Summary

- The market was not expecting the Fed to have higher inflation expectations going into 2025, even if they are saying they are temporary. Looking forward, we should expect that any data suggesting an increase in inflation will be a particularly touchy subject for investors.

- What does Wednesday’s stock and bond market dip, plunge, pullback, correction, etc. mean for your portfolio for the remainder of 2024 and 2025?

- For the investor with an outlook longer than a few weeks, new risks may have emerged, but the bull market remains intact and the fundamental drivers of economic growth and corporate earnings remain solid.

- Short-term risks and opportunities are clearly increasing for the tactical investor in the form of corrections and market rotation in indexes, sectors, and asset classes.

By Geoff Bysshe

From everyone at MarketGauge, we wish you and your family the happiest and healthiest holiday season. We appreciate the time and attention you spend with us and hope we can help you reach your goals in 2025 and beyond.

Speak to any veteran of the market about what they like and respect about being involved with the market and two words will undoubtedly be used – humbling and perspective.

Last week offered the opportunity for investors to experience both, and with that in mind…

A Tough Day At The Office

Imagine you had the opportunity (or responsibility) to speak to a room of reporters (some friendly some not), all grilling you with questions about your perspective on the economy as the world’s most powerful and influential participants in the financial world analyze every word and tone of your response.

Now imagine that your answers to the reporters’ questions led to the Fed day responsible for the biggest one-day loss in stock market value since 2001 and the biggest surge in 10-year interest rates since the Taper Tantrum in 2013.

That’s a tough day at the office.

Of course, the market plunge doesn’t describe the whole story of what happened on Wednesday, when it felt like markets’ decline accelerated with each new question by reporters at the Fed’s press conference.

Remember, Chair Powell is, in some respects, the messenger on Fed days. He’s wrangling a committee of Fed Governors that are anonymously contributing to the data “dots” that left the stock market feeling like an employee who confidently walked into a year-end review meeting only to immediately find out he is getting a pay cut and demoted, and now needs to spend the rest of the meeting hearing all about why.

What Happened on Wednesday? A Fed “Flip Flop”

We’ve got a lot of perspective to unpack and questions to answer from Wednesday’s Fed press conference and the market reaction that lasted right up to the closing bell on Friday.

For example…

What does Wednesday’s stock and bond market dip, plunge, pullback, correction, etc. mean for your portfolio for the remainder of 2024 and 2025?

As always, we’ll look at the market’s message for the answers. We’ll begin with the questions.

Why did the market fall so hard?

Which areas should we look to recover first and fastest?

Is the Santa Claus rally dead?

Is the bull market wounded?

Pre-Existing Conditions and Symptoms

It’s important to consider the context of Wednesday because sudden market moves are usually a result of a catalyst that ignites a pre-existing condition.

The Fed’s news hit the market when it was vulnerable, and right where it would hurt most.

We highlighted this vulnerability here last week with the title of this column, “The Santa Claus Rally Under Attack.” The commentary also got right to the point with the first sentence – “Last week, the stock market’s annual Santa Claus Rally came under attack by the bond bears.”

The concluding paragraphs held out hope for the bulls with the statement, “There is, however, one person who could sprinkle some holiday cheer on the markets. Chairman Powell, Wednesday at 2:30 ET, during his press conference. I don’t expect it, but the seasonal trend is his friend.”

So, while widely followed charts (i.e., QQQ, SPY) were just days from all-time highs on Tuesday, it was no secret that market internals, broader market indexes, and the bond market were weakening.

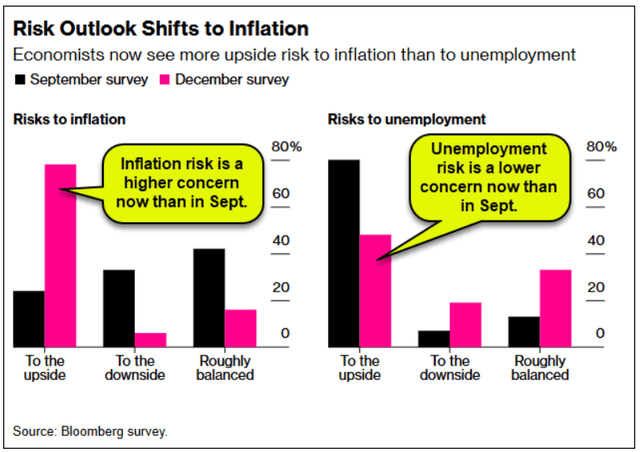

As you can see in the charts below from a Bloomberg survey done prior to the Fed meeting, one of the biggest concerns amongst economists was the very catalyst that led to the implosion – inflation.

