LilliDay

Intro

Analysts have been expecting a recession for years now, but the S&P 500 (NYSEARCA:SPY) does not care and continues to rise. During 2024 it recorded new all-time highs several times, and those who waited for a crash to invest in it probably regretted not doing so earlier. Those who sold in panic I hope have realized that it always pays to stay invested, even if everyone expects a new 1929 soon.

At the end of 2023 I wrote an article on the 2024 of S&P 500 where I showed my optimism for the first half of the year, thanks to the AI hype, but I underestimated the magnitude of this trend. I expected a new all-time high but not that it would touch $5,600; never did I think Meta would grow an additional 50% in a few months and Nvidia by 160%. It was a pleasant surprise for my portfolio, but I think it is time to question the sustainability of this growth.

Obviously, I will continue with my buy & hold strategy no matter what, but the concerns I had at the end of 2023 are gradually materializing and may halt the growth of the S&P 500. In the second half of 2024, I expect there will be many more challenges to overcome than in the first 6 months, as interest rates are only now really hitting the economy. Empirically, the consequences of a rate hike have been shown to have a lagging effect of about 12 to 18 months on the economy, and we are only now experiencing them in full.

My S&P 500 price target for late 2024 was only $3,600, a highly improbable figure after such a strong rise in big tech companies. In any case, I would not rule out a good portion of the gains made so far being wiped out. In my opinion, it is necessary for the Fed to start cutting rates as early as the next meeting, otherwise an economic slowdown/recession at the end of the year is inevitable, which is something I already anticipated in my previous article.

I would like to emphasize again that this article is not intended to spread panic and entice you to take profits on the best performing companies; just take it as food for thought. As I have previously mentioned, my view about the investment world is totally different from doing market timing. I think it is always worth staying invested and taking advantage of slumps to invest more, as long as you have chosen the right companies, of course.

The economy is beginning to creak

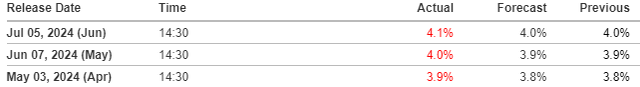

High interest rates are beginning to hurt the economy, particularly the labor market. No one doubts its current resilience. In fact, the unemployment rate is only 4.10%, but there are signs that do not bode well for the coming months.

Investing.com

First of all, from April onward there has been a slow but steady deterioration. Among other things, for three months in a row, analysts’ estimates have been too optimistic.

In general, we cannot criticize the current level of unemployment, but at the same time we cannot base our analysis of the labor market solely on it. First of all, because it is a lagging indicator, so it does not give us any information about the future, and secondly, its volatility can change drastically depending on the macroeconomic environment we are in. Let me give you a real-life example to make my point.

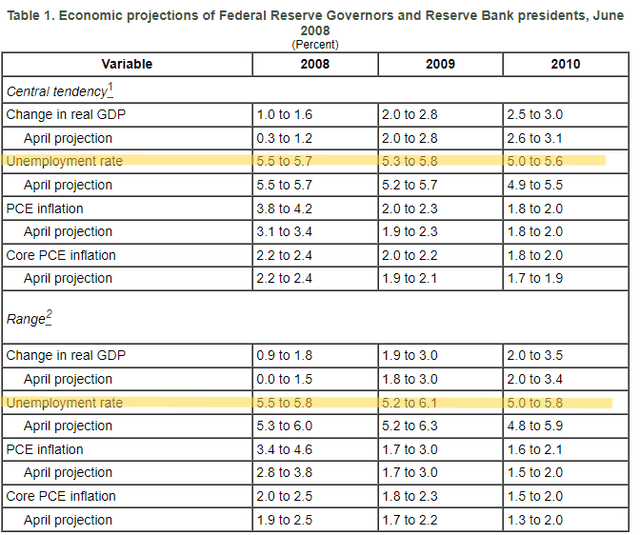

In June 2008, the unemployment rate was 5.60%, and no one expected it to rise much higher, not even the FOMC.

