Jonathan Kitchen

Jonathan KitchenIntroduction

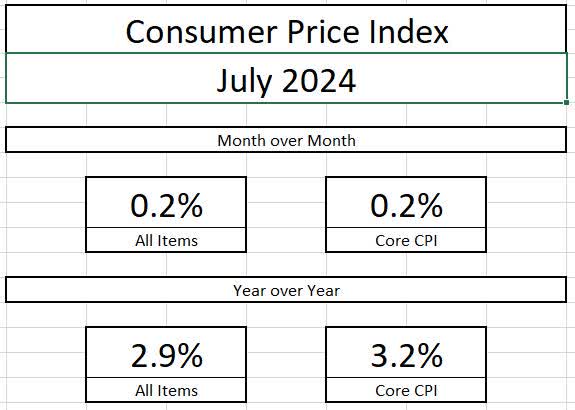

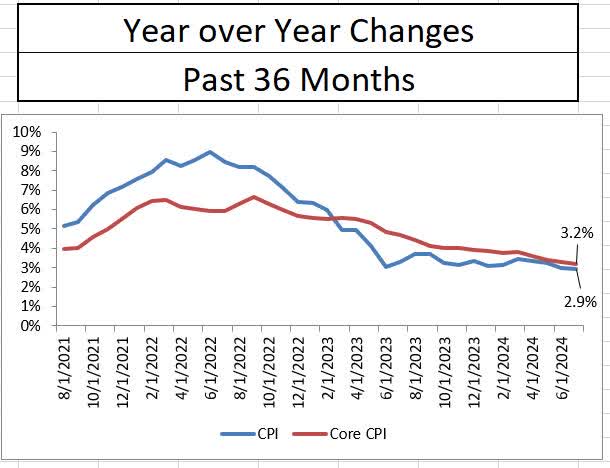

Earlier today, the Bureau of Labor Statistics released the Consumer Price Index for the month of July. The report indicated that inflation rose at 0.2% in the month of July, and 2.9% on a year-over-year basis. When removing the volatile elements of food and energy, core inflation also rose at 0.2% in the month of July and 3.2% on a year-over-year basis. The weight of the inflation report has been somewhat subdued by the softening labor market, but the overall disinflationary trend is supportive of an introductory rate cut this fall.

Bureau of Labor Statistics

Bureau of Labor Statistics Bureau of Labor Statistics

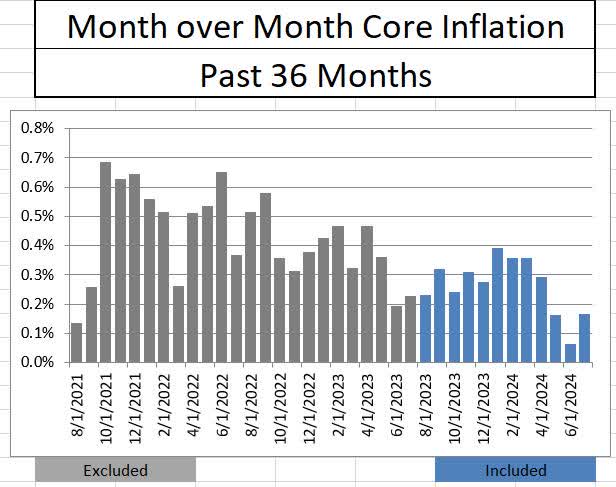

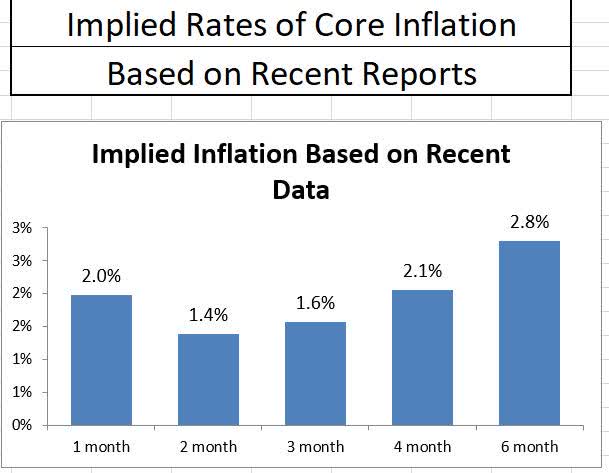

Bureau of Labor StatisticsWhile July’s month-over-month change in core inflation is hotter than June’s, it matches May’s changes. The last three months combined are clearly the softest three inflationary reads of the past year, and when annualized, come out to just 1.6%. Even adding the hotter April read and annualizing the last four months brings us slightly over 2%. The economy is beginning to string together several months of tame inflation data pointing to a 2% trend, despite the current year-over-year trends being higher.

