Summary

- President Trump’s announcement of tariffs on Canada, Mexico, and China caused market turmoil, highlighting the economic risks and potential inflationary pressures.

- Markets initially overreacted, but news of a 30-day delay on Mexican and Canadian tariffs led to a partial recovery.

- The tariff threats damage investor, consumer, and business sentiment, increasing uncertainty and potentially stalling economic growth and monetary policy easing.

- I believe Trump will ultimately retract the tariffs due to their widely advertised negative economic impacts, including reduced GDP and S&P 500 earnings.

- This idea was discussed in more depth with members of my private investing community, The Portfolio Architect.

catscandotcom

Finviz

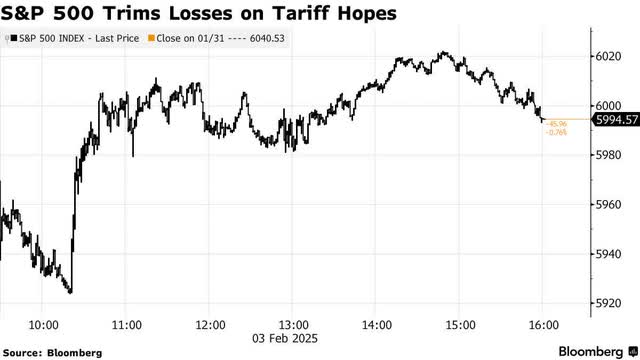

I also indicated yesterday morning that markets would likely overreact, which could be the catalyst for a rethink by the President, resulting in a rollback or reduction in the tariffs based on new developments. My assumption was that this would take days or weeks and not hours. The major market averages started to recover in earnest once news broke that Trump agreed to delay the 25% tariff on Mexican imports for 30 days after a discussion with Mexican President Sheinbaum. After the close, news broke that the 25% tariff on Canadian imports would also be delayed for 30 days, which had overnight futures largely wiping out Monday’s losses, but at a serious cost.

Bloomberg

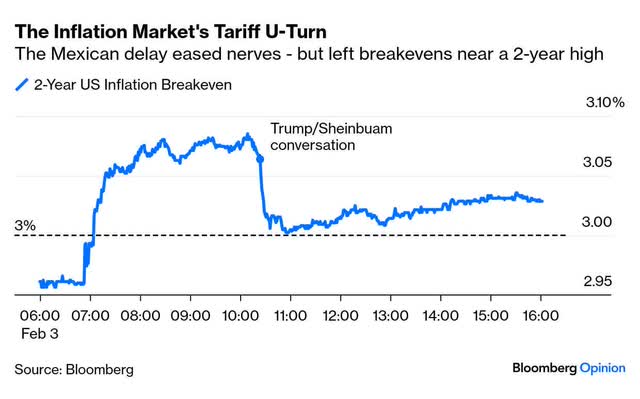

We may have a 30-day reprieve before we worry about the threat of tariffs all over again, but this unnecessary drama comes with a cost. It damages investor sentiment because of the revelation that markets could swoon at any moment on an errant tweet from the President, as they did on Friday afternoon. It damages consumer sentiment because the average American household will wonder if the prices of gas, food, and other necessities may rise in price in the coming months, which can weigh on discretionary spending. It damages business sentiment the most because business owners will now have to operate under tremendous uncertainty, which weighs on capital spending and hiring plans. Note that despite the Mexican delay during market hours, the increase in inflation expectations did not fully revert to their prior levels.

Bloomberg

This isn’t a game, but it is being played like one, which is unfortunate. It appears that in return for the 30-day delay in imposing tariffs, both Mexico and Canada have agreed to beef up border security to prevent illegal crossings and stop the flow of fentanyl. Still, President Trump discusses immigration, fentanyl, and our trade deficits with both countries in the same breath, so will deficits be the new bone of contention in 30 days? The one thing markets do not like is uncertainty, and we are seemingly bathing in it right now.

Ultimately, I do not think President Trump will follow through with his tariff plans on either Canada or Mexico because the adverse impact on the economy and markets has been so widely advertised that he would have difficulty deflecting the blame. China has already responded with a 10% tariff on some $20 billion of our exports to that country. Goldman Sachs was clear in pointing out that the 25% tariffs would knock 0.4% off GDP and increase the core rate of inflation by 0.7%, which would reduce S&P 500 earnings by 2-3% this year. That does not consider the knock-on effects I already mentioned. This is because we pay the tariffs as businesses and consumers.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Shared by Golden State Mint on GoldenStateMint.com