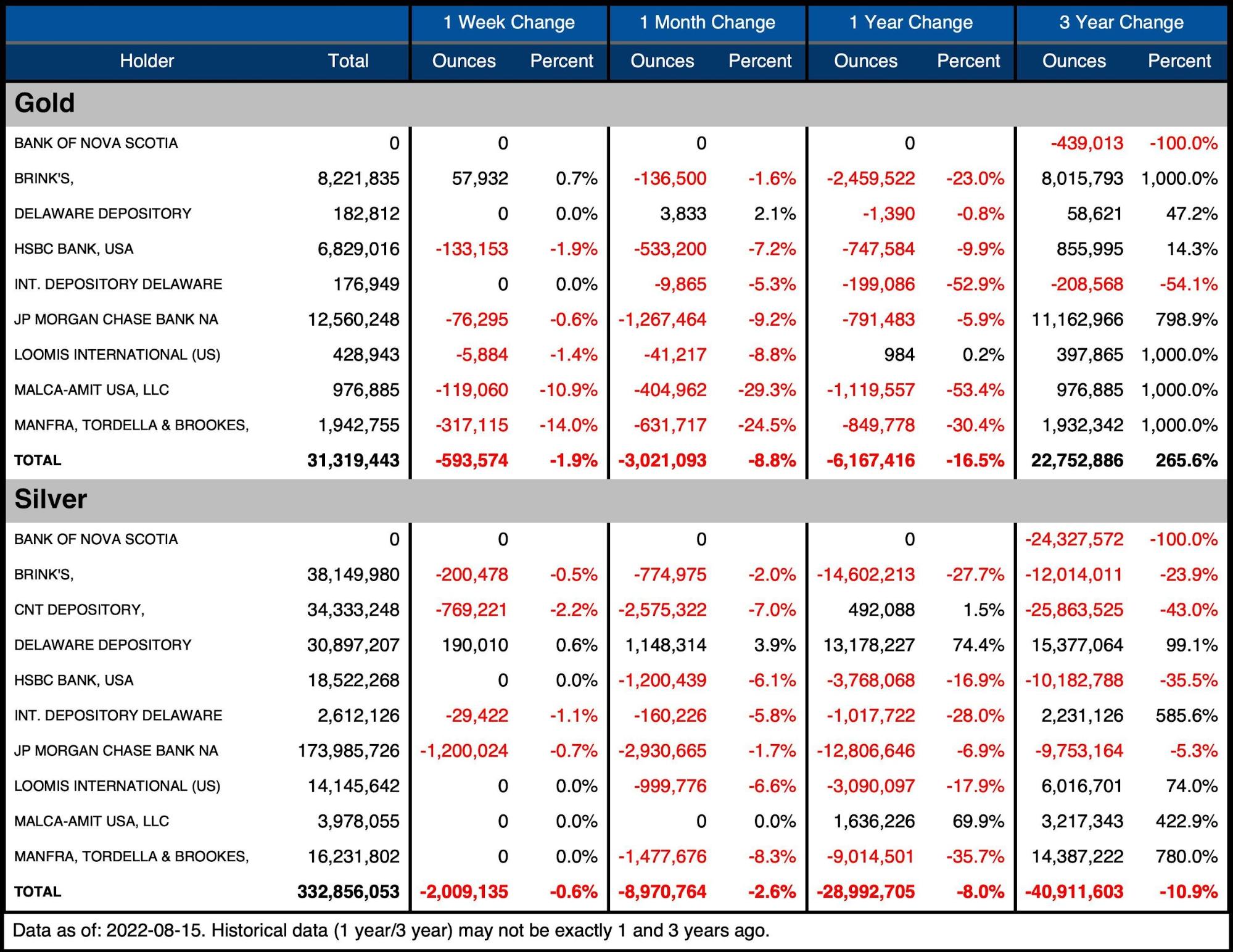

The next table shows the activity by bank/Holder. It details the numbers above to see the movement specific to vaults.

