Weekly recap of the precious metals market

Investing.com – Will the now-viral fist bump result in more oil for the world? Possibly in the coming weeks, says the White House. But Saudi Crown Prince Mohammed bin Salman (a.k.a. MbS), who received the fist bump from President Joe Biden, says the kingdom’s output will climb by just a million to reach 13 million barrels per day, and that only by 2027.

The truth is probably somewhere in between.

Biden’s awkward encounter with a man and kingdom that he had hoped to isolate for the 2018 butchering of Saudi-journalist-turned-US-resident Jamal Khashoggi underscored the challenges for a president desperate to bring home relief from high gasoline prices. Months of painstaking behind-the-scenes work by U.S. State Department and Saudi palace officials made it happen, and each side played up the positives from Friday’s photo-op between the two men.

Politically, the gambit seemed a disaster for Biden, with criticism from some of his own party faithful, led by California Democratic Senator Adam Schiff, who tweeted that “one fist bump is worth a thousand words” and this one showed “the continuing grip oil-rich autocrats have on U.S. foreign policy in the Middle East.” Khashoggi’s widow also tweeted, telling the president that “the blood of MbS’ next victim is on your hands”.

But strategically, even if the Saudis raise production slightly in the coming weeks — after the additional 650,000 bpd a month that OPEC+ has already committed for July and August — it’s a win of sorts for the White House.

With the Biden visit, it’s looking increasingly likely that Saudi oil policy towards the administration will not be as toxic as before. This is in spite of the president reminding MbS on Friday that he held him responsible for Khashoggi’s death, to which the monarch responded by releasing pictures of the two of them smiling and chatting.

To MbS, most important was to show the world that Biden acknowledged him as the next Saudi king and that the president recognized Riyadh as holding the levers to the world’s oil. In Biden’s case, he wanted to tell MbS who he really thought he was to his face, and that he was there as a president of the American people. In that sense, both got what they wanted.

The week in oil itself scored 1 for the bulls and 0 for the bears.

Crude prices fell as much as 7% on the week as earlier losses induced by a strong dollar offset the likelihood that Biden’s Saudi visit will not immediately lead to additional production of oil. The dollar surged to two-decade highs between Wednesday and Thursday after panic across markets that the Federal Reserve might opt for a record 100-basis point rate hike next to quell new four-decade highs in consumer prices — a threat later downplayed by the central bank’s officials.

Crude’s increasing sensitivity to the dollar, Fed rate hikes and recession threats showed it was turning into a greater financial play than a commodity driven just by supply-demand.

Global crude benchmark Brent Oil has fallen for five straight weeks now, losing a cumulative 17%. U.S. crude’s West Texas Intermediate, or WTI, gauge has dropped in four of those five weeks, sliding by a net 19%.

The narrative in oil now is no longer about barrel deficiency alone. Over the past week, previously unasked questions about whether oil had become too pricey for consumers and needs to come down meaningfully to lower inflation have started getting investors’ attention. All these questions coincide with pump prices of US Gasoline that have also started their descent from last month’s record highs of above $5 a gallon to a national average of $4.55 last week.

The average price of U.S. gasoline, all grades combined, has now dipped for the fourth week in a row, to $4.65 as of Monday, according to data from the Energy Information Administration, or EIA.

In the week through July 8, gasoline consumption plunged by 9.7% to 8.73 million barrels per day, on a four-week moving average, according to EIA data. The EIA measures gasoline consumption in terms of barrels supplied to the market by refiners, blenders, etc., and not by retail sales at gas stations. This was the steepest decline yet so far this year.

Some say that U.S. drivers are resorting to all kinds of tricks to put a lid on their gasoline expenditures: Drive a little less, take it easier with the gas pedal, cut out unnecessary trips, plan shorter road trips, prioritize the most fuel-efficient vehicle in the garage, use mass transit, etc.

A debate now is whether a recession — which the Fed says it’s trying hard to avoid despite Deutsche Bank, JPMorgan Chase & Co. and Morgan Stanley suggesting one may be inevitable — will do more to bring oil consumption and prices down.

But talk of a recession — and how badly that could impact oil — may also be overblown as the physical market for crude remains strong.

While June and July have brought sweeping changes to what decides the direction in oil, new restrictions on Russian exports or a shipment blockade in Libya or Nigeria can still turn the market on its head, sending crude prices soaring.

And despite the selloff in Brent and WTI, oil for near-term delivery continues to trade at a big premium to contracts for later delivery. The downward curve slope, known as backwardation, is a hallmark of a very tight physical oil market. At about $4 a barrel, the front-to-second front month backwardation is near its strongest ever. Back in July 2008, the oil time-spreads were in the opposite condition: a contango, with spot barrels at a discount to forward contracts, a sign of an oversupplied market.

