The latest financial releases from the tech giants show mixed performances.

NVIDIA reported impressive results for the fourth quarter of fiscal 2025, surpassing market expectations. Sales reached $39.33 billion, exceeding expectations of $38.1 billion, while adjusted earnings per share came in at $0.89, compared with $0.85 expected.

A key element of this performance was the launch of the Blackwell processor, which generated $11 billion in revenues over the quarter, marking the fastest product roll-out in the company’s history. This result also far exceeded forecasts, illustrating the massive enthusiasm of technology companies for this new product range.

However, a more detailed analysis reveals potential signs of a slowdown. Gross margins, which peaked at 79% last April, are in steady decline, at 73.5% this quarter, with a forecast of 71% for the coming quarter. This decline is attributed to costs associated with the ramp-up of the Blackwell architecture.

On the other hand, accounts receivable jumped by $5.4 billion quarter-on-quarter, outstripping sales growth of $4.2 billion over the same period. This suggests that all revenue growth is coming from receivables, suggesting that customers are taking longer to pay their bills. This trend could indicate an easing of credit conditions to support sales, which could become risky if clients find it difficult to meet their payments.

Although NVIDIA is posting a solid financial performance, with the successful launch of its Blackwell processor, falling gross margins and rising trade receivables call for caution. These signals could signal potential challenges on the horizon, requiring heightened vigilance on the part of investors and analysts.

For the time being, the consensus of a large majority of analysts is largely bullish on the stock.

According to the data available, the majority of financial analysts recommend buying NVIDIA (NVDA) shares. In fact, of the 42 analysts surveyed over the past 12 months, 39 recommend buying, three advise holding, and none suggest selling, according to Zacks.

Similarly, according to another source, out of 41 analysts, 21 assigned a “Strong Buy” rating and 18 issued a “Buy” recommendation, with no recommendation to sell!

These ratings testify to analysts’ widespread confidence in NVIDIA’s growth prospects and financial strength.

Is the market too optimistic about the future of the American AI giant? Can this near-unanimous consensus be maintained over the long term?

Unfortunately, the optimism surrounding NVIDIA’s future is not shared by analysts across the entire technology sector. NVIDIA is supporting the market, but for other stocks, difficulties are piling up.

Salesforce disappointed by forecasting annual sales of between $40.5 and $40.9 billion, below the consensus of $41.46 billion. Similarly, eBay saw its shares fall by 7% after announcing below-estimated revenue forecasts for the first quarter of 2025.

These mixed results beg the question: can NVIDIA support the market on its own? Although its performance is solid, reliance on a single company to stabilize the market seems risky, especially in the face of worrying signals from the US economy.

