PM Images

PM ImagesThe U.S. dollar has been strong, partially driven by the high interest rate policy of the U.S. Federal Reserve (Fed) in recent years to get inflation under control.

With the Fed poised to start lowering rates, some are speculating that the U.S. dollar may go through a period of depreciation. Who stands to benefit from such a regime change?

Emerging market equities.

Dollar Strength and U.S. Equity Dominance

Coming out of the global financial crisis of 2008–2009, few equity markets kept up with the U.S. markets.

- Big companies—the “Magnificent 7,”1 in particular—delivered strong returns. It is difficult to find companies outside of the U.S. that are operating at the scale and heft of the trillion-dollar market capitalization giants in the U.S.

- Capital has flowed strongly into the U.S., chasing these returns and bidding the U.S. dollar higher, in general, over this period.

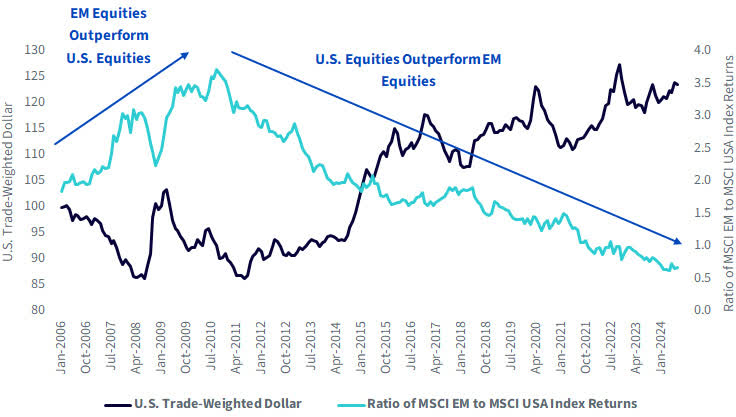

In figure 1, we note the ratio of cumulative performance, looking at the MSCI USA Index (U.S. equities) and the MSCI Emerging Markets Index (EM equities) as we also plot a measure of the U.S. dollar against a basket of other currencies.

Figure 1: Emerging Market Equities Underperformed U.S. Equities as the U.S. Dollar Appreciated

Sources: MSCI, Board of Governors of the Federal Reserve System (U.S.), Nominal Broad U.S. Dollar Index [DTWEXBGS], retrieved from FRED, Federal Reserve Bank of St. Louis for the period 1/1/06–7/1/24. You cannot directly invest in an index. Past performance is not indicative of future results.

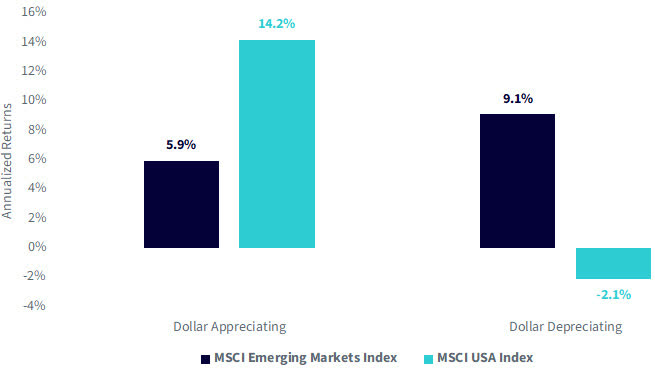

Sources: MSCI, Board of Governors of the Federal Reserve System (U.S.), Nominal Broad U.S. Dollar Index [DTWEXBGS], retrieved from FRED, Federal Reserve Bank of St. Louis for the period 1/1/06–7/1/24. You cannot directly invest in an index. Past performance is not indicative of future results.If we dig into the two distinct periods, denoted from basically the end of August 2010 to the present for “Dollar Appreciating” and from the start of the time series to August 2010 for “Dollar Depreciating,” we see figure 2:

- The MSCI USA Index, on an annualized basis, significantly outperformed as the U.S. dollar appreciated. Also, we would note that the MSCI Emerging Markets Index return is measured in local terms, so it is not running into a currency headwind in these figures.

- On the other hand, while the dollar depreciated, the MSCI Emerging Markets Index, albeit for a shorter overall period, dramatically outperformed the MSCI USA Index. Some of us might have forgotten what it looks like to see emerging markets outperforming U.S. equities in a sustained way.

Figure 2: Emerging Market vs. U.S. Equities in Periods of Dollar Appreciation and Depreciation

Source: MSCI. “Dollar Appreciating” refers to the period 8/31/10–7/31/24. “Dollar Depreciating” refers to the period 12/31/05– 8/31/10. Past performance is not indicative of future results.

