DNY59

DNY59Since 1450, there have been six reserve currencies. Portugal dominated the currency world from 1450 through 1530, when Spain took leadership from 1530 through 1640. From 1640 through 1720, the Netherlands controlled the world’s top foreign exchange instrument before France took over the leadership role until 1815. Great Britain ruled the world financial markets until around 1920, when the United States and the dollar rose to the top spot. Each dominant period lasted around a century, with the dollar’s current term eclipsing its one-hundredth anniversary.

Aside from the passage of time, recent events have made the future of the dollar’s dominance dubious. A 2022 handshake between the Chinese and Russian leaders and geopolitical events threaten the dollar’s continued leadership role. De-dollarization will have significant ramifications for global assets. Commodities transcend borders as they feed, energize, and shelter people worldwide. A change in the international financial system that alters the U.S. currency’s position could cause dollar-based commodity prices to rise, perhaps dramatically.

The dollar index is not objective and is a mirage

Many market participants watch the dollar index for clues about the value of the U.S. currency. The index measures the U.S. dollar against other world reserve foreign exchange instruments.

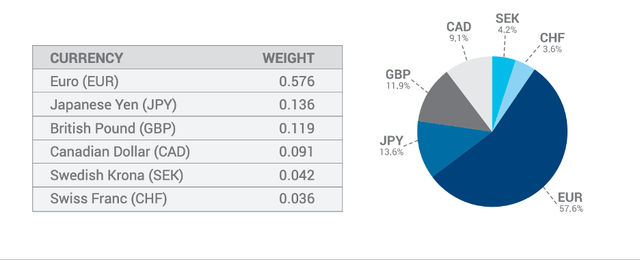

Composition of the Dollar Index Futures Contract (ICE)

Composition of the Dollar Index Futures Contract (ICE)The chart highlights the dollar index’s 57.6% exposure to the world’s second-leading reserve currency, the euro. The index’s composition included exposure to the Japanese yen, British pound, Canadian dollar, Swedish krona, and Swiss franc, all fiat currencies. A fiat currency’s value depends on the full faith and credit of the countries issuing the legal tender, and has no backing other than economic and political stability.

In today’s world, the index reflects the dollar’s value against other allied countries’ foreign exchange instruments. Interest rate differentials are the most significant factor in one of these currencies’ values against the others. Since the U.S. central bank is the leading institution, many other allied central banks follow the Fed’s monetary policy lead.

The bifurcation of the world’s nuclear powers is why the dollar index has become a mirage. The February 2022 handshake between Chinese President Xi and Russian leader Vladimir Putin on a “no limits” alliance was a watershed event. Russian troops invaded Ukraine less than one month after the fateful agreement, leading to a series of U.S. and NATO sanctions on Russia. Meanwhile, China has continued with plans to reunify with Taiwan. To avoid sanctions, China, Russia, and allies have made moves to avoid using the U.S. dollar and euro to settle cross-border transactions. China is the world’s second-leading economy, and Russia is a significant commodities-producing nation. The geopolitical shift has caused the dollar’s global reserve currency role to diminish.

The de-dollarization trend reflects the geopolitical landscape

Together with allies, de-dollarization has begun to take hold, with the Saudis selling oil to China in yuan and India in rupee. Earlier this year, Saudi Arabia abandoned a fifty-year petrodollar agreement that prices petroleum in U.S. dollars.

China and Russia have reduced dollar and U.S. government bond holdings, have increased gold holdings, and have led an effort to create a BRICS currency with some gold backing to challenge the dollar’s dominant role. Governments have increased their gold purchases over the past few years, with China and Russia taking the leading role. Moreover, as the world’s leading gold producers, China and Russia are likely vacuuming domestic gold production to increase reserves. Since strategic commodity inventories are a national security issue in China and Russia, their reserves are likely higher than current estimates.

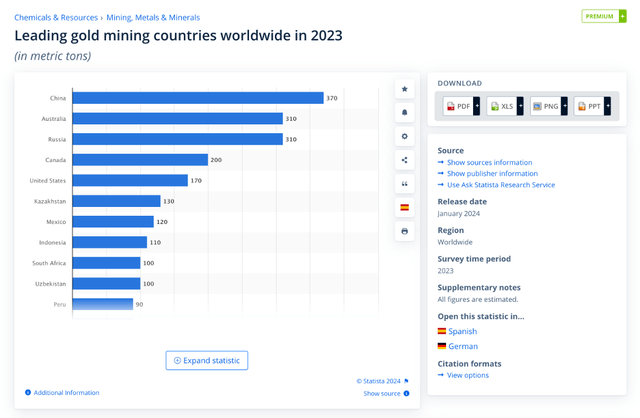

Leading Gold Mining Countries in 2023 (Statista)

Leading Gold Mining Countries in 2023 (Statista)The chart highlights that China and Russia produced 22.7% of the world’s gold mine output in 2023. The thirst for gold, the world’s oldest currency and means of exchange, is a commentary on the role of the U.S. dollar in the worldwide financial system and its position as a reserve asset. The handshake creating the China-Russia alliance began the era of de-dollarization.

The pricing mechanism for commodities- De-dollarization presents significant ramifications for raw material prices

The dollar’s role as the world’s reserve currency made the U.S. currency the benchmark pricing foreign exchange instrument for most raw materials. The London Metals Exchange is the world’s leading nonferrous metals trading arena. Meanwhile, in the U.K., the LME metals contracts, including copper, aluminum, nickel, lead, zinc, and tin, use the U.S. dollar as the pricing currency. Moreover, the London bullion market is the leading gold and silver trading venue. Gold and silver prices in London use the U.S. currency for pricing. Metals are not the only commodities trading in dollars. Agricultural products and energy commodities also use the U.S. currency as the leading pricing benchmark.

