Summary

- Tariffs act like a sales tax, increasing production costs and reducing consumer spending, which can undermine economic expansion and the bull market.

- Consumer spending, fueled by fiscal stimulus, has been the primary driver of economic recovery, job creation, and wage growth post-pandemic.

- Despite the threat of tariffs, current consumer spending remains resilient, but future trade policies could impact economic growth and market sentiment.

- Monitoring leading indicators of consumer spending, including interest rates and financial market performance, is crucial to staying on track with economic trends.

- This idea was discussed in more depth with members of my private investing community, The Portfolio Architect.

Wicki58

I continue to have grave concerns about tariffs, and for reasons that have nothing to do with politics and everything to do with economics. Consumers are the backbone of our economy, and their spending is its lifeblood. Any policies that curtail spending will slow, if not undermine, the expansion and bull market. Tariffs are akin to a sales tax on the consumption of goods by consumers. The portion of the tariff that is not passed onto consumers is a tax on the business that imports the good or raw material, which increases production costs, reduces margins, and eats into profits. If there are benefits to economic growth from tariffs that are an equal offset to the loss of purchasing power, they have yet to be proven in practice. Depending on what is implemented relative to what has been proposed, I think they run the risk of cracking the foundation of our expansion and bull market.

Since the summer of 2022, as the rate of economic growth was decelerating from the sugar high of the post-pandemic period, I have asserted that the US economy would avert a recession for the simple reason that the ongoing expansion was built from the bottom up. This gave it an extremely strong foundation. Granted, the Federal Reserve did provide monetary stimulus by lowering borrowing costs to stimulate the economy from the top down, as is typical, but the unprecedented amount of fiscal stimulus that was deposited directly into the bank accounts held by lower- and middle-income households was the primary fuel for the recovery. This is because it was spent on goods and services rather than saved or invested. As we learned after the Great Recession, lowering borrowing costs to near zero does little for most consumers who can’t borrow at the depths of an economic contraction or the early stages of recovery. While the mountain of post-pandemic savings is now gone, the spending it fueled led to job creation, wage growth, and the historically low unemployment level we still have today.

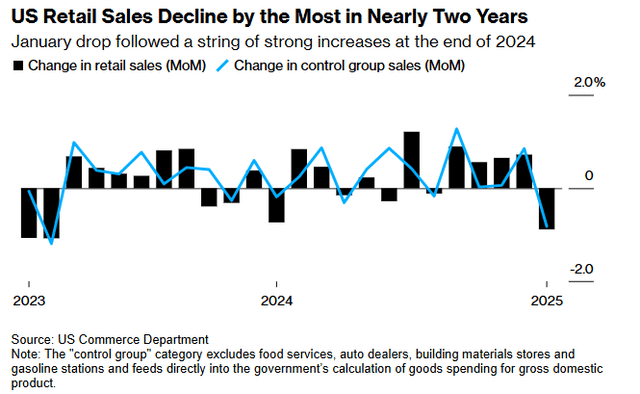

So far, the widespread tariffs that were advertised on the campaign trail have not materialized, but we have seen how the threat that they may become policy dampened consumer sentiment and possibly pulled forward spending on durable goods, as evidenced by last week’s retail sales report.

Bloomberg

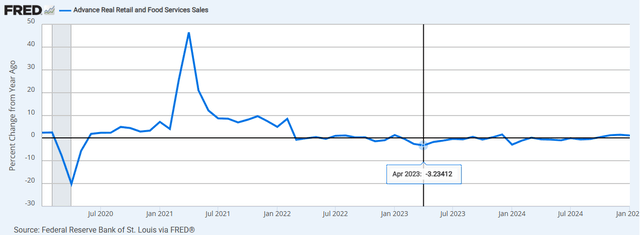

At this point, existing tariffs, including the new 10% on Chinese imports, should not weigh heavily enough on consumer spending to be detrimental. While January’s retail sales declined month-over-month by the most in two years, they still rose 1.2% on an inflation-adjusted basis (real) over the past year. Compare that to the year-over-year decline of 3.2% we had in April 2023, and last month’s decline still looks healthy. Additionally, in early 2023 consumers were still focusing their spending on services over goods, and every category within the retail sales report is goods-related apart from bars and restaurants. Today, we are closer to a pre-pandemic balance.

