DNY59/iStock via Getty Images

DNY59/iStock via Getty ImagesThe editorial on inflation in the Wall Street Journal on August 14 seemed to me to be “spot on.”

I don’t find myself saying this very often, so I felt I needed to follow up on this feeling.

The opening paragraph:

“The financial press is cheering that Wednesday’s inflation report makes an interest rate cut next month a fait accompli. Go, Jay, go. Yet while cooling inflation shows that the Federal Reserve’s monetary policy medicine is working, Chairman Jerome Powell’s caution to date has been warranted.”

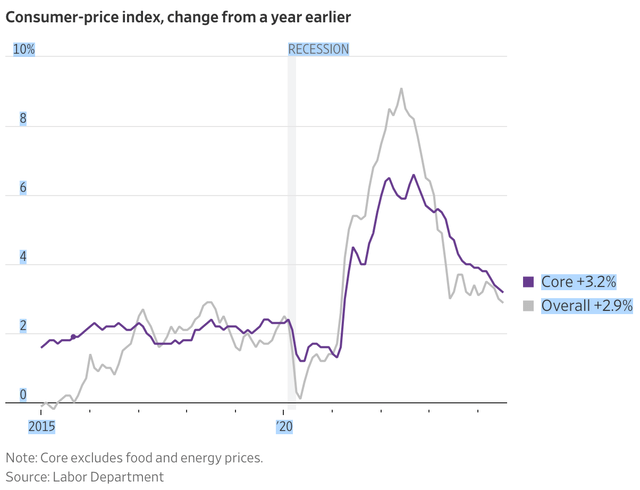

The year-over-year rate of inflation in July, according to the Labor Department’s consumer price index (CPI), was 2.9 percent.

This is the lowest inflation has been since March 2021.

Consumer Price Index__Year-over-year change (Labor Department)

Consumer Price Index__Year-over-year change (Labor Department)But, the editorial issues this warning.

“Markets seem to think inflation is whipped, and the Fed should start worrying about being late to cut rates. But, Mr. Powell was right to postpone easing policy earlier in the year, as inflation readings ticked up. Cutting rates in September might make sense, though inflation still isn’t dead, and prudence is advised.”

Prudence is advised.

Yes, sir.

The Fed, not only wants to get inflation down around its target rate of 2.0 percent, but the Fed wants to create an environment of trust, trust that it will maintain a monetary policy that will be consistent with a 2.0 percent annual rate of inflation, month after month after month.

The Fed must create a market atmosphere that “believes” that the inflation rate will be maintained at 2.00 percent…and that the Fed is not going to go off here…or, go off there…chasing some other “goal.”

The Federal Reserve was able to do this after the Great Recession.

Note that in the early part of the above chart, the inflation rate in the U.S., according to the CPI, was right around 2.0 percent during the decade following the Great Recession.

Following the battle against inflation in the 1970s that ended with a major financial tightening around 1980-81, the Federal Reserve, under the leadership of Paul Volcker, convinced investors and others that it would not tolerate a rising inflation rate and would fight any effort to raise consumer prices at a rate higher than 2.0 percent.

Alan Greenspan, who followed Mr. Volcker as the Fed Chair, also conveyed this message to market participants.

And, Ben Bernanke followed suit.

Thus, we see during the decade of the 2010s, inflation posting numbers that were acceptable to the Federal Reserve so that the Fed could focus on other things, like keeping the economy moving ahead. Hence, the longest economic expansion in post-World War II history.

It should be noted that the U.S. economy was changing during this period of time, becoming much more driven by information technology and by the innovation that surrounded the new environment.

For one, as I have written about many times, business advancements tended to be more of a continuous process based upon “time pacing” than upon completed “new” generations of change. That is, rather than waiting for an entirely new model change, businesses were bringing innovations to market every two or three years, regardless of whether the changes represented a full model change.

Competition was driving this. Given the new technologies coming to market, firms could focus on this strategy and, as a consequence, if firms didn’t keep up, they fell behind.

And, we are seeing this business strategy playing out in the world of artificial intelligence. In the world of AI, it is so important for the “new” to be brought to market just as soon as it can to keep up with or drive the competition.

Sometimes, in the world of AI, it seems as if we hear of “new” things being made available quarterly, if not sooner.

Innovation is almost continuous.

And, this is one reason why Federal Reserve Chairman Ben Bernanke sought to modify the way the Fed did business. Periods of “quantitative easing” became the Fed’s way to help underwrite this new era of innovation and investment.

It seemed to have worked.

Then the Covid-19 pandemic hit.

The Federal Reserve reacted.

After three rounds of quantitative easing through 2016, the Federal Reserve, with Jerome Powell as the Chairman, began a fourth round of quantitative easing in early 2020 and expanded the Fed’s holding of securities enormously.

Inflationary numbers rose dramatically as the economic and financial world saw all the focus on maintaining inflation give way to keeping the U.S. economy from falling into a major downturn.

As can be seen in the above chart, “core” CPI inflation topped out at over 9.0 percent in 2023.

Quantitative tightening followed, and as reported the inflation rate dropped, reaching the 2.9 percent reported for July.

The really interesting thing, however, is that the economy continued to “chug” along during this period.

Yes, there was a recession, the shortest one on record…two months in February and March 2022.

But, for the most part, the movement of innovation and information continued on in a very persistent way during this period of time.

I was just amazed at all the new ideas and innovations that were developed during this time period. My work in venture capital and angel finance during this time kept on going…money was available…companies were formed…innovation carried on.

And, that is what we are seeing on the other side of the 2022 recession.

Even though the Federal Reserve has been conducting a period of quantitative tightening for 27 months now, the U.S. economy keeps on, innovation and investment continue, and the economy grows.

But, the Federal Reserve continues on its efforts.

Although there have been mounting pressures on the Federal Reserve to lower its policy rate of interest, the Fed has not moved.

To me, “trust” is the key element that is behind this Fed stance.

The “new” economy is working.

Innovation and change is almost continuous.

Money is available to finance this innovation and change.

As the Wall Street Journal article closes…

“The economy doesn’t show signs of an imminent recession. Best for the Fed to use the running room it now has to keep reducing its $7.2 trillion balance sheet and stay on a path to normalize monetary policy.”

In the past, the Fed has always moved on too easily to another stance, once people feel that its past work has been done.

The Federal Reserve is regaining the “trust” the market had in the Fed during the 2010s, but work still needs to be done to cement this “trust.”

To support this, the federal government could, at this time, also move to regain some “trust” over the way it manages its budget, but that seems a long way off.

Shared by Golden State Mint on GoldenStateMint.com