Summary

- Gold has risen 38% since June 2024 and is up 23% in 2025, outperforming major assets like the S&P 500 and Bitcoin.

- Gold historically performs well during recessions, offering a safe haven due to its unique properties and lack of counterparty risk.

- Rising global uncertainty, high inflation, and geopolitical tensions make gold a preferred investment to stocks, bonds, and cryptocurrencies.

- Given the current economic and political climate, now is a time for caution and safety, making gold and ETFs like SPDR Gold Shares ETF attractive.

J Studios

Gold has risen 38% since my June 2024 Seeking Alpha article titled “Gold And Silver Bull Market Is Just Beginning.”

Now not only is the gold bull market continuing, but it is arguably the only major asset still in a bull market.

Gold Is TINA So Far In 2025

So far in 2025, gold has risen 23% to an all-time high. Meanwhile, the S&P 500 is down 9%, the NASDAQ 100 is down 11%, the Russell 2000 is down 17%, global stocks are down 5%, REITs are down 6%, commodities are down 2%, high yield “junk” bonds are down 1%, long-term US Treasury bonds are down 0.4% and Bitcoin is down 20%.

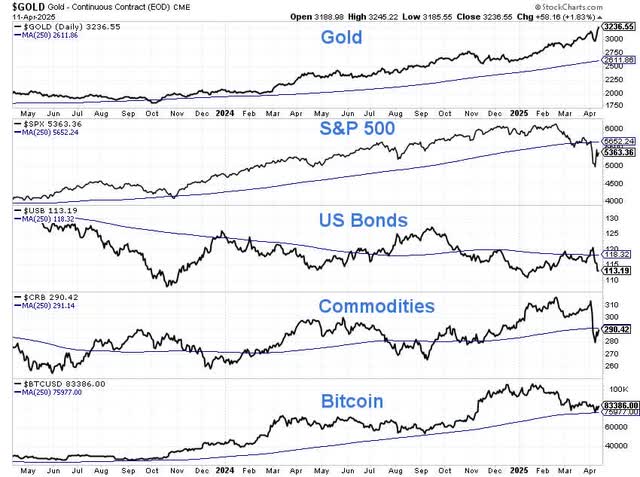

The chart below shows what an excellent performer gold has been over the past two years compared to the S&P 500 stock index, US Treasury bonds, commodities and Bitcoin.

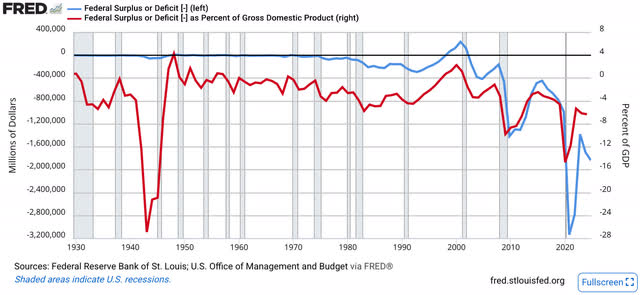

This next chart shows gold has significantly outperformed the S&P 500, US Treasury bonds and commodities over the past two years. And while it has underperformed Bitcoin during that time, the price of gold relative to Bitcoin has recently risen above its key 250-day moving average after outperforming year-to-date, which suggests the beginning of a change in the relative trend.

Gold Is Often TINA In Recessions

If a recession is coming, as I believe is likely, then the key question is: “How does gold perform in a recession?”

Gold has risen or at least been flat during every recession since Nixon severed the US dollar’s ties to gold in 1971, except during the disinflationary 1982 recession — after gold’s 1970s bubble had already burst. There was also a lot of volatility for gold during the Great Recession, but gold was higher overall then.

Let’s take a closer look at gold’s performance during recessions.