Gold

-

- Over the last month, outflows have been spread across all the vaults

-

- Malca and Manfra have been hit particularly hard, losing +24% each

- Over the last year, Malca and Manfra have lost 53% and 30% respectively

-

- Over the last month, outflows have been spread across all the vaults

Silver

-

- Silver MoM saw only one vault increase inventories with 5 vaults shedding more than 5% of inventory

-

- Four vaults lost over 1m ounces in the last month

-

- Over the last year Brinks, JP, and Manfra have collectively lost over 36M ounces ($720M)

- Silver MoM saw only one vault increase inventories with 5 vaults shedding more than 5% of inventory

Figure: 8 Stock Change Detail

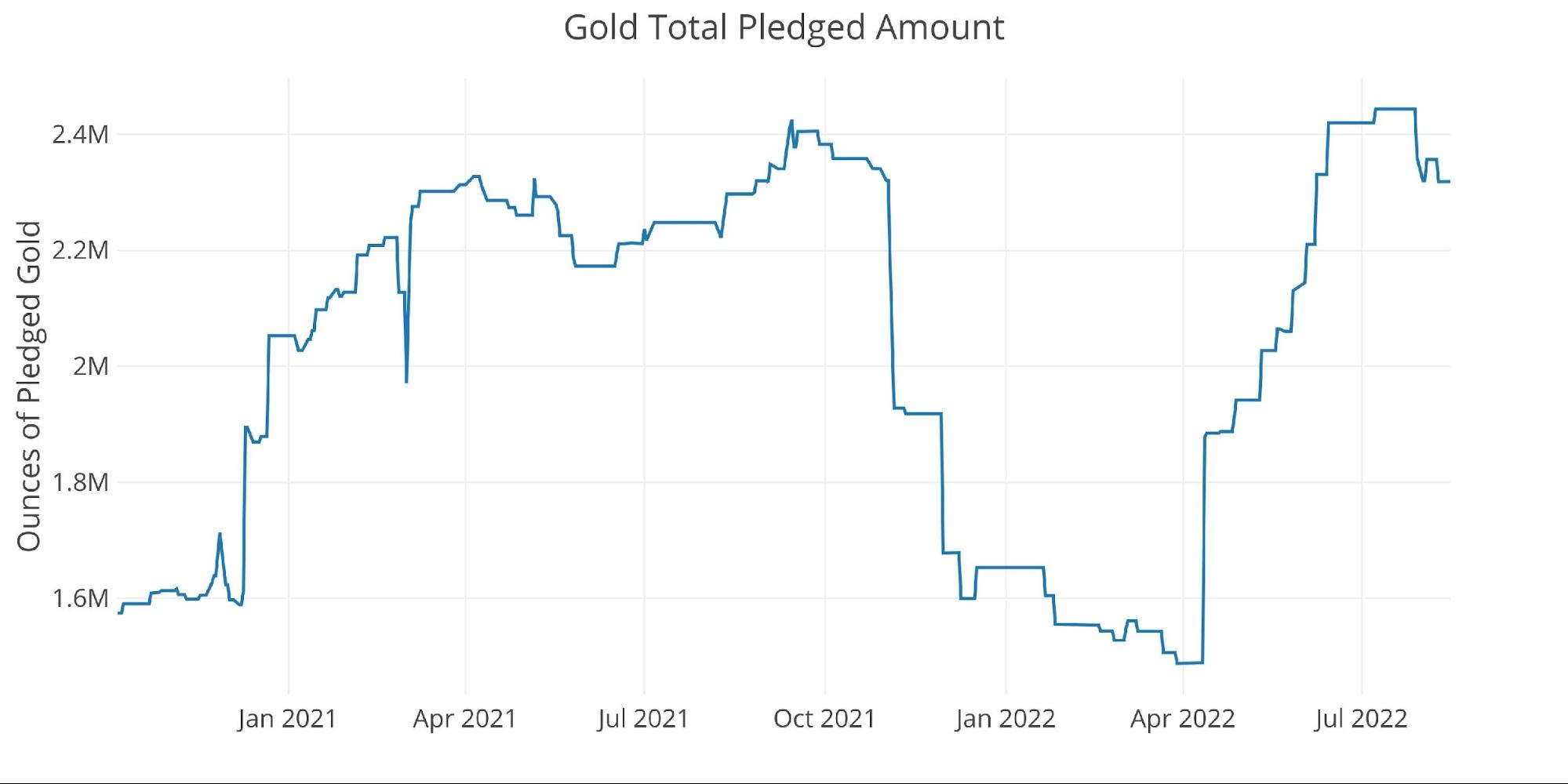

Pledged gold (a subset of Registered), has come down some after setting a new record back in July. Pledged is Registered but not available for delivery, which means gold has lost an additional 900k ounces of available delivery supply since March when you include Registered.