The market had it coming…

The market shouldn’t have been expecting a bullish narrative because it was widely expected that the press conference would deliver a “hawkish cut,” which is a cut with a message that the future may hold fewer-than-expected cuts. However, investors clearly weren’t expecting a narrative that would lead to a record-breaking sell-off in stocks and bonds.

Mohamed El-Erian elegantly summarized the crux of the matter as being another “Fed Flip Flop,” which is his way of saying that the Fed changed from messaging that they will follow a path of being data-dependent to potentially one anticipating data future data.

Mohammed explains that this is not a unanimous view, but a significant shift nonetheless. If you’d like a more detailed explanation, you can find his short video explanation here.

In case this shift seems insignificant, consider the recent example of the Fed setting policy by anticipating data. In 2021, it held rates down with inflation rising with the justification of inflation being “transitory.” Need I say more?

A Flip Flop With Inflation On Top

I’m not one to spend time on the nuances in the wording of a press release or the choice of words used in the press conference, but after such a big market reaction, I decided to “watch the replay.”

The popular headline explanations like, “The Fed reduced the number of expected cuts in 2025 from 3 to 2 and pushed them out further” don’t seem to justify the market reaction.

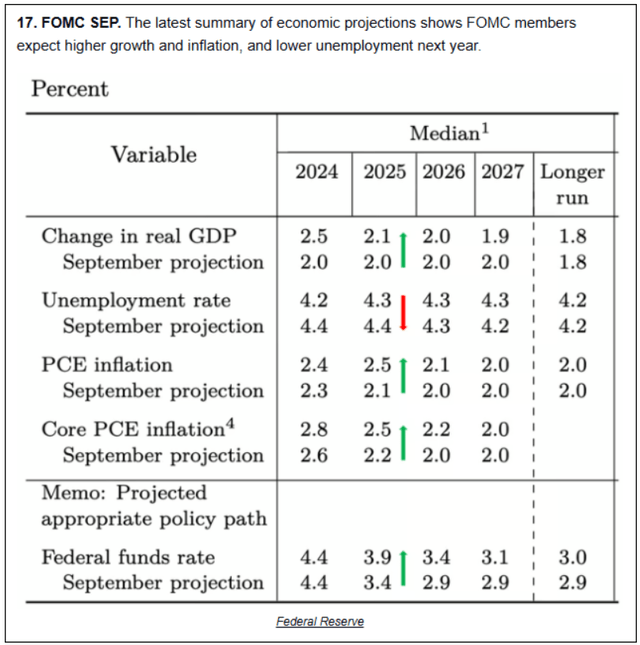

At the risk of taking quotes out of context, below you’ll see the Fed’s summary of Economic Projections (SEP), followed by a few responses by Chair Powell to reporters’ questions.

For better or (mostly) worse, the commentary was very effective at explaining the extent to which inflation concerns are very real despite Chair Powell’s constant refrain of “We’ve made a lot of progress.”

“The median projection in the Summary of Economic Projections (SEP) for total PCE inflation is 2.4 percent this year and 2.5 percent next year, somewhat higher than projected in September.”

“You ask about 2025, I think that the lower, the slower pace of cuts for next year really reflects both the higher inflation readings we’ve had this year, and the expectation inflation will be higher. You saw in the SEP that risks and uncertainty around inflation, we see as higher.”

“What’s happened is that our forecast for inflation for this year, I think are five-tenths higher than they were in September. So, you had two months of higher inflation, September and October, and as I mentioned November is back on track, but once again, we’ve had a year-end projection for inflation, and it’s kind of fallen apart as we’ve approached the end of the year.”

So, if you consider a falling market listening to language like that, and a new concern that the Fed may now be trying to anticipate or weigh the effect of Trump 2.0 tariffs in its policy decisions, it’s easy to see how the VIX had its fourth-largest percentage one day gain ever, and stocks and bonds didn’t find any buyers on Wednesday.