Federal Reserve

The expected range for the 2008 unemployment rate was between 5.50% and 5.80%, in 2009 between 5.20% and 6.10%. At the end of 2008, the unemployment rate rose to 7.30%, yet the estimates had been made a few months earlier. In just 6 months, the situation changed dramatically, but the biggest error concerns the estimate for 2009: the unemployment rate at the end of the year reached 9.90%.

In light of these considerations, it seems clear that the unemployment rate is not suitable for understanding the future of the labor market, and therefore not useful in our investment theses. It gives us information about the past, but we are interested in the future.

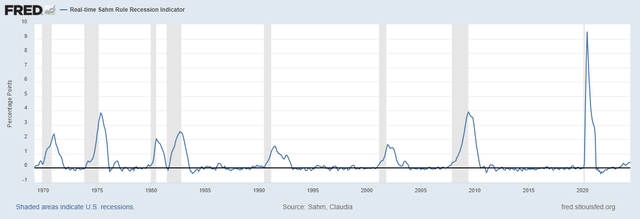

What can help us instead is the Sahm Rule Recession Indicator, created by the macroeconomist of the same name, Claudia Sahm. Often, to predict a recession, we look at the inversion of the yield curve, but this other indicator has also proven flawless at predicting all recessions since the 1970s. But how does it work?

The rule is very simple and involves relating the value of the current three-month moving average unemployment rate to the value of the lowest three-month moving average unemployment rate over the past 12 months. In other words, it seeks to show an abnormal increase in the unemployment rate compared with what has been recorded over the past year. Its purpose is thus to predict whether the unemployment rate is about to shoot up, much more than the market might expect.

Federal Reserve Bank of St. Louis

Every time the indicator has exceeded the 0.50 threshold there has been a recession; today we are at 0.43 and the figure is rather worrying since it is steadily worsening. Of course, the Sahm Rule is not law, so it could be wrong, but I, personally, rely on it a lot. After all, I have no reason to think that this time is different. It is not certain that we will touch 0.50 in a few months, but at the same time I wonder why there has to be an improvement.

Interest rates are still very high, and the Fed, unlike other central banks, remains quite reluctant to reduce them. It wants to make sure 100% that inflation has been defeated, which is agreeable, but economics is not a certain science and historically, the timing of central banks has never been perfect.

I would like to point out that I don’t think it is their fault, recessions are part of the business cycle and will always be there. An economy cannot grow all the time, and surely a mild recession is better than out-of-control inflation. The point is that the magnitude of the recession cannot be known in advance, and keeping rates high even though inflation is falling may prove to be the wrong choice.

Right now, no one knows for sure what the right choice is; my view is that rates should be cut by 25 basis points as early as the next meeting, so one cut in 2024 is not enough. Only in a few years will we know whether the Fed has made the right choice, and at that point it will be very easy to judge.

Returning to the analysis of the labor market, there are other signs that puzzle me.

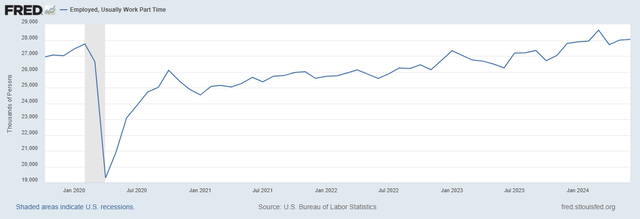

Federal Reserve Bank of St. Louis

Federal Reserve Bank of St. Louis

Since the pandemic, both full-time and part-time jobs have achieved significant increases, however, since January 2023, full-time jobs have halted their run. They are even declining from the end of 2023.

In other words, employers are beginning to prefer part-time rather than full-time hires. This could be due to less demand for their products/services, and therefore it is no longer necessary to have as many full-time employees.

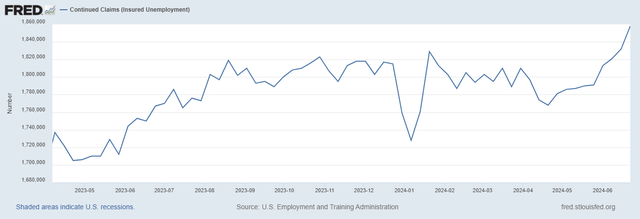

In addition, another interesting data point is that of continued claims.

