Summary

- The US economy added 151,000 jobs in February, slightly below expectations, with private sector gains offsetting federal job losses.

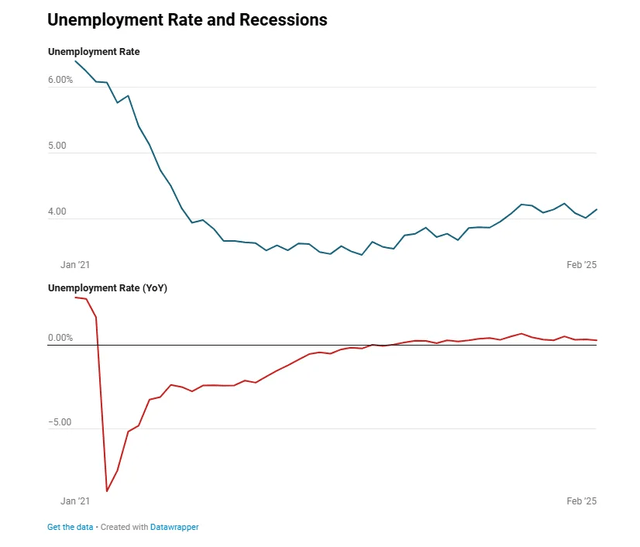

- Unemployment rose to 4.1% due to a decline in the labor force, indicating a tighter labor supply and softer market conditions.

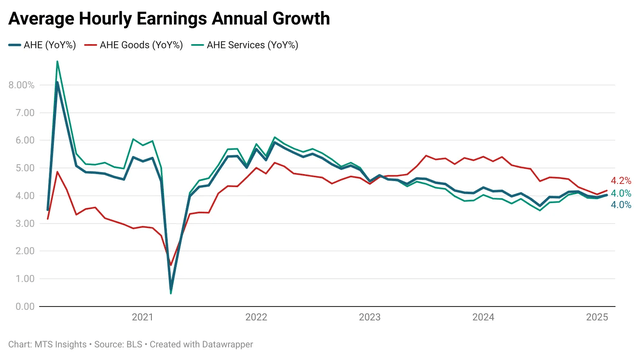

- Wage growth increased to 4.0% YoY, but short-term wage pressures eased, suggesting a favorable trend for inflation.

- Market reactions were mixed, with solid private hiring providing reassurance, but geopolitical uncertainty and contradictory data adding volatility.

Klaus Vedfelt

BLS

Despite much discussion about the impact of DOGE and government layoffs, the US economy posted solid job gains in February as the private sector appears to be solid. The headline job gain number was 151,000 which was actually slightly below expectations of 160,000. While firms reported job growth, the unemployment rate ticked up 0.1 ppts to 4.1%, above expectations of the rate remaining at 4.0%. In general, one would not look at this jobs report and think there had been a shake-up in the federal government, with thousands of jobs being threatened.