In fairness to Chair Powell, I’ll also share his closing comments so as not to represent the press conference as all negative…

“So now we have inflation itself is way down, but people are still feeling high prices and that is really what people are feeling. The best we can do for them, and that’s who we work for, is to get inflation back down to its target and keep it there so that people are earning big, real wage increases so that their wages are going up, their compensation is going up faster than inflation year upon year upon year, and that’s what will restore people’s good feeling about the economy. That’s what it will take, and that’s what we’re aiming for.”

Fed Day Conclusion

It’s not new news that the Fed is focused on getting headline inflation down to 2%. It’s not new news that investors would like inflation to continue to trend lower. It’s not new news that the inflation data has been “sticky.”

However, the market was not expecting the Fed to have higher inflation expectations going into 2025, even if they are saying they are temporary.

Looking forward, we should expect that any data suggesting an increase in inflation will be a particularly touchy subject for investors.

What Can We Learn From Wednesday?

The Fed day’s impact on the markets doesn’t end on the Fed day.

In our active trading memberships for traders, we teach how to view the Fed days as having 4 periods that can be traded and or used to inform you about the significance of the day’s news on future price action. These 4 periods are the announcement range, the press conference range, the reaction range, then the following days’ reactions to the Fed day.

At any one of those “checkpoint periods” during the Fed day, the short-term outlook can change like a football game interception in the last few minutes of a tied game.

As a day trader, when you see markets trending in the same direction as the Fed’s commentary would suggest, you can continue to press your bets and lock in your profits at the end of the day. Last Wednesday was a home run for a savvy or disciplined day trader.

As a swing trader or active investor, you need to be ready to adjust or enter in the days following the Fed day, because the market’s initial reaction is often the wrong direction. Additionally, the Fed Governors may try to alter the narrative if the market doesn’t react as they feel appropriate.

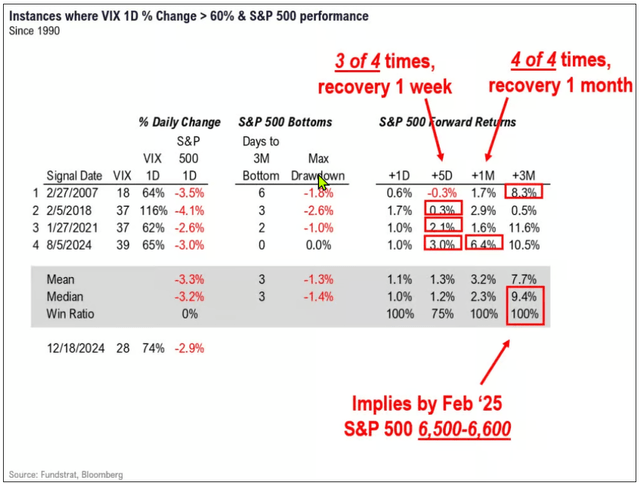

In this case, as noted above and outlined in the table below, the “panic” as measured by the VIX was historically high and, as a result, set up a condition that was susceptible to a bullish reversal.

As you can see in the data below, the 1-day and 5-day returns after such a historic move have been quite bullish – over 1% and 3%, respectively. This is a limited set of data, but increasing the data set to include any one-day VIX move of 50% or greater shows similarly bullish patterns.

This context explains what happened on Friday when PCE data was reported as slightly less inflationary than expected followed by an interview on CNBC, in which Fed President Goolsbee was emphatic in his belief that interest rates would come down in 2025.

With bullish inflation data, a supportive voting Fed member, and a short memory, the market bounced back aggressively.

Buy The Dip? It Depends

The good news in the Wednesday conference call was that the economy is strong, the labor market is stable, and Chair Powell is confident that if the labor market were to maintain its current condition, the environment will continue (if we can still say that) to pull inflation down toward the Fed’s 2% target.

As a result, for the investor with an outlook longer than a few weeks, new risks may have emerged, but the bull market remains intact and the fundamental drivers of economic growth and corporate earnings remain solid, as will be discussed below.

Short-term risks and opportunities are clearly increasing for the tactical investor in the form of corrections and market rotation in indexes, sectors, and asset classes.

Did the Fed Kill the Santa Claus Rally?

Last week, we suggested that exceptional year-end strength would likely be limited to the current high-momentum market leaders near significant highs (which was a narrow list), unless interest rates reversed their rapid descent.

