Summary

- The Fed’s recent rate cut has fueled a gold price rally, but inflation expectations, not just interest rates, are driving gold’s bullish trend.

- Persistent high costs in rent and food, key components of Americans’ budgets, are pushing investors towards gold as a hedge against inflation.

- Despite declining overall inflation rates, specific sectors like food and shelter continue to see rising prices, supporting the demand for gold.

- I recommend maintaining exposure to gold through physical bullion or gold-backed ETFs, as rising living costs suggest continued upward trends for the metal.

Jonathan Kitchen

To the surprise of almost no one, the Fed’s decision to cut interest rates last month sparked yet another gold price rally in what has been the strongest year for the metal since 2020. And most observers view the Fed’s looser policy as a reason why gold should remain bullish heading into the New Year.

But as I’ll attempt to prove here, it isn’t so much interest rates that are driving gold prices, but inflation expectations. More specifically, the market seems to be sensing that rising prices on the retail level will persist (and potentially even accelerate) heading into 2025, which is likely the main catalyst pushing investors into buying gold.

Heading into the September 17-18 Fed policy meeting, it was widely discussed in financial circles that an anticipated drop in the fed funds rate would almost certainly kickstart another leg higher in gold’s ongoing secular bull market. The basis behind this thinking is sound enough, namely that lower rates are stimulative, as it makes non-yielding bullion more attractive to safety-oriented investors (who often prefer holding gold to owning bonds when rates are falling).

What many pundits didn’t consider, however, is that the primary motivation behind the relentless demand for gold among safe-haven buyers since 2020 hasn’t been yield-related considerations, but rather protection against the loss of purchasing power. And this loss of purchasing power is a direct result of the government’s over-printing of money during the Covid years, along with the massive disruption to the global supply chain. Both of these occurrences produced a drastic reduction in the dollar’s value for the average consumer by way of rising prices.

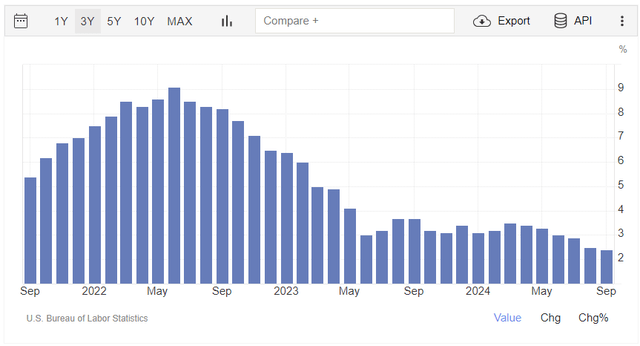

However, for much of this year, there has been a near unanimity of opinion among mainstream economists that inflation is diminishing in the U.S. The argument is predicated on the observation that the annual inflation rate has been trending lower since peaking in mid-2022, as shown in the following graph.

According to Trading Economics: “The annual inflation rate in the U.S. slowed for a sixth consecutive month to 2.4% in September 2024, the lowest since February 2021.” The continued decline was mainly due to the fall in gasoline prices (down 15% in the past month).

However, as Trading Economics also noted, several components of U.S. inflation continued to increase, including shelter costs, which rose by nearly 5% in September (although the rate of increase was lower from the prior month). The website further observed: “On the other hand, inflation accelerated for food (2.3% vs 2.1%) and transportation (8.5% vs 7.9%),” which are salient points in our analysis that the cost of living for consumers is still very much a problem.

This brings me to the main point of this discussion, namely that two of the three biggest components in the monthly budgets for most Americans—rent and food—are still a problem, as both costs remain historically high and continue to increase. And as long as this remains the dominant trend, I argue that gold prices will continue to track higher in harmony with those costs.

