Summary

- U.S. exceptionalism in stock market performance is driven by multiple factors.

- Elevated valuations and fiscal vulnerabilities pose significant risks to U.S. equities.

- How should investors weigh the pros and the cons of staying overweight U.S. stocks?

- I do much more than just articles at The Dividend Freedom Tribe: Members get access to model portfolios, regular updates, a chat room, and more.

Written by Sam Kovacs

Introduction

If I’m going to answer this question, it will only be regarding stock market performance. This is Seeking Alpha, after all.

And in this regard, US exceptionalism has been impossible to deny.

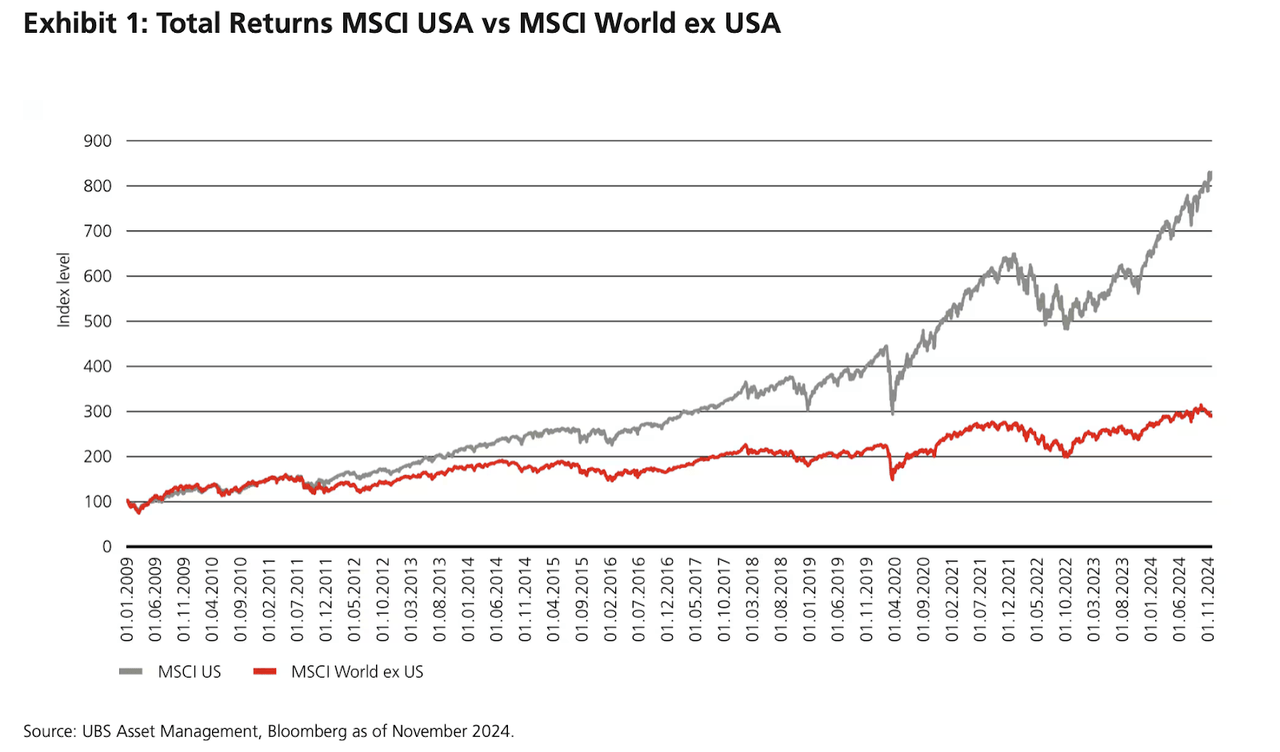

Since the GFC in 2008, US equities have outpaced global markets with a consistency and magnitude unmatched in modern financial history.

The S&P 500 (SPY) has delivered staggering returns, vastly outperforming the rest of the world.