Bureau of Labor Statistics

Bureau of Labor Statistics Bureau of Labor Statistics

Bureau of Labor StatisticsIndicators Leading Up to the Inflation Report

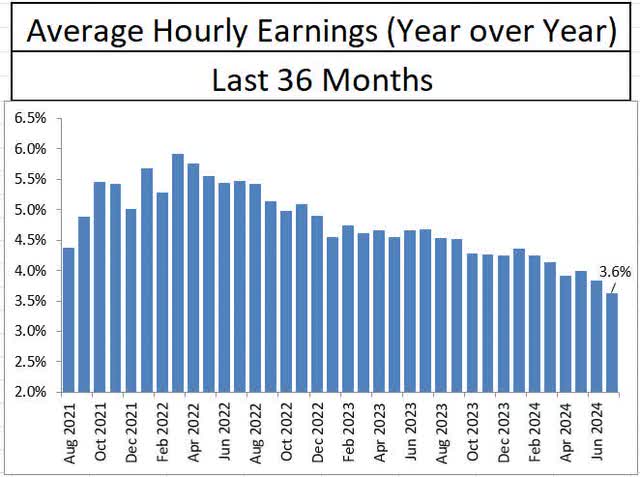

In advance of the report, economists and investors were optimistic that the disinflationary story would continue its trend. One of the largest inputs to consumer inflation is wages. After year-over-year wage growth flirted with 6% in early 2022, average hourly earnings have steadily declined to 3.6% on a year-over-year basis, a trend that is closely matching the disinflationary trend.

Bureau of Labor Statistics

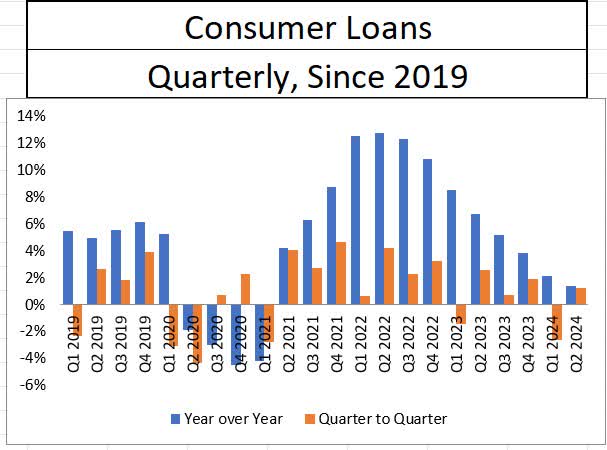

Bureau of Labor StatisticsAnother source of price inflation is consumer credit. After the stimulus packages of 2020 and 2021, consumer loans grew at 10-12% year over year through 2022. As interest rates have risen, consumer loan demand has fallen, and after two quarters of contraction, the rate of consumer lending growth was still tame at 2% in the second quarter.