Figure: 9 Gold Pledged Holdings

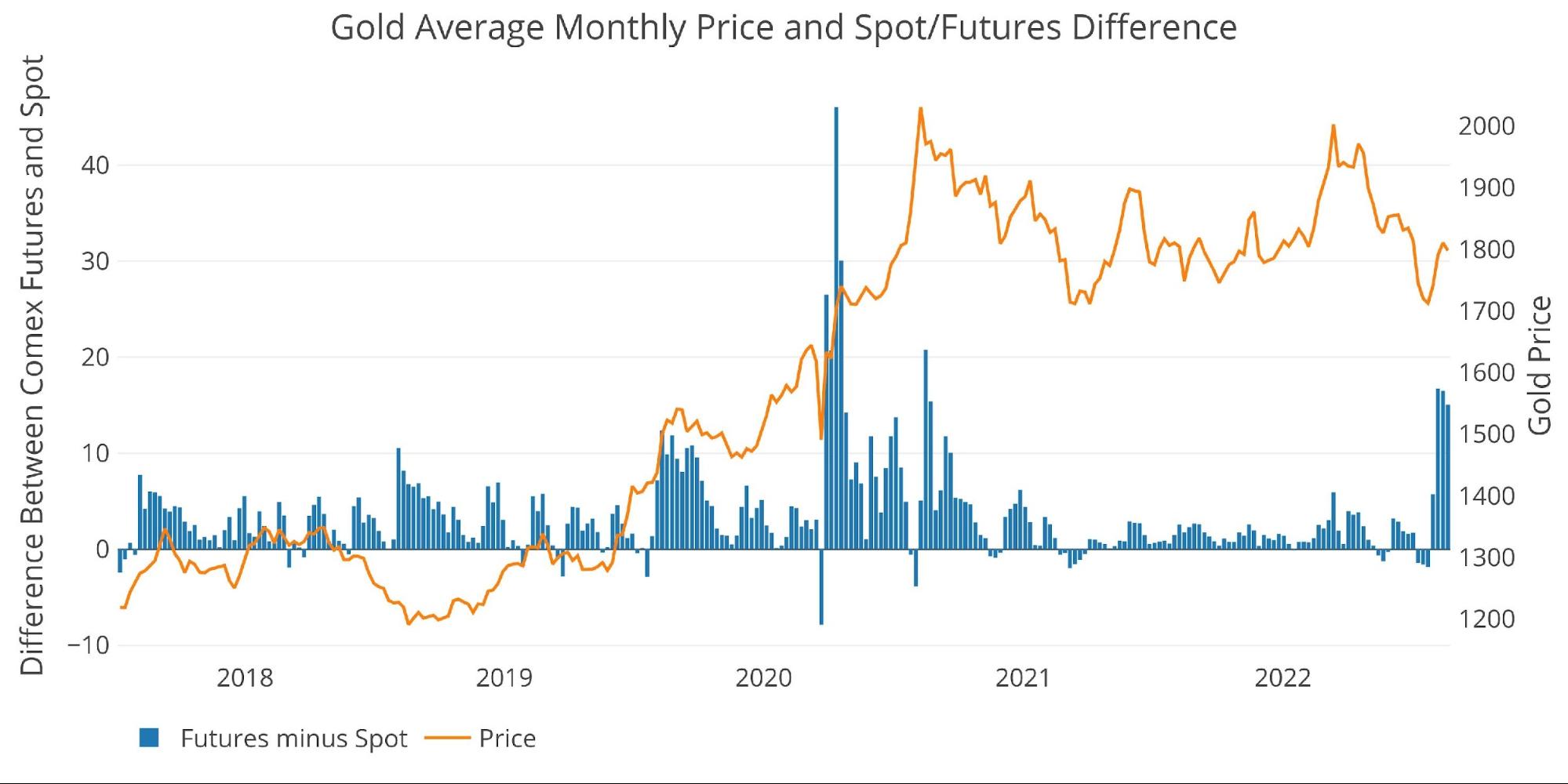

Gold entered backwardation last month for three consecutive weeks until the August contract was replaced with the December contract. It has now entered the strongest contango since September 2020. In 2021, the conversion from August to December resulted in a spread increase less than $1. In 2022, that same contract conversion flipped the price almost $20!