UBS

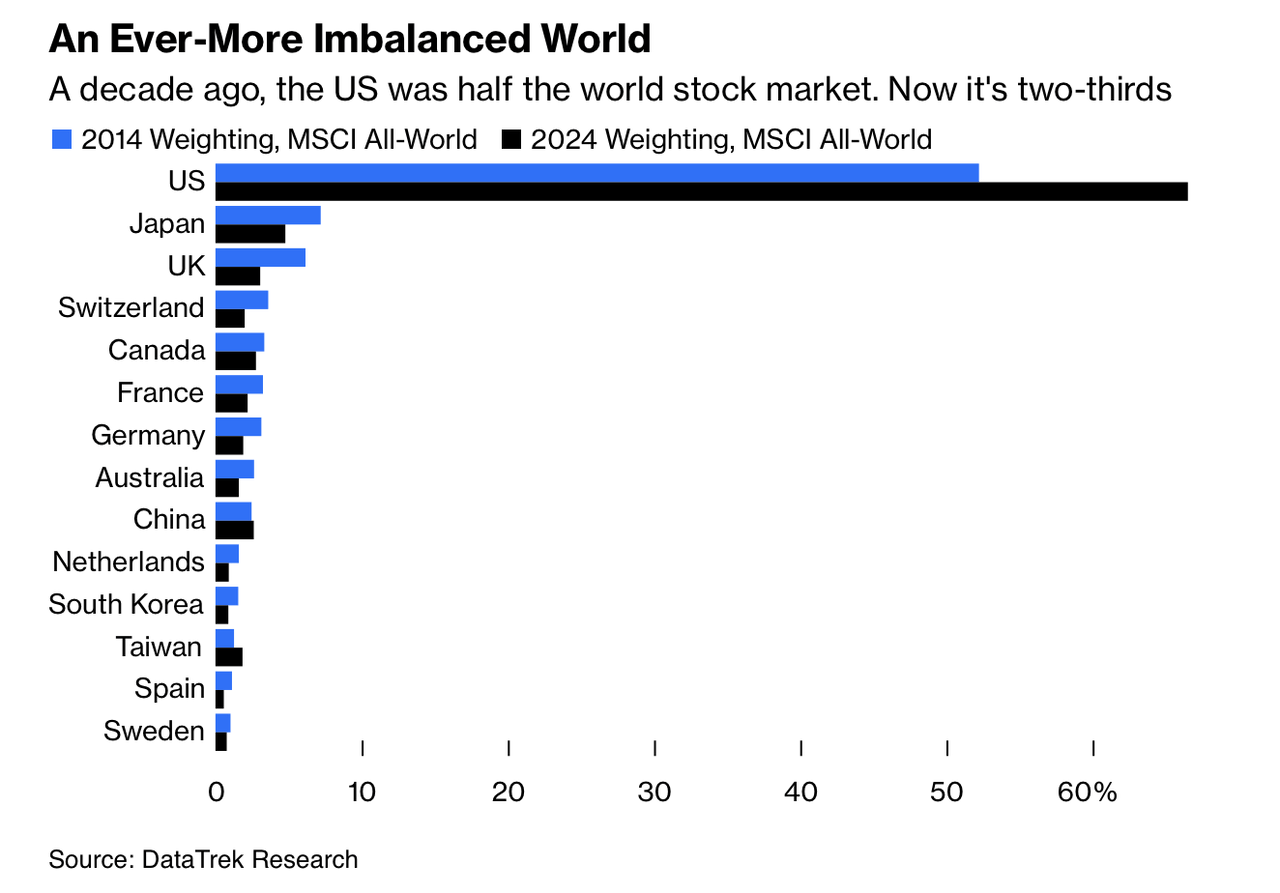

Over the past decade, the US share of global equity market capitalization has grown from 52% to 67%.

Bloomberg

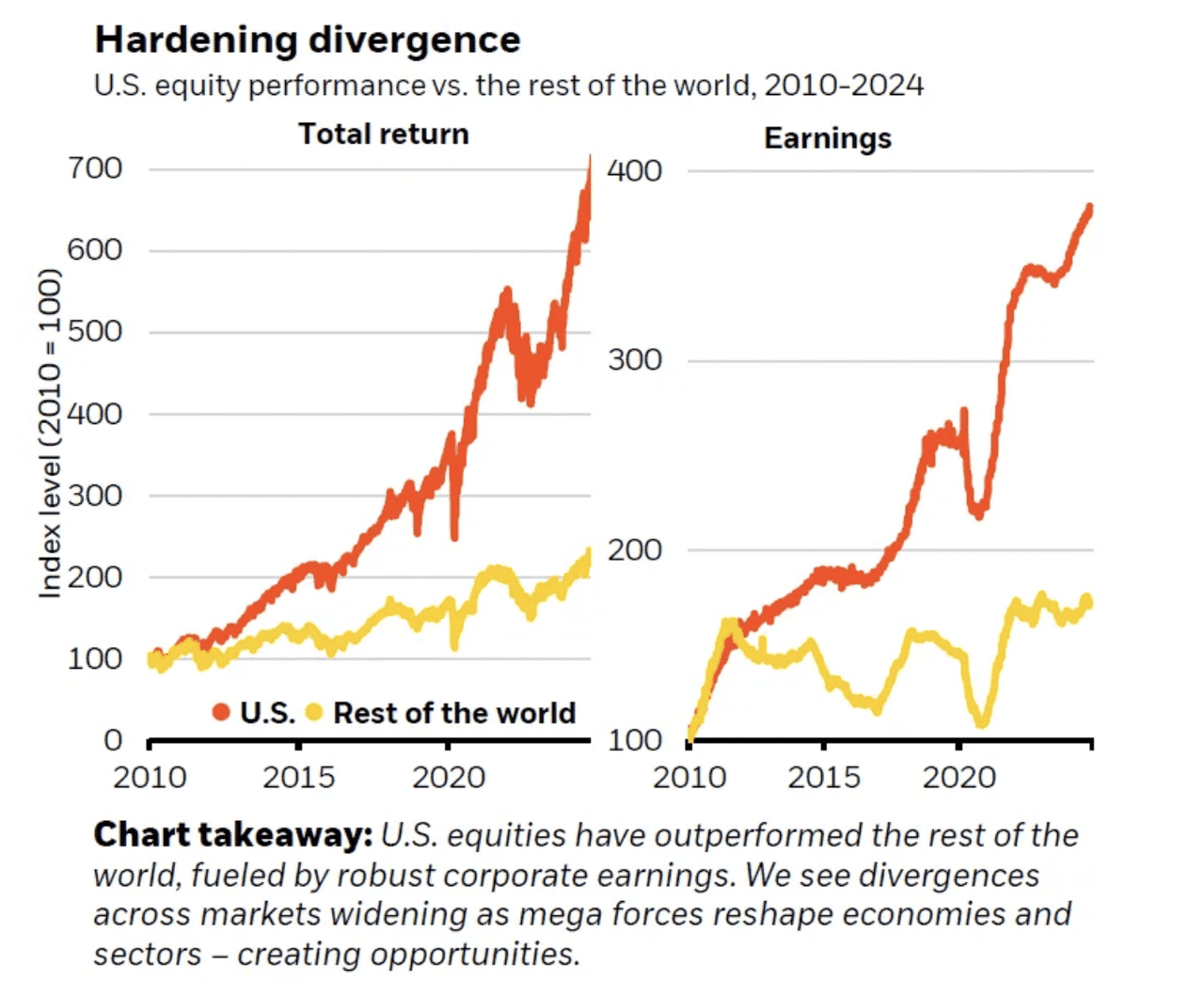

At the same time, US corporations have delivered extraordinary earnings growth, driving their valuations close to all-time highs.

Bloomberg

But the other day, I had lunch with a friend who works as a senior executive at a private equity firm in the UK.

He recently decided to move his pension fund to a self-directed vehicle and invest everything in the S&P 500. His reasoning? “US stock market exceptionalism.”

This anecdote reflects a broader sentiment that has spread throughout financial markets and the media. Newspaper headlines mentioning “US stock market exceptionalism” have been popping up all over financial media, from Bloomberg, the FT, Yahoo Finance and TheStreet. The big question is whether it is sustainable, and firms like UBS and Schroders have published reports on the very topic.

This article assesses the arguments in support of the notion of American exceptionalism while identifying the structural factors that ensure its durability as well as the increasing vulnerabilities that may potentially erode it. I will conclude with some recommendations for investors.

The Case for US Stock Market Exceptionalism

The US stock market has several inherent advantages that have underpinned its dominance:

1. Superior Corporate Profitability:

US corporations have consistently delivered higher earnings growth compared to their global peers. According to FT, Since 2010, the S&P 500 earnings per share have risen by 290%, while MSCI Europe has only grown by 60%.

