Summary

- The Fed’s cumulative actual loss has reached $203B, with realized losses being incorrectly reported as “paper” losses by the mainstream media.

- The Fed’s financial instability is due to earning a 2.2% yield on assets while paying nearly 5% on liabilities, creating an unsustainable net interest spread.

- A potential recession may lower interest rates but could trigger a banking crisis, exacerbating the already significant risks in the U.S. banking system.

- Retail investors should conduct thorough due diligence on their banks as larger banks face greater risks, and reliance on FDIC protection may not be prudent.

- Looking for a helping hand in the market? Members of The Market Pinball Wizard get exclusive ideas and guidance to navigate any climate.

MCCAIG

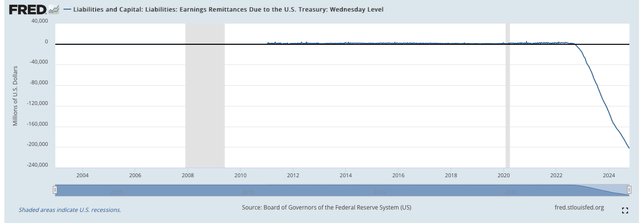

According to recent data published by the Fed, the regulator’s cumulative loss has reached $203 billion.

St. Louis Fed

It’s worth mentioning how the mainstream media reported this news. For example, here’s an article from Reuters.

Reuters

First and foremost, as we have already said in our previous articles, the mainstream media mistakenly label these losses as “paper.” Those are real cash losses, and, importantly, they’re a part of the U.S. budget deficit.

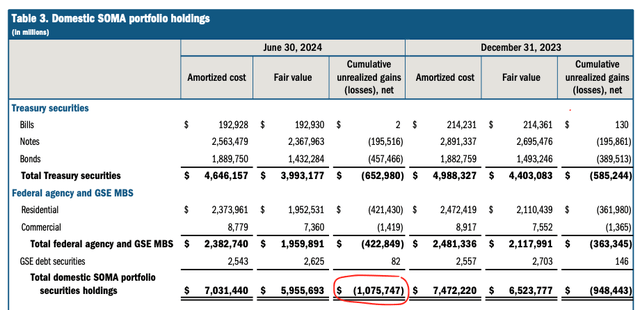

As the table below shows, the Fed’s paper or unrealized losses were much higher at $1.1 trillion as of the end of the second quarter.

The Fed

But those $203B are realized losses, and it’s very important to understand that media reports about paper losses and cash losses are incorrect.

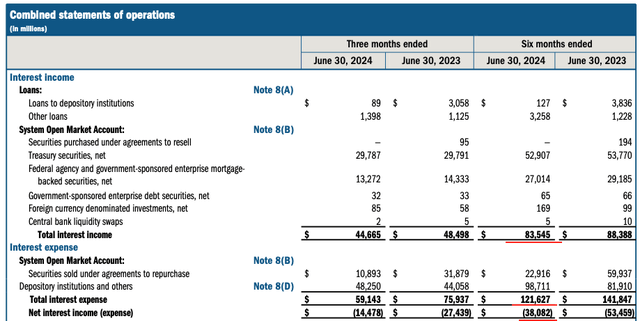

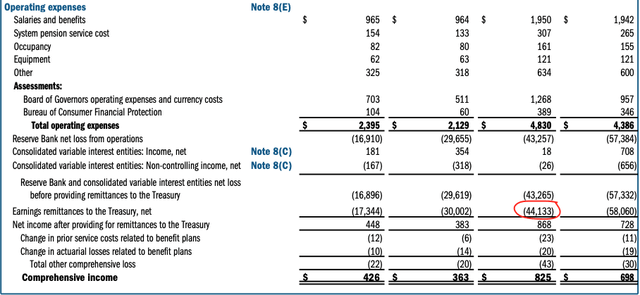

The Fed has not yet published its financial report for 3Q24, and, as such, we have only the 2Q/1H data. The table below shows a breakdown of the Fed’s net interest income (expense). The regulator’s interest income for the first six months of the year was $83.6B. However, its interest expense was $121.7B. As a result, the Fed’s net interest expense for 6M24 was $38.1B.

The Fed

There also were operating expenses of $4.8B, and, as a result, the Fed’s total net loss to the Treasury for 6M24 was $44.1B.

