By Craig Hemke

It has been a very challenging year for almost all asset classes, and the precious metals haven’t had it easy either. Though the Fed seems intent upon further rate hikes in the months ahead, one day soon will bring a bottom and trend change for COMEX gold and silver.

Could that bottom and trend change have already occurred? Maybe. As with all trend changes, this one will only be seen in hindsight. But in the COMEX precious metals, there are always some signs you can look for, and a few of them are currently in place.

Let’s start with short interest in the big silver ETF, the SLV. Growing short interest in this fund reflects a retail and institutional demand to bet on lower silver prices in the months ahead, and it is almost always a good contrarian indicator. Why? Because this type of shorting reflects hot money chasing a dying trend. Where was all this shorting back when silver was $28? There wasn’t any, and all the hot money was on the long side instead. Now it’s short, and that alone should tell you something.

SRSrocco Report

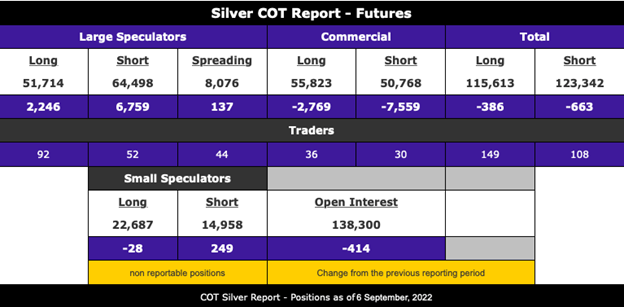

Next we should look at the latest Commitment of Traders report in order to assess where things stand with the “big boy” money. Let’s start with the Legacy Report, which simply places traders into the Commercial and Large Speculator categories. On this report, the Commercials are almost always net short while the Speculators are net long—but not currently, as you can see on this table provided by GoldSeek:

GoldSeek

As you can see, as of the COMEX close on September 6—and with COMEX silver at $18.14—the Large Speculators were actually NET SHORT 12,784 contracts and GROSS short 64,498 contracts. At 5,000 ounces/contract, that’s 64,000,000 ounces net short and 322,500,000 gross short. And those are all ounces these “Speculators” DO NOT HAVE. They are simply short the COMEX paper. This means that, at some point, they will be forced to buy back and cover those short positions because they do not have the metal to deliver to any “long” standing for potential delivery.

For historical context, other Large Speculator short positions peaked at 22,409 net short on May 28, 2019, and the all-time high of 28,974 net short on September 4, 2018. See the chart below:

Barchart

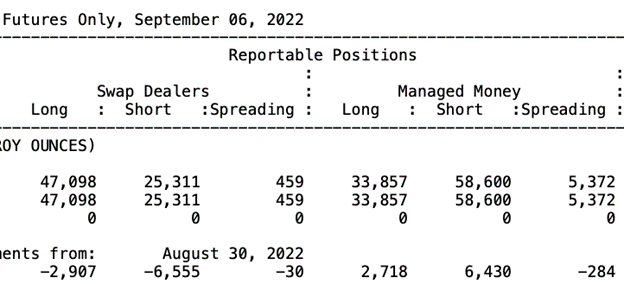

Further, on the disaggregated report where the CoT data is broken into smaller categories, be sure to note which entities hold these net short and net long positions. Below you can see the breakdown where “Hedge Funds” are currently net short 24,742 COMEX silver contracts for about 124,000,000 ounces. That’s about 15% of annual global mine supply and, again, metal they do not have.

On the other side are the “Swap Dealers”. What’s a swap? A futures or options contract. And who “deals” them? The bullion banks. And who are the bullion banks? Think JPMorgan and Bank of America. And these “Swap Dealers” are now NET LONG 21,787 contracts. Which side do you think comes out ahead in the long run?

Author

And finally, let’s have a look at the short-term chart, where price is once again trying to gain a toehold above its 50-day moving average. Since price has been in a pattern of lower lows, the key in recognizing a bottom will be a higher high. In this case, a move above the $21 highs of mid-August. Once above that level—and then above $22 for further confirmation—we’ll be able to state that the chart has officially reversed. For now, just keep watch on that pattern of lower lows and lower highs and watch for it to shift.

Barchart

So keep an eye on things in the days and weeks to come. Silver will soon bottom, of that you can be certain. It’s just a matter of when. This has been a difficult year, but it can all change pretty quickly and that next Fed-loosening-induced rally is going to be significant.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Shared by Golden State Mint on GoldenStateMint.com