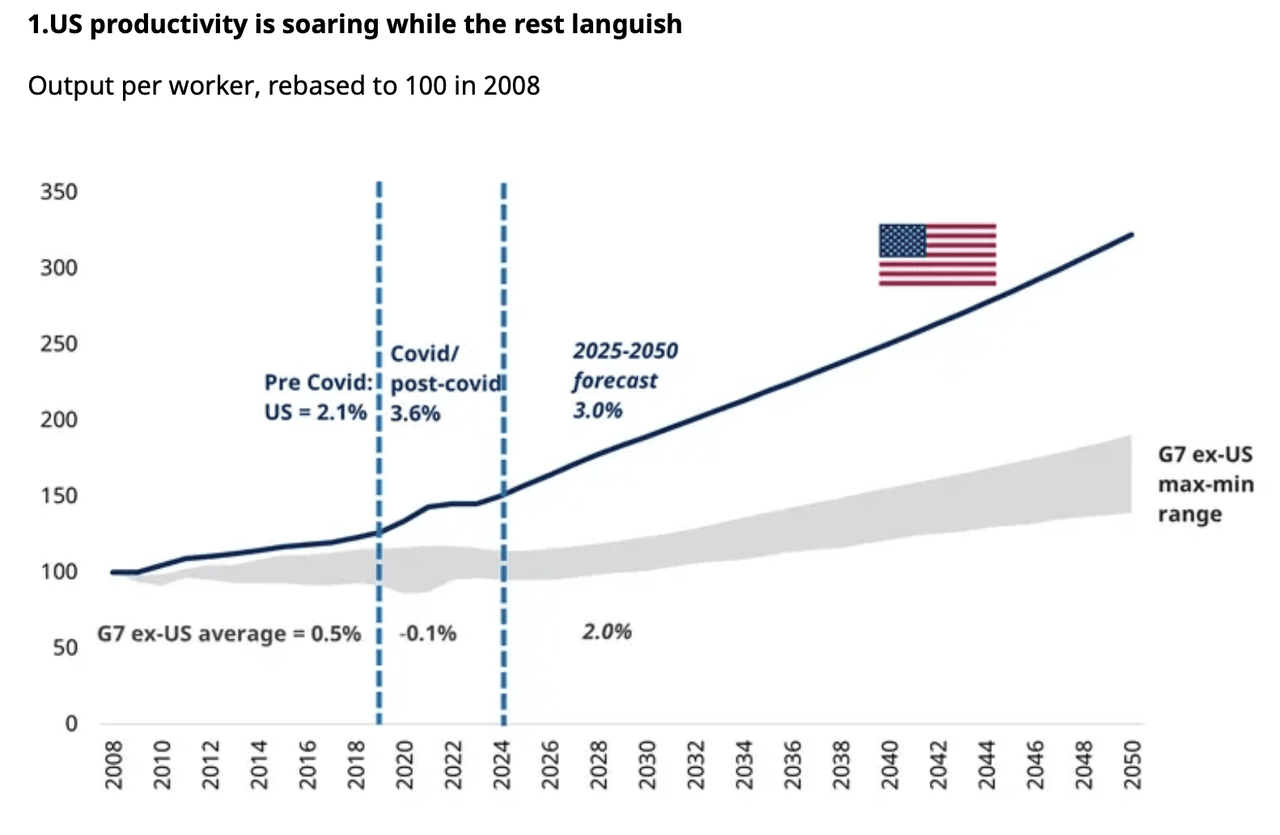

This stems from the fact that productivity in the US has been soaring while the rest of the world languishes, as a report from Schroders puts it.

Schroders

Nobel Prize winning economist Paul Krugman said in his 1990s book “The Age of Diminished Expectations” that:

Productivity isn’t everything, but in the long run it is almost everything.

This reflects the idea that at a macro level, growth can come from three gross areas: Debt, population growth, or productivity.

Population growth is the first obvious source of growth. I always explain this as it’s easier to sell a pair of jeans to you and one to your brother than it is to sell two pairs to you. However as a source of growth it’s limited as we have witnessed over time as economies mature birth rates go down.

Debt is the easiest lever to pull, but it’s stealing growth from the future, as you (in theory) need to actually pay the debt back at some point.

So you’re left with productivity as a source of growth and wealth, and the US has dominated the world since the GFC and even more since the pandemic, resulting in higher profits.

2. Innovation Leadership:

US leadership in artificial intelligence and technology can be best embodied by the Magnificent 7, which since 2010 have accounted for 40% of the S&P 500’s returns.