Federal Reserve Bank of St. Louis

More and more people are struggling to find new employment, and while the current figure is not alarming, there has been a rather rapid deterioration since late April 2024. This is something that needs to be monitored, not least because as long as rates remain high, I see no reason why continued claims should improve.

Overall, the labor market data are not positive, and for the first time in several years (with the exception of the pandemic) we can see the first cracks. In any case, I would like to emphasize that I do not think we are facing a new 2008, it would not make sense to make this kind of analogy. Every recession is different, although there are common features. The motivations behind the 2008 crisis are different from those that might trigger a recession in late 2024-early 2025.

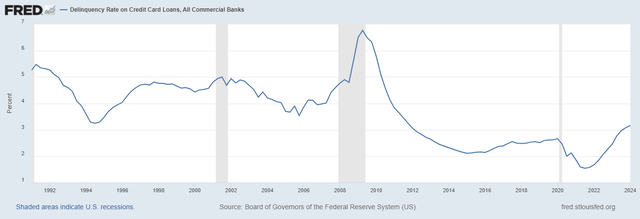

To some extent, one aspect that perhaps can connect them might be people’s inability to meet their loans on credit cards.

Federal Reserve Bank of St. Louis

Until 2021, delinquency rates were at historic lows, but since rates were raised, there has been a rather steep increase. While current levels are not too different from the historical average, what is worrying is that this upward trend has never stopped.

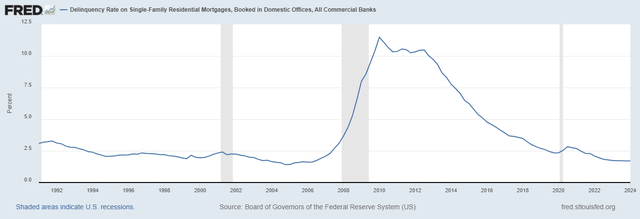

In other aspects, such as the inability of households to pay their mortgages, we are on two totally different tracks.

Federal Reserve Bank of St. Louis

U.S. households have never shown a sign of weakness in recent years and delinquency rates have declined quarter by quarter.

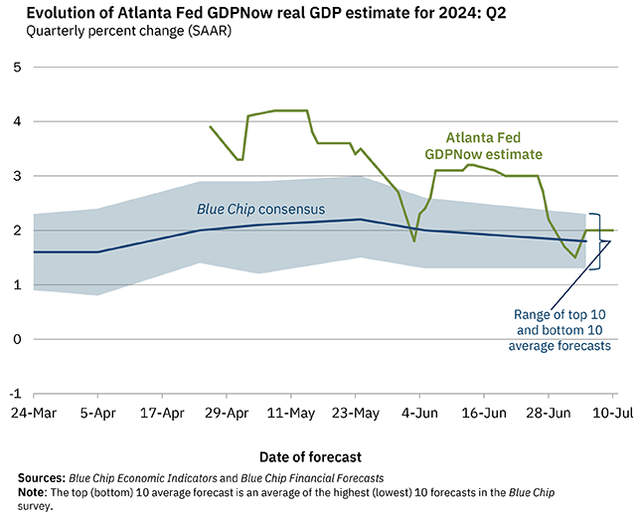

Finally, to conclude the topic on the impact of high interest rates on the economy, I must mention the GDP growth estimates for Q2 2024.

Federal Reserve Bank of Atlanta

Real GDP is expected to grow by 2% in Q2 2024, a positive figure but halved from just a few months ago. In a very short time frame, expectations have deteriorated radically, but we still cannot call it an economic contraction.

Basically, the economy remains solid, but high interest rates are hurting the expectations for future growth, yet the S&P 500 is not discounting any of this.

TradingView

The index continues to record new all-time highs, driven mainly by the most influential tech companies active in artificial intelligence. As much as this pleases me (Meta is the top position in my portfolio), I believe that sooner or later, investors will have to do a reality check, since this upward trend cannot be sustainable.