There Are Many Flavors of Emerging Market Equities

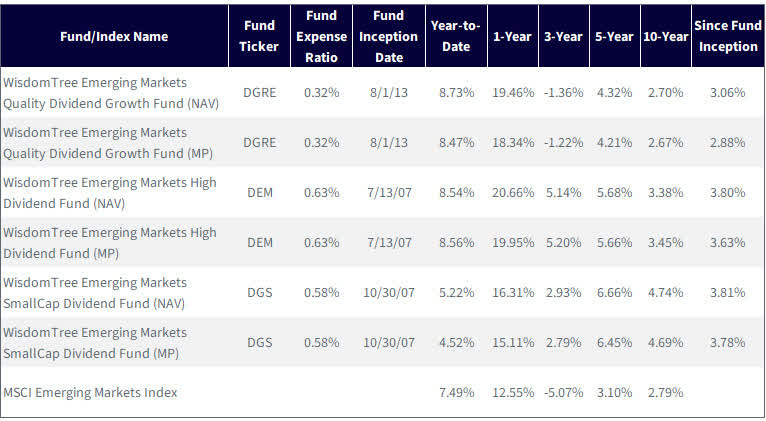

WisdomTree has a range of options for emerging market equities, a number of which have been around for longer than 10 years.

- The WisdomTree Emerging Markets Quality Dividend Growth Fund (DGRE) seeks to track the investment results of dividend-paying companies with growth characteristics in the emerging markets region.

- The WisdomTree Emerging Markets High Dividend Fund (DEM) seeks to track the total return performance, before fees, of the WisdomTree Emerging Markets High Dividend Index. The focus is on higher-yielding dividend payers within emerging markets.

- The WisdomTree Emerging Markets SmallCap Dividend Fund (DGS) seeks to track the total return performance, before fees, of the WisdomTree Emerging Markets SmallCap Dividend Index. The focus is on dividend-paying smaller market capitalization stocks within emerging markets.

The most widely followed emerging market equity performance benchmark is the MSCI Emerging Markets Index.

Recent Evolutions of Emerging Market Equity Performance

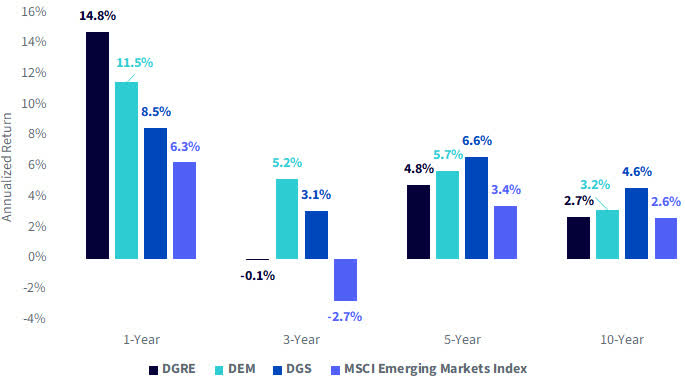

If we look at DGRE, DEM and DGS relative to the MSCI Emerging Markets Index on a performance basis, we see different things over different periods:

- Those looking at the long term, periods like 5 years or 10 years, see that DGS has been the leader.

- Those looking at the most recent three years see the defensive nature of DEM has come to the fore.

- Those looking over the past year see DGRE taking the lead.

Figre 3a: Average Annual Total Returns

Sources: WisdomTree, MSCI. Fund data specifically from the Fund Comparison Tool in the PATH suite of tools, as of 6/30/24. Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Total returns are calculated using the daily 4:00 p.m. EST net asset value (NAV). Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times.

Sources: WisdomTree, MSCI. Fund data specifically from the Fund Comparison Tool in the PATH suite of tools, as of 6/30/24. Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Total returns are calculated using the daily 4:00 p.m. EST net asset value (NAV). Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times.Figure 3b: Different Periods Have Exhibited Different Performance Leadership in Emerging Market Equities

Sources: WisdomTree, MSCI. Fund data specifically from the Fund Comparison Tool in the PATH suite of tools, for the period 7/31/14–7/31/24. Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Total returns are calculated using the daily 4:00 p.m. EST net asset value (NAV). Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times.

Sources: WisdomTree, MSCI. Fund data specifically from the Fund Comparison Tool in the PATH suite of tools, for the period 7/31/14–7/31/24. Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Total returns are calculated using the daily 4:00 p.m. EST net asset value (NAV). Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times.Location, Location, Location…

When people talk about real estate, all of us know the mantra—location, location, location. In emerging market equity investments, the same mantra applies.