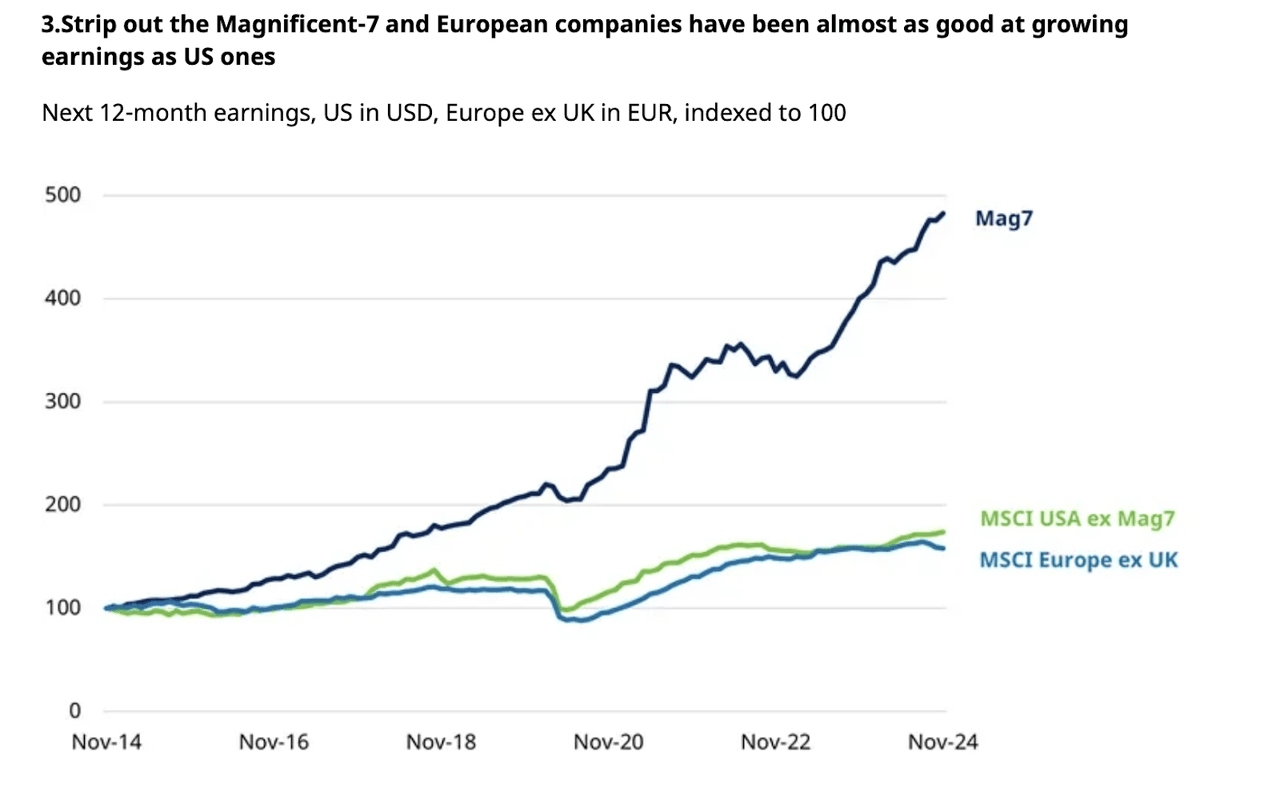

They have also been the largest source of earnings growth in the US, to be fair. As the Schroders report points out, if you strip out the Mag 7, earnings growth in Europe has been similar to the US.

Schroders

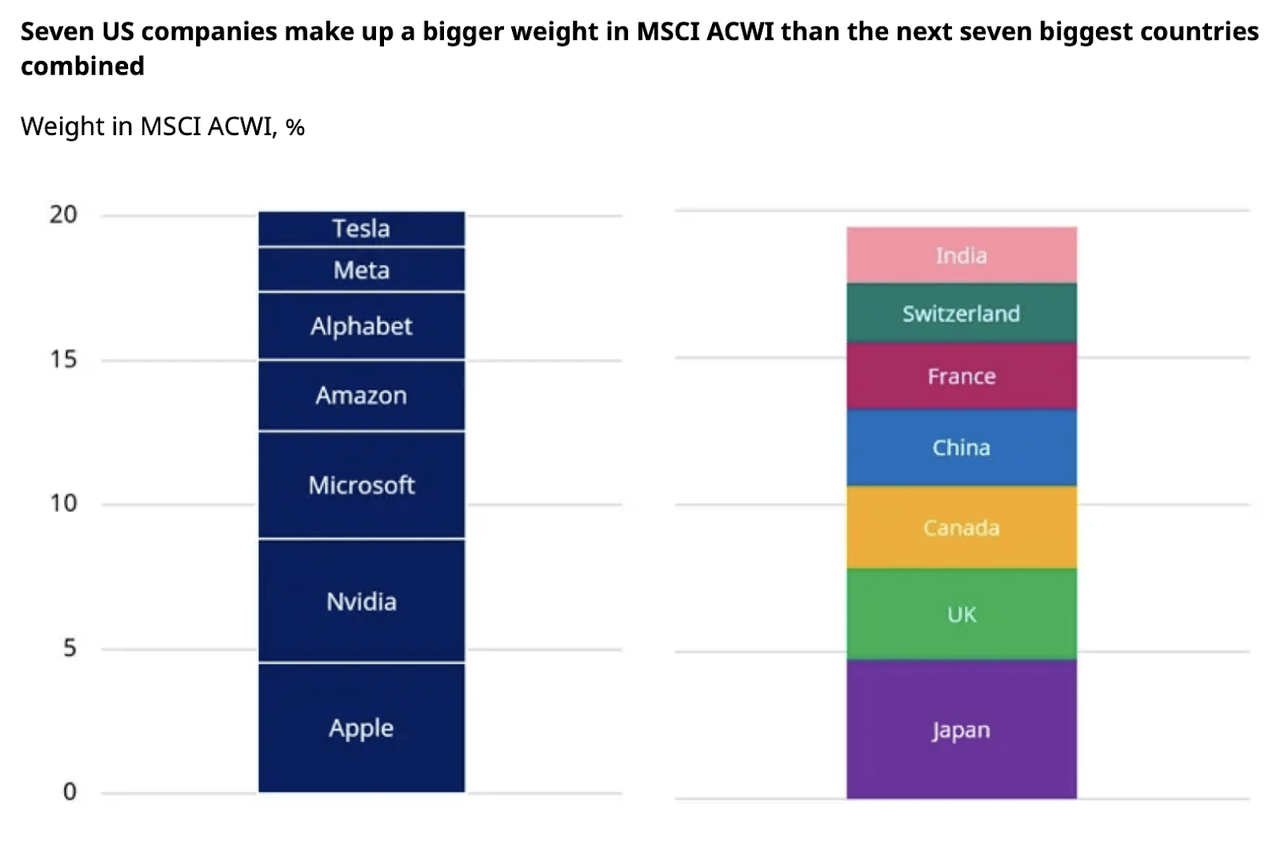

I don’t view this as a reason to discard US earnings growth, rather it shows that the US houses companies which dominate the world in scale. Put together, Tesla (TSLA), Meta (META), Alphabet (GOOG) (GOOGL), Amazon (AMZN), Microsoft (MSFT), Nvidia (NVDA), and Apple (AAPL) make up a bigger weight in the MSCI ACWI than the next seven biggest countries combined.

Schroders

UBS believes that the AI revolution will increase productivity across the board, which should reinforce America’s economic advantage. I highlighted this in January 2023, when I suggested that ChatGPT was a turning point in the AI revolution.

3. Policy Tailwinds

The upcoming Trump administration’s pro-business policies, such as tax cuts and deregulation, are anticipated to boost US stocks even further.

At the same time, as the US seeks to cement its AI dominance, it seems unlikely they will do much to enforce any antitrust fears on their big companies which we might have feared with the outgoing administration.

Fears of US tariffs might keep a risk premium on European and Chinese equities, and thus keep them depressed going forward.

The Challenges to US Exceptionalism

It should go without saying that there are some challenges to US exceptionalism. There’s no such thing as a sure thing, and if there is it likely gets priced by market participants over time.

As the late Charlie Munger said in a speech which I sourced from Poor Charlie’s Almanack:

What makes investment hard, is that it’s easy to see that some companies have better businesses that others. But the price of the stock goes up so high that, all of a sudden, the question of which stock is best to buy gets quite difficult.

