Summary

- Trump’s tariffs initially depressed silver prices, but long-term supply disruptions and safe-haven demand could drive prices higher.

- Silver’s industrial demand in green energy and electronics, combined with geopolitical uncertainties, supports a bullish outlook.

- Physical silver investment is recommended due to high paper-to-silver ratios and potential market chaos.

- Despite short-term bearish factors, long-term silver prices are likely to rise due to tariff-related supply issues and green energy demand.

AlexLMX

A lot has happened since my last article about silver, where I wrote that the prices for the grey metal might soar to triple digits. President Trump’s tariffs, however, have rattled the markets, thus depressing many asset prices. This also affected the silver market. I will explain why. In this article I will also explicate why Trump’s tariffs are bullish rather than bearish for the grey metal’s pricing.

Recap of my previous article on silver

In my previous article about silver, I wrote that the grey metal was undervalued and had the potential to appreciate further, driven by economic and political uncertainties and industrial demand in green energy and electronics.

Additionally, I wrote that silver prices might surge if geopolitical tensions intensify, thus making the grey metal a safe-haven asset like gold but cheaper.

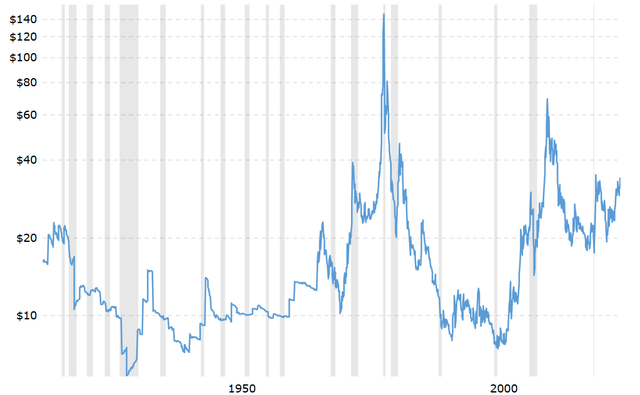

Also, historically, silver price trends showed the metal was not too expensive if we consider inflation. As of the time of my previous article’s publication, it remained below previous peaks, meaning room for growth.

I also recommended investing in physical silver due to the high paper-to-silver ratio. I predicted $140 per ounce should there be real market chaos. My investment case remains broadly unchanged. The reason why I am writing this article is because the trade war has reached its peak. So, some investors might not be so sure whether to invest in silver now.

Silver and Trump’s tariffs

The initial reaction of silver markets to the growing tensions between the US and China was a fall in the prices of gold and silver due to the USD’s surge relative to other asset classes. In other words, market participants panic-sold their assets to get more cash. Obviously, this initially made the silver prices go down.

However, both gold and silver typically act as safe haven metals that protect investors’ savings if there is political or economic uncertainty. As I have mentioned in my previous work before, silver is more volatile but more attractive than gold for investors with smaller sums of money available to commit to buying precious metals. So, in the long term, silver, just like gold, is likely to appreciate thanks to safe haven demand.

But is there really a threat that tariffs would physically affect the supply of silver?

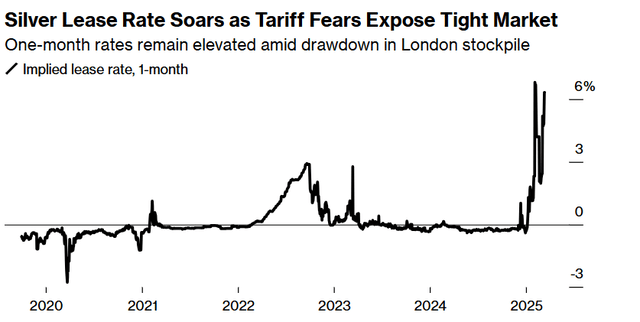

According to a Bloomberg article published on 18 March this year, the silver market faces mounting stress. Due to trade war risks, rates to borrow metal rise.

A surge in lease rates for silver, the cost of borrowing metal, generally for a short period, has hit new highs. This is due to anxiety over risks of further tariffs that could potentially be imposed by Trump.

Bloomberg

This made the silver prices in New York soar, which in turn made silver sellers transport silver from London into the US to take advantage of premium prices. This has caused a supply deficit in London. One-month rates for silver exceeded 6% in March after a larger spike in February. In addition, to fast-depleting London stocks, not all of the remaining silver is available given the fact that silver is tied to exchange-traded products. As I have mentioned in my previous analyses, there is much more paper silver than there are physical silver reserves.

Therefore, on a physical level, the tariff concerns — especially the ones against Canada and Mexico and remaining in effect despite the 90-day pause announced by Trump— have transferred large amounts of both gold and silver out of London into US vaults. At the same time, gold tends to be easier to transport and store due to its high prices. Silver, meanwhile, often takes longer voyages, especially by ship, due to the amount of space it takes. According to Cao Shanshan, an analyst at COFCO Futures Co., the lease rate in London would remain high for about two to three months due to the transportation concerns.