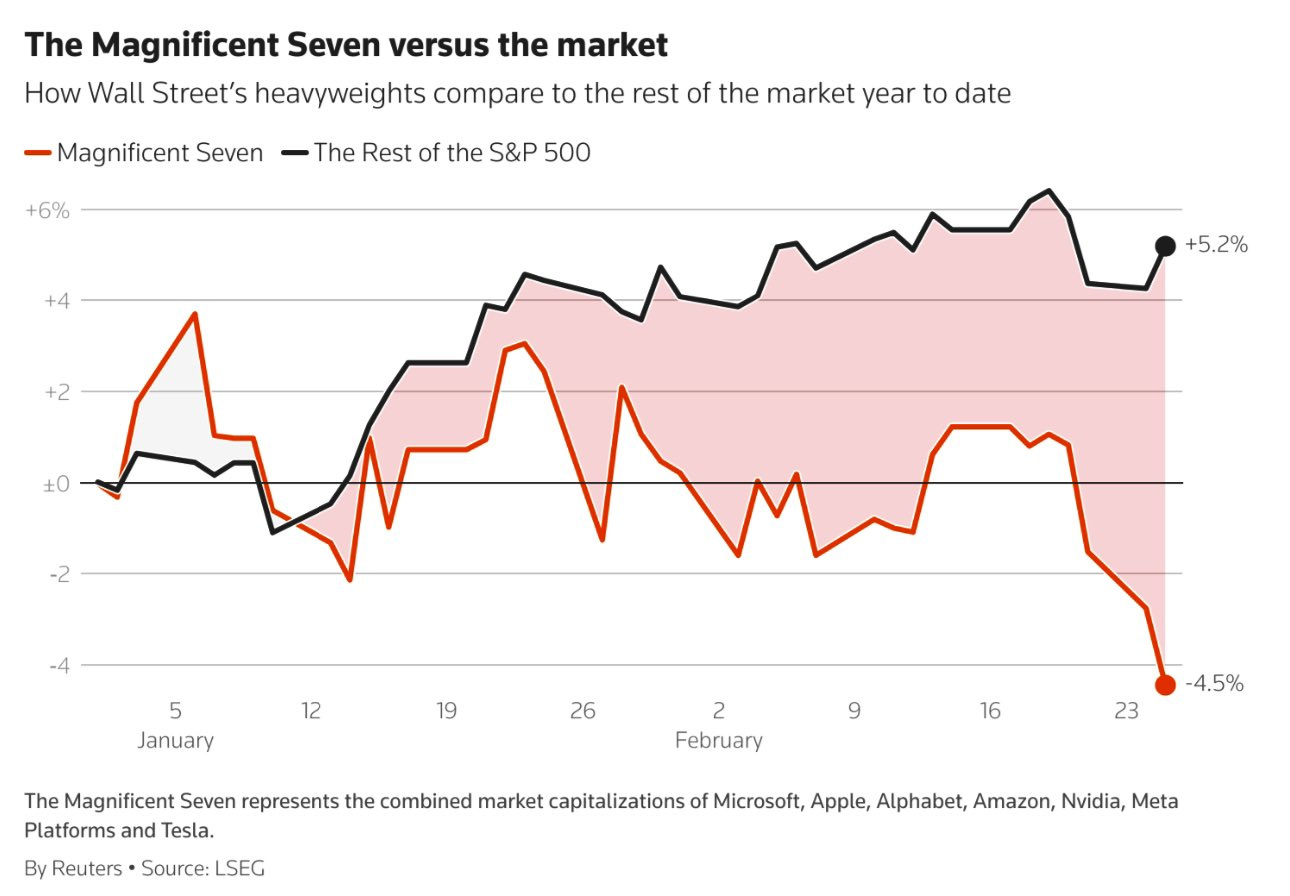

The resilience of the “Magnificent 7” actually masks an ongoing correction in the rest of the market:

This market downturn reflects persistent weakness in the US economy.

US retail sales fell by 0.9% in January, beating analysts’ forecasts:

In January 2025, retail sales in the USA fell by 0.9%, recording their sharpest decline since March 2023. The sectors most affected were sporting goods stores (-4.6%) and car dealers (-2.8%).

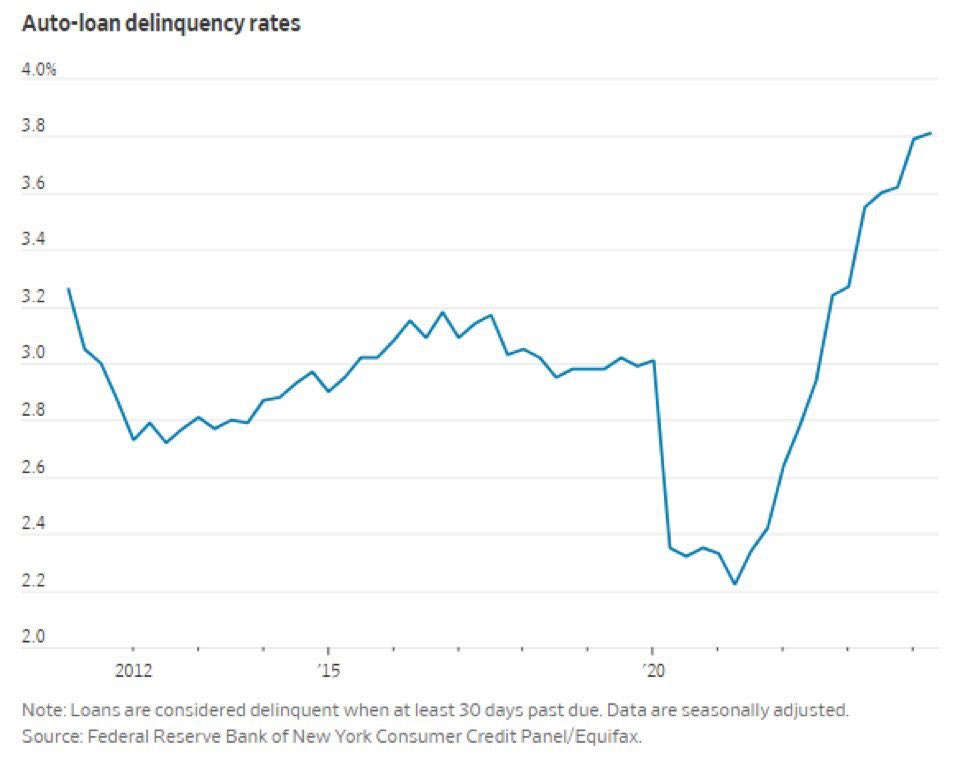

At the same time, serious delinquency rates (90 days or more) on US auto loans reached 3.0% in the fourth quarter of 2024, their highest level in 14 years, since the recovery period following the financial crisis.

Serious defaults now exceed the levels seen during the 2001 recession and the 2020 crisis:

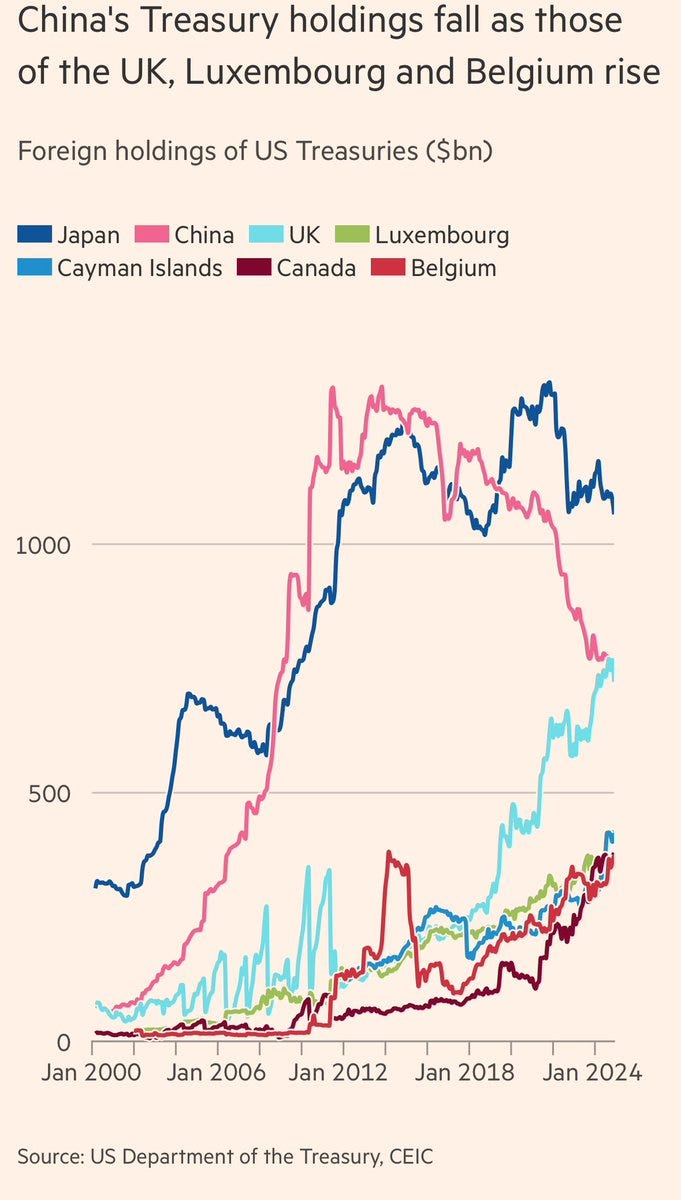

Faced with the threat of an economic slowdown in the United States, China is reducing its holdings of US Treasuries in favor of gold, reflecting a strategy of diversifying its reserves and a possible distrust of the US dollar:

Against this backdrop, the US dollar is showing signs of weakness. After a period of strength, recent data reveal a weakening of the greenback:

The dollar is weakening, but not because of renewed growth in Europe.

Europe is also showing signs of weakness. In France, the PMI services index fell to 44.5 in February, well below forecasts of 48.9, indicating a significant contraction in the sector.

The price of gold is benefiting from concerns about growth, and is riding a wave of record highs. Every pullback, however modest, is quickly bought back:

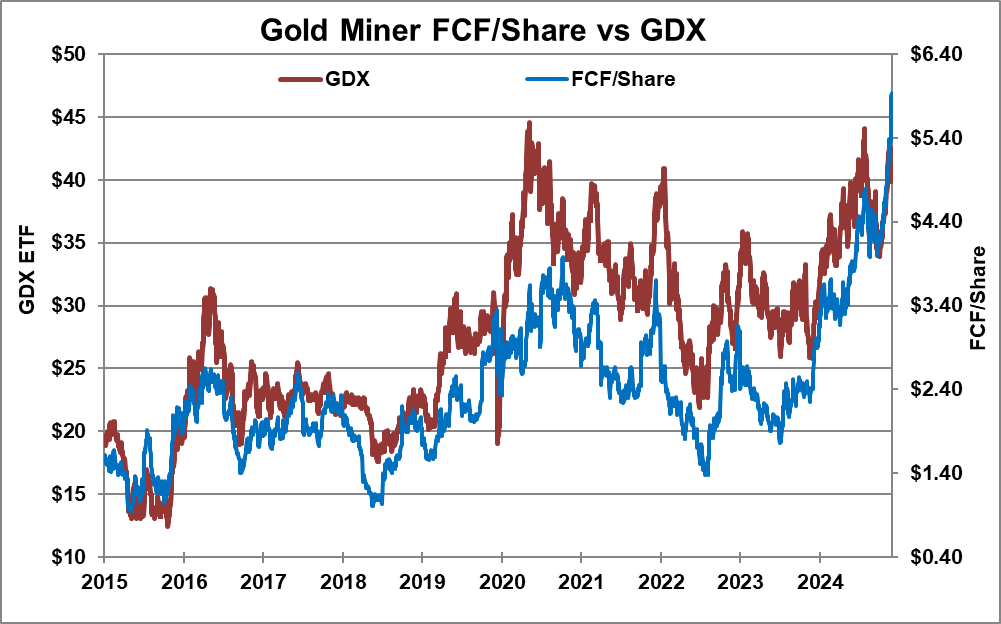

For the time being, gold mining companies tend to follow the correction in small caps, and the market seems to be ignoring the dizzying rise in free cash flow per share. Gold miners have never been so undervalued in terms of this ratio: even in 2015 and 2020, they were trading at higher levels than today.

The GDX/Gold ratio offers exceptional upside potential, provided that the market recognizes this revaluation.

Written by Laurent Maurel of GoldBroker