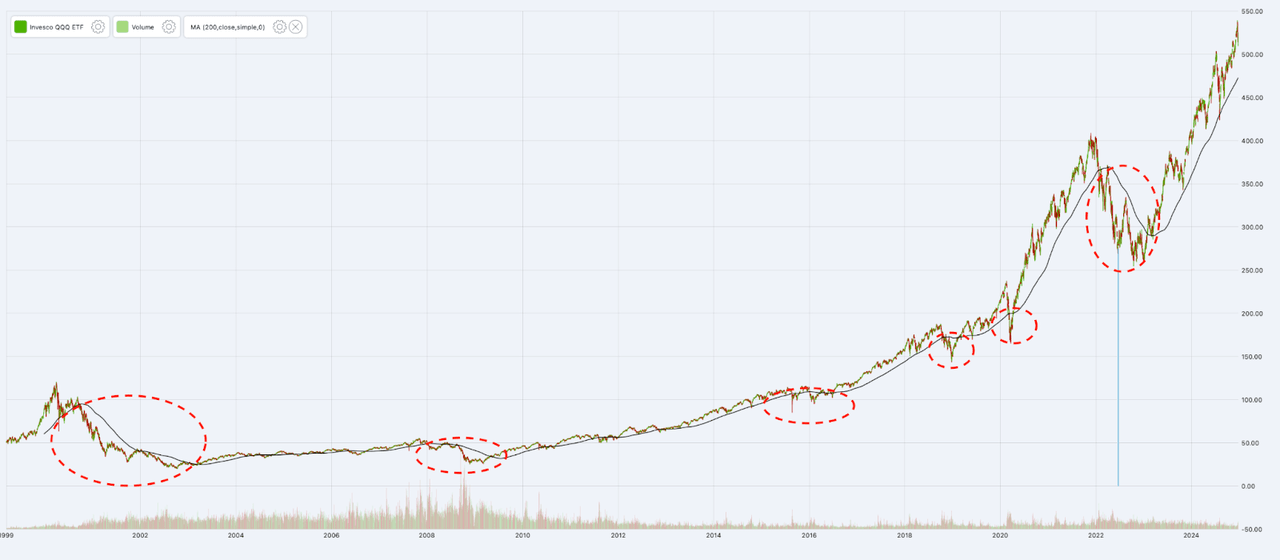

1. Excessive valuations

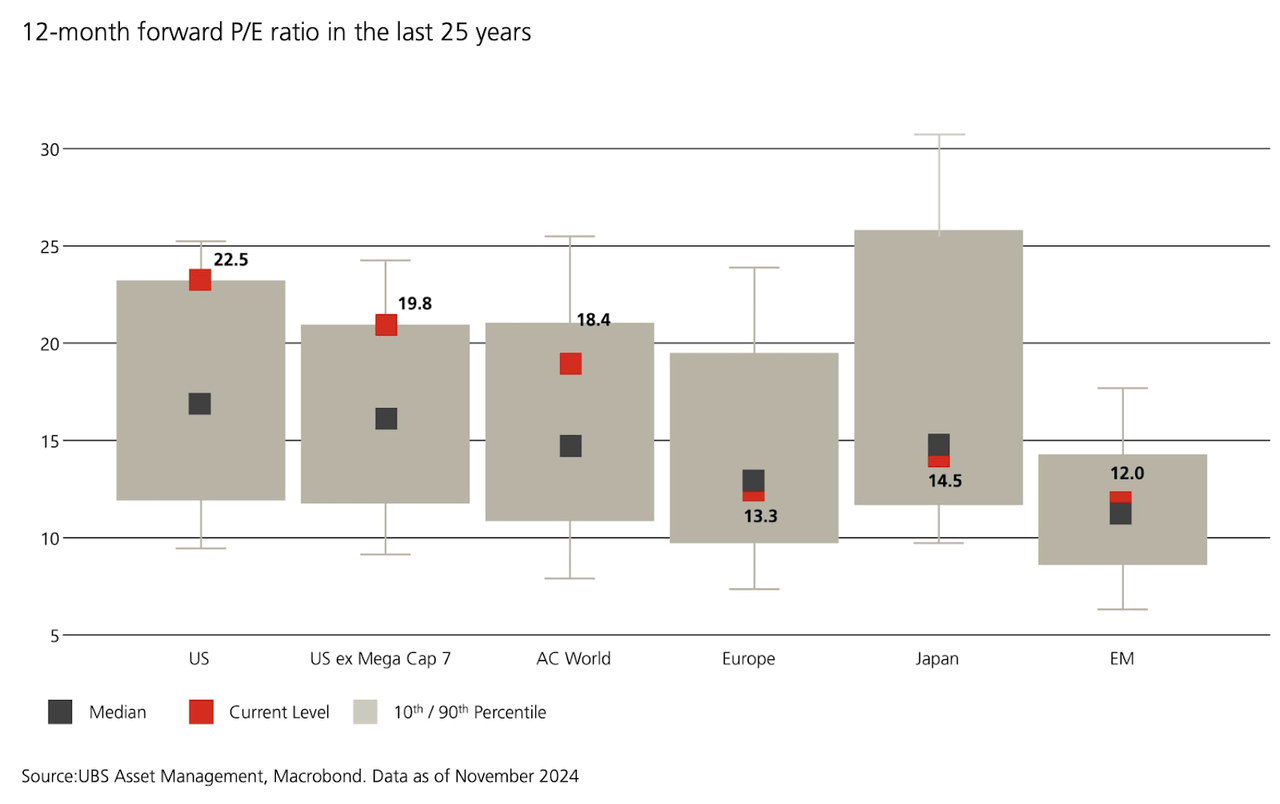

US equities trade at historically high valuations, raising concerns about sustainability.

The S&P 500’s 12-month forward price-to-earnings (P/E) ratio is above the 90th percentile of its historical range, even excluding the tech giants.

