Summary

- The Fed’s 0.50% rate cut has driven gold prices to $2620 per ounce, with further gains expected due to potential additional rate cuts and quantitative easing.

- Geopolitical uncertainties, such as US-China-Russia tensions and Middle East conflicts, could further boost gold prices, potentially reaching $5200 per ounce.

- The monetary base to gold ratio suggests gold is undervalued, indicating significant appreciation potential, especially if the ratio returns to 2011 levels.

- Risks include the possibility of less aggressive easing than expected and the Fed successfully avoiding a recession, which could limit gold’s gains.

Anthony Bradshaw

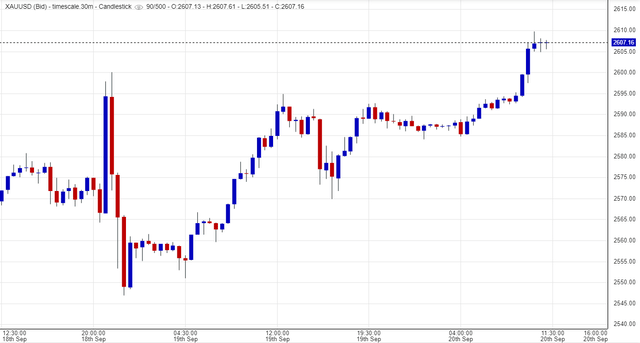

One of the most important pieces of economic news has recently been the Fed’s 0.50% rate cut. Gold has therefore touched a high of $2600 per ounce. Some economists predict the $3000 mark is possible as early as mid-2025. According to Aakash Doshi, head of commodities, North America at Citi Research, gold could reach $3,000 per ounce by mid-2025. Mr. Doshi also predicted $2,600 by the end of 2024. But this target has already been reached. As I am writing this, gold prices are near $2620 per ounce. In my opinion, this forecast is too conservative. Every asset class, including gold has a market price at which it is currently trading and also an intrinsic value at which it should trade if the market were rational. Right now despite the remarkable rally, gold has further gains to make, given the likelihood that a series of rate cuts will follow. Let me explain why and under which conditions it would surge higher.

My previous work on gold prices

In my previous article about gold, I wrote that gold prices remained unchanged despite easing geopolitical tensions and inflation exceeding the Fed’s target. These factors did not make gold go down in value. Consumer spending data published at the time suggested the US economy was not slowing down, giving the Fed no reason to ease monetary policies. The situation is quite different now. The recent macroeconomic data suggests the economy’s slowdown. Also, the decreasing inflation numbers allowed the Fed to ease on Wednesday by 50 basis points. Just before the Fed’s meeting, I wrote an article where I suggested the 0.50% rate cut was in the cards.

Why is gold near its all-time highs?

So, why is gold at its all-time highs? In other words, there has been an unstoppable rally since the beginning of July this year.

But the recent several days of rallying gold prices were due to the Fed cutting the interest rates on Wednesday.

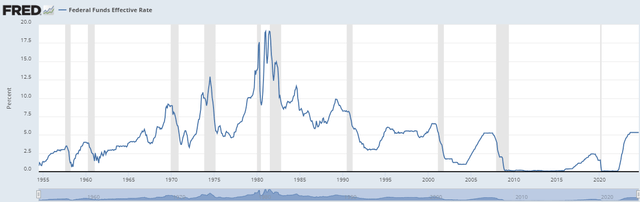

At the same time, it is noteworthy that most investors buy on expectations. They are not that concerned with the current market conditions or the recent news. Instead, they invest for the future. Right now, the market expects the Fed to keep decreasing the interest rates. It seems strange, though, because the Fed does not expect the era of cheap money. According to Jerome Powell’s press-conference, America is “not going back’ to ultra-low interest rates” or to a situation where there were trillions of dollars of sovereign bonds trading at negative rates. Although Powell feels the neutral rate is likely significantly higher than it was back then, he is not yet sure how high it is. But this contradicts the fact that the first rate cut was so substantial. One of the FOMC’s members, namely Fed’s Governor Michelle Bowman, called for a quarter-point cut instead. So, it seems to me that a decrease of 0.50% was just the beginning. And given the fact, the interest rates are relatively high, many more cuts could follow.