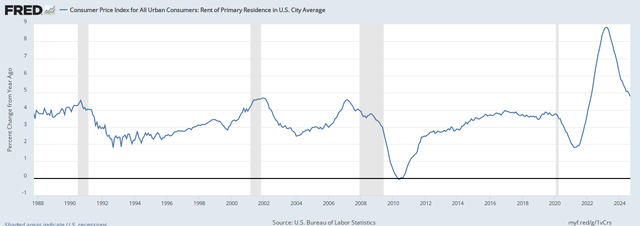

First, let’s examine the trend for rent. According to a study by Worth Insurance, 65% of Americans under age 35 rent instead of owning their own home. This constitutes nearly a quarter of the total U.S. population. What’s more, over half of renters are 45 years or younger—a demographic that encompasses nearly 60% of the overall population. Suffice it to say, monthly rents are a huge expenditure for a sizable percentage of Americans.

The rate of change in the nationwide average for rents, while lower than it was a year ago, is still above the historical norm over the last 40 years. This further illustrates that higher shelter costs are still a burden for millions of people.

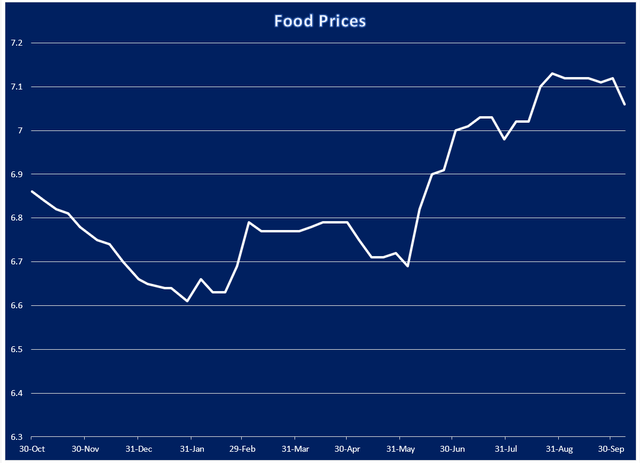

Then there’s the cost of food, which, according to a recent study by Ramsey Solutions, is the third-biggest monthly expenditure for the average American (at around 13% of monthly expenses). To anyone who dines out or shops for their own groceries, it’s no secret that food costs are still historically high and show no signs of abating across most food categories. To that end, I maintain my own personal inflation index of sorts, shown below. It’s basically a weekly average of prices for 15 key staple items available from the nation’s number one retail outlet, Walmart.

The index includes staple items like eggs, milk, cereal, bread, peanut butter, rice, hamburger and coffee, but also trash bags, paper towels and other food-related items that most shoppers purchase on a regular basis. Here’s what my consumer goods-based inflation index shows as of the week of October 7-11.

As you can see, the trend for consumer goods (mainly food) across various items remains in an overall upward trend, which is clearly discernible over the past year. It further suggests that inflation for the average American hasn’t really abated, as economists are insisting.

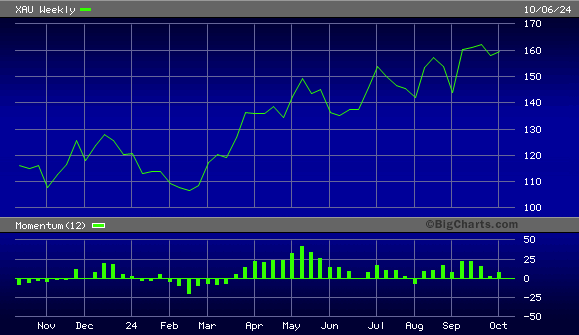

Now compare the above food inflation chart with the chart below showing the PHLX Gold/Silver Index (XAU), which is a reflection of investors’ demand for exposure to the companies that mine gold. Granted, it’s not a perfect correlation, but there are similarities between the two data sets that imply a connection. I don’t think it’s a stretch to infer that rising living costs are a big reason for investors’ increased demand for gold.

BigCharts

With the rising trend in food and shelter costs not showing any signs of abating, I further maintain it’s a warranted assumption that gold will also continue trending higher in the coming months. All told, my bullish long-term thesis for the yellow metal remains unchanged, and I continue to recommend that investors have some exposure to gold either through holding of physical bullion or gold-backed ETFs—or a combination of the two.

Clif Droke is the chief analyst for the Cabot Turnaround Letter. He has covered equities and commodities, specializing in gold, since 1997 and has worked for Cabot Wealth Network since 2020.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Shared by Golden State Mint on GoldenStateMint.com