Anthony Bradshaw

Anthony BradshawAs gold trades at $2,500, a record high, its path ahead faces challenges related to the upcoming FOMC meeting. Still, the balance of risks appears to support precious metal prices. Let’s examine the key factors that could influence its trajectory moving forward.

Inflation remains above the Federal Reserve’s target of 2% but continues to decline slowly. For example, the latest PCE report came in at 2.5%; a year ago, this rate was 3.3%. The core PCE was 2.6%, 1.6 percentage points below its rate from July 2023.

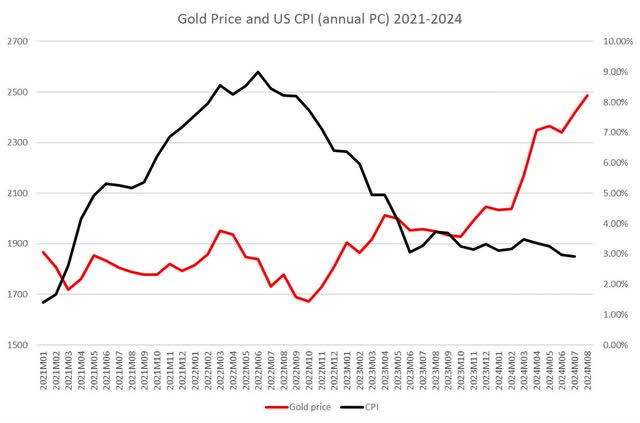

Since gold is perceived as a hedge against inflation, shouldn’t lower inflation put downward pressure on its price? Recent data suggest that inflation hasn’t been responsible for the rising demand for gold, as shown in the following chart.

Figure 1: Gold and Inflation

Author’s Creation (FRED)

Author’s Creation (FRED)During the rise of inflation in 2021-2022, gold only slightly increased, and as inflation declined in 2023-2024, gold prices kept climbing to reach new highs.

While inflation may not have been the main factor in rising gold prices, the decline in inflation and the prospects of lower long-term rates did. The strong correlation between long-term rates and gold has been one of the critical factors affecting the metal’s price trajectory. Indeed, the recent rally in gold is partly due to the recent decline in long-term interest rates as inflationary pressures eased. For example, the 10-year treasury bond yield decreased by 74 bp since May, while inflation (CPI) by 43 bp. In addition, the difference between the 10-year yields of treasury bonds and TIPS has been stable throughout most of the year – another indication that most of the decline in yields is due to the decline in inflation.

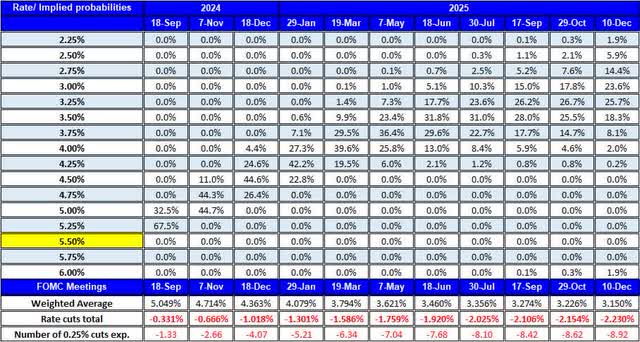

Besides the lower inflation, the FOMC could reduce long-term interest rates by cutting short-term rates in the upcoming meeting. The markets expect the FOMC to cut rates every meeting throughout the remainder of the year, as estimated in the bond market (see the table below). In addition, the market gives a 32% chance of 50 bp in September.

Table 1: Target rate probabilities for 2024-2025

Author’s Creation (CME)

Author’s Creation (CME)As the FOMC cuts and long-term rates fall, they could weaken the US dollar, providing an additional tailwind to precious metal prices.

Some of these upcoming rate cuts are probably priced in, so it will require much more substantial rate cuts than the current market outlook to push gold to new highs. Alas, the market seems a bit too optimistic that the FOMC would cut rates by one percentage point by December, which, for now, seems unlikely; the FOMC has been known to have a very conservative approach and tends to underdeliver on stimulative policies – unless there is an apparent crisis like the COVID shock of early 2020 or the plunge in stock prices in late 2018. Hence, it is more likely they may decide to cut rates by only 25 bp in September and be more cautious of promising a rate cut every meeting. Nonetheless, the upcoming non-farm payroll report, released this Friday, might persuade them to cut rates by 50 bp if the number of jobs added is well below expectations and unemployment ticks up again. It could provide additional clues as to whether the US economy is heading toward a recession – another potential contributing factor to the demand for gold.

While gold may not be the best hedge against inflation, it is more of a hedge against recessions. The previous jobs report raised alarm bells that the US could face a recession as the Sahm rule hit the 0.5 threshold, and the next one could reinforce this assessment. While even Sahm herself thinks this time is different and her rule should be taken with a grain of salt, it’s still enough to boost precious metal prices, as was the case during the Covid-induced recession of 2020, as seen in the chart below.

Figure 2: Sahm rule recession indicator and gold price

Author’s Creation (FRED and Author’s Calculations)

Author’s Creation (FRED and Author’s Calculations)The bottom line is that gold could face some headwinds, such as the FOMC underdelivering on rate cuts in the upcoming meetings. However, the current trajectory of falling short-term rates along with low inflation is likely to keep lowering long-term rates; in addition, the weaker US dollar and the prospects of a recession may be enough to support gold prices.

Shared by Golden State Mint on GoldenStateMint.com