Summary

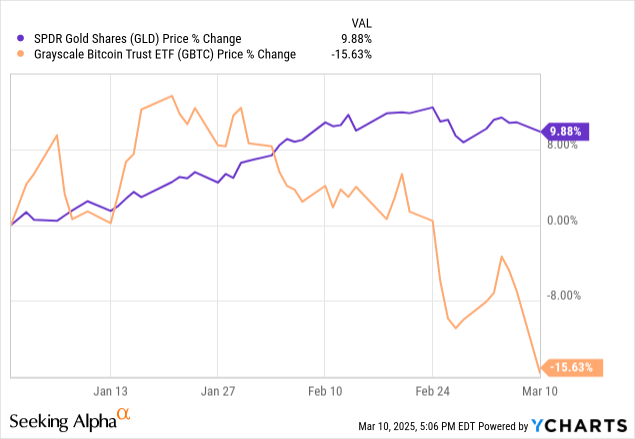

- The article explores the ongoing debate about digital gold, focusing on year-to-date total returns for GLD and GBTC.

- Gold in ETF format is becoming nearly as liquid as crypto with T+1 instituted in 2024.

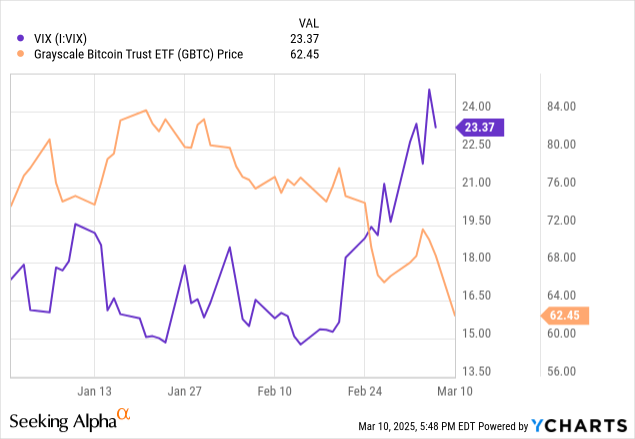

- GLD has shown resilience in the face of a rising VIX, showing that this is the real digital gold risk off asset.

- GBTC and Bitcoin can both serve a place in a portfolio, but in a possible recession, investors will look for preservation of value versus appreciation.

The debate about digital gold

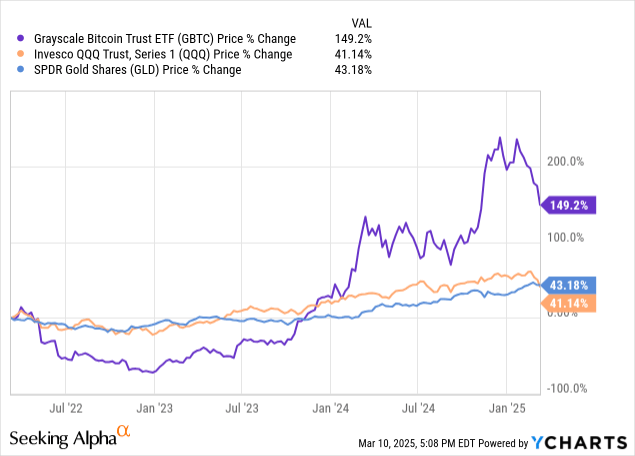

There is an emerging divergence in the conversation about what Bitcoin (BTC) actually represents. I covered Bitcoin in an article just once. My outlook was not one that was negative, it was merely one that discussed the various use cases. That was coverage back in 2022 when Bitcoin was only at $19K per coin. The run-up to now has been enormous.

Oddly enough, this “digital gold” asset has actually started to see another negative year ensue even though the market is starting to become “risk off” in terms of equities. You would assume that both gold and Bitcoin would have the ‘safe haven’ reaction with investors flocking to both of those assets. President Trump even stated that the United States would start a strategic crypto reserve with Bitcoin as one of the centerpieces.

Gold, on the other hand, has been resilient. For the purpose of this article I am using the SPDR Gold Shares ETF (GLD) as the investment of choice if an investor wants to own gold. It’s an efficient ETF with very high volume and nearly $85 billion in assets invested into the fund. I’d like to compare both and give my opinion about why GLD is the better bet on “digital gold” at this moment in time.

The Grayscale Bitcoin Trust ETF (GBTC) is in my opinion the equivalent vehicle for owning Bitcoin without having to find a brokerage where Bitcoin is sold directly. Chances are high that if you are not a long-time crypto investor, you probably don’t have a Coinbase account or something similar that allows you to buy crypto directly. Gold is also cumbersome to store physically in large quantities and frankly a bit dangerous unless you have added home insurance policy riders to cover large quantities of gold. Crypto exchanges also have the added danger of lacking SIPC insurance whereas a securitized crypto ETF such as GBTC should have that, although it won’t protect the underlying assets of the trust, just your ownership of the trust.

Year-to-date total returns

We can see on a year-to-date basis that Gold has been the flight to safety asset whereas Bitcoin has tracked the Nasdaq on the way down with similar negative returns for the year as the VIX has spiked:

Use cases

The use case for Bitcoin that I previously heralded in my only opinion piece on digital currency is that you are akin to a shareholder in a peer-to-peer banking system. I do believe Bitcoin has more inherent value than just a remittance system like a check in that the movement of funds is nearly instant in a cross-border situation without many checks and balances.

