Summary

- Is the correction over? To determine that, we need to see evidence of buyers re-entering the market to absorb the sellers’ oversupply of equities.

- The relative strength index has started improving along with momentum, which triggered a buy signal, yesterday.

- The difference between successful investing often comes down to the straightforward reality of controlling our emotions and honestly assessing risk.

J Studios

The biggest question I have been getting from clients and prospects lately is, “Is the correction over?”

This is not surprising, given that market declines are brutal on emotions. However, as investors, we often forget that, like the laws of gravity, “what goes up must come down.”

In today’s blog post, I want to provide two takeaways:

- The technical backdrop of the market – does it support a tradeable bottom for investors, and;

- A list of rules for investors to follow to navigate whatever comes next.

The rules will be familiar if you have been a long-term reader of our commentary. However, revisiting your investment rules to remove emotion from your trading decisions during market stress is crucial. As always, the biggest impediment to successful investing over the long term tends to be the investors themselves. As Dalbar Investments noted recently:

“After dismal returns for the Average Equity Fund Investor in 2022 of -21.17% compared with the S&P 500 return of -18.11%, the Average Equity Fund Investor experienced an even higher gap against the market in 2023, experiencing returns of 20.79% compared with the S&P 500 returns of 26.29%.”

- The Average Equity Fund Investor Underperformed the Market: In 2023, the average equity investor earned 5.5% less than the S&P 500, the third-largest investor gap in the last ten years.

- The Average Fixed Income Investor Underperformed to a Lesser Degree: The Average Fixed Income Investor earned 2.63% less than the Bloomberg Barclays Aggregate Bond Index gain.

- Emotional Decisions Hurt Returns: Investors tend to sell out of investments during downturns and miss out on rebounds. The report illustrates the importance of a long-term investment strategy.