Establishment Data

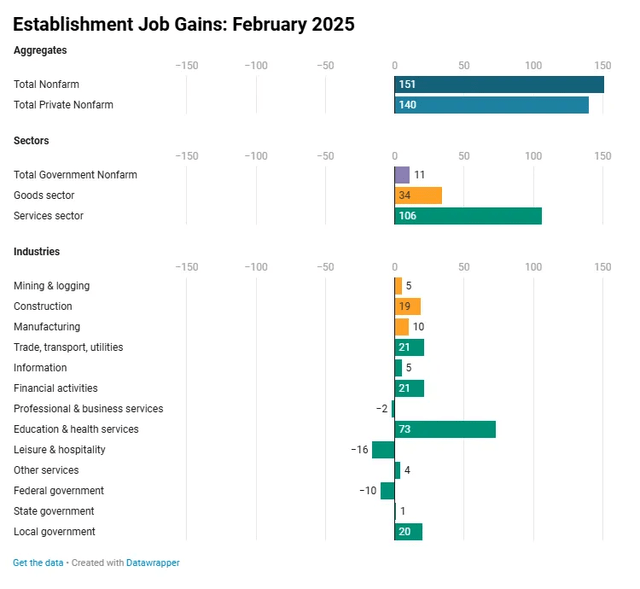

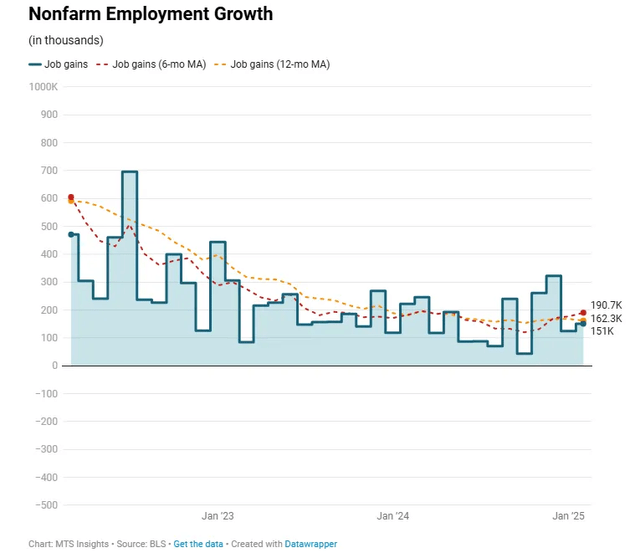

Total nonfarm payrolls increased 151,000 in February according to data from the BLS’ Establishment Survey. This is above the January increase that was revised down by -18,000 to 125,000 but below the December gain that was revised up by 16,000 to 323,000. The private sector drove job gains this month, adding 140,000 in February, making up for a weaker government number.

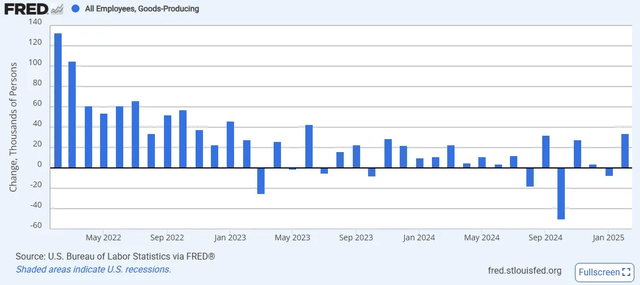

- The goods sector added 34,000 jobs with the cyclical manufacturing and construction sectors slightly bouncing back, up 19,000 and 10,000, respectively. Notably, auto manufacturing jobs increased 8,900 after declining in each of the last six months. The February increase in good sector jobs is actually the largest increase since June 2023 which is a sign that producers may already be responding to Trump’s tariff policy.

- The service sector once again added a bulk of the jobs as firms reported a 106,000 increase in employment. Private education and health services continues its steady growth, adding 73,000, the largest gain by industry. The next largest service industries adding jobs were transportation & warehousing up 17,800 and financial activities up 21,000. Business services employment fell for the 2nd month in a row, down -2,000.

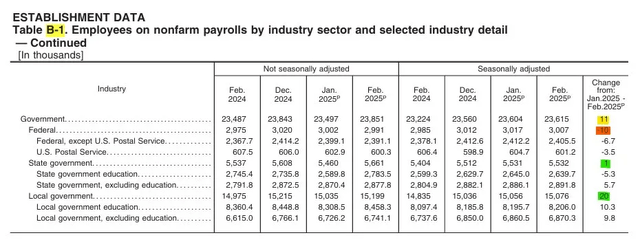

- The recent headlines have been dominated by DOGE ripping through federal agencies, and some of those job losses were evident in the February report. Federal government employment was down -11,000, the largest decline since June 2022. However, that drop was offset by state & local government hiring that totaled 21,000 in February.

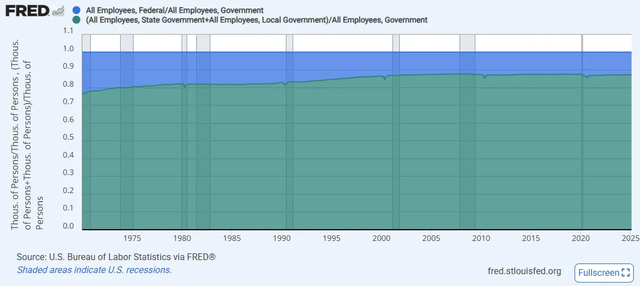

The Establishment Survey data shows that hiring demand continues to be solid, and the labor market is not capitulating, even though the DOGE headlines might have one thinking otherwise. The reality is that federal government employment is unlikely to have a major impact on jobs reports because it is such a small portion of overall government employment and has been increasingly shrinking in the long run. In February, federal employment was less than 2% of all nonfarm payrolls and just 12.3% of government employment with state & local employment accounting for 87.7%.

