Picture showing a montage of Benjamin Franklin, U.S. Flag, 100 dollar bills, and an inflation chart

By Blu Putnam

At A Glance

- The labor market continues to grow despite two quarters of negative real GDP

- Slow labor force growth plus low labor force participation rates are both working to keep the job market tight

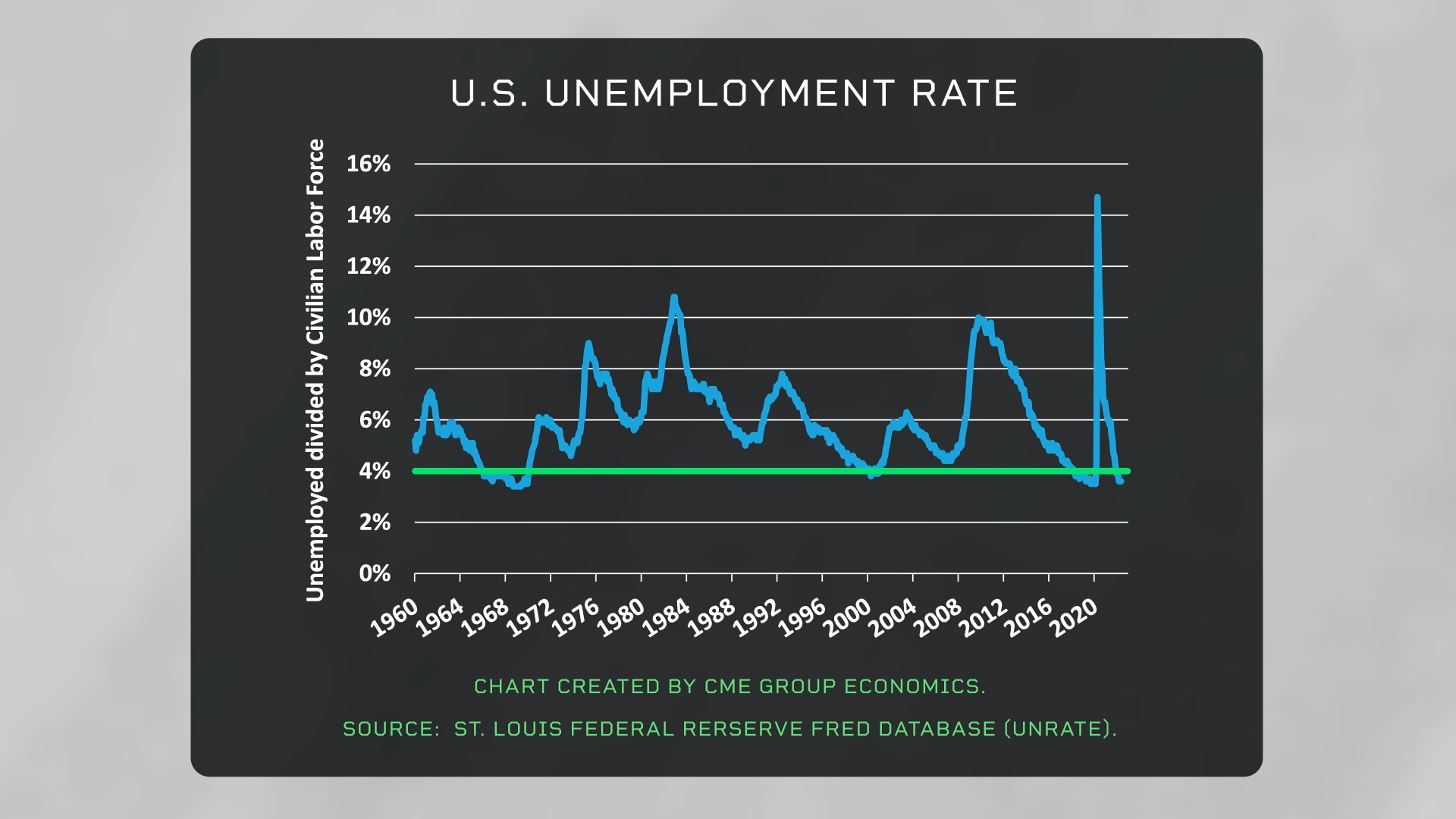

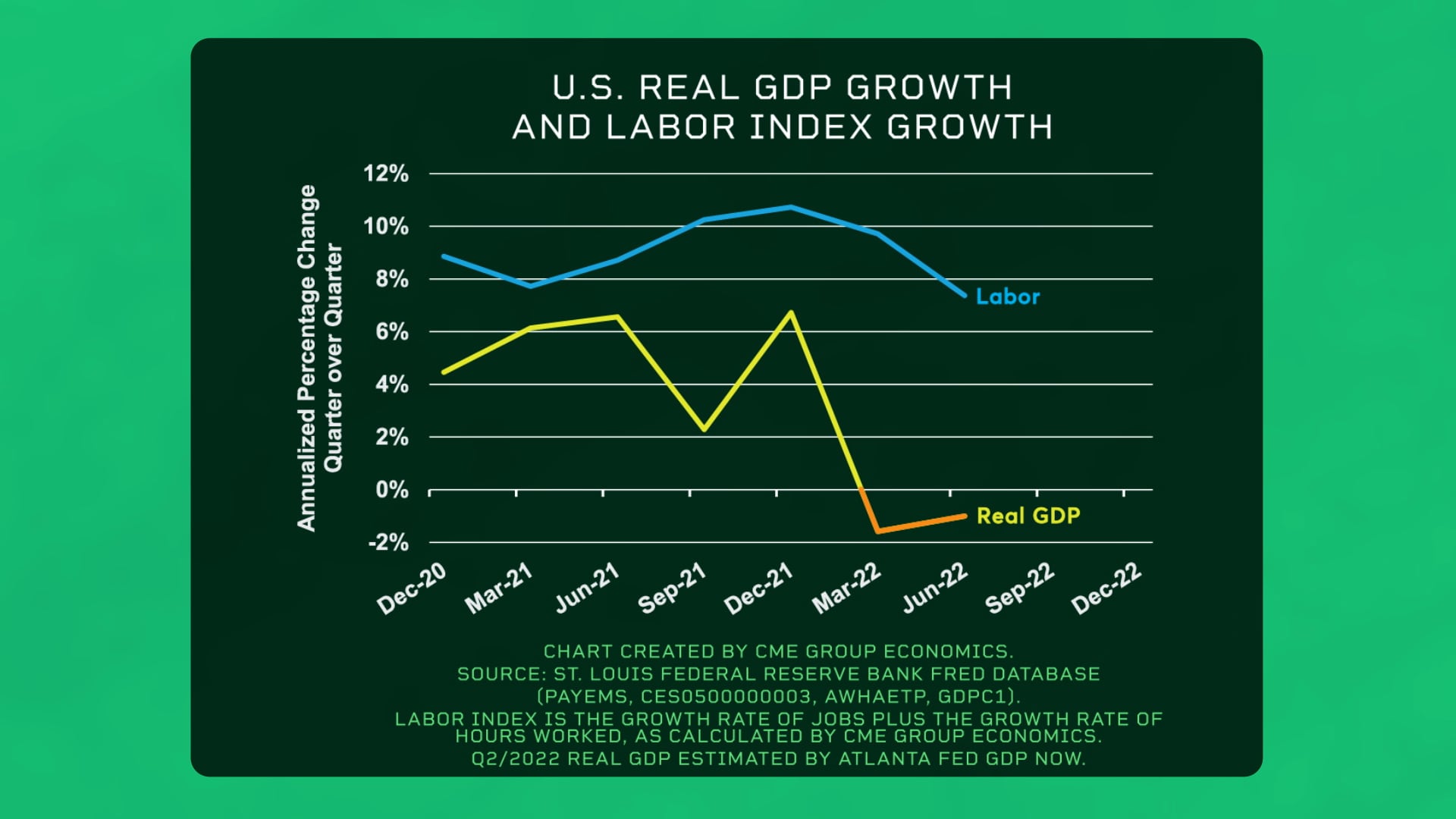

There is a disconnect between U.S. real GDP and the labor market. The U.S. job market remains quite healthy, with the unemployment rate under 4%, and job growth, while slowing, remains above the likely long-run trend. By contrast, U.S. real GDP was negative for Q1 2022, and according to the Atlanta Fed’s GDPNow estimate may be negative in Q2 as well.

There are four key factors to watch in this disconnect.

- Some may choose to call two back-to-back quarters of real GDP declines a recession. But the National Bureau of Economic Research’s recession dating committee will probably disagree since they focus more on real personal income and nonfarm payroll employment, the latter of which remains very strong.

Chart showing the U.S. unemployment rate created by SME Group Economics using data from the St. Louis Federal Reserve database.

Author

2. The Fed’s jobs mandate is specifically to encourage full employment. So, the jobs data takes priority over GDP data in the calculus of how fast interest rates might be raised to combat elevated inflation.

Chart showing the GDP Real Growth and Labor Index Growth with data provided by teh St. Louis Federal Reserve database.

