Copper is oftentimes overlooked, and does not get the same acknowledgement as the precious metals, silver and gold. Changes in the economy, renewable energy and electric vehicles are bringing a different view of the shiny metal, and the upcoming years are going to see copper prices rise as it is one of the most versatile metals on the market.

Copper is a soft, reddish-orange metal that has been used by humans since around 8,000 B.C.[i] Copper has been used for coins, ornaments, jewelry, tools, and in more recent times, in building construction, power generation and transmission, electronic product manufacturing, and the production of industrial machinery and transportation vehicles. Copper is malleable, and can be molded and shaped, is corrosion resistant, and conducts heat and electricity. These attractive qualities contribute in making copper the third most used metal in the world.

Construction, currently the largest application for copper worldwide, uses around 40% of the supply. Forecasts are predicting global construction to grow at a compound annual growth rate of 10.16% between 2016-2020.[ii] This will put an impressive demand on the copper market. The average American single-family home uses 439 pounds of copper for wiring, pipes, and appliances.[iii] Copper can be found in TVs, radios, electrical wiring, plumbing, washers and dryers. Most other aspects of life also have high copper utilization. Roofs, flashings, rain gutters, downspouts, domes, spires, vaults, and doors have been made from copper for hundreds or thousands of years. Copper’s architectural use has been expanded in modern times to include interior and exterior wall cladding, building expansion joints, radio frequency shielding, and antimicrobial and decorative indoor products such as attractive handrails, bathroom fixtures, and counter tops.

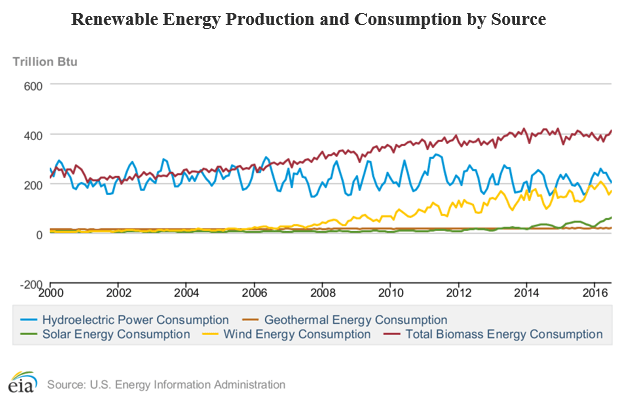

Strides in renewable energy and electric vehicles are going to bring a huge boost in the demand for copper. The rapid growth of these sources in the 21st century has been prompted by increasing costs of fossil fuels, as well as their negative environmental impacts. In 2010 the average capacity of renewable energy sources was only 7% globally. For 2016, renewables contributed 19.2% to humans’ global energy consumption and 23.7% to their generation of electricity in 2014 and 2015.[iv] Conventional internal combustion engines in motor vehicles use an average of 45 lbs. of copper. A hybrid car will use about double that amount of copper at 90 lbs., while an electric vehicle can use an average of 175 lbs. It is expected that the global fleet of electric vehicles (EV) will expand from 1 million, to 140 million by 2035. According to Vicky Binns, the VP of BHP Billiton, the largest mining company in the world,

“Subtracting the copper that would have been used in the internal combustion engines ‘displaced’ by EVs, and that figure comes down to around 8.5 million tonnes of genuine new demand – worth around $US38 billion dollars at today’s copper price … around one-third of total refined copper demand today.”

Renewable energy sources, such as solar, wind, tidal, hydro, biomass, and geothermal add to these figures. Wind and solar power generation use more copper per unit of electricity produced then non-renewable energy source. A coal-fired power station contains about 2 kgs of copper per kilowatt, but solar needs about 5 kgs.[v] A single wind turbine that delivers 1.5 megawatts of power requires 1,900 pounds of copper.

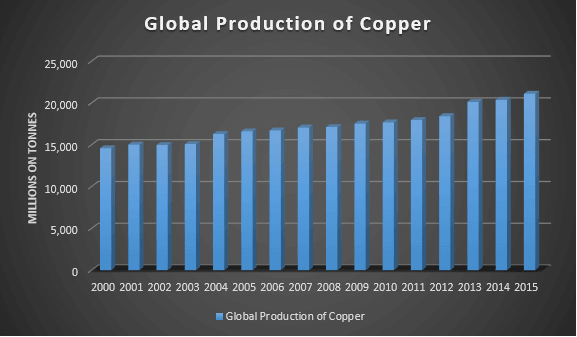

Copper is a commodity, and as such, the price is set by the free market. The demand for copper is going to continue to rise, driving the price with it. Copper is poised for fantastic growth. For 2016, the global copper industry is on track to produce 22.5 million tonnes of copper, which is up 3.6 percent from last year’s output.[i] The push for cleaner and renewable energy sources is strong, and the population is growing. Copper has found itself replaced with aluminum in some wires, conductors, and various electrical parts, but aluminum can’t replace copper. Even with the replacements, copper demand has still risen. Aluminum’s global stockpiles only offer enough metal to replace copper consumption for nine days. Copper is a very relevant and necessary component to world growth.

Copper will be hard to ignore as the demand rises. Having physical copper is a very promising prospect, offering a guaranteed way to maintain safe and steady exposure. Investing in copper bullion offers a hedge against inflation. As with other commodities, copper will always have its inherent value, and will track inflation. Gold and silver cost more than copper. Reasons for this disparity include scarcity, and public opinion. Due to these factors, copper is more volatile, allowing copper prices to be able to more than double, giving investors the ability to see even greater gains.

[i] http://geology.com/usgs/uses-of-copper/

[ii] http://www.prnewswire.com/news-releases/global-construction-estimation-software-market-to-grow-1016-by-2020-300356973.html

[iii] https://www.copper.org/education/c-facts/home/

[iv] http://www.ren21.net/wp-content/uploads/2016/06/GSR_2016_Full_Report.pdf

[v] http://www.smh.com.au/business/bhp-billiton-reckons-copper-to-win-from-shift-to-renewables-electric-vehicles-20161031-gsf23x.html

[vi] http://www.reuters.com/article/us-metals-copper-ica-idUSKCN12S230

All data and information provided is intended solely for informative purposes and is not intended to be considered individualized advice or investment recommendations. You understand that you are using any and all information available on or through this site at your own risk.