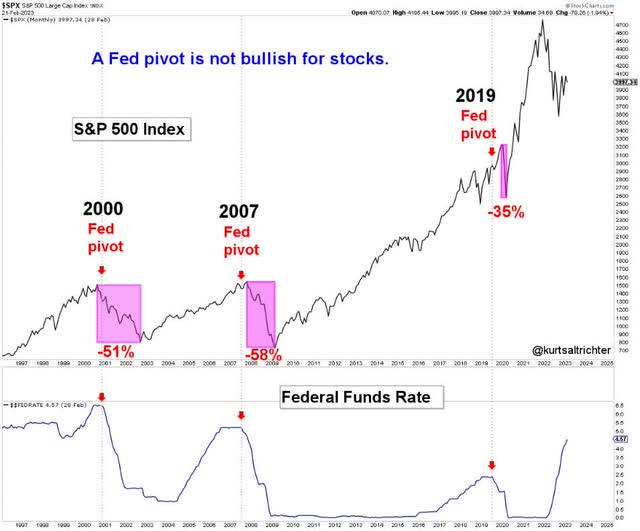

The market is just waiting for the first-rate cut to feed the bull market, which is quite controversial since a recession has always followed the pivot in the past decades. If we based on what has happened in the past, we should hope that it will never happen.

@kurtsaltrichter X profile

In any case, it should be made clear that it is not the first-rate cut that triggers a recession, but the wrong timing with which it occurs. Theoretically, rates should be cut gradually, but it almost always ends up with panic cutting, as happened both during the early 2000s and during the Great Financial Crisis.

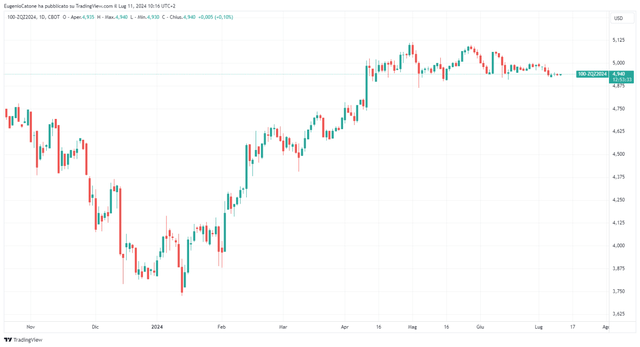

TradingView

To date, the market is discounting only one cut of about 25 basis points by the end of 2024, too little in my view to curb the continued deterioration of the labor market. Moreover, with the S&P 500 making all-time highs every week, it is clear that much of the investor base is discounting a future scenario in which the Fed will succeed in fighting inflation without triggering a recession. As much as I might hope that this is the case, the track record of the past few decades tells an entirely different story. In other words, I think the market is not considering at all the option that something could go wrong, and that is what worries me.

What has sustained the U.S. economy to date

Since the Fed raised rates, the word recession was in many more articles/journals. High rates coupled with the end of QE looked as if it might deal the death blow to the S&P 500’s climb, but actually, it did not. Excluding a brief pessimistic interlude that ended in late 2022, and the flash crash of March 2020, investors have not experienced a real bear market since 2008. Yet, the conditions for it to happen were there.

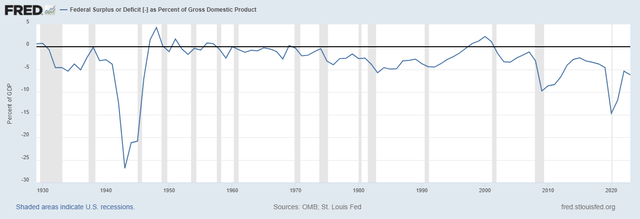

The reason the most anticipated recession of all time never happened is because expansionary fiscal policy was able to offset the Fed’s restrictive moves.

Federal Reserve Bank of St. Louis

Thus, even though the Fed Funds Rate has exceeded 5%, when the fiscal deficit/ GDP greatly exceeds the historical average, the economy is being held up artificially. In 2023, this figure was -6.19%, in 2022 -5.34%, in 2021 -11.76% and in 2020 -14.69%. I mean, I can understand that in 2020-2021, we were facing an unprecedented global pandemic, but the deficit in the next two years is still much higher than it was historically. The large fiscal stimulus has fueled a sharp rise in the stock market, regardless of the Fed’s actions. This is probably why rates have not yet been lowered, because the fiscal deficit is still too high. Something might change after the presidential election.

What is worrying is that this kind of deficit is becoming the norm, which will lead to negative consequences in the long run.

