Summary

- The President is embarking on a trade war that could put the economic expansion at risk and the rest of his agenda.

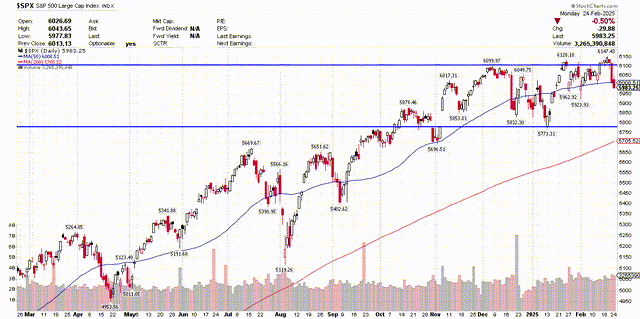

- The S&P 500 looks to be on track to test its long-term moving average in an ensuing pullback.

- I expect the administration to pull back on punitive policies as it recognizes the adverse impact on the economy and markets.

- This idea was discussed in more depth with members of my private investing community, The Portfolio Architect.

gorodenkoff/iStock via Getty Images

The major market indexes attempted to rebound after Friday’s dramatic selloff, but those hopes were dashed in the late afternoon when President Trump reiterated his intentions to go ahead with tariffs on Mexican and Canadian imports next month, despite efforts by both to meet his demands. Officials also asserted that reciprocal tariffs to be placed on all trading partners, including Mexico and Canada, were on schedule for April. Then we have 25% tariffs on pharmaceuticals, semiconductors, and autos scheduled for April, as well as an increase to 25% on steel and aluminum to begin March 12. Our trading partners around the world appear to be working in concert with a coordinated response in retaliation. Unless this is simply more theatrics from the Trump administration, it appears the trade war is on. No one wins a trade war, and the biggest losers are lower- and middle-income households.

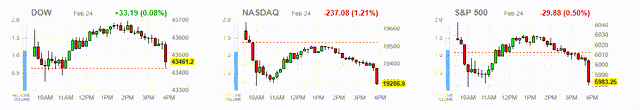

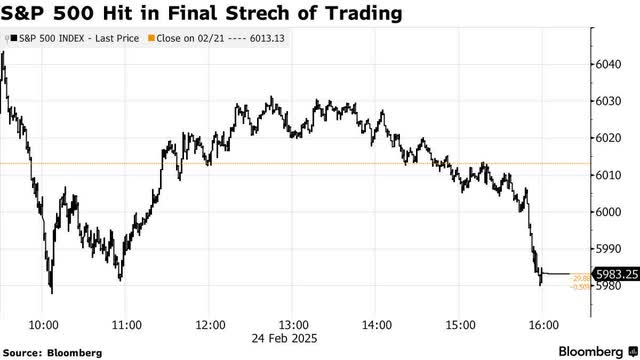

The foundation of our economic expansion and the vitality of the American consumer is about to be tested mightily. Consumer and business sentiment has already cracked. We are starting to see disappointments in the high-frequency economic data, which is leading to lower estimates for GDP and corporate profits in the first quarter. The implementation of all the tariffs, as advertised, will only exacerbate the negative rates of change. Perhaps we were due for another pullback in the major market indexes after the S&P 500 reached a new all-time high last week and these developments are the convenient reason for it. Yet, I think the president is playing with fire at a time when a pullback could turn into a correction that could turn into something worse if he doesn’t rethink the timing of his fiscal policy implementation.

The S&P 500 has remained in a tight 4% range since the election with a brief breakout last week to a new all-time high that failed to hold for obvious reasons. Given the news flow, it seems almost certain that we will test the lower end of this range at approximately 5,800, which will come close to testing the 200-day moving average. That would be a 6-7% pullback from the all-time high and approximately 4% from yesterday’s close. It sounds relatively modest, especially compared to last summer’s nearly 10% decline in July. Still, it is concerning to me because of the reasons for the decline.