The dollar’s descent on the global stage supports higher commodity prices

As a reserve currency, governments, central banks, and monetary authorities held U.S. dollars as their critical currency for cross-border transactions. De-dollarization that reduces dollar holdings will lead to trading and bartering for other currencies and assets. The decline in the dollar’s position is bullish for commodities because it erodes the full faith and credit in the U.S. currency, leading to inflationary pressures pushing commodity prices higher. Therefore, even if the dollar index rallies over the coming months and years, it only relates to the dollar against the other reserve currencies in the index’s basket. Increasing global trading in different currencies means the dollar’s value could decline even if the dollar index strengthens.

DBC is a diversified commodity ETF with exposure to energy, agriculture, and metals

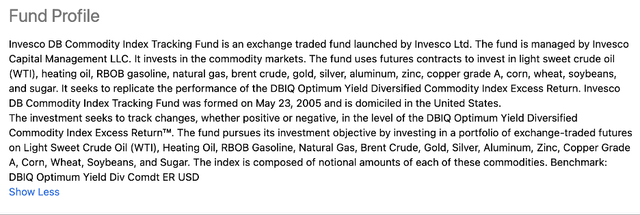

The significant shift in the geopolitical landscape that leads to de-dollarization and competition from a potential BRICS currency with gold backing could increase inflationary pressures, eroding the U.S. dollar’s purchasing power and pushing commodity prices higher. The fund profile for the Invesco DB Commodity Index Tracking Fund (NYSEARCA:DBC) states:

Fund Profile for the DBC ETF Product (Seeking Alpha)

Fund Profile for the DBC ETF Product (Seeking Alpha)The most recent top holdings include:

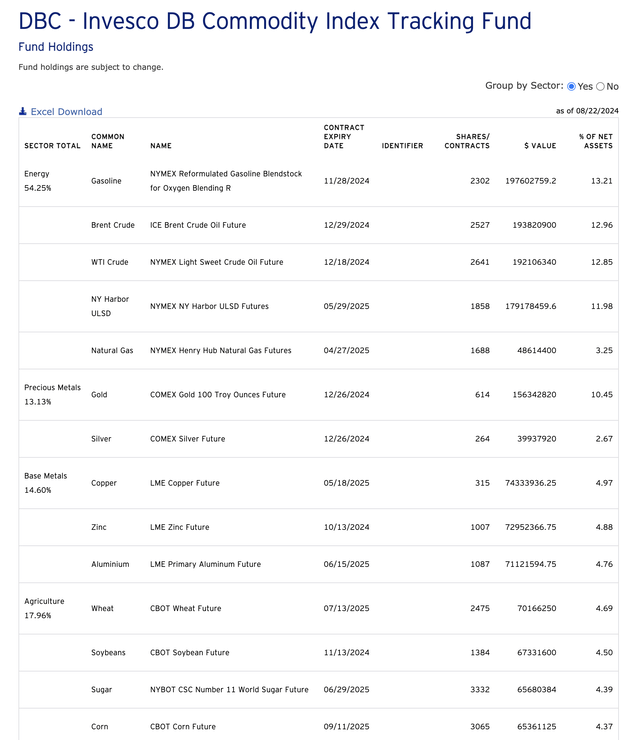

Top Holdings of the DBC ETF Product (invesco.com)

Top Holdings of the DBC ETF Product (invesco.com)DBA invests over half its assets in energy commodities. DBA has additional exposure to precious and base metals, and agricultural commodities. At $22.41 per share, DBC had $1.50 billion in assets under management. DBC trades an average of over 995,000 shares daily and charges a 0.85% management fee. The ETF paid a $1.09 annual dividend, translating to a 4.86% yield.

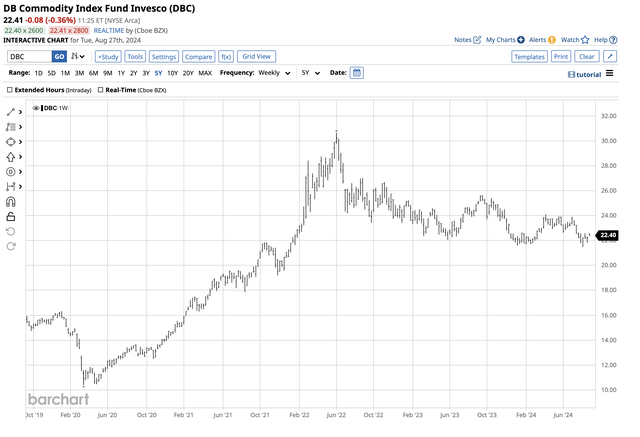

Five-Year Chart of the DBC ETF Product (Barchart)

Five-Year Chart of the DBC ETF Product (Barchart)The five-year chart shows the sharp 194.3% gain from the 2020 pandemic-inspired $10.41 low to the 2022 $30.64 per share high. DBA has corrected from the 2022 high, and while the current trend is slightly bearish, the ETF has consolidated from $21.51 to $24.09 per share in 2024.

De-dollarization could dramatically change the commodity markets over the coming years, pushing prices appreciably higher. DBC invests in a diversified portfolio of raw material assets that feed and power the world. As the dollar loses its dominant position, commodity prices will likely increase, and the Invesco DB Commodity Index Tracking Fund ETF should appreciate.

Shared by Golden State Mint on GoldenStateMint.com