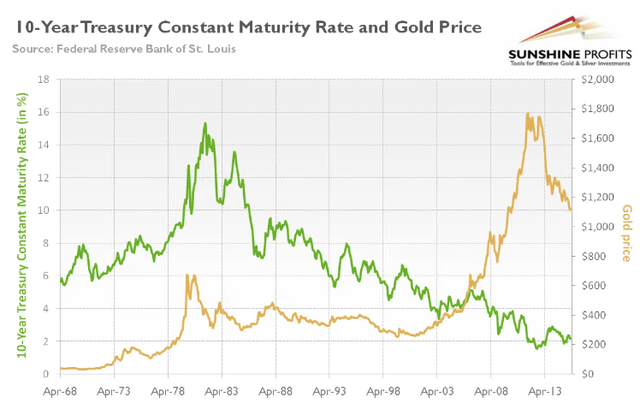

Let us also not forget that there are other measures the Fed can take to ease the monetary conditions to the extreme. This is known as QE (quantitative easing) or money printing, in plain words. This is when the Fed buys back the Treasuries to flood the US economy with some extra cash. This was actively done during the 2008 crisis and also during the Covid-19 pandemic. It is also possible the Fed would eventually do this during the current easing cycle. So, if everything goes according to the plan, in the next several years gold will only keep rising because the correlation between the yellow shiny metal and the interest rates is strongly negative.

Now let us talk about gold’s potential in the next several years of the easing cycle.

Why is $3000 gold too low?

I, personally, think that the gold price of $3000 per ounce many economists predict as early as mid-2025 is far too conservative. Why is that, and how can one estimate the fair value of gold, given that it does not generate any cash flows? Well, there is a so-called monetary base to gold ratio, which shows the relationship between the money mass and the gold prices. If the ratio is high, it means that gold is highly undervalued compared to the money mass. This is not exactly the case right now.

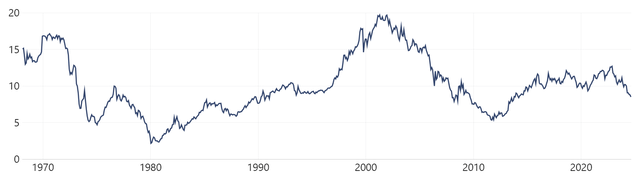

US M2/Gold Ratio

The ratio is not as high as it used to be in the 1970s or the beginning of 2000s. However, it is not as low as it used to be in 1980 or in 2011. So, it is quite average, which means it can easily decrease further. But the fact that this ratio is quite average under the current market conditions means that gold can appreciate much further. This is because the interest rates are near decade highs.

Federal Reserve

When interest rates are so high, it means there is not much money mass in the economy. So, assuming the ratio touches the levels reached in 2011, around 5, that is, from the current level of 10, gold should appreciate twofold, thus totaling $5200. That is because we can safely assume the money mass would rise substantially, thus raising the ratio, so gold should have further space to run.

Why could gold surge?

Apart from a series of rate cuts and potential for quantitative easing, which could push gold to unseen before highs, there are several factors, which could make gold surge.

- First and foremost, this is geopolitical uncertainty. By this, I mean any major political conflicts, wars, trade wars and rising tensions between countries. For example, there could be deteriorating relations between the US, China, and Russia. Alternatively, the conflict between Gaza and Israel can get even more countries involved. Something like this is happening now. Tensions in the Middle East have escalated further following Hezbollah leaders’ exploding pagers. The situation can obviously escalate further.

- Then, the USD can also lose its dominance as the world’s reserve currency. This will definitely not happen dramatically overnight. At the same time, certain countries, including Saudi Arabia and the BRICS are moving away from trading in USDs, which could obviously decrease the demand for the US dollar, thus also diminishing its importance. As an alternative to the dollar, it is possible that an international currency will eventually be created. It could be backed by gold, as a unit of account.

Risks

Now, let me talk to you about some possible risks.

- It is always a poor idea to buy an asset at its all-time highs. Gold is an asset class that is trading at its record highs because everyone expects aggressive easing. But the easing process may not be as aggressive as everyone expects. So, the disappointed investors may therefore cut their positions in the precious metal.

- If there is an economic crisis and the market starts panicking, the gold prices may initially fall because the US dollar would strengthen. But this tends to be very short-lived. After most asset classes’ depreciation, the Fed would start easing even more aggressively, which will make most asset classes appreciate again.

- The economic cycle – the period between recessions – will last even longer than most analysts expect. In other words, the Fed will successfully manage to avoid a recession and will make the US economy grow faster than most macroeconomists expect. So, the Fed would not have to take extra measures like QE (quantitative easing) to improve the economic indicators. This will mean limited (not as high as expected, that is) gains for gold.

Conclusion

In conclusion, I would say that gold has much further room to run. The current level of about $2600 per ounce was just the beginning. Even the $3000 predicted by several analysts will be reached very fast because the easing cycle has just started, it seems. Add to that the fact the monetary base to gold ratio is not at its all-time highs and that the interest rates are still very high. Further bullish factors include geopolitical uncertainty and the USD losing its status as the world’s reserve currency.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Shared by Golden State Mint on GoldenStateMint.com