- Economic indicators show a sharp and sudden deterioration, with significant drops in GDP and consumer spending, indicating increased odds of a recession.

- Factors contributing to the slowdown include high tariffs, less federal spending, higher unemployment, and declining consumer and business confidence.

- Recommend reducing exposure to economically vulnerable sectors, building cash, and considering investments in U.S. businesses that could benefit from tariffs.

Colin Anderson Productions pty ltd

There is Chaos not only in Washington, DC, but in Boardrooms nationwide. Planning for the future is difficult when everything gets turned upside down. Large, sharp, sudden changes always have an economic impact, but I do not recall one as sharp and sudden as what we are seeing now.

What the charts say

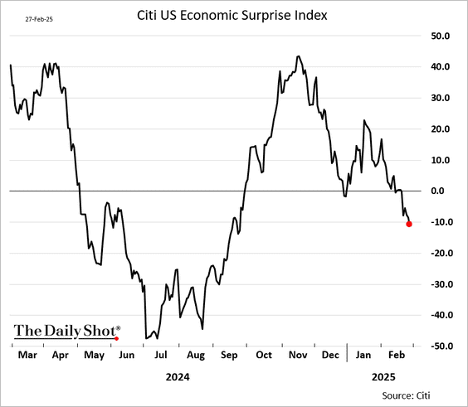

Usually, there is a bit of a lag before something like this impacts the economy. But recent economic indicators are now showing a sharp and sudden deterioration. This first chart shows U.S. Economic Surprise Index published weekly by Citi.

The Daily Shot

This indicator tends to have an outsized impact on the stock market. Remember, the last time the stock market had a large pullback was last summer.

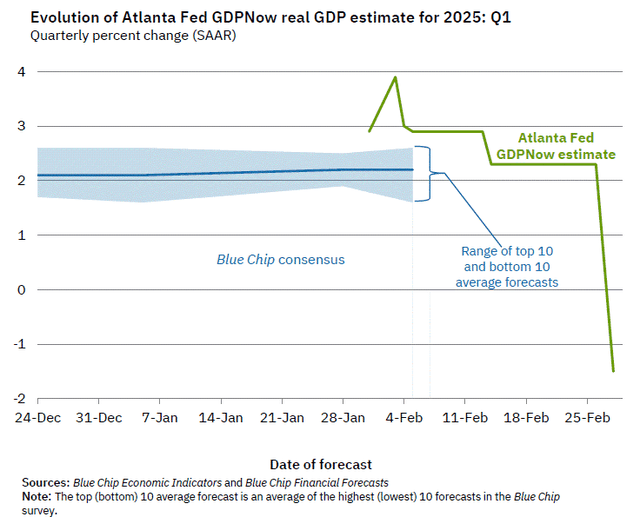

The next chart just came out and is what caused me to write this article. It is the GDP tracker for this quarter published weekly by the Federal Reserve of Atlanta. Get ready for a WOW.

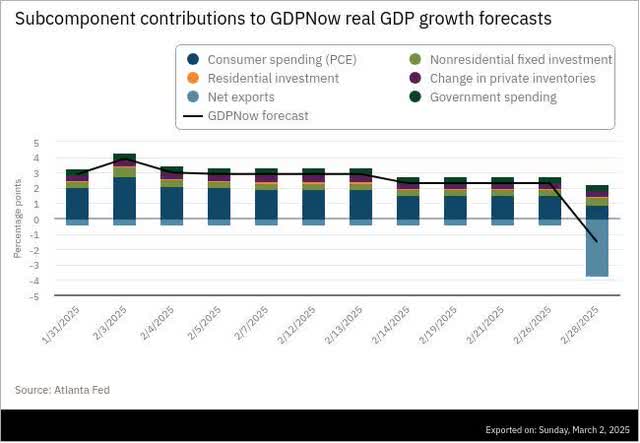

This chart shows a drastic fall off in GDP, one of the biggest I have ever seen in such a short time period. However, it’s not as bad as shown above. Once you look at the underlying factors, as shown in the chart below, you’ll see that the majority of the drop-off appears to be from a surge in imports to get around announced tariffs.