UBS

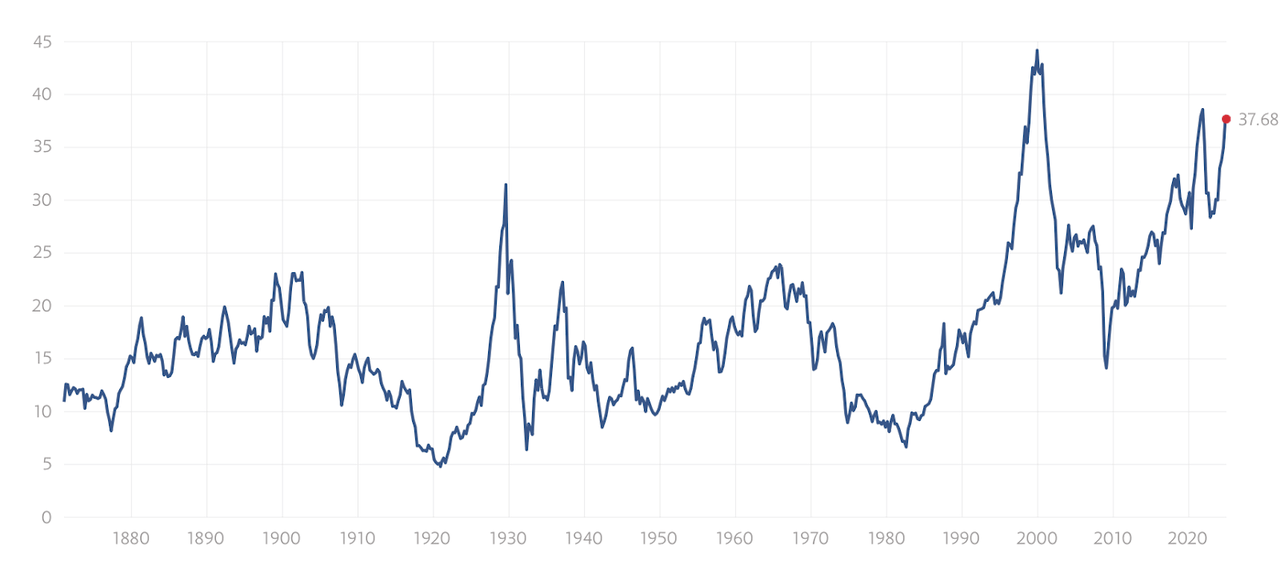

Elevated cyclically adjusted price-earnings ratios, popularized by Robert Shiller, suggest potentially lower returns in upcoming years.

Multpl

Barring the dotcom bubble, this is now the most expensive that US stocks have been relative to their 10-year earnings in over 140 years.

High valuations make US equities more susceptible to corrections, particularly if earnings growth fails to meet expectations.

Another big risk is the US governments overreliance on deficit spending. Rockefeller International’s chairman Ruchir Sharma claims that to produce $1 of GDP growth, we need to increase debt by $2, which is a 50% increase in just five years.

If this trend continues, investor confidence could decline, leading to higher interest rates or demands for fiscal discipline.

The dominance of the Magnificent Seven which account for nearly one third of the US market’s capitalization creates vulnerabilities.

2. Global Growth Convergence

The US has outperformed other developed countries for the past 10 years but there are signs this gap may close:

The European central bank has cut rates and more is expected to come which is a big contrast to the US Fed.

China has moved to an “appropriately loose” monetary policy stance, the second most accommodative in their 5 tier framework. They may devalue their currency as an option to offset tariff impacts and improve competitiveness as they face the possibility of an extended trade war and a struggling domestic economy.

3. Historical Precedents

The US has not always been the dominant market. According to Sharma, over the past 11 decades, US stocks lagged global peers in six, most recently in the 2000s.

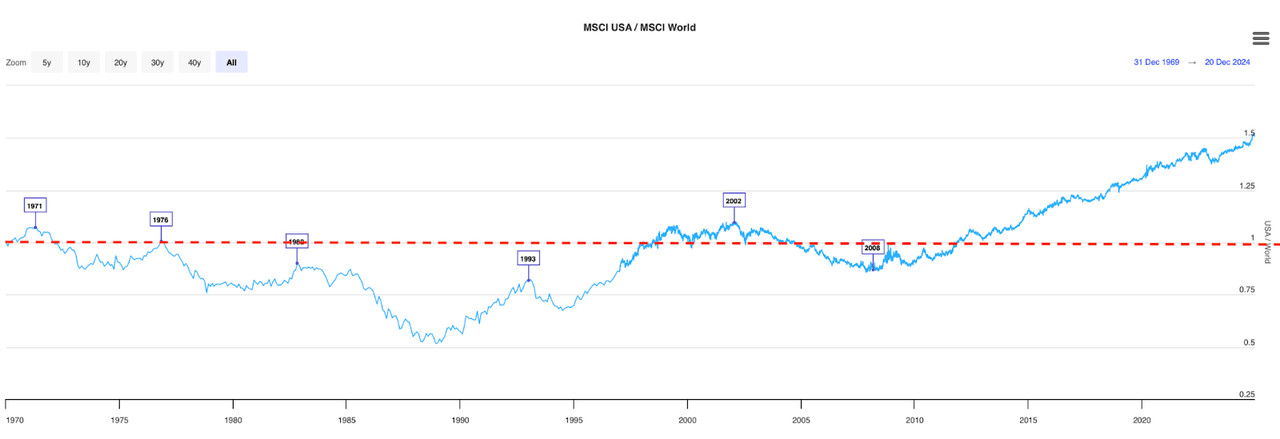

The chart from longtermtrends.net below highlights this by dividing the MSCI USA / MSCI World since 1969.

longtermtrends.net

This serves as a reminder that market leadership is cyclical and not guaranteed. Furthermore the above chart isn’t as good as a MSCI US / MSCI World Ex-US at demonstrating this. It will do for demonstration purposes.

4. The Consensus Paradox

It’s not what you don’t know that gets you in trouble. It’s what you know for sure that just ain’t so – Likely not Mike Twain

The overwhelming confidence in US exceptionalism may itself be a red flag. Sharma argues that widespread consensus often marks the late stages of a bubble.

Parabolic price movements, extreme valuations, and investor exuberance are all hallmarks of a market nearing its peak. For instance, US stocks have outpaced global peers by the widest margin in 25 years over the past six months.

I’ve noticed such parabolic moves in our coverage, with Broadcom (AVGO) which shot up vertically after the latest earnings.