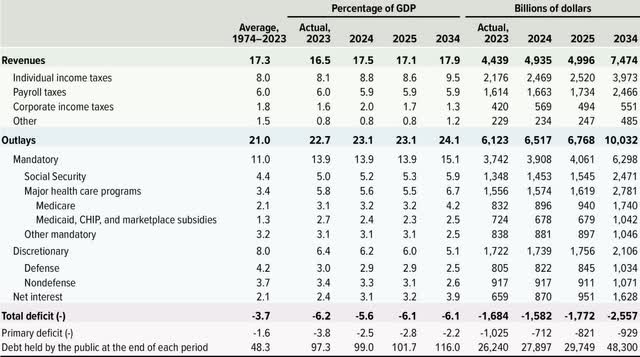

CBO’s Budget Projections

Total deficit estimates do not seem to be improving in the next few years, quite the contrary. Even if the United States is the world’s leading power, it does not mean that it can borrow as much as it wants, because this process involves a gradual distrust of the quality of its debt. In particular, if there is no reversal of the trend, the cost of net interest will become a burden that will limit economic growth.

Today, we are close to reaching the trillion mark in net interest, and according to estimates, it will be worse in the future. Its weight compared to GDP could reach 3.90% in 2034.

In other words, the large deficit may have postponed the recession, but long-term economic growth will suffer. Of course, the rating agencies are aware of all this, which is why both Fitch and S&P no longer consider U.S. debt AAA. This does not mean that the United States is at risk of default, it simply needs to avoid running deficits as if we were in the middle of a world war. Once the deficit is contained, there will no longer be the driver that is offsetting the negative effects of restrictive monetary policy.

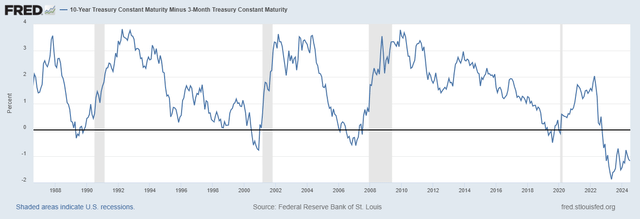

Moreover, the deficit issue may also be of interest to investors concerned about the re-inversion of the yield curve. Let me explain further.

Federal Reserve Bank of St. Louis

We all know that yield curve inversion has predicted all past recessions, and the main trigger is its re-inversion. In any case, re-inversion does not always happen in the same way.

- In the first case, it can occur because T-bills are bought more than T-bonds, so it is called bull steepening.

- In the second case, the exact opposite can happen, that is, T-Bonds are sold more than T-Bills, so it is called bear steepening.

The second case is the one we are most interested in at the moment, because short rates will probably remain high for a long time to come, while long-term rates may see an increase due to the problems addressed earlier regarding the huge fiscal deficit. To put it another way, many expect re-inversions at the time when rates will be cut several times (this is many quarters from now) but actually, it could happen before that time. Certainly, worse-than-expected inflation data could speed up this process, as T-bond yields would surge upward.

The Budget and Economic Outlook: 2024 to 2034.

EUR/USD exchange rate and AI bubble

My bearish thesis on the second half of 2024 is mainly based on what has been discussed so far, but there are other factors to consider that I will dwell on a bit.

The first is the EUR/USD exchange rate, as it is affected by the monetary policy of the Fed and ECB. The latter has already started to cut rates, while the Fed may not even cut rates in 2024, although this is an unlikely scenario. Regardless, it is evident that the ECB is more inclined than the Fed regarding a more expansionary monetary policy, and this could depreciate the euro against the dollar. While part of this assumption is already discounted in the current exchange rate, in my view there may be a case for a weaker euro than expected.