Considering the interest rate and inflation conversation we’ve had here, it seems obvious that the list of high-momentum Santa Claus rally candidates has not grown, and the environment for them to run has certainly deteriorated.

That said, in preparation for our “All Access” members-only meeting to be held on Monday afternoon (Dec. 22), and for our “Complete Trader Live Mentoring” group, I’m preparing a list of “Relentless 2024 Momentum” candidates with instructions for potential trading levels.

As a reader of Outlook, here’s a list of several of the names that will appear on this list of candidates to run into the year-end as long as the market doesn’t fall apart (which I don’t expect to happen, but I would have said the same thing going into the Fed day).

Warning: The year-end play in these names is to get in only if they run, don’t hold long if they pull back, and let them run if they do. This is not a trade setup for anyone who isn’t skilled at managing risk.

In summary, it’s been tough sledding for Santa this year, and unless bonds stabilize, conditions are getting more challenging.

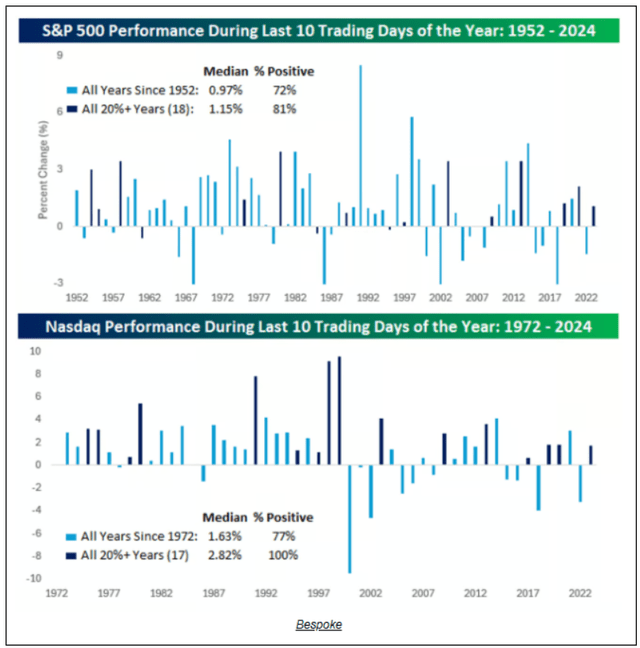

That said, as you can see from the chart below, history favors the last 10 days of December, and even more so when there is momentum like we’ve had this year.

Most traders and active tactical investors, however, would be wise to turn their attention to the bigger opportunities that tend to show up with a new year and the January Trend Trade.

Did The Fed Wound The Bull Market?

It’s not hard to argue that there are several areas of the market that are at the high end of historical earnings-related valuations (i.e., P/E ratios). However, there are two ways for this concern to be resolved. Lower stock prices or higher earnings.

At MarketGauge, we manage trades and portfolios with attention first to risk management to protect against lower stock prices, and second to profit from the edge of being in trends and market conditions that have a proven track record of being persistent and durable.

Two factors that produce predictable, persistent, and durable trends are relative momentum and earnings growth.

Wednesday’s market tantrum didn’t change the opportunities our models are finding in the areas of durable trends or the prospects for earnings growth.

In fact, the majority of our stock models have experienced less than half of the market’s recent downside volatility, while remaining positioned to capture any move higher.

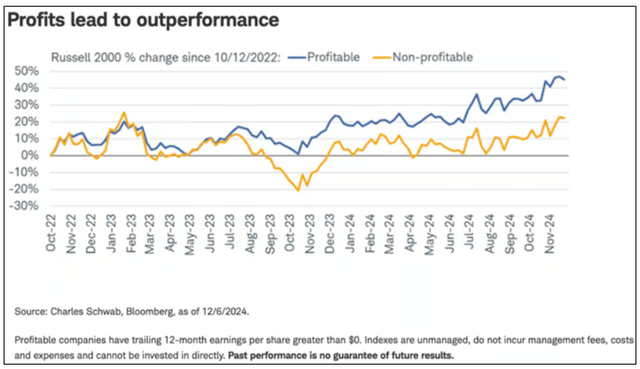

As we look into 2025 with high market valuations associated with large-cap stocks, one of the key indicators of market durability and investible opportunities will be related to earnings growth.