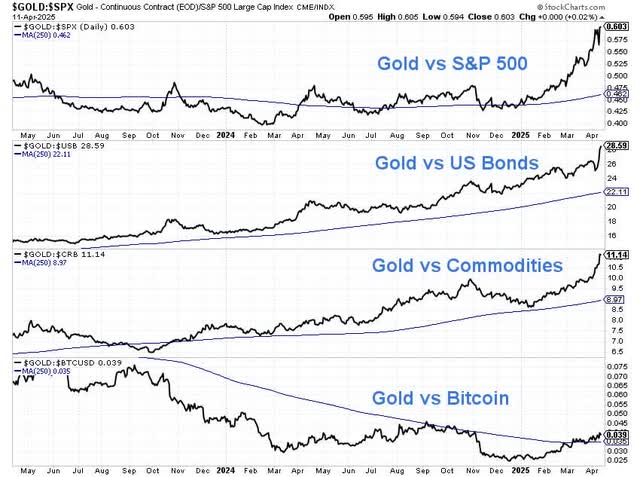

During the “stagflationary” 1970s, which may be the period most similar to our current environment of stubbornly high inflation, gold generally rose during recessions. This chart shows that gold nearly doubled during the brutal 1973-1974 recession, when the S&P 500 was nearly cut in half. Gold rose in the very early part of the 1980 recession, then sold off and finally recovered for an overall gain during that recession. US Treasury bonds, which are often a safe haven and rise during recessions, were decimated in the stagflationary 1970s and early 1980s as interest rates skyrocketed.

This chart shows that gold rose during the recessions of the early 1990s, early 2000s and 2008-2009. However, it did not move in a straight line (no financial asset does, of course) and was often volatile, particularly during the Great Recession. But gold’s 18% rise during the Great Recession was much more comforting and profitable to investors than the S&P 500’s 57% collapse.

How did gold fare during the 2020 covid panic recession? As this chart shows, it hardly noticed it, while the S&P 500 crashed 34%.

Why Gold Is A Safe Haven

This raises the question: “Why does gold typically rise and dramatically outperform stocks and most other risk assets during a recession and other periods of heightened risk?”

The answer to this question has to do with the nature of gold. As I discussed in a Seeking Alpha article, gold has served as the primary medium of exchange, i.e., money, throughout most of human history. It is only in the last 54 years that money has not been tied to gold, only to government fiat. This means gold has been the ultimate “safe haven” for investors for millennia.

Gold provides invaluable peace of mind for investors during periods of heightened risk and uncertainty. This is because gold is not a liability of anyone, so it has no default or counterparty risk. It is recognized and valued by everyone around the world for its beauty and unique and durable physical properties. It can be transported and exchanged physically with no reliance on technology or even electricity. Gold cannot disappear or go bankrupt, even in a recession or nuclear war. This is not true for businesses, stocks, leveraged real estate, private or public bonds, many commodities and even cryptocurrencies which depend on technology and electricity. And gold cannot be created out of thin air by any government, bank or counterfeiter, so its supply is relatively fixed, which has enabled gold to maintain its purchasing power over time.

While Bitcoin has been promised to be “gold 2.0”, it continues to be driven by speculative investor psychology and remains highly correlated with stocks, as I detailed in a Seeking Alpha article. Gold remains driven by investors seeking safety, simplicity and certainty.

Why Gold Is TINA Now

Gold is TINA now due to the rising uncertainty and chaos in the world. But that did not just start in recent weeks. It has been going on for quite a while.

Let’s review just the past five years.

First, stock market valuations rose to near their highest levels in history by early 2020 after years of reckless Fed money creation in the form of “quantitative easing” and artificially low interest rates. High valuations created a significant headwind for stocks and locked in poor long-term returns. Meanwhile, gold prices relative to GDP remain a small fraction of their 1980 peak.

Then we had the global covid pandemic and lockdowns. The Fed’s response to this virus was to increase the money supply by an unprecedented 40%. This naturally caused the highest inflation rates in four decades. This forced the Fed to raise rates at the most aggressive pace since the early 1980s, after Fed Chair Jay Powell infamously dismissed the high inflation as “transitory”. All of this led to the worst bear market for US Treasury bonds, the supposed “ultimate safe haven”, in over four decades.

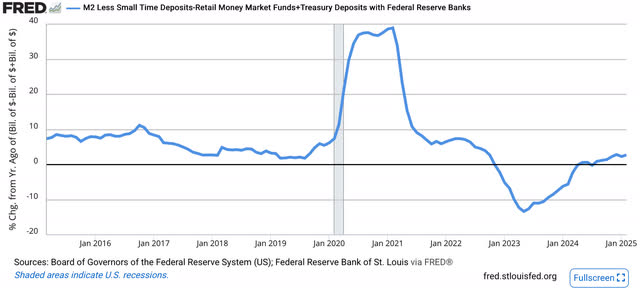

The Fed tightening also led to the largest decline in the money supply since the Great Depression, as shown in this chart of the “Austrian” money supply, which is the best measure of money supply, as it only includes money that can be immediately spent and does not double count, unlike other money supply metrics like M2. Unfortunately for the Fed, consumers and investors, despite all of their tightening, inflation still remains stubbornly above the Fed’s arbitrary 2% target, which is why the Fed is not able to justify rate cuts until the economy gets much worse.

