Heightened stock market volatility at the hands of blistering tariff headlines continues to drive one important discussion among investors.

Have markets fully priced in a US recession as tariffs impact the economy?

New data from Deutsche Bank suggests markets have a way to go before fully baking a recession into stock valuations.

Since the “Liberation Day” tariff announcements, the S&P 500 (^GSPC) is down about 13.9% from its mid-February peak, Deutsche Bank strategist Henry Allen calculated. At the low point on April 8, the index was down as much as 18.9%.

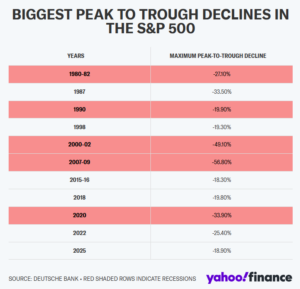

In the five most recent recessions, the peak-to-trough declines for the S&P 500 have been far more severe. The drops have ranged from 27.1% in the 1980-1982 recession to the 56.8% decline in the 2007-2009 recession.

“It’s clear that investors aren’t fully pricing a recession in just yet,” Allen said. “So markets clearly don’t see a recession as inevitable, particularly if the tariffs don’t come into force after the latest 90-day extension. But of course, the flip side is that with markets not fully pricing in a recession, that opens significant downside risks if we do get one, as none of the major asset classes have seen moves consistent with the other recessions of recent history.”

Allen goes a step further to see if oil prices are factoring in a recession. During a recession, oil demand typically cools as consumers curtail driving to save money and businesses run operations with an eye toward cost savings.

Brent crude oil is down about 10% from its level on “Liberation Day,” Allen noted. But that’s a far cry from the two-thirds decline for Brent crude oil during the COVID-19 pandemic and the Great Financial Crisis.

“Clearly oil is something where a lot of confounding variables are at play, but the fact we’ve only seen relatively modest declines suggests that investors aren’t anticipating a huge slowdown for global growth just yet,” Allen explained.

None of this is to say, however, that markets are easy sledding at the moment.

The S&P 500 (ES=F) and Nasdaq Composite (^IXIC) are down about 4% each in April, with the Dow Jones Industrial Average (^DJI) off by 5.3%. Market leaders Apple (AAPL) and Nvidia (NVDA) have shed 5% and 3%, respectively. Earnings warnings have piled up from the likes of Tesla (TSLA) to United Airlines (UAL).

Gold prices have climbed to a record high as investors seek safe havens. The US dollar is hovering around a three-year low while the 10-year yield has clung to the above 4% level after a steady climb.

“I think what we’re experiencing is a loss of confidence in the policy,” Charles Schwab chief fixed income strategist Kathy Jones told me on Yahoo Finance’s Opening bid podcast (video above; listen in here). “I think there really is a lot of confusion about which way we’re going, what the tariffs are meant to accomplish, whether the tariffs are in place or not in place and for how long.”

Brian Sozzi is Yahoo Finance’s Executive Editor. Follow Sozzi on X @BrianSozzi, Instagram, and LinkedIn. Tips on stories? Email brian.sozzi@yahoofinance.com.

Shared by Golden State Mint on GoldenStateMint.com