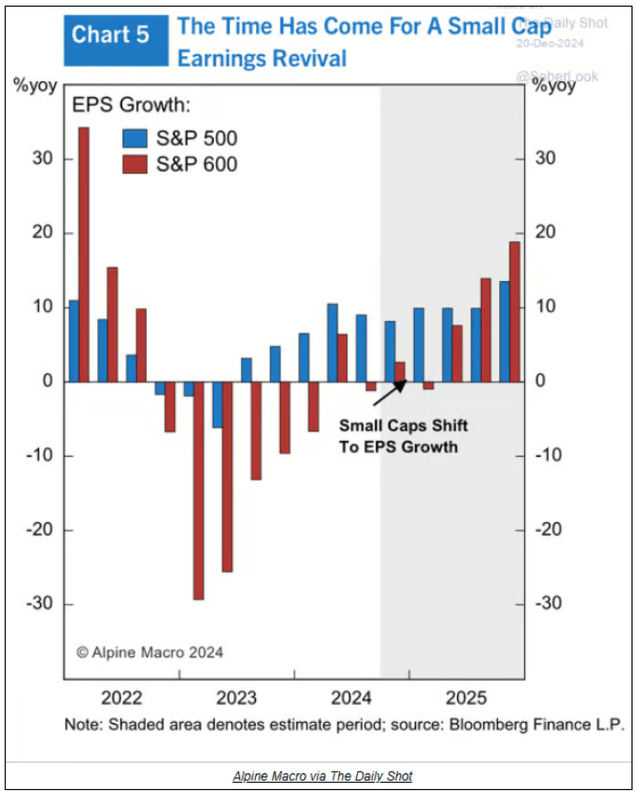

The value of earnings growth is demonstrated by the chart below, with a focus on the area of the market that is likely to be a very hot topic in 2025 – small caps.

My MarketGauge perspective on this chart is that the outperformance here is due to the significant outperformance in the down period of 2023 that was successfully maintained and modestly improved in the bull market of 2024.

Our Small and Mid-Cap Earnings Growth portfolio has exhibited similar performance (but better, having outperformed IWM by 13x in the last 7 years) for similar reasons – a focus on earnings, which we then combine with tactical use of relative momentum.

As you can see from the chart below, there is reason for optimism if the projections in this chart come to fruition. After two years of losses in the S&P 600, earnings are expected to not only grow but outpace the S&P 500.

We’re looking forward to the prospects of our Small- and Mid-Caps model in 2025.

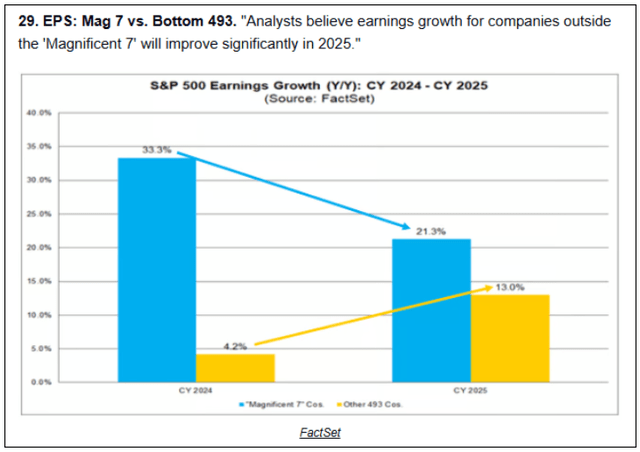

Small caps aren’t the only area that has a positive earnings outlook.

FactSet believes that earnings growth is going to broaden out, as shown below.

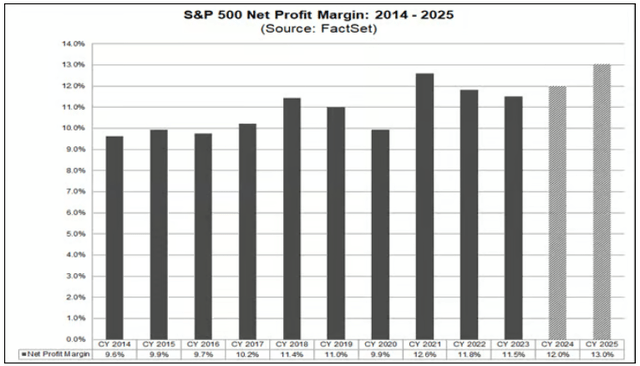

FactSet is also estimating that S&P 500 margins will expand in 2025 to a level not seen since 2008.

