SusanneB

I wrote about the inflation report that moved markets last week, and now, all eyes are on the Fed. Typically, the Fed cuts rates when there is a problem or when something is seriously wrong with the economy. Therefore, lowering interest rates is often associated with negative economic factors and potential downside for stocks. However, the economy remains resilient, and the Fed will likely cut rates on September 18th.

We’ve been trapped in a relatively high interest rate environment for a long time. Now that inflation has decreased considerably and the job market has weakened, it’s time to cut rates. Moreover, housing, manufacturing, and other segments of the economy are showing signs of substantial weakness.

While the near-term volatility could persist, a more accessible monetary stance should lead to improved growth and increased liquidity, a highly constructive dynamic for high-quality stocks and other risk assets. Furthermore, the Fed could cut by 50 Bps to kick things off, which markets should welcome.

Also, corporate earnings remain healthy, and despite the potential temporary growth slowdown in AI and other segments, we could see improving and better-than-expected earnings in future quarters. Valuations, while elevated, are not nearing any extremes, implying there could be substantial upside in the current bull market. Due to this constructive dynamic, I am keeping my S&P 500 “SPX” (SP500) year-end target at 6,200.

The Technical Image – A Triple Top?

SPX (stockcharts.com )

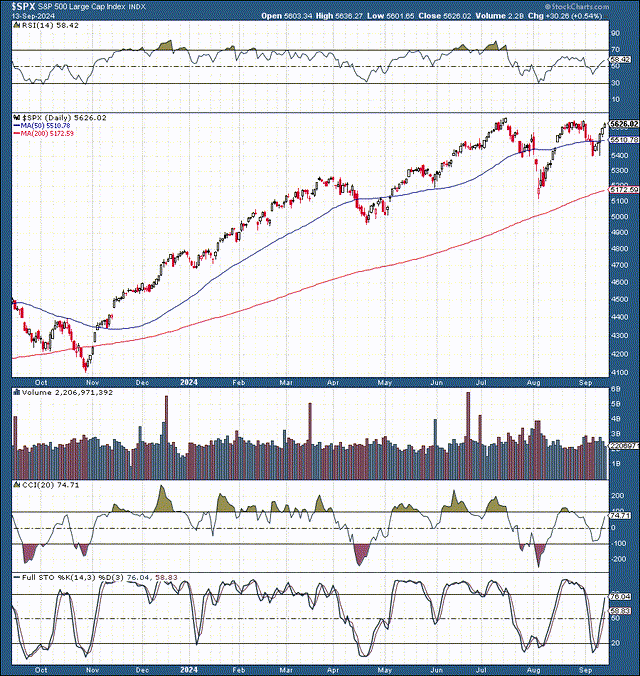

SPX (stockcharts.com )“There are no such things as triple tops.” That’s how the trading saying goes. Incidentally, we see the SPX approaching what could be a triple top, but there is a high probability that the SPX will break out. We witnessed a highly constructive technical correction in July and early August. This correction lowered the SPX by about 10% to roughly the 5,200 support level. Moreover, the SPX successfully re-tested the support, only dropping to 5,400 recently. Now, SPX appears set up for another move higher here.

Data This Week – The FOMC Approaches

Data (investing.com )

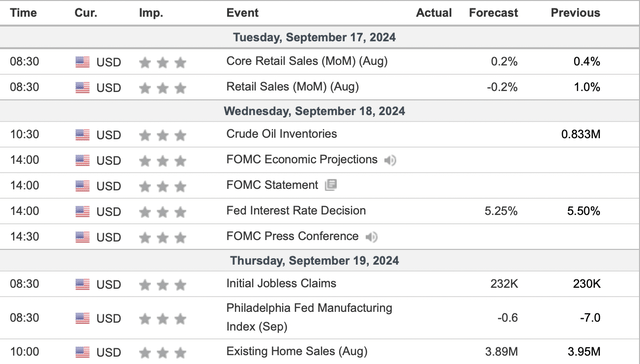

Data (investing.com )While there are several crucial data points this week, it’s all about the FOMC and the rate cut. The million-dollar question, of course, is, will the Fed cut by a modest 25 Bps or go big with a 50 Bps jump cut? The market would very likely react more favorably to the more significant 50 Bps cut. However, the essential element is that the Fed is on the right path to a more accessible monetary environment. Therefore, while we may see an adverse knee-jerk reaction to a 25 Bps cut, the selling will likely be short-lived, and a post-FOMC pullback will likely turn into a buying opportunity in the coming days.