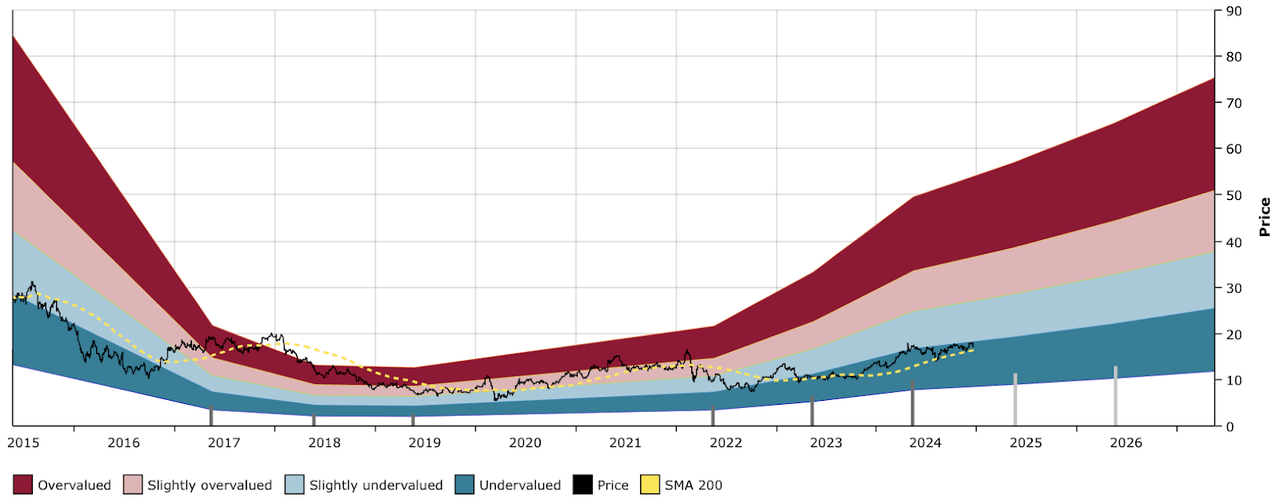

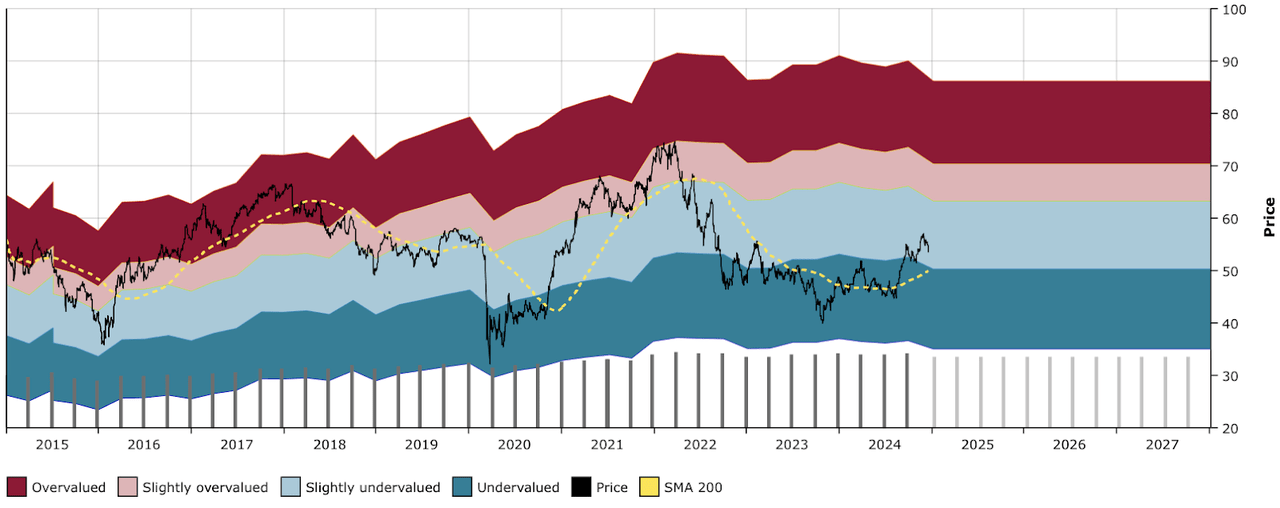

AVGO DFT Chart (Dividend Freedom Tribe)

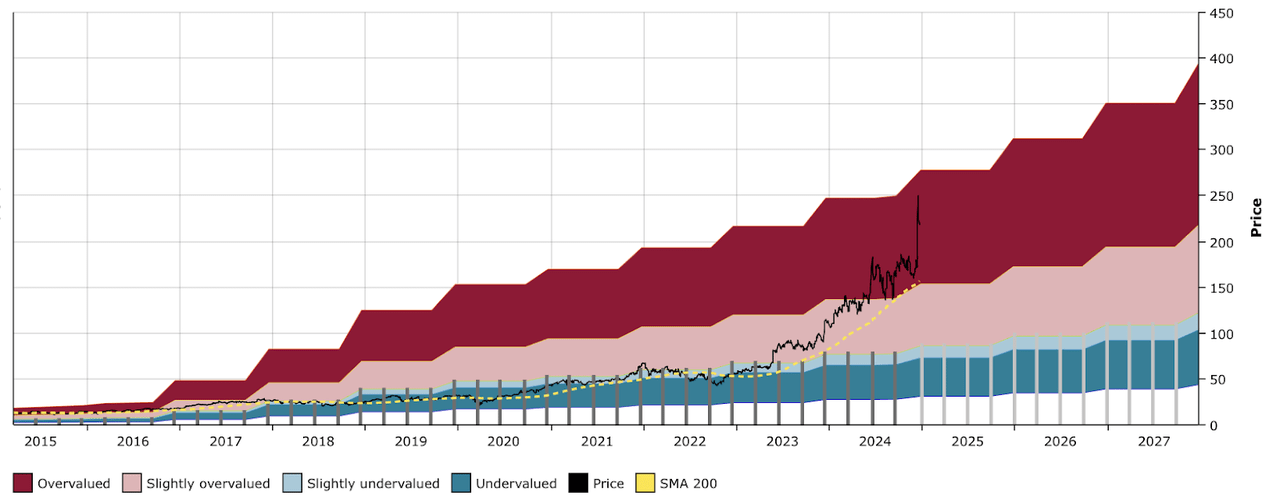

Nvidia’s (NVDA) stock price has also undeniably gone vertical, rendering all returns from 1999 to 2016 irrelevant.

NVDA stock price (Dividend Freedom Tribe)

Past bubbles, such as the commodities boom of 2011 and China’s growth bubble of 2021, also ended unexpectedly. Similarly, US exceptionalism could unravel if growth slows or alternative markets emerge as more attractive.

Jeremy Grantham, in an interview with Morningstar, said this in a way which I couldn’t have better articulated:

The bigger the new idea, the bigger the new invention, the more the market becomes overpriced, the more it attracts euphoric. It’s not accidental.

[…]

So, the fact that it’s a real idea doesn’t say that there won’t be a crash. It’s quite the reverse. The more important the idea, the more guaranteed almost it is, historically, that it will attract too much short-term attention, then there will be a crash, and then the railroads will change the world, Internet will change the world, AI will change the world.