While the overall labor market is still healthy, there are still some signs of slowing. The 3-month average changes eased back to a three-month low of 200,000 with the private job gains 3-month average falling back below 200,000 to 169,000. While federal layoffs may not move these numbers much, a drop in government consumption through canceled contracts and grants could have a significant indirect impact on private job gains. Thus, I would expect private payroll growth to continue to slow if the Trump administration is successful in cutting government spending.

Household Data

While job gains continued, the unemployment rate ticked up 0.1 ppts to 4.1% and painted a softer picture of the labor market. The increase in the unemployment rate came from a -588,000 decline in the number of employed and an increase of 203,000 in the number of unemployed. The reason the unemployment rate didn’t rise further was because the labor force saw a large drop of -385,000. The decline in the labor force caused the labor force participation rate to fell -0.2 ppts to 62.4% and the employment-population ratio fall -0.2 ppts to 59.9%. The drop in the participation rate means that the labor supply is now the tightest since January 2023.

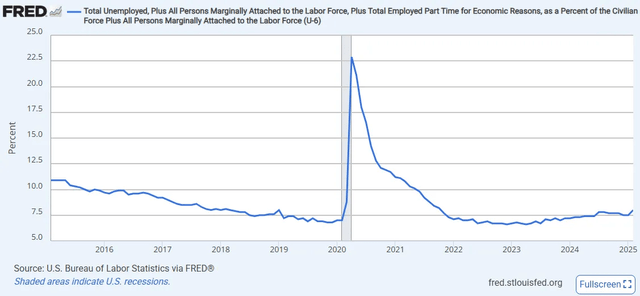

Some detailed measures of unemployment are evidence that there was an abrupt deterioration in hiring conditions in the short term. Specifically, unemployment by duration ticked up significantly in the < 5 weeks (+47k) and 5 to 14 weeks (+217k) segments while the 15 to 26 weeks segment dropped -130k and the 27 weeks and over segment only increased +12k. There was also a large increase of 460,000 in individuals who reported working part-time for economic reasons, the largest increase since June 2023. Of that total, 399,000 pointed to slack work or business conditions.

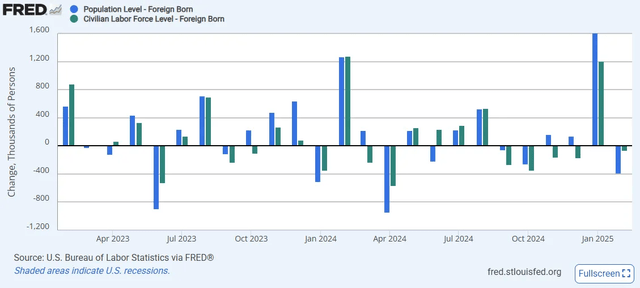

The household data appears to have been impacted by the Trump administration immediately moving forward with mass deportations and imposition of stricter border measures. BLS reported a -385,000 decline in the foreign born population level and a -66,000 decline in the foreign born labor force level, both significant declines compared to last year’s monthly movements (with the exception of April 2024). If Trump’s quickly enforced immigration policy disrupted the employed immigration population, then it would make sense to see a major decline in headline decline in the number of employed and the labor force. It is worth noting, however, that these movements could have been a correction in the data after the BLS made massive revisions to population estimates in January.

Once again, we see the Household data and the Establishment data contradicting each other. The unemployment numbers reported by households points to a softer labor market and a tighter labor supply. The U-6 unemployment rate, which includes marginally attached workers and adds workers forced to work part-time for economic reasons to the unemployed count, increased 0.5 ppts to 8% in February, the highest since October 2021. This shows how the shifts in labor supply are masking the magnitude of the weakness in the labor market in the February report.

Wage Data

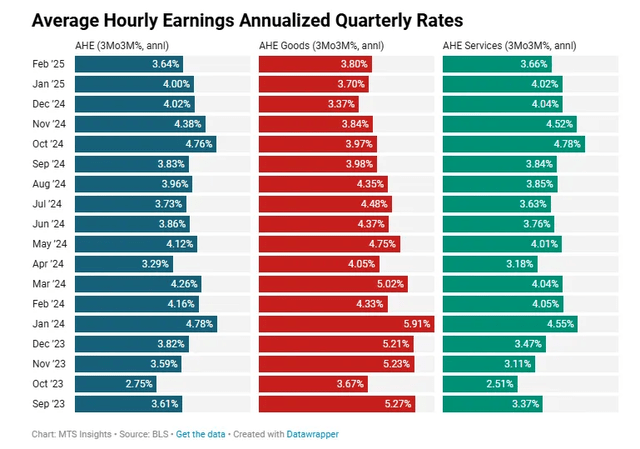

Average hourly earnings growth moved below the 4% level in January, coinciding with a cooler reading in hiring, but wage growth has increased back over that level in February. Overall average hourly earnings increased 4.0% YOY, up a few basis points from the 3.9% YOY reading in the month before. Both goods and services saw their annual rates accelerate. Goods average hourly earnings were up 4.2% YOY, up from 4.1% YOY, and services average hourly earnings growth accelerated to 4.0% YOY, up from 3.9% YOY.