I believe the drop-off in net exports is mostly a surge in imports to get around tariffs. That makes it mostly noise. But there is another component above that is a lot scarier. That is consumer spending. Expected growth in consumer spending looks like it has been cut by over half in just the past month, from 2% to under 1%. This decline had been slow, but really picked up steam in the past few days. It’s certainly possible there is noise in the numbers, but if these numbers are confirmed, it indicates a sharp slowdown in the economy.

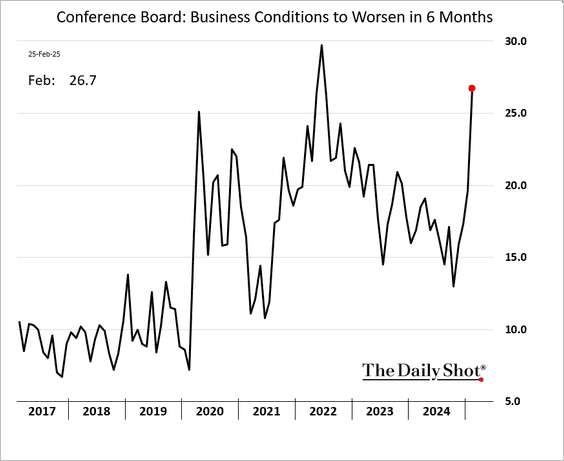

The chart below is just one of many that show a sudden decline in consumer and business confidence.

The Daily Shot, The Conference Board

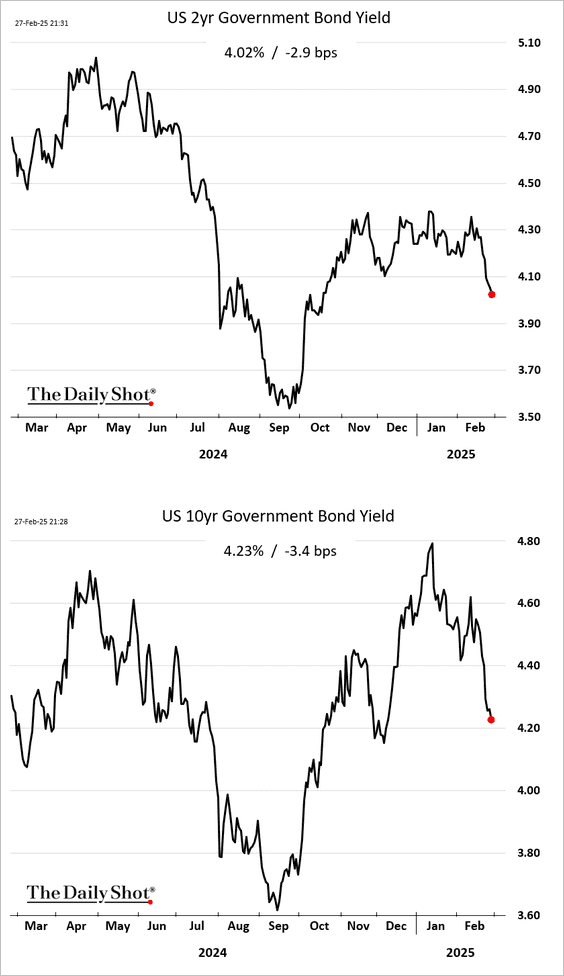

The chart below shows interest rates for 2 and 10 year treasuries. They have started to drop despite inflationary expectations from high tariffs and a tight labor market caused by reshoring and deportations. Those normally would increase interest rates. This indicates investors expect an economic slowdown to have more impact than inflationary pressures.

The Daily Shot

Why this is happening

There are a number of factors that have suddenly come together to cause the slowdown. These are listed below.