The Fed

The Fed has been losing money since September 2022, and its total loss, as we showed earlier, reached $203B.

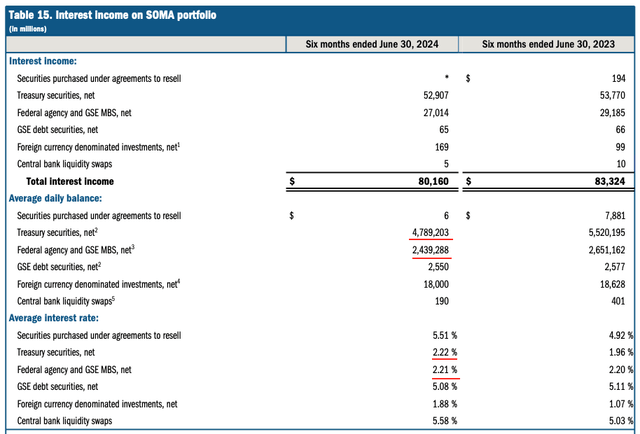

The reason for this significant loss is the Fed’s balance sheet. Here’s a breakdown of the Fed’s interest income on the SOMA (System Open Market Account) portfolio with average daily balances and average interest rates.

The Fed

The Fed has almost $5T of Treasuries with an average yield of 2.22% and $2.4T of Federal Agency and GSE MBS, which have an average yield of 2.21%.

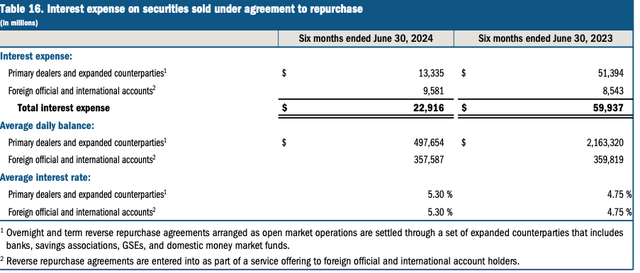

The table below shows the regulator’s interest expense in 1H24. 19% of its total interest expenses were expenses on securities sold under an agreement to repurchase. As shown below, the Fed was paying 5.3% on these instruments in 1H24.

The Fed

The rest of the regulator’s interest expense is what it’s paying to depository institutions. According to the Fed, depository institutions earn interest at the interest on reserve balance (IORB) rate, which is currently 4.9%.

As such, the Fed is receiving a 2.2% yield on its assets but is paying almost 5% on its liabilities. Obviously, this is not a sustainable situation, and any commercial bank would fail with such a net interest spread.

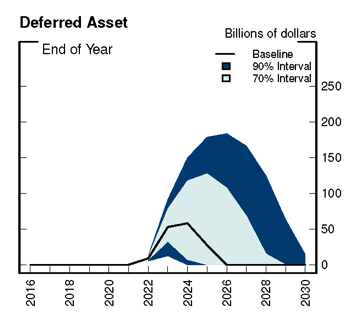

Notably, the Fed calls these losses a “deferred asset” according to its accounting methodology, which was introduced in 2010. This makes sense from the regulator’s perspective, as otherwise, with a total loss of $203B and a capital of $43B, the Fed would have negative equity of $160B.

But did the Fed expect such massive losses? Did its models predict the regulator would post a loss of $203B in the beginning of October 2024?

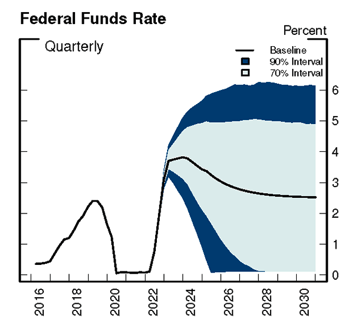

In mid 2022, the Fed published an article titled “An Analysis of the Interest Rate Risk of the Federal Reserve’s Balance Sheet, Part 2: Projections under Alternative Interest Rate Paths.” In this paper, the regulator examined how fluctuations in interest rates affect its financial result along with the unrealized gain or loss position of the SOMA portfolio.

One of the regulator’s scenarios assumed that the policy rate would reach 6% in 2025-2026 and stay at this level until 2030.

The Fed

Surprisingly, even under this scenario, the Fed did not expect that its cumulative loss or a “deferred asset” would be more than $180B.