Rates Likely Going Lower Quickly

Rate probabilities (CMEGroup.com )

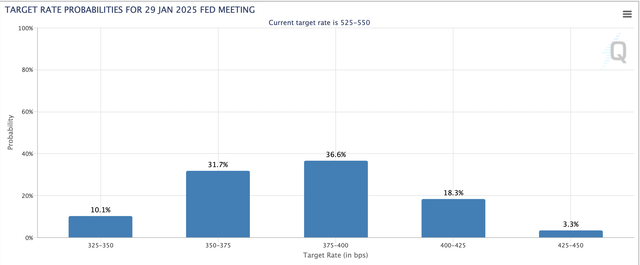

Rate probabilities (CMEGroup.com )Rates will likely be much lower by early next year. There is about an 80% probability that the funds rate will be around 3.75-4% or lower by the end of January 2025. This is a vast difference from the current 5.25-5.5% benchmark rate environment.

Therefore, we could see about 150-200 Bps worth of cuts in the next several months. I want everyone to realize how significant the initial rate reduction phase could be. The Fed may take a shock-and-awe approach, including potential jumbo 50 Bps cuts in the mix as it moves toward an appropriate rate policy.

Also, 4% is not the floor. Instead, it’s likely only the beginning. The benchmark could be around 3% by around mid-year 2025, and we could see lower interest rates after that. It seems like every time the Fed embarks on an easing cycle expectations are that it may end half way right after things normalize.

In reality, monetary cycles typically don’t stop half or part of the way. They go “all the way.” The Fed may tolerate higher inflation to increase growth and improve the labor market. Also, inflation could have a lagging effect and continue lower even as the Fed transitions to a lower interest rate policy.

Inflation could also increase gradually as growth may be sluggish in the near future. Thus, we could see much more easing and potential future QE and other stimulus programs, providing backstops and liquidity to markets in the coming years.

Earnings Season Approaches

It seems like earnings just ended. Nonetheless, earnings season approaches again. The recent earnings season was primarily positive, and much of the guidance was also solid. Therefore, we could see outperformance when big reports start in early October. Big banks, including JPMorgan (JPM) will report on October 11th, and we should see many bellwether stocks reporting around this time frame. This dynamic creates a favorable catalyst for stocks to move higher into the best time of the year, the holiday season, and year-end.

The Valuation Perspective

P/E valuations (WSJ.com)

P/E valuations (WSJ.com)The S&P 500 trades at a forward P/E ratio (non-GAAP) of approximately 22-23. While this may seem relatively expensive historically, it may be inexpensive in the context of entering an easing monetary cycle in a resilient and stable economic atmosphere. Also, the growth image can improve, and earnings may increase more than expected, implying that the forward (2025) P/E ratio may be below 22 here.

Also, the Nasdaq 100’s forward P/E ratio is around 29, but it may be around 28 or lower relative to 2025’s earnings, which is a slightly more bullish case outcome. Considering the AI growth potential and upcoming monetary environment,28-30 times forward earnings may not be too expensive for the world’s best tech companies.

The S&P 500’s Shiller P/E ratio is around 36 now. While historically, this is relatively high, the all-time high was around 44. Also, the Shiller P/E ratio could move to an ATH in this bull market cycle. This dynamic implies that earnings, valuations, and stock prices could continue to appreciate from here. Due to the solid technical and fundamental dynamic, I am leaving my SPX year-end target at 6,200.

Shared by Golden State Mint on GoldenStateMint.com