Federal Reserve

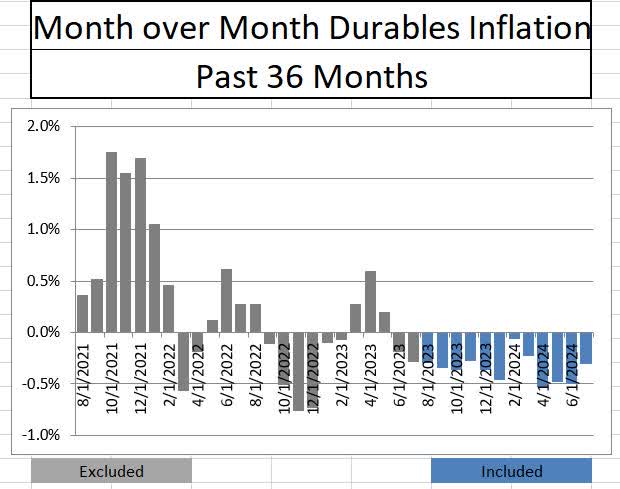

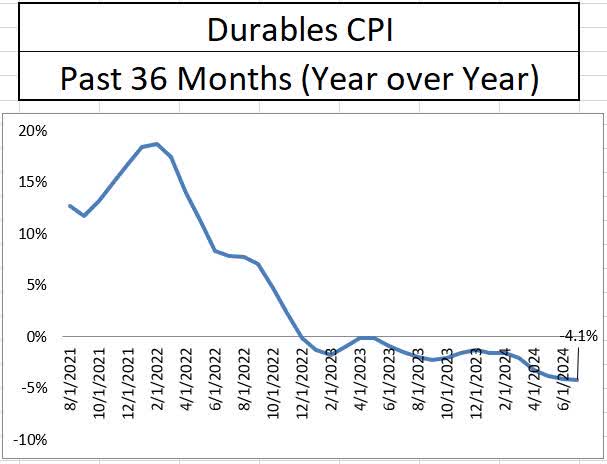

Federal ReserveGoods Deflation Continues to Help

Durable goods deflation continues to help push core inflation towards the 2% target. In July, the month-to-month change in durable goods pricing was negative for the 14th consecutive month. On a year-over-year basis, durable goods prices declined by 4.1%, which was the same as last month and continues to be the lowest point of this business cycle.

Bureau of Labor Statistics

Bureau of Labor Statistics Bureau of Labor Statistics

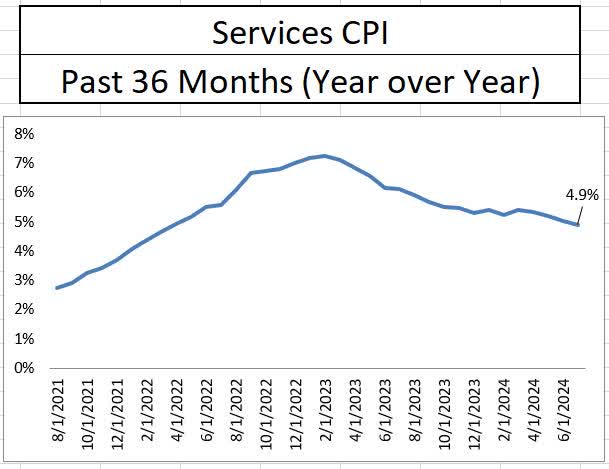

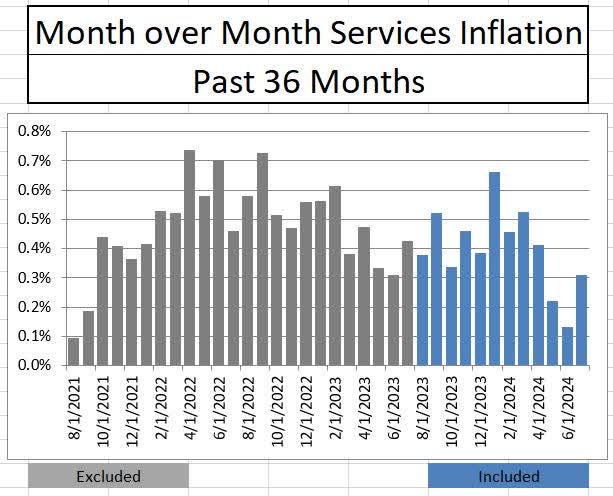

Bureau of Labor StatisticsProgress on Services, But Elevated Pricing Remains

For the first time since April 2022, year-over-year services inflation fell to under 5% at 4.9%. While year-over-year services inflation has declined in fourteen of the last seventeen months, it remains elevated. By comparison, service sector inflation in July 2017, 2018, and 2019 was 2.4%, 3.1%, and 2.8% respectively on a year-over-year basis. July’s monthly service sector inflationary change was the third lowest in the past twelve months, so there is hope that disinflation will continue in services.