While the deferred asset reaches a peak of about $60 billion in the baseline projection, the tail risk in these projections, represented by the upper edge of the dark-blue area, indicates that the deferred asset could reach as high as about $180 billion.

The Fed

So, the Fed forecasted that its loss would peak in 2026 at $180B. But the loss is already more than $200B, and the policy rate has been cut this year, which was not assumed by the Fed.

And, if we look back to when Alan Greenspan was the Fed Chairman, his quote at the time explains why trusting the Fed is not wise:

“We really can’t forecast all that well, and yet we pretend that we can, but we really can’t.”

Yet, this is the entity that most of the market believes has reached a point of reliance to the extent of omnipotence. Many of you in that category will likely be lambs led to the slaughter, maintaining such belief.

Bottom Line

Some economists say that a recession in the U.S. economy, which is expected by quite a lot of experts, would lead to a decrease in interest rates and would solve this issue with the Fed’s losses. However, a potential recession will likely trigger a major banking crisis given that U.S. banks have a lot of issues, which we discussed in our previous articles.

On the other hand, if the Fed’s losses continue to increase, it also will likely be a major issue for the stability of both the U.S. economy and the banking system.

Another takeaway from our analysis is that the Fed’s estimate of its own losses and its assessment of its tail risk events make some question the reliability of the regulator’s stress tests, which it publishes annually for U.S. banks.

Moreover, our expectation is that, while rates may come down over the coming 12-24 months, it’s likely only setting up what we expect to be a bond market crash due to interest rates likely rising rapidly beyond 7% as we look toward the last half of the current decade.

This begs the obvious question: How can the Fed assess the safety of the U.S. banks when it can’t correctly estimate the risks of its own balance sheet? We have written a lot about the Fed’s stress tests, but this situation, with huge losses for the regulator, has undermined their credibility even further, in our view. We believe retail depositors should not rely on the Fed’s stress test when choosing a bank for their savings.

Believe it or not, there are major issues on larger bank balance sheets as compared to smaller banks, which we have covered in past articles. Moreover, consider that there was one major issue which caused the GFC back in 2008, whereas today, we currently have many more large issues on bank balance sheets. These risk factors include major issues in commercial real estate, rising risks in consumer debt (approaching 2007 levels), underwater long-term securities, over-the-counter derivatives, and high-risk shadow banking (the lending for which has exploded). So, in our opinion, the current banking environment presents even greater risks than what we have seen during the 2008 GFC.

Almost all the banks that we have recommended to our clients are community banks, which do not have any of the issues we have been outlining over the last several years. Of course, we’re not saying that all community banks are good. There are a lot of small community banks that are much weaker than larger banks. That’s why it’s absolutely imperative to engage in a thorough due diligence to find a safer bank for your hard-earned money. And what we have found is that there are still some very solid and safe community banks with conservative business models.

So, I want to take this opportunity to remind you that we have reviewed many larger banks, including those noted above, in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, and you can read about them in the prior articles we have written. And, as these issues get worse, the risk continues to rise.

Moreover, if you believe that the banking issues have been addressed, I think that the recent issues surrounding New York Community Bancorp (NYCB) are reminding us that we have likely only seen the tip of the iceberg. We were also able to identify the exact reasons in a public article which caused SVB to fail weeks before it happened. And I can assure you that they have not been resolved. It’s now only a matter of time before the rest of the market begins to take notice. By then, it will likely be too late for many bank deposit holders.

At the end of the day, we’re speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you’re relying on the FDIC, I suggest you read our prior articles, which outline why such reliance will not be as prudent as you may believe in the coming years, one of the main reasons being the banking industry’s desired move towards bail-ins. (And, if you do not know what a bail-in is, I suggest you read our prior articles.)

It’s time for you to do a deep dive into the banks that house your hard-earned money to determine whether your bank is truly solid or not. To that end, review our due diligence methodology here.

Avi is the leader of the investing group The Market Pinball Wizard where they help members gain a more real-time understanding of where the market is likely heading. Features of the group include: daily S&P 500 directional analysis, intraweek metals analysis, weekly expanded analysis on the S&P 500, metals, USO, and USD, weekly live webinars where we walk you through the charts we are tracking, and community chat with direct access to Avi and his team of analysts to ask questions. Learn More.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Shared by Golden State Mint on GoldenStateMint.com