If these earnings projections come to fruition, 2025 will be well-positioned to be a good year for the bulls.

Conclusion

Wednesday’s Fed Flip Flop, combined with an unexpected deterioration in the outlook for inflation, led to a messaging nightmare for the Fed’s press conference, which pushed a weak bond market lower, resulting in nervous stock investors throwing a tantrum (Wall Street gibberish for “panic”).

However, underneath the news that got all the negative attention, there appears to be a foundation for what most investors have on their wish list: a “soft landing”, a recession-free 2025, and happy thoughts for the 2025 New Year.

Happy holidays.

Big View Summary

By Keith Schneider

Every week we review the big picture of the market’s technical condition as seen through the lens of our Big View data charts.

The bullets provide a quick summary organized by conditions we see as being risk-on, risk-off, or neutral.

Summary: Markets needs to hold current levels, especially in the two leading indexes (SPY and QQQ), and hopefully drag the lagging market internals back into positive mode, though the debt ceiling issue may provide continued volatility and downward pressure until resolved.

Risk-On

- Very mixed picture in the indexes after the Fed induced sell-off mid-week. The Nasdaq held its 50-Day Moving Average and remains in a strong positive bull phase. S&P closed right on its 50-Day Moving Average. S&P got oversold on price and real motion. (+)

- With three out of the four indexes down for December, seasonally the markets tend to be positive towards the end of December and we could see a year-end rally. (+)

- Market internals as measured by the McClellan Oscillator for both the S&P 500 and Nasdaq Composite hit extreme oversold levels and started to bounce Friday, which supports some further mean reversion into year’s end. (+)

- Huge volatility spike corresponding with the sell-off Wednesday and Thursday. Historically, these types of spikes suggest strength in the market going forward when they occur in bullish uptrends. (+)

- Growth continues to lead value by a wide margin. (+)

Neutral

- Risk gauges are a strong neutral, despite the sell-off. (=)

- The number of stocks above key moving averages deteriorated across the board, but on a short-term basis, it suggests some mean reversion. (=)

- Two critical members of the Modern Family, semiconductors and grandma retail, held up well. However, biotech, transports, and regional banks all closed either under their 50-Day Moving Average or below the 200-Day Moving Average for IBB. (=)

- Copper is holding onto critical lows set in July and October. Needs to hold onto these levels. (=)

- Gold got hit pretty hard on the sell-off, with momentum breaking down and Real Motion going into a bear phase (warning phase on price). (=)

- The dollar hit new recent highs, not surprising with the Fed indicating it is likely to reduce the number of rate cuts next year, which may put more pressure on equity markets. (=)

- In a strong market year, we are seeing some weakness in the final month relative to traditional seasonal patterns. (=)

- The dollar (UUP) is counter-trending to its seasonal pattern, most likely due to economic and geopolitical stress in the European Union, and could be a headwind for U.S. equities. (=)

Risk-Off

- Despite the rally on Friday and even a bullish engulfing pattern in the Dow at very oversold levels, both DIA and IWM closed in distribution phases and under post-election lows from early November, which could be viewed as a critical swing point. (-)

- Volume patterns were extremely negative in three out of the four indexes, with only three accumulations days across the DIA, SPY and IWM in the last two weeks and confirming the negative price action. (-)

- The cumulative advance decline line has deteriorated below key levels from October. (-)

- The new high new low ratio for both the Nasdaq Composite and the S&P, as we pointed out last week, looks and remains negative. (-)

- Foreign equities continue to underperform the U.S. and broke down hard on Friday, further diverging from U.S. equities, which is bearish for both foreign equities and equity markets in general. (-)

- Aggs continue to outperform the S&P on both a short- and long-term basis. Inflation persists and is affecting the Fed’s forecast for rate cuts. (-)

- The color charts, which is the moving average of the stocks above key moving averages, have been negative and further deteriorating, with the exception of IWM. (-)

- Rates across the board look under pressure, breaking below key support levels established through the summer and fall. Short term, they may be subject to some mean reversion. (-)

- All the sectors were negative on the week, though technology (a risk-on sector) was down the least, along with Utilities (a typical risk-off sector). Real estate led the decline. (-)

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Shared by Golden State Mint on GoldenStateMint.com