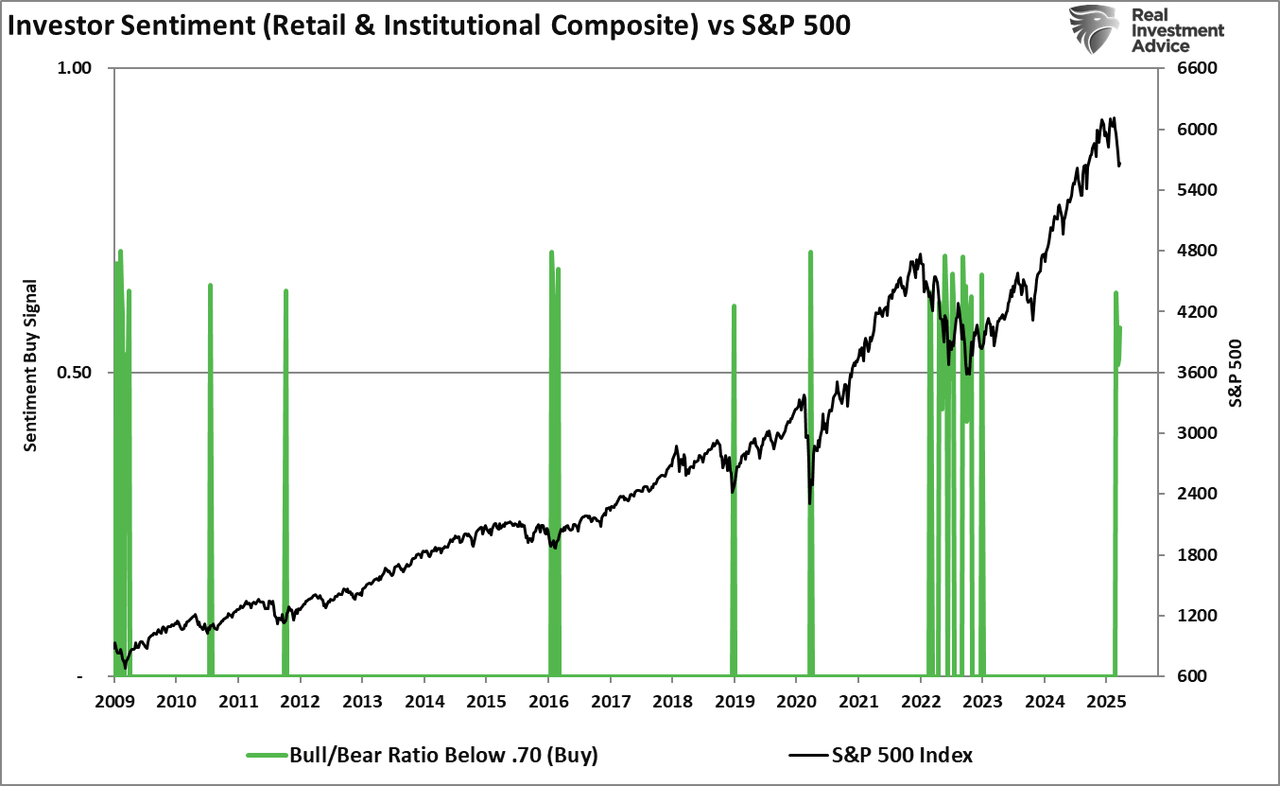

Emotions drive investment mistakes, which is one key reason for monitoring investor sentiment. The chart below is a version of our investor sentiment composite index (retail and professional). The green bars represent periods where combined investor sentiment is extremely bearish. Unsurprisingly, when investors are the most bearish, markets have generally been at or close to their correction lows.

Notably, sentiment is not a market-timing indicator. It tends to indicate when sellers are likely becoming exhausted. As we discussed previously, “sellers live higher, buyers live lower.”

“The stock market is always a function of buyers and sellers, each negotiating to make a transaction. While there is a buyer for every seller, the question is always at “what price?”

In the current bull market, few people are willing to sell, so buyers must keep bidding up prices to attract a seller to make a transaction. As long as this remains the case and exuberance exceeds logic, buyers will continue to pay higher prices to get into the positions they want to own. Such is the very definition of the “greater fool” theory.

However, at some point, for whatever reason, this dynamic will change. Buyers will become more scarce as they refuse to pay a higher price. When sellers realize the change, they will rush to sell to a diminishing pool of buyers. Eventually, sellers will begin to “panic sell” as buyers evaporate and prices plunge.”

If the correction is over, we need to see evidence of buyers beginning to emerge. For that evidence, we can review the price action in the market.

The Technical Support For A Bottom

Is the correction over? To determine that, we need to see evidence of buyers re-entering the market to absorb the sellers’ oversupply of equities. For that evidence, we can look at measures like relative strength, momentum, and money flows.

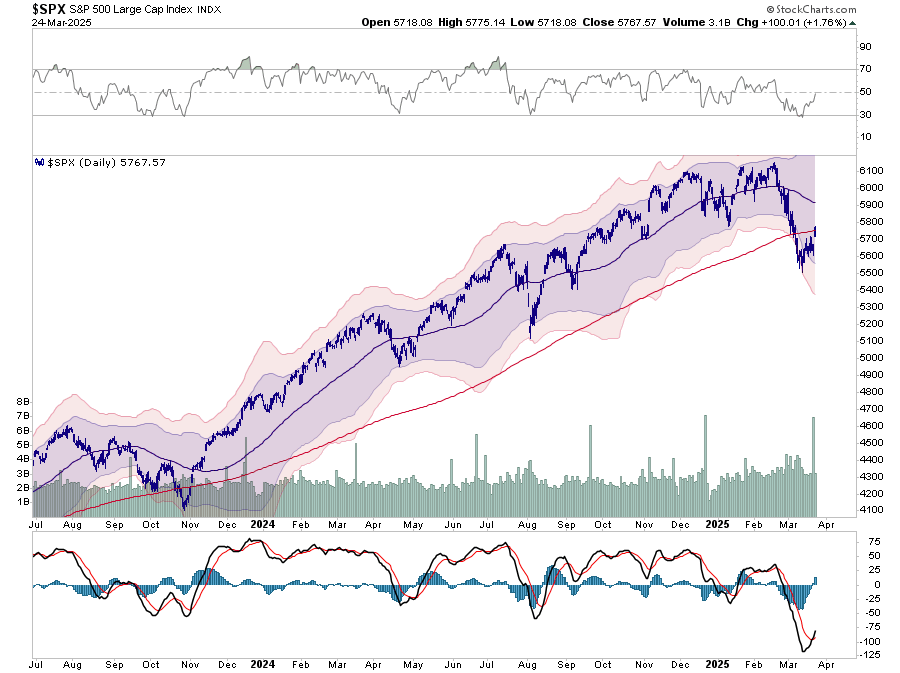

First, for a “moving average,” the market must trade above and below that average over time. In other words, like a rubber band, it will return when the market deviates too far from its moving average. The market fell three standard deviations below its moving average during the recent decline. Such extremes, like stretching a rubber band too far, will revert to its mean or more. Furthermore, relative strength (RSI) has started improving along with momentum (MACD), which triggered a buy signal, yesterday. When put together, such suggests buyers are beginning to re-engage in the market, at least in the short term. Such typically marks the end of a correction.