Liquidity in oil market futures is, meanwhile, poor, leaving them vulnerable to anyone unwinding a large position or selling forward contracts. Over the summer, several big producer-hedging deals are likely, including the annual deal used by the Mexican government to lock in prices for the following year. Wall Street banks also have large put options for 2023 — likely a sign that a big client was in the market hedging oil prices.

New York-traded West Texas Intermediate, or WTI, crude posted a final trade of $97.57 per barrel on Friday, after settling the official session up $1.81, or 1.9%, at $97.59 per barrel.

For the week, however, WTI was down 6.9% after plumbing a near five-month low of $90.58 on Thursday.

The U.S. crude benchmark has also lost 8.1% since the start of July.

London-traded Brent crude posted a final trade of $101.13 per barrel on Friday, after settling the official session up $2.19, or 2.2%, at $101.16 a barrel.

The global crude benchmark fell to $95.42 in the previous session, marking a low since late February.

For the week, Brent was down 5.5%, while for July it has lost 7.4%.

Amid heightened volatility ahead, WTI’s sustained move away from the just-ended week’s lows of $90.58 to hold at above $92 can push it towards the Daily Middle Bollinger Band of $104.30, said Sunil Kumar Dixit, chief technical strategist at skcharting.com.

“If WTI manages to break and sustain above week high of 105, the recovery can extend to the 50-Day Exponential Moving Average of $106.80 and the 100-Day Simple Moving Average of $107.40, as well as the weekly middle Bollinger Band of $108.50,” said Dixit.

But he also cautioned that failure to breach $105 could resume WTI’s downward correction to $94-$92-$90.

“If WTI breaks below $90, it will eases the drop to the vertical support of $88-$85-$83,” Dixit added.

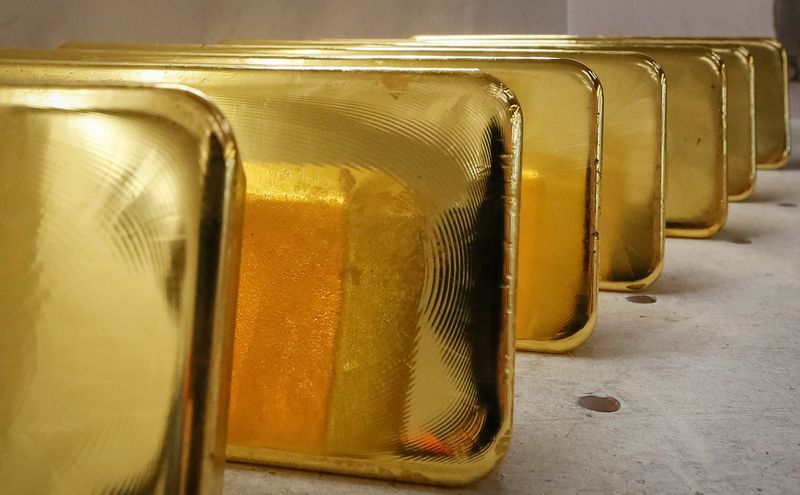

Gold for August delivery on New York’s Comex posted a final trade of $1,706.50 per barrel on Friday, after settling the official session down $2.20 at $1,703.60.

For the week, however, August gold was down 2.2% after plumbing a 27-month low of $1,695 on Thursday.

The U.S. gold benchmark has fallen for five straight weeks now, losing a cumulative 9%. Year-to-date, it is down 7%.

Since the Consumer Price Index for the year to June came in on Wednesday at a new four-decade high of 9.1%, bets on rates have been volatile — with the pendulum swinging between an unprecedented increase of 100 basis points for July versus the broader consensus for a 75-basis point hike.

“Risky assets have been beaten up enough and could be ready for a bounce here,” said Ed Moya, analyst at online trading platform OANDA. “The precious metal is still vulnerable to further technical selling.”

Dixit of skcharting said the five-week drop in gold has taken out all key markers including the Middle Bollinger Band of $1,877 and the major moving averages 50 week EMA 1837 and 100 Week SMA 1836.

“The stochastic readings for daily gold at 6/12 and weekly gold are 3/6 are extremely oversold,” Dixit said. “Thus, a short-term rebound towards at least $1,745 is a high probability.”

He also said if gold manages to breakout above $1745, it could extend towards $1770-$1,800 and $1,815

“As an erstwhile safe haven, gold is not out of the woods yet and its doors remain open for another break below $1,700, aiming this time for $1683-$1,666-$1,652,” Dixit added.

Disclaimer: Barani Krishnan does not hold positions in the commodities and securities he writes about.

Shared by Golden State Mint on GoldenStateMint.com