Having worked with investors from around the world in the past, the value of this system is enormous when you consider the currency controls most countries have on outbound wires and currency conversion. It is also a hedge against a foreign investor’s currency which may be in rapid depreciation. In short, I believe Bitcoin provides far more inherent value to non-US investors than it does to US investors as a whole.

Gold, on the other hand, is the historical store of value currency. The US has done an excellent job securitizing gold and turning it into a digital asset like GLD. This type of investment in a trustworthy vehicle like the SPDR Gold Shares ETF is not normal in other countries where physical gold may be the only possible exposure. If you think there is less fraud in owning physical gold, think again:

The demand for gold combined with unsophisticated Chinese consumers and investors unable to differentiate between 24-carat and lower quality gold has given rise to scammers,” Rein added.

Reports about the rise in gold scams have been on local media and consumer protection sites such as Heimao Tousu, a third-party consumer service platform under tech giant Sina.

One user who reportedly bought five gold pendants for 1,985 Chinese yuan [about $280] on online e-commerce platform Taobao said he found out the gold was fake after conducting a flame test. Fake gold gets darker or reveals a greenish color when placed under flame, while pure gold turns brighter on exposure to heat.

In short as a US consumer and investor without strict outbound currency controls and the “risk off” hedge the Gold ETF assets present, I believe US investors get far more benefit out of owning a Gold ETF at present when the VIX is spiking.

Similarities

Both of these can be held digitally and then converted into fiat currency to transact with. US tax law is evolving in respect to crypto and buying goods directly using crypto in the US likely constitutes a taxable event if the coins used have capital gains versus your tax basis. In other areas of the world where tax law is slower to evolve, it’s possible crypto can be exchanged freely for goods and services. More detail here from Coinbase:

Taxable as capital gains

Selling crypto for cash: Did you sell your crypto for U.S. dollars? You’ll owe taxes if you sell your assets for more than you paid for them. If you sell at a loss, you may be able to deduct that loss on your taxes.

Converting one crypto to another: When you use bitcoin to buy ether, for example, you technically have to sell your bitcoin before you buy a new asset. Because this is a sale, the IRS considers it taxable. You’ll owe taxes if you sold your bitcoin for more than you paid for it.

Spending crypto on goods and services: If you use bitcoin to buy a pizza, for example, you’ll likely owe taxes on the transaction. To the IRS, spending crypto isn’t that much different from selling it. You need to sell the asset before it can be exchanged for a good or service, and selling crypto makes it subject to capital gains taxes.

So at this point, GLD and a cryptocurrency are not extremely different. Don’t forget, last year we changed settlement for brokerage securities from T+2 to T+1:

T+1 settlement cycle will apply to most routine securities transactions, which means that the settlement period for most securities issuances and trades will shorten from two business days after the trade date to one business day after the trade date to one day.

Thus, with the liquidity of being able to turn securities into cash within one day, a gold fund like GLD is now extremely close to an equivalent digital crypto backed by gold.

Larry Fink, CEO of BlackRock, has been pushing for a tokenization of stocks and bonds. This would, in theory, make it possible to send stocks and bonds without sale and turn any stock or bond into a cryptocurrency. This would effectively make GLD a crypto equivalent, and possibly Apple and Microsoft too.

Larry Fink, CEO of the world’s largest fund manager BlackRock, has expressed his hope that the US Securities and Exchange Commission SEC will swiftly approve the tokenization of bonds and stocks. During a CNBC interview on Jan. 23, Fink strongly endorsed digital assets, underscoring their potential to democratize investments.

Differences

Bitcoin is a ‘risk on’ asset

So if GLD is becoming more and more digital with T+1, fantastic daily liquidity, and the eventual push for tokenization, in my opinion, one of the main differences will eventually be that Bitcoin is a ‘risk on’ asset and GLD is risk-off. We can see that Bitcoin has risen even faster than the Nasdaq in the last 3 years and rallies around the same time.

Bitcoin will remain a superior asset for countries with currency controls.

The above is true, especially for the ultra-wealthy who may have trouble transferring large sums of money due to CFIUS [Committee on Foreign Investment in the United States] controls and other issues of foreign funds transfers related to exchange rates and currency controls. Having worked in a field dealing with Foreign investors, the issue was not where are the people with money, the issue was proving the source of funds and then clearing the currency controls of their native countries combined with the funds passing scrutiny once they landed in the US.

With President Trump preparing to institute the new “Gold Card”, which will, in essence, be a $5 million version of a Green Card where the investor moves to the front of the line and gets expedited processing, Bitcoin may be key. Moving such large sums may be difficult otherwise. The strategic crypto reserve might be set up to be able to take inbound contributions from such investments. While the Gold Card doesn’t have many details yet, my guess is, it will be a zero coupon type bond with no accrued interest for a 5-10-year period. This is similar to programs in New Zealand and Singapore.

Summary

I believe in a volatile environment, GLD serves as the true “digital gold” and could have similar outperformance in a high VIX environment to that of long bonds and more conservative income-producing equities like REITs and dividend aristocrats/kings.

Bitcoin and GBTC are more suited for a calmer VIX with a ‘risk on’ environment, but I do believe the asset is of use, especially when it comes to cross-border transactions. Right now, GLD is a buy and GBTC is a hold in my opinion.

Shared by Golden State Mint on GoldenStateMint.com