FRED

This Fed tightening also led to the longest yield curve inversion in US history, even longer than the prior record inversion that occurred before the Great Depression. As this chart shows, recessions usually follow an inverted yield curve — with long and variable lags — like night follows day.

Then we had the Russian invasion of Ukraine and the US proxy war with Russia, which could lead to nuclear war. Then we had the 2022 bear market, when the NASDAQ fell nearly 40% and Bitcoin fell nearly 80%. Then we had AI mania, which drove stocks to the all-time highest valuation levels in history.

Then we had the Israeli-Palestinian conflict, which could end up leading to war with Iran, which could also lead to nuclear war.

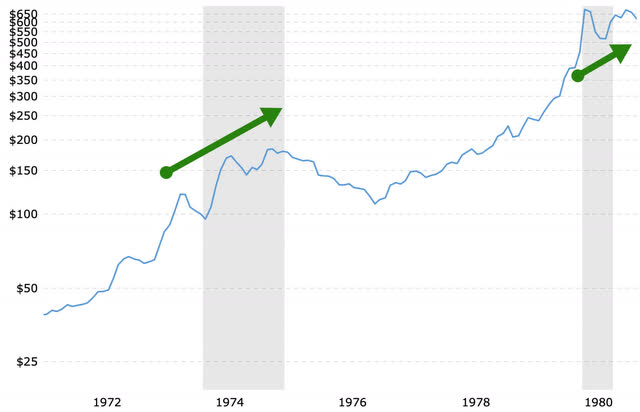

Throughout this period, the Federal government has incurred the largest budget deficits in history, which are now more than 5% of GDP, as shown here.

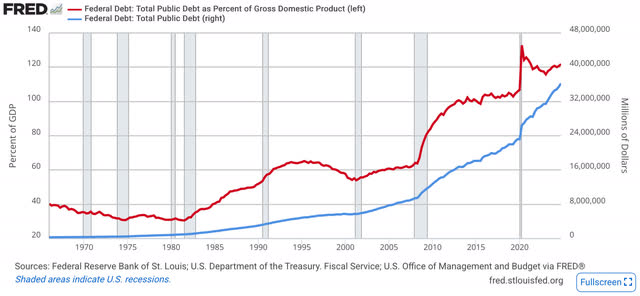

This has resulted in the largest Federal debt in history, which is about 120% of GDP, as this chart shows.

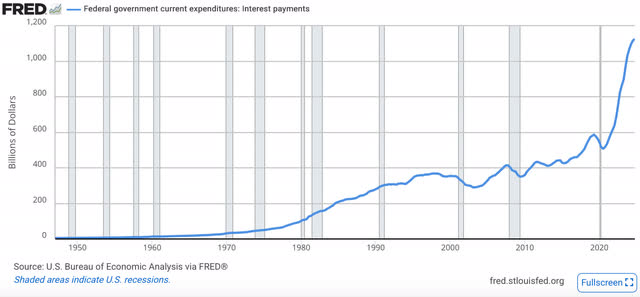

Due to much higher interest rates and Federal debt, interest expense on the Federal debt has more than doubled in recent years, as shown here, and is now the second-largest line item in the Federal budget after Social Security.

And it’s not just the government. After more than a decade of ultra-easy money, total debt for all sectors relative to GDP is near the highest levels in history at 3.5 times, as shown here.

And to make matters worse, we have probably the greatest political division in US history between “the left” and “the right” in modern times, which is being heightened by the latest election.

And now we have Trump’s global trade war, with tariffs creating the greatest economic risk since the Smoot-Hawley tariffs that contributed to the Great Depression.

This has resulted in a collapse in consumer sentiment to the lowest levels in modern history, as shown here. It doesn’t help that the unemployment rate has already risen by 0.8%. Every time it has risen that much, there has been a recession.

As a result, even BlackRock CEO Larry Fink says many CEOs think a recession has already started in the US.

Conclusion

Given all the major issues going on in the world these days, it is not surprising to see gold rising and most other assets declining. While it is possible, this could be short-lived, given how difficult all these issues will be to solve — particularly after the Fed’s huge rate hikes, which are likely starting to impact the economy in their typical negative way — I would not bet on that. Now is a time for caution and safety, not the rampant speculation we have seen in recent years. Now is a time for gold, including ETFs like the SPDR Gold Shares ETF (NYSEARCA:GLD).

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GLD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Shared by Golden State Mint on GoldenStateMint.com