Figure: 10 Recent Monthly Stock Change

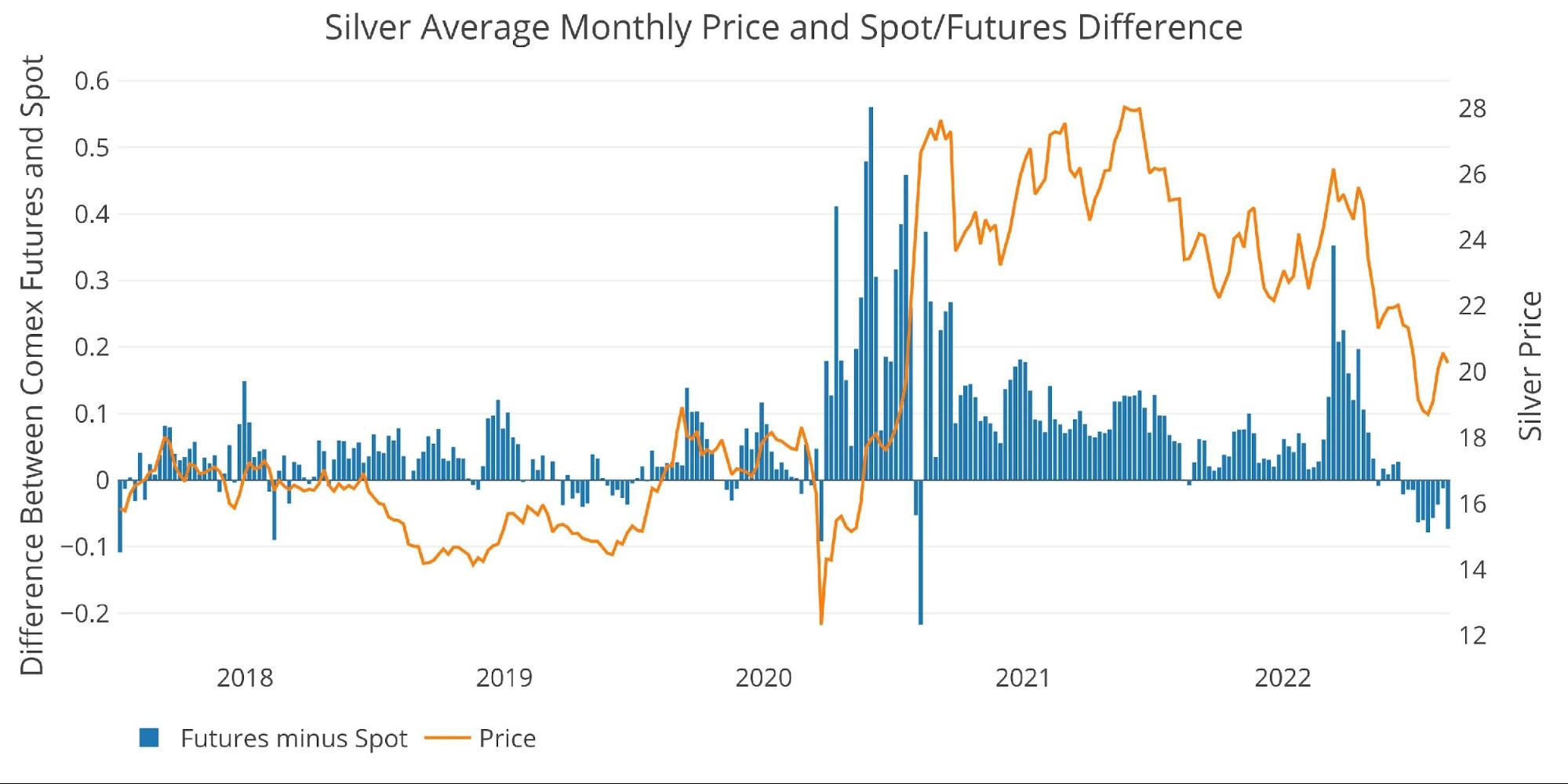

While gold is back in contango, silver remains in heavy backwardation. This is the longest such period of continual weekly backwardation since 2013

Figure: 11 Recent Monthly Stock Change

Historical Perspective

Available supply for potential demand

As can be seen in the chart below, the ratio of open interest to total stock has fallen from over 8 to 1.45. In terms of Registered (available for delivery against open interest), the ratio collapsed from nose bleed levels (think Nov 2019 where 100% stood for delivery) down to 2.7 in the latest month. The recent fall in the ratio is from open interest falling faster than the physical supply. This is not unexpected though; it is much easier for the paper supply to fluctuate compared to the physical supply.