While the annual increase in wages ticked up, short-term wage pressures actually eased. The 3-month annualized growth rate of average hourly earnings was just 3.64% in February, the lowest since April 2024, as the hotter November and October readings fell out of the calculations. A deceleration in short-term wage pressures has been caused by the services’ 3-month quarterly rate falling to just 3.66% which is a favorable trend for the inflation outlook.

Market Reaction

The markets’ reaction to another jobs report where the Establishment and Household data provided contradictory views of the labor market was mixed. We are seeing whipsaw movements in several key markets. The 10-year (US10Y) and the 2-year (US2Y) both spiked in the immediate aftermath of the report before falling to intraday lows. Around 10 am, however, yields are roughly back to where they started, down about -1 to -2 bps. Trading in S&P futures followed a similar path and contracts are up about 0.25% around 10 am after being down by the same magnitude around 9 am. These moves are a feature of the geopolitical uncertainty that the Trump administration has injected into financial markets since his inauguration in January. The contradictions in the jobs data doesn’t help either.

The biggest data point impacting the markets is the solid growth in private employment in the Establishment data, which indicated that US firms have not been majorly affected by the Trump administration’s early actions. Indeed, markets will also be aware that government payroll changes are actually not going to be very impactful in the jobs report because of the miniscule representation in overall employment.

The Fed’s View

How does the Fed parse this employment report? Like the market, I believe FOMC members will be encouraged by the continued strength in private hiring. This will give them reassurance that there hasn’t been a capitulation in the labor market that demands swift action, and the plan for a gradual, meeting-by-meeting approach is still in place. It will also allow the members to remain focused on the inflation mandate. However, the signs of weakness in the Household data will increase the odds for a rate cut in the coming meetings. The minor tick up in the unemployment rate and the large increase in the broader U-6 unemployment rate gives some room for further policy loosening in the first half of the year.

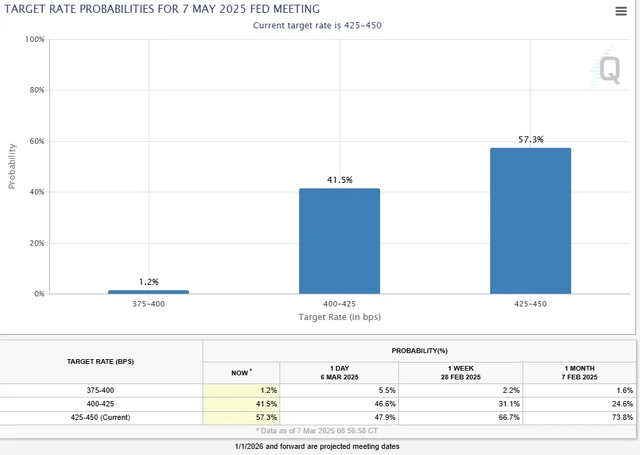

Trading in the Fed funds futures markets suggests that the hiring strength and sticky wage growth takes precedence over the increase in unemployment. The probability for a cut at this month’s meeting has more-or-less disappeared at just 3.0%, down from 12.0% yesterday. Traders also downplayed expectations for a rate cut at the May meeting, as the probability dropped from 52.1% yesterday to 57.3% after today’s jobs report. However, this is still up from 26.2% a month ago.

The biggest problem for the Fed and investors is that Trump’s administration has created a new era of uncertainty that has caused volatility in financial markets to increase and cloudiness in economic outlooks. The February jobs report is a good example of this. Firms reported solid hiring, offsetting federal government job losses, but households reported an increase in unemployment and part-time work due to weak economic conditions. At the same time, the labor supply tightened, and wage growth accelerated slightly. There is no clear view on how things could evolve with DOGE, tariff policy, and immigration in flux daily. Investors must remain dynamic and find the signal through the noise.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Shared by Golden State Mint on GoldenStateMint.com