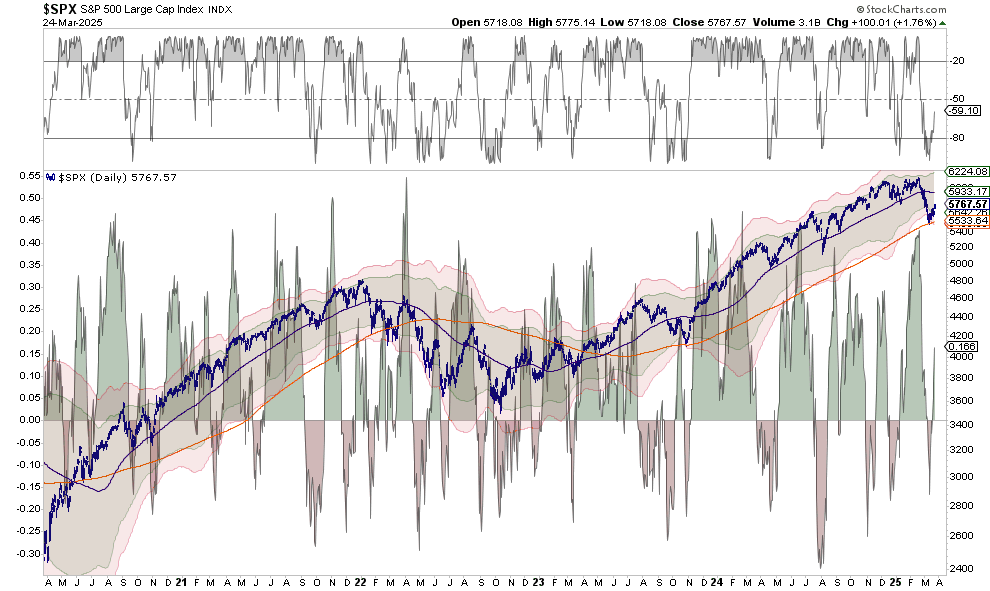

The chart below expands on the time frame and adds the change in money flow behind the market price chart. When those money flows typically reverse from negative to positive, as they did last week, such typically marks the bottom of a correction. Such is mainly the case when the market is deeply oversold and beginning to reverse.