Figure: 12 Open Interest/Stock Ratio

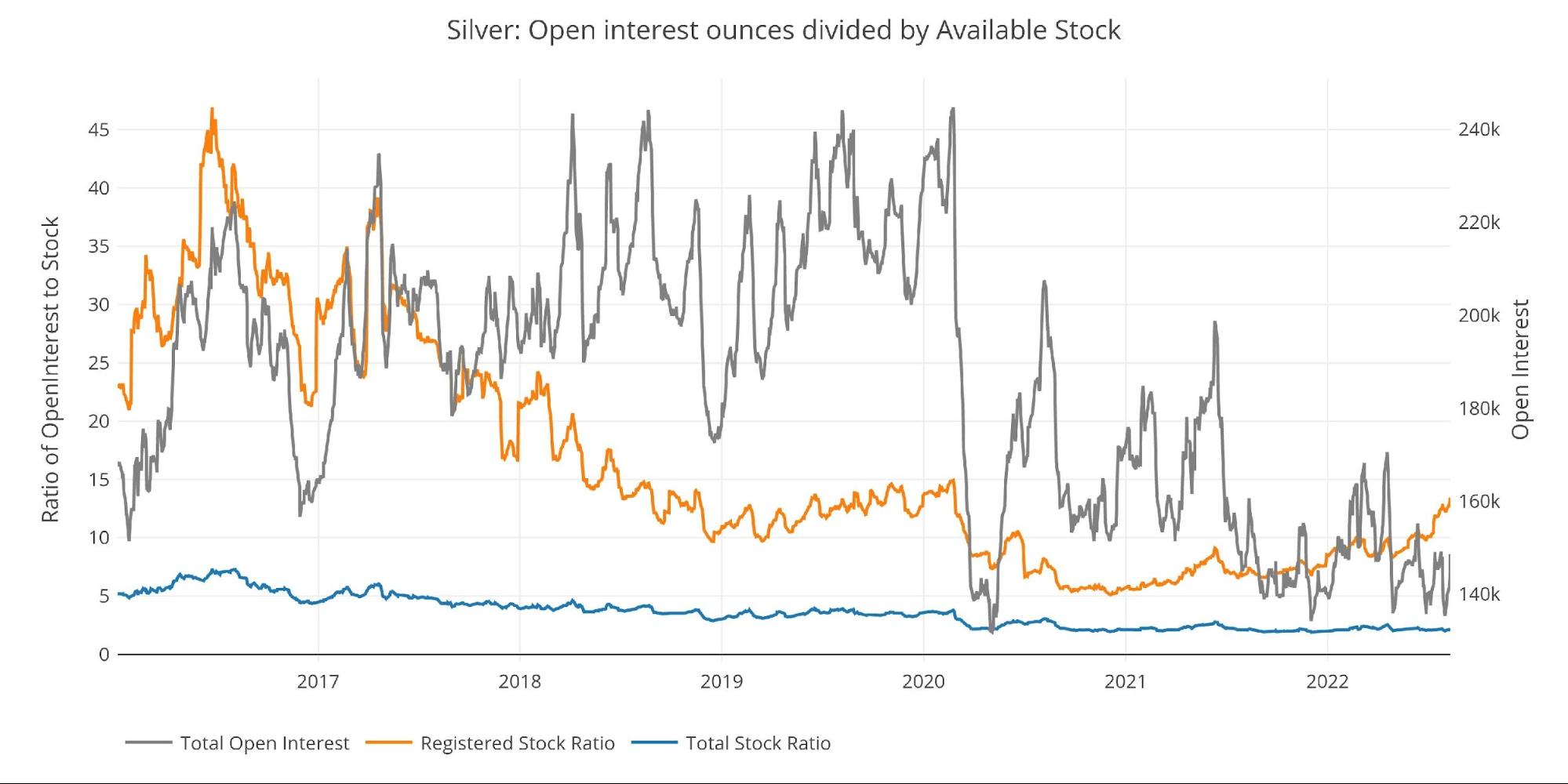

Coverage in silver is weaker than in gold with 13.45 open interest contracts to each available physical supply of Registered (up from 8.2 at the end of April). The ratio has been driven up by a recent increase in open interest, along with the continued movement out of Registered.

Figure: 13 Open Interest/Stock Ratio

Wrapping Up

Comex deliveries should not be confused with load-outs where metal actually leaves the vaults. For perspective, the August gold contract has seen 3.25M ounces of gold delivered. Ironically, this is close to the 3M ounces that have left the vault over the last month. Over time, the divergence is greater with 17.2M ounces being delivered since December and only 4.2M ounces leaving the vault during the same period.

That being said, the increased delivery volume over the last 2+ years has translated to a lot more metal leaving the Comex. While Delivery volume is still close to near-term averages, the amount of gold leaving vaults has accelerated rapidly in recent weeks. With total gold inventories down almost 20% since May, this could be the early stages of a bank run, or in this case, a “vault-run”.

If someone were to describe the early stages of a collapse in Comex confidence, it would look exactly like this. A few years of elevated deliveries back and forth sloshing around. Metal starts leaving the vault slowly but steadily. Inventories get thin, and the banks restock but not enough. Then a little more fear sets in and the exodus accelerates.

Everyone knows there is more paper gold than physical gold, but most traders are fine with this as long as they can get the USD exposure to the gold they want through margins and futures. However, there is clearly a second set of actors in the market who are not after highly leveraged bets on short-term future gold prices. These actors understand the value of gold and silver as the true wealth and currency of the world. The data shows that these investors may be losing confidence in the system and are extracting their metal while they still can.

As paper trading continues, the price of gold and silver remains suppressed in a fractional reserve system. With an infinite supply of paper shorts available, true price discovery is much harder. The real investors are taking advantage of the artificial suppression in prices, and cashing in their paper for metal.

Data Source: https://www.cmegroup.com/

Data Updated: Daily around 3PM Eastern

Last Updated: Aug 15, 2022

Gold and Silver interactive charts and graphs can always be found on the Exploring Finance dashboard: https://exploringfinance.shinyapps.io/goldsilver/

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Shared by Golden State Mint on GoldenStateMint.com