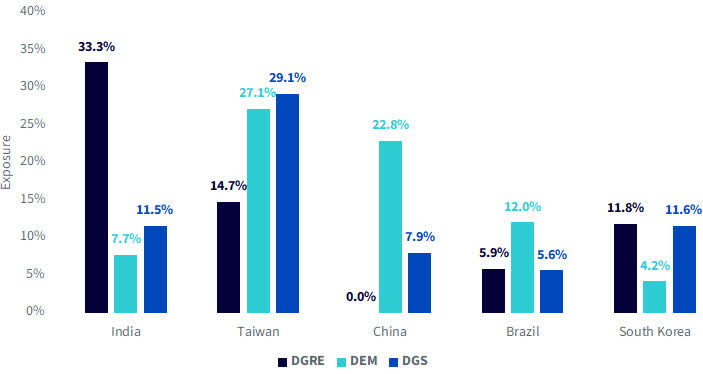

The world has been very excited about the stability of India, in that the country has elected the same leader through three elections. Even if no government is perfect, sometimes stability and the capability to actually implement policy over a longer time is more important than any one leader being perfect. Business and investment can follow as long as people know what is going on. As we look to figure 4:

- DGRE has roughly one-third of its assets in India’s equities.

- Taiwanese companies have a culture of paying dividends, and this market has been well-represented in DEM and DGS for many years.

- China is a polarizing topic across the U.S., particularly in an election year. In fact, people might even say it is not polarizing because it feels like it could be one’s patriotic duty to be “against China.” On a pure benchmark basis, China has the biggest equity market by market capitalization in emerging markets. Many strategies have significant exposure. DGRE has taken the opposite stance, offering investors a way to have a diversified approach but without any China exposure. While we don’t know if China will always underperform, we think the geopolitical conflicts and economic challenges motivate more options like DGRE for investing in emerging markets ex-China.

- Brazilian equities have historically been characterized by higher dividend yields, leading to more exposure in DEM.

- South Korea, on the other hand, does not tend to be a high-yielding dividend market, but it is at least looking at some Index providers like FTSE. It is a developed country,2 so there is a lot of equity market activity with some very interesting global companies to choose from.

Figure 4: Location, Location, Location—the Country Exposures of DEM, DGRE and DGS

Source: WisdomTree, specifically the PATH fund comparison tool, with data as of 6/30/24. Holdings subject to change.

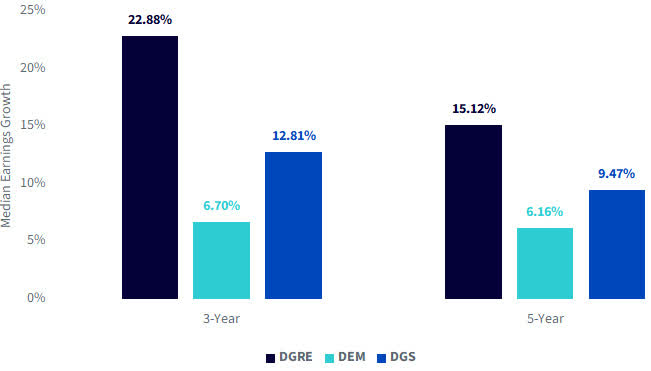

Earnings Growth or High Dividend Yields?

One of the trade-offs that investors often have to make is as follows:

- One group of stocks has a low valuation, possibly seen through a very high dividend yield or a very low P/E ratio. There are some who see this and find it exciting, not needing to know too much more. There are others who tell us, yes, but…aren’t these companies “cheap for a reason”? This is a version of asking—what if this is a “value trap”? It is absolutely true that certain companies may be inexpensive on a valuation basis and getting even more inexpensive, potentially even going out of business.

- Another group of stocks may not have as low a valuation but may have stronger earnings growth metrics. Usually, companies with better earnings growth metrics never showcase the lowest valuation metrics because investors appreciate the growth in earnings and tend to bid the share price levels higher.

Historically, DEM’s strategy of following the highest-yielding dividend payers has been more defensive in consistently finding the lowest valuations but also finding the lowest earnings growth.

DGRE is meant to be a contrasting style of investment, finding companies with stronger earnings growth over time.

DGS is a bit different, being more of a broad-market small-cap strategy exposed to hundreds of underlying stocks. Emerging market companies pay dividends very early in their respective life cycles.

We see a version of this story playing out in figure 5.

Figure 5: Where Is the Earnings Growth in EM?

Christopher Gannatti, CFA, Global Head of Research

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.

Shared by Golden State Mint on GoldenStateMint.com