The US Comex-tallied stocks of silver have increased to the highest level ever since 1992 after a 40% surge in the first quarter this year, a record rise. The silver flows to the US are not passing just yet. So, if they continue, it is likely there will be a “silver squeeze” in Europe. At the same time, the US may face decreasing supplies of silver because it imports about 70% of its grey metal from Canada and Mexico. The US 25% tariff on products it imports from Mexico and Canada that are not covered under the region’s USMCA trade agreement is valid despite the 90-day pause granted by Trump. Energy and potash from the two countries will also continue to be tariffed at 10%. In response, Canada announced 25% counter tariffs on about C$30 billion ($20.8 billion) of US-produced goods, including silver.

It still seems to me that the market may be underestimating the impact of silver supply deficits.

According to TD Securities’ Daniel Ghali, “If reciprocal tariffs are really like-for-like, you would expect retaliatory tariffs on Canadian silver, and that’s about 20% of US imports — so there is a higher risk associated with silver.” In other words, there is plenty of uncertainty associated with silver supplies right now.

Silver—downside risks

However, among the risks associated with silver is the fact that silver is an industrial metal. At the beginning of April, Reuters wrote that prices of silver dropped to over eight-week lows due to concerns about demand for the industrial precious metal. This was caused by recession fears stemming from Trump’s new tariff announcements.

As I have mentioned many times before, silver often moves alongside gold. However, industrial uses, including but not limited to electronics and photovoltaics, account for more than 50% of the world’s demand. According to the Silver Institute industry association, it totaled around 700.2 million troy ounces as of 2024.

Gold price per ounce

Goldprice.org

Silver price per ounce

goldprice.org

As can be seen from the graphs above, gold, a traditional refuge from political and economic uncertainty, has touched multi-year highs this year. Silver has not broken through the 12-year peak of $34.87 an ounce it hit on 22 October 2024.

Silver dropped below $30 per ounce on the day when higher tariffs were announced. Silver tends to move with industrial metals, which are also negatively affected by worries about economic growth due to escalating trade tensions.

So, it is likely that silver would do better if there is more economic certainty, along with monetary easing by central banks. At the same time, in the long term, the demand for silver as a green energy metal may make the prices for the commodity go up significantly. As I have mentioned before, silver is not only useful in electronics but also in green energy. In fact, according to an Australian study, solar cells may use most of the global silver reserves by 2050.

Thanks to its excellent electrical conductivity, the grey metal is an essential element in the production of solar panels. Each solar panel only uses a small amount of silver, but due to the fact that the demand for solar panels expands rapidly every year, those small amounts of silver add up to significantly raise the demand for the precious metal. According to the University of New South Wales’ researchers, solar producers will likely demand over 20% of the current yearly silver supply by 2027. And by 2050, solar panel manufacturers will likely utilize about 85–98% of the current global silver stocks.

Silver price target and the current valuations

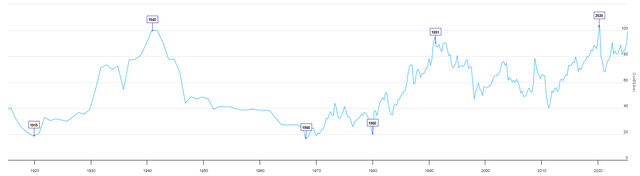

Most silver ratios imply serious undervaluation. The gold-silver ratio, a measure of the amount of silver required to purchase one gold ounce, is currently at 100, its record high since June 2020.

Gold-to-silver ratio

Longtermtrends

In fact, silver is very cheap compared to gold. We could see that in 1980 one ounce of gold was only worth about 20 ounces of silver. Therefore, if there are serious market distractions and market panic like there were in 1980, silver can become several times more expensive compared to the price of about $32 per ounce it is trading at now. Trump’s tariffs and supply deficits can facilitate this price change. So, in my view, a price of $140 per ounce is possible if the market shock like there was in 1980 ever happens.

The reason why I came up with that number is because it is the 1980 silver price adjusted for inflation.

Silver prices adjusted for inflation

Macrotrends.net

Conclusion

Even though geopolitical uncertainty and concerns with macroeconomic growth are bearish for silver in the short-to-medium term, silver prices are likely to gain due to tariff-related supply distractions. Also, monetary easing can make the grey metal appreciate further. Long-term demand for silver can also be strongly supported by the metal’s use in green energy, in particular solar cells. So, my bullish silver thesis remains unchanged.

Written by Anna Sokolidou

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Shared by Golden State Mint on GoldenStateMint.com