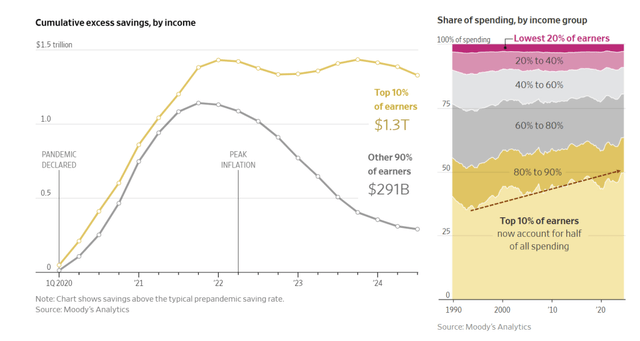

If the threat of punitive tariffs can damage consumer sentiment to the extent it already has, as well as impact consumer and business spending, the implementation of those tariffs would be far worse. If consumer spending stalls, then we will start to see deterioration in the labor market, compounding the efforts by DOGE to cut spending and reduce the size of the federal government’s workforce. If stock prices fall, that can also adversely impact consumer spending, as we know that the top 10% now account for approximately half of all spending, and they are the investor class.

This can have a snowball effect, which I don’t think Trump administration officials have had the courage to relay to the president. A meaningful downturn in the economy and market is a prescription for undermining the rest of the Trump administration’s agenda. Unfortunately, I think investors will have to suffer some near-term pain to get that message across.

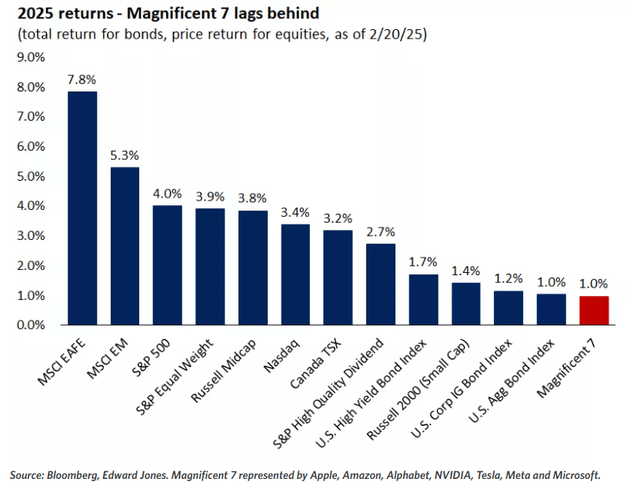

Once it does, we are still likely to remain range bound, as sector rotation continues. As if the technology sector needed another headwind, earnings growth for the Magnificent 7 is decelerating sharply from 2024 to 2025, which has resulted in the sector falling from first in 2024 to last so far this year. That comes as no surprise, but the significant weighting these companies have in the S&P 500 will limit the upside for the index this year, as earnings catch up with what are still expensive stock prices. I still prefer the equal-weighted index.

Lastly, as concerning as my tone may be, I am still assuming that this is a pullback to the correction phase for the market and not an end to its bull run or economic expansion. Corrections of 10% or more have almost always been a function of the Federal Reserve tightening monetary policy or remaining too tight for too long. Today, we have a Fed that is poised to ease again as soon as we make more progress on inflation. That should be a meaningful counterbalance to the Trump administration’s policies if needed.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Lawrence Fuller is the Principal of Fuller Asset Management (FAM), a state registered investment adviser. He is also the manager of the Focused Growth portfolio on the copy-trading platform Dubapp.com. Information presented is for educational purposes only intended for a broad audience. The information does not intend to make an offer or solicitation for the sale of purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. FAM has reasonable belief that this marketing does not include any false or material misleading statements or omissions of facts regarding services, investment, or client experience. FAM has reasonable belief that the content as a whole will not cause an untrue or misleading implication regarding the adviser’s services, investments, or client experiences. Past performance of specific investment advice should not be relied upon without knowledge of certain circumstances or market events, nature and timing of investments and relevant constraints of the investment. FAM has presented information in a fair and balanced manner. FAM is not giving tax, legal, or accounting advice.

Mr. Fuller may discuss and display charts, graphs, formulas, and stock picks which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions. Consultation with a licensed financial professional is strongly suggested. The opinions expressed herein are those of the firm and are subject to change without notice. The opinions referenced are as of the date of publication and are subject to change due to changes in market or economic conditions and may not necessarily come to pass.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Shared by Golden State Mint on GoldenStateMint.com