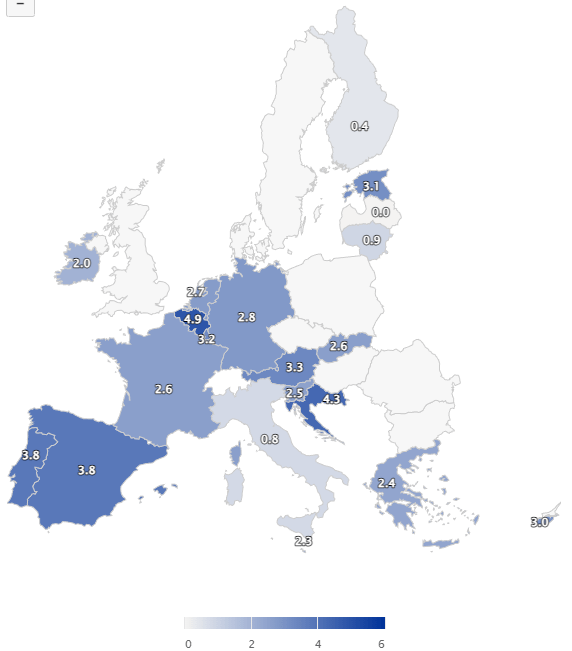

ECB inflation dashboard

Taking a look at the HICP in detail, we can see that there are some countries where there is a risk of deflation rather than high inflation. Italy’s HICP is only 0.80%, for Finland and Latvia 0.40% and 0% respectively. At the same time, others such as Belgium and Croatia are well above 4%, Portugal and Spain slightly below. There is a great diversity in Europe in terms of inflation rate, and keeping the main refinancing operations rate at 4.25% can be detrimental to countries with inflation below 1%.

In short, I think there are conditions for the ECB to cut rates faster than expected in 2024, resulting in an appreciation of the dollar against the euro. If it does not, some countries may experience a severe recession. This is important for any U.S. company that sells in Europe, as imports will be hurt.

Finally, one last aspect I would like to address is the issue of artificial intelligence. You have been hearing about the famous AI bubble for months now, so I will not dwell on it too much.

In my opinion, it is pointless to make comparisons with the tech bubble of early 2000; we are in a totally different situation. The tech companies that are fueling the bubble today are giants that generate tens of billions of dollars in free cash flow every year, as well as having negative net debt: the companies in vogue in 2000 were not even generating profits.

Bubble or no bubble, justified valuation or not, what is certain is that these giants cannot grow that much every single year and have a huge weight on the S&P 500.

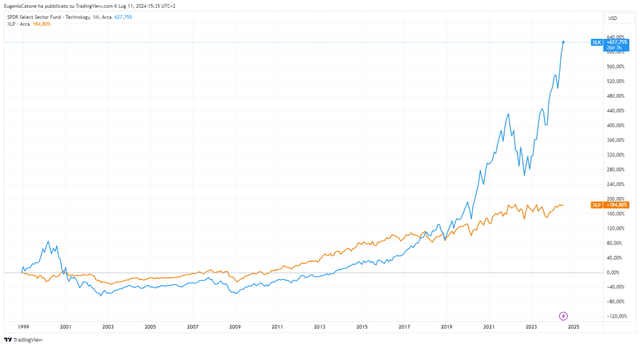

TradingView

Historically, consumer staples (XLP) have never experienced such a divergence in returns compared to the tech sector (XLK). I do not doubt that today’s tech companies are even sounder than many consumer staples, but such a divergence is too marked not to expect a return to the mean. Simply put, I think it makes more sense at the moment to add to the portfolio those businesses that we consider boring rather than those that are recently in the spotlight.

Conclusion

Everyone was pleased with this huge bull run, but like every good thing, sooner or later, there is an end. No one can know when, but based on the data analyzed in this article, I would say that a crucial time will be the end of the year. The outcome of the presidential election will have a major impact on the issue of the fiscal deficit, and by that time the Sahm Indicator may have already crossed the 0.50 threshold. At the same time, the yield curve may also have re-inverted due to bear steepening.

In my view, the deterioration of the labor market can only be stopped (if it is not already too late) if the Fed starts cutting rates as early as the next meeting; otherwise it risks getting the timing wrong, as it almost always did.

My strong sell rating refers to a second half of the year far more disappointing than the first, whose difficulties could perpetuate into 2025. We will see what happens, I certainly will not sell everything in a panic even in the event of a 15-20% collapse from current levels. Having a long-term approach allows you to see recessions as an opportunity to be exploited and not as something negative.

Shared by Golden State Mint on GoldenStateMint.com