1. Less free trade – Many investors are aware that the last time we had high tariffs was in the 1930s, caused in part by the Smoot-Hawley Act of 1930. The 1930s were the time of the Great Depression. I am not predicting that, but throughout history, high tariffs have usually led to economic weakness. U.S. economic growth has surged since around 1990 due in large part to the fall of the Berlin Wall and the opening up of China. Both led to much more free trade as there were many more trading partners.

2. Less federal spending – Cuts in Federal spending alone could be enough to put us in a recession. Let’s do the math. The DOGE wants to cut at least $1 trillion in Federal spending. U.S. GDP was $27.7 trillion in 2023. A $1 trillion cut in spending is 4% of GDP. Our GDP growth has averaged only 2-3% in recent years. While it’s unlikely all those cuts would occur in one year, a cut of that magnitude would still have a huge impact. The most vulnerable year is fiscal 2026, starting in October 2025.

3. High tariffs – High tariffs are not only inflationary, but they usually lead to counter tariffs on our goods, resulting in fewer exports. Exports are a major component of GDP.

4. Higher unemployment– The headline layoffs currently are at the federal level. But any cuts there will be magnified by all the businesses that receive fewer government contracts and need layoffs to stay profitable. Then there is all the social agency non-profits rely on federal monies. I am on the board of one, and we don’t see how many will survive. Then there are all the businesses indirectly impacted by less spending from those who were laid off.

5. Businesses can’t plan – All the above makes it hard for businesses to plan for the future. When that happens, their intuition is often to become more conservative with hiring and spending. I recommend watching the capex economic data and hiring data closely to see if that happens. As noted in number 7 below, business confidence is already dropping.

6. Less immigration– Less legal and illegal immigrants make it tougher for businesses to find workers. However, a recession should offset that.

7. Consumer and business confidence– Numerous reports are showing a sharp recent drop in consumer and business confidence. I showed one above, but it is across the board.

8. Trauma– Polls show Democrats are very concerned about the future. That is not conducive to discretionary spending or investing by a large segment of the population.

What is carrying the economy

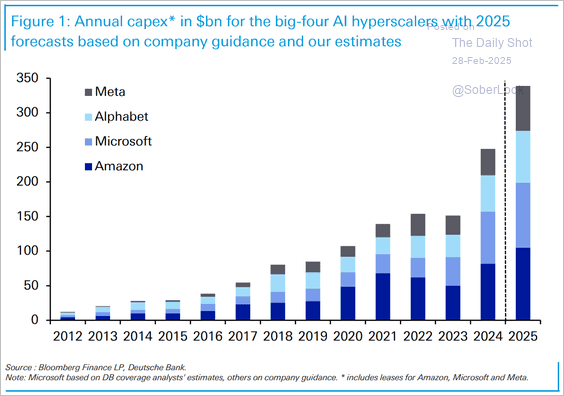

The biggest item carrying the economy right now is a massive surge in capex and research spending by large IT firms on AI. This is shown in the chart below.

Bloomberg

If this were to slowdown, it would have a major impact on our economy with all the tailwinds listed above. I am not necessarily predicting that, but it is something to watch for.

Take Away

With economic policy changing by the day, it is hard to know which specific stocks to go long or short. Policymaking in Washington DC could become more benign, and all this could be just a scare. At a minimum, I recommend starting to pull back with less weighting of economically vulnerable sectors in a recession.

Reduce weighting in the most susceptible sectors to a recession, such as consumer discretionary, commercial construction, and transportation. Increase weighting in utilities, consumer nondiscretionary, healthcare, and home building. A recession usually significantly lowers interest rates, which should benefit home building. I also recommend buying the iShares 20+ Year Treasury Bond ETF (TLT). A decline in long-term interest rates will increase its stock price. Avoid riskier stocks and overweight stocks of steadier companies. Riskier stocks are often characterized by higher betas and higher leverage.

If you are concerned about tariffs, there are U.S. businesses that will benefit. I wrote about one a month ago about NN (NNBR) titled NN, Inc.: The Tariff Beneficiary Poster Child.

Finally, while I am not abandoning the stock market, this is a good time to build your cash position.

Shared by Golden State Mint on GoldenStateMint.com