Bureau of Labor Statistics

Bureau of Labor Statistics Bureau of Labor Statistics

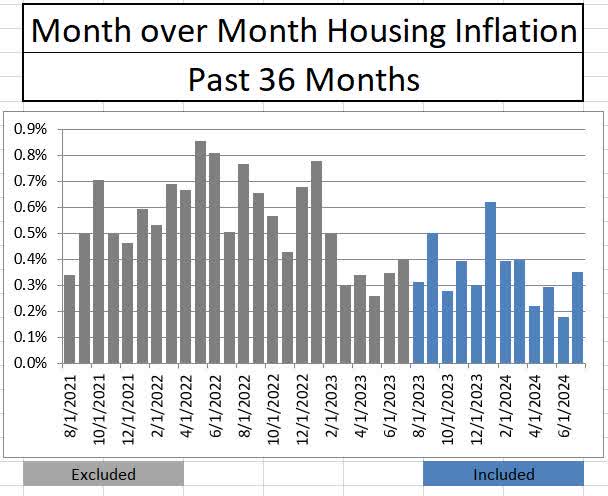

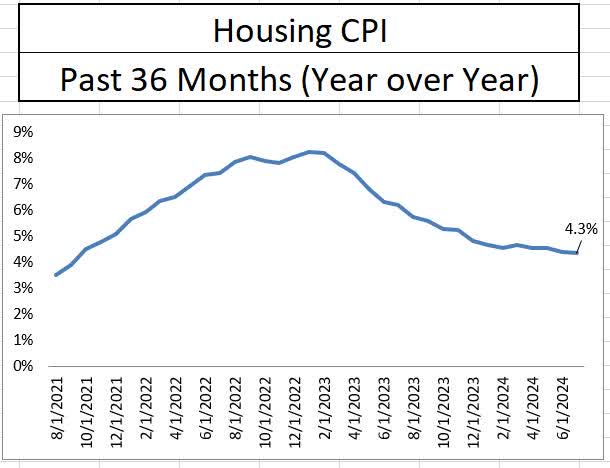

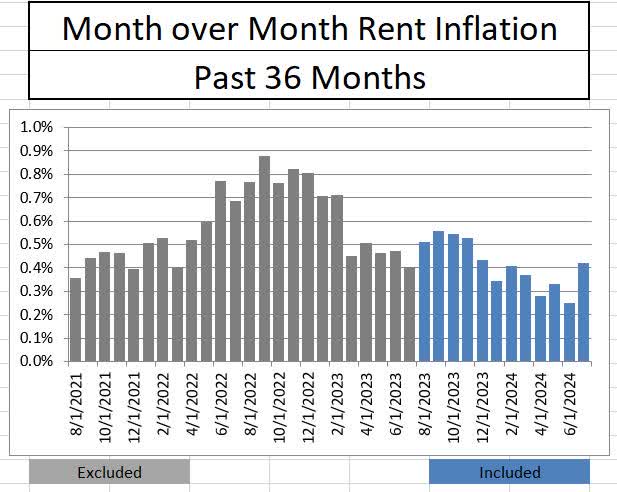

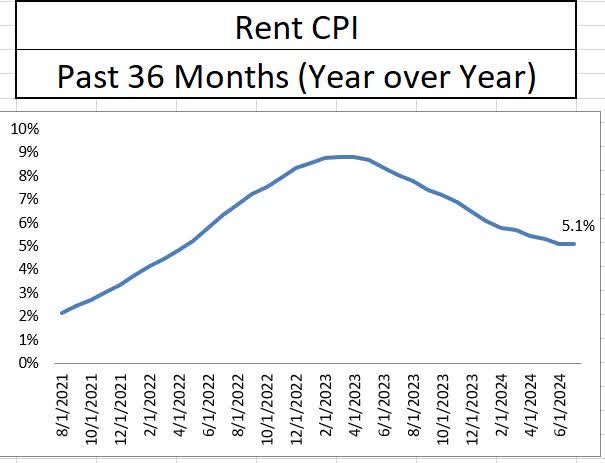

Bureau of Labor StatisticsThe leading issue within the service sector remains housing. During July, housing inflation rose by 0.35% which represented the higher threshold of monthly changes over the last twelve months. At 4.3% year over year, housing inflation seems poised to stall as supply constraints continue to dominate the industry. Rent changes also fell in line with housing. As the prospect of rate cuts looms large, the Fed is going to need to accept the goods and services pricing dichotomy to effectively move towards a neutral rate.

Bureau of Labor Statistics

Bureau of Labor Statistics Bureau of Labor Statistics

Bureau of Labor Statistics Bureau of Labor Statistics

Bureau of Labor Statistics Bureau of Labor Statistics

Bureau of Labor StatisticsConclusion

The debate seems to have shifted from whether to cut to debating over how much the Federal Reserve should cut in its meeting next month. I continue to be skeptical of the possibility of a soft landing, and while economic metrics are softening, we need to keep in mind that we got here via overaggressive monetary easing. I would not want to risk a re-firing of inflation and the threat of stagflation by having over-accommodating monetary policy. Thus, I believe a 25-basis point cut is more warranted, with additional cuts to follow if future economic trends support them.

Shared by Golden State Mint on GoldenStateMint.com