Author

3. Real GDP recovered its pre-pandemic peak back in Q2 2021, so it was naturally going to decelerate after such a rapid rebound. For jobs, the pre-pandemic peak is only now being fully recovered, with job vacancies abound and wages rising.

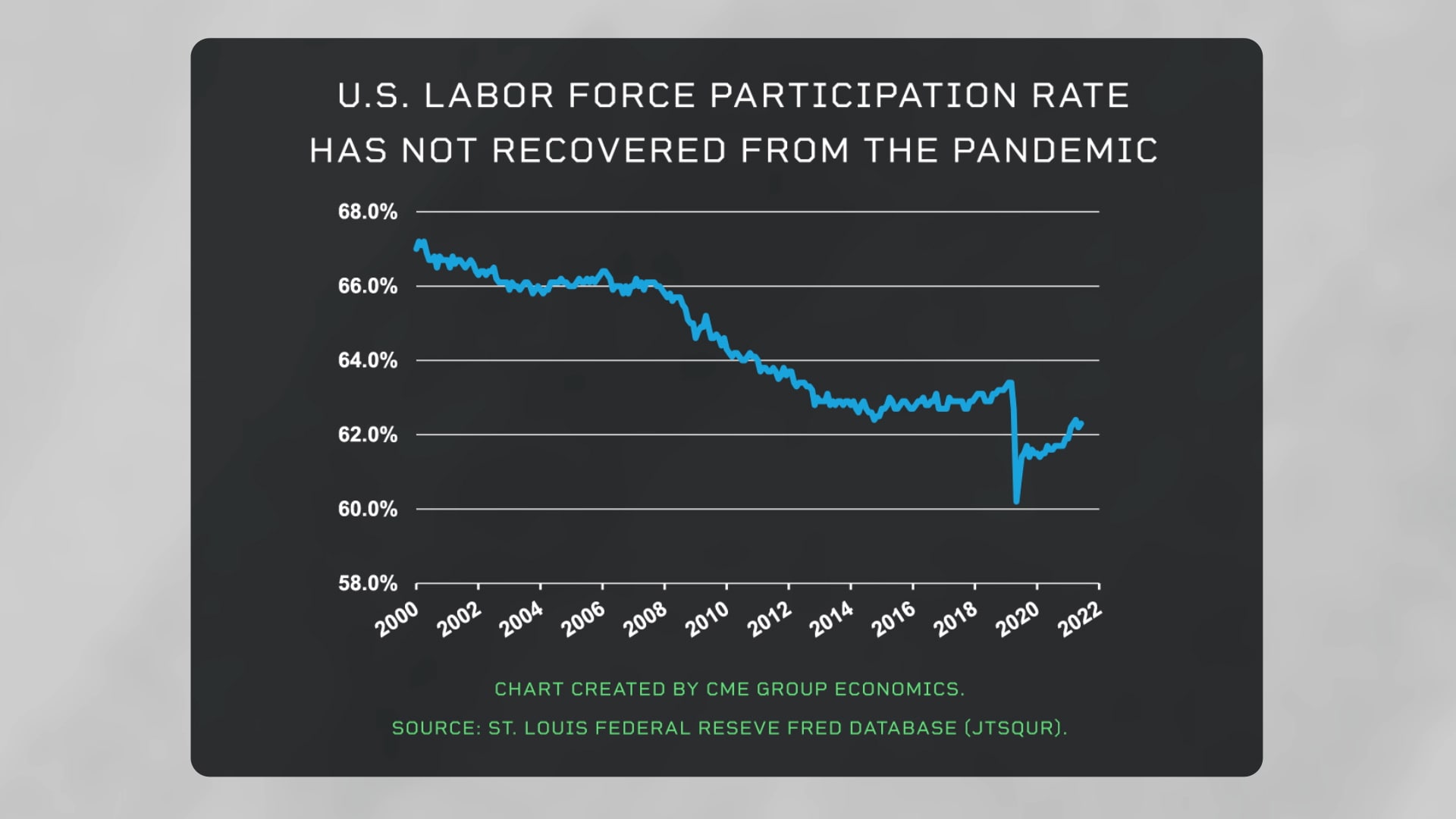

4. Labor force growth is likely to be very slow, and labor force participation rates are low, both working to keep the job market tight.

Graph of the U.S. Labor Force Participation Rate with data provided by the St. Louis Federal Reserve Fred database

Author

The bottom line is that a robust labor market is not necessarily going away just because of a little GDP weakness after a very rapid rebound.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Shared by Golden State Mint on GoldenStateMint.com