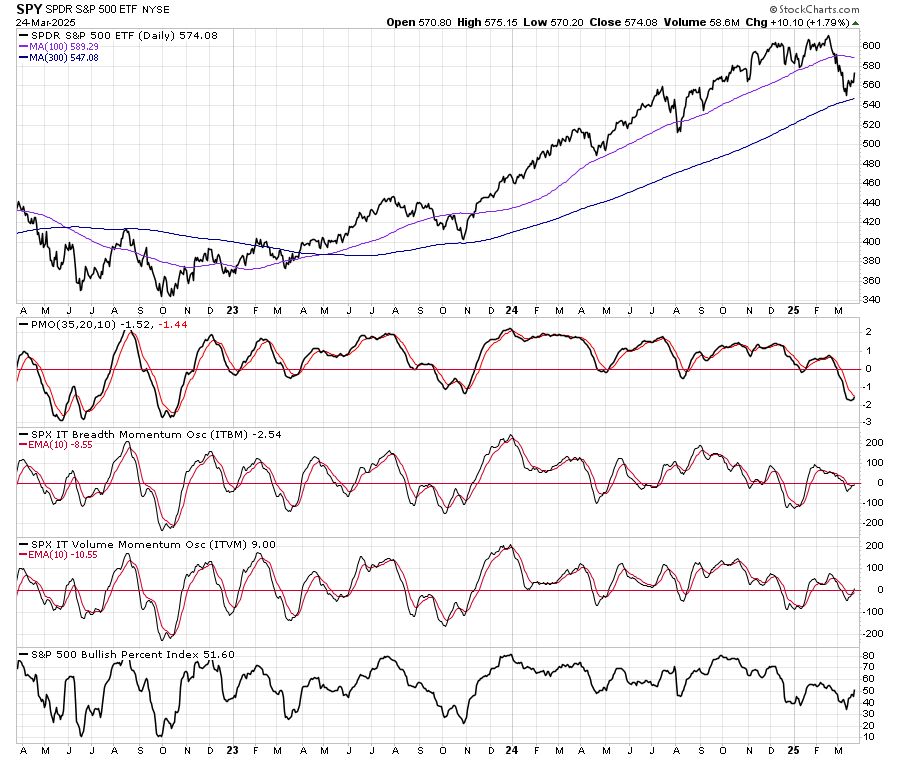

Lastly, we can look at other measures of short-term market dynamics to determine if a correction process is complete. The chart below has four subpanels. The first is a simple price momentum oscillator. This measure is currently deeply oversold after the recent bout of selling and, like the MACD, is beginning to turn higher. That signal is confirmed by the following two indicators, which measure the volume and breadth of the market (are transactions increasing along with more buyers than sellers). With those two indicators also increasing and the number of stocks on “bullish buy signals” rising, the early clues of a market bottom are appearing.

If you look at the charts above, the evidence, from a historical perspective, suggests that markets may be close to ending the current correction.

Is that a guarantee? No.

As investors, during corrective cycles, we become distressed from the decline and fall prey to the behavior of “loss avoidance.” Loss avoidance is where investors take actions to limit further losses and, therefore, fail to buy when markets are correcting previous excesses.

This is why investing rules are critical to long-term success.

The Rules To Navigate What Comes Next

I have often provided you with our rules for investing and managing client portfolios.

However, the following 12 rules are from Gerald Loeb for something insightful and different. Gerald Loeb (July 1899 – April 13, 1974) was a founding partner of E.F. Hutton & Co. and a renowned Wall Street trader. He is the author of The Battle For Investment Survival and The Battle For Stock Market Profits, both still considered to be investor staples. While he largely avoided losses during the 1929 crash, it greatly impacted his views on the markets, which drove him to be an early trend-following pioneer. His rules have been a timeless staple for investors to mitigate risk when investing.

Loeb’s 12 Investing Rules

1. The most important single factor in shaping markets is public psychology.

2. To make money, you must be ahead of the crowd or sure they follow.

3. Accepting losses is the most vital action to ensure the safety of capital.

4. The one thing separating investors who continually procure a net profit is not a question of superior stock selection or timing. Instead, they know how to capitalize on success and curtail failure.

5. The most important indications are made in the early stages of a broad market move. Nine times out of ten, the leaders of an advance make new highs ahead of the averages.

6. “A picture is worth a thousand words.” One might paraphrase this as “a profit is worth more than endless alibis.” Prices and trends are the best and simplest “indicators.”

7. Profits are made safely when the opportunity is available. Not because they are desired or needed.

8. The key to success in the battle for investment survival is the willingness and the ability to hold funds uninvested while awaiting real opportunities.

9. A contributing factor other than inflation or deflation is the psychological. If people think prices will advance or decline, such contributes to price movement. The momentum of the trend perpetuates it.

10. Most people try to obtain a certain percentage return. When properly calculated over the years, they inevitably secure a negative yield. Investors who take less risk have a better chance of success.

11. All relevant factors register in the market’s behavior. In addition, the market’s action should allow reasonably accurate news forecasting before its occurrence.

12. You don’t need analysts in a bull market, and you don’t want them in a bear market.

Is the correction over? Honestly, I nor anyone else knows with certainty.

The difference between successful investing often comes down to the straightforward reality of controlling our emotions and honestly assessing risk.

Although it may seem contradictory, embracing uncertainty (like today) reduces risk, while denial increases it. Another benefit of “acknowledging uncertainty” is it keeps you honest. A healthy respect for uncertainty and a focus on probabilities drives you never to be satisfied with your conclusions. It keeps you moving forward to seek more information, question conventional thinking, continually refine your judgments, and understand that certainty and likelihood can make all the difference.

The key takeaway? Don’t fear risk – understand, manage, and use it to your advantage.

We can’t control outcomes; the most we can do is influence their probability. This is why managing risks day to day and investing based on probabilities rather than possibilities are important to capital preservation and investment success over time.

My name is Lance Roberts. After having been in the investing world for more than 25 years from private banking and investment management to private and venture capital; I have pretty much “been there and done that” at one point or another. I am currently a partner at RIA Advisors in Houston, Texas.

The majority of my time is spent analyzing, researching and writing commentary about investing, investor psychology and macro-views of the markets and the economy. My thoughts are not generally mainstream and are often contrarian in nature but I try an use a common sense approach, clear explanations and my “real world” experience in the process.

I am a managing partner of RIA Pro, a weekly subscriber based-newsletter that is distributed to individual and professional investors nationwide. The newsletter covers economic, political and market topics as they relate to your money and life.

Shared by Golden State Mint on GoldenStateMint.com