FRED

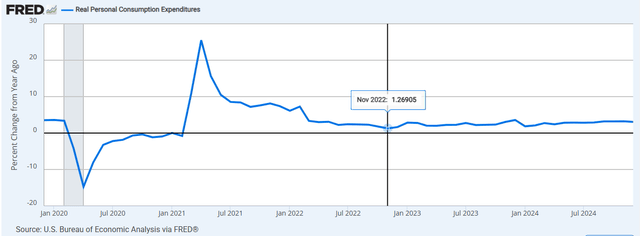

Still, tariffs are a major concern for me, so I am extremely focused on how consumers respond, depending on what is implemented. Consumer spending will be the tip of the spear in the next inevitable economic downturn. It is likely to begin in discretionary categories first. We may receive some advanced notice in the surveys of service sector executives conducted by the Institute for Supply Management (ISM) and S&P Global, but my primary focus remains the year-over-year growth rate in real personal spending, which includes goods and services. It rose better than 3% in December, and we will have January’s number at the end of the month.

For comparison, the weakest level of real personal spending growth we have experienced since this expansion began was in November 2022 at 1.2%. That was a point in time when most economists and market strategists were forecasting a recession. It is very difficult to realize a contraction in economic activity when the largest percentage contributor to the calculation is still growing by 1.2%. Focusing on this one indicator alone kept me on the expansion track.

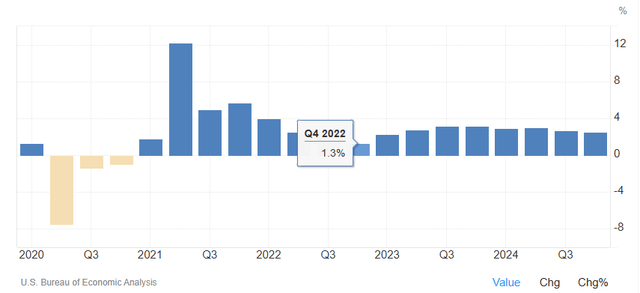

FRED

The sharp deceleration in the rate of spending coincided with the weakest annualized rate of economic growth we have had during this expansion at 1.3% in the fourth quarter of 2022. This was shortly after the rate of inflation peaked and the Federal Reserve raised borrowing costs to combat it. While the S&P 500 did suffer a bear market decline of 25% during the first nine months of that year, it bounced back rapidly, largely because we averted a recession. The economy has consistently expanded at a rate above its long-term trend of 2% ever since.

Trading Economics

Consumer spending accounts for approximately two-thirds of our overall economic output, which is why the resilience of the consumer dictates the strength of the foundation of our expansion. There is an extremely high correlation between the rate of economic growth and the rate of corporate profit growth. Corporate profits are what drive stock prices.

Tariffs will weaken this foundation, but to what extent we don’t know until we understand what trade policies will be implemented. Even when we do, it will be difficult to determine how consumers respond. Last night, President Trump announced he will “probably” impose a 25% tariff on cars, drugs, and semiconductor chips as soon as April 2 with no specifics about which countries or products. Is that a negotiating tactic for better trade deals, or a targeted source of revenue for the federal government? No one knows, which makes it very difficult for companies of all sizes to conduct business. This is weighing on sentiment. I think it will continue to weigh on the rate of economic growth, as it did in last month’s retail sales report. That said, it should also be temporary until we know what policies take effect and should not disrupt the uptrend in markets or the economic expansion.

I expect focusing on the leading indicators of consumer spending will keep us on track as they did in 2022. Of course, other factors influence consumer spending, including interest rates, financial market performance, tax policies, and immigration. Some will be headwinds, while others are tailwinds that offset. The key is to consider them all in aggregate and focus on the rates of change in the data.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Lawrence Fuller has been managing portfolios for individual investors for 30 years, starting his career at Merrill Lynch in 1993 and working in the same capacity with several other Wall Street firms before realizing his long-term goal of complete independence when he founded Fuller Asset Management. He also manages the Focused Growth portfolio on the new fintech platform called Dub, which is the first copy-trading platform approved by securities regulators in the US, allowing retail investors to copy the portfolio and ongoing trades of the manager they choose automatically. You can also find him on Substack and lawrencefuller.substack.com.

Shared by Golden State Mint on GoldenStateMint.com