But it would be classic for it to be overdone. That’s what the history book is shouting at us. And to have that come in the middle, if you will, in the middle of a gentile old-fashioned bubble forming and breaking, is to create a very novel and complicated twist.

[…]

So where do we go from here, I think, is back to the history books. When you have these great developments, they overdo themselves in the short term, they crash in the intermediate term, and then they come out of the wreckage and change the world in the long term. And that’s what I expect will happen this time.

Investment Implications

US exceptionalism has become commonplace, and that worries me.

The anecdote I shared with my friend only partially reflects the change in feeling globally.

In 2017, when as a grad student I explained to my university professors and peers that I would be shunning a career in banking or asset management to instead pursue full time a career providing research on US equities to US retail investors on this site called Seeking Alpha, I was met with blank stares.

Why would a British boy, who’s only been to the US for 10 days in his life on a family trip, living at the time in Europe, want to focus on the US and US people?

Now, when I talk about that decision, I get nods all over. In part because I proved the model, but also because retail has caught the “US exceptionalism” bug.

If the consensus worldwide has turned to US exceptionalism, who else is left to jump on the bandwagon?

The question does remain however: If not in the US, where can the money go?

Because of all the points made on US superiority in productivity, capitalism, and profits, it’s impossible to suggest moving away completely from the US.

While US equities remain attractive due to their structural strengths, investors should prepare for potential reversals.

To quote Chuck Prince, Citigroup’s (C) old CEO at the peak of the 2007 credit crisis:

As long as the music is playing, you’ve got to get up and dance. We’re still dancing.

Let’s dance, but be aware that the music might stop.

1. Play defense when things go south

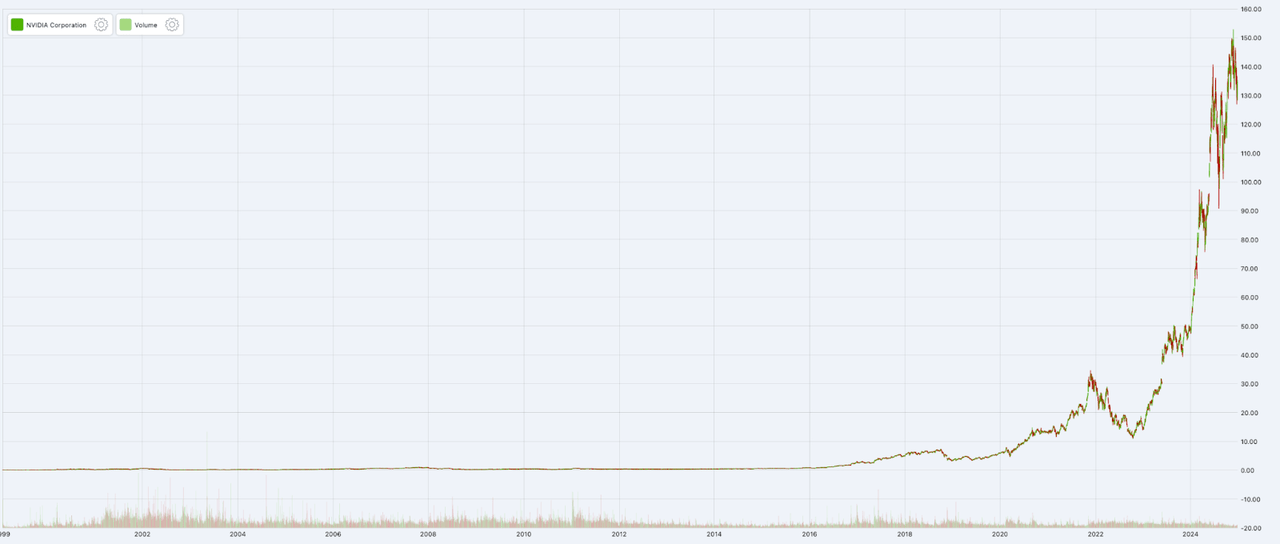

The first thing I’d suggest investors do is monitor the Invesco QQQ ETF (QQQ) for any dips below the 200 day moving average. With 52% of the funds assets in the Mag7 + Broadcom, a reversal in these market leaders could indicate the end of the market.

I highlighted times in the past 25 years when using this simple rule would have served investors well, on the chart below.

QQQ price + 200 day moving average (Dividend Freedom Tribe)

To quote Paul Tudor Jones in an interview he gave to Tony Robbins:

The whole trick in investing is: “How do I keep from losing everything?” If you use the 200-day moving average rule, then you get out. You play defense, and you get out.

Sure the 200 day moving average rule means you get out quite a bit after a crash has started, but I feel it is a safer alternative than exiting and missing out on a massive rise in prices which would cost you more.

To quote Peter Lynch:

Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves

When such a shift happens, it will be a good time to exit positions which have appreciated the most among tech picks and consumer discretionary names, raise cash to be deployed either to more conservative sectors, or in the two suggestions below

2. Diversify Regionally:

Dividend investors can benefit from being invested at least partially in non US names. In fact, as we enter 2025, the Dividend Freedom Tribe’s portfolios are stacked with the highest concentration of non US stocks ever, ranging from 10% to 15% allocations.

Consider allocating some capital to undervalued markets like Europe or emerging markets, which have lower starting valuations and potential for growth.

A couple picks I like a lot are :

- Deutsche Bank (DB) in Europe:

DB DFT Chart (Dividend Freedom Tribe)

- Scotiabank (BNS) in Canada:

BNS DFT Chart (Dividend Freedom Tribe)

3. Consider other asset classes:

I feel that a small allocation to longer duration US bonds is now warranted. We have 5%. Vanguard’s long term bond (BLV) is a good place to start.

It would also be conservative to have 5% of funds exposed to crypto and/or gold. I own no gold. I do own Bitcoin, Ethereum, and Solana, for a total of no more than 5% of my liquid net worth.

Conclusion

It’s hard to make a suggestion against US stock market exceptionalism, but one lesson I’ve learned from Howard Marks is that the pendulum always swings.

I’ll be maintaining my exposure to US equities, but leaving some room for risk reduction and diversification. The secular AI trend is not something we want to miss out on entirely.

But secular trends might be interrupted by cyclical greed and fear cycles, and it’s very possible that this market finds a top somewhere in 2025.

If you want to Buy Low, Sell High & Get Paid to wait…

The first thing you want to do is hit the orange “follow” button, so we can let you know when we write more dividend related articles.

Shared by Golden State Mint on GoldenStateMint.com