KanawatTH/iStock via Getty Images

KanawatTH/iStock via Getty ImagesAfter a lively start for the month of August, gold still has several technical and fundamental advantages in its favor on an intermediate-term (six-to-12-month basis). That said, the near-term outlook suggests headwinds will persist in the next several weeks, making it difficult for gold prices to mount a sustained rally. But as I’ll explain here, the big picture outlook remains favorable for higher gold prices starting in fall.

Let’s begin this analysis by taking a look at gold’s technical backdrop. Despite the multiple headwinds that gold has faced this summer—ranging from unfavorable sentiment for speculators to competition from cryptos—the precious metal managed to hold its own while refusing to bow to broad commodity market selling pressure.

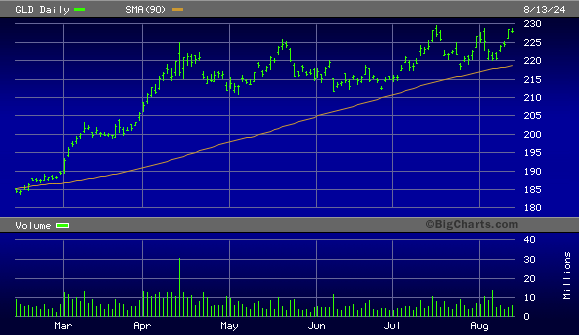

But after treading water for over three months, gold has just made an attempt at breaking free from its trading range on safety-related demand. In my previous article in mid-June, I observed regarding the SPDR Gold Shares ETF (GLD):

…there’s a good chance GLD will manage to continue treading water near current levels before the rising 90-day moving average (the next most important trend line in my technical tool kit) catches up and presumably incites some new buying interest from technically-oriented traders.

That’s pretty much what happened, as the chart below shows GLD maintaining a mostly lateral trend until the 90-day line came into play later that month, pushing gold higher.

BigCharts

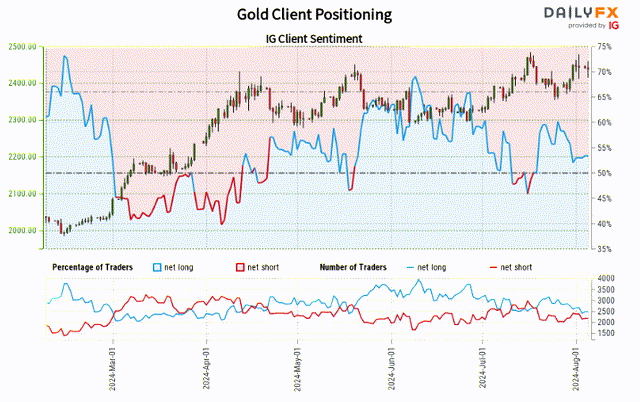

BigChartsAs you can see, however, gold still hasn’t managed to take flight in a sustained fashion, and I believe the reason for that is due to a lack of decisive commitment to either a bullish or a bearish market stance. That is, there appears to be no clear consensus in the sentiment data among retail participants as to which direction gold is headed in the near-term outlook.

Shown below is the most recent gold sentiment indicator from the DailyFX website, which reveals that as of this writing, 52% of retail traders are net long gold. That’s very close to a neutral position for the metal, and such positioning is often followed by lateral trading ranges due to the market’s indecisiveness.

DailyFX

DailyFXIf this same principle holds true again, we should expect to see gold making only minimal upside progress at best; at worst, a sideways trend can be expected (or perhaps even minor weakness). However, I don’t anticipate gold to show a conspicuous degree of weakness going forward, due to the tremendous geopolitical and global economic uncertainties that are keeping safety-related demand for the metal very much alive.

Indeed, every time in recent months the bears have attempted to control the gold trend, resurgent safety demand has allowed the bulls to quickly regain control of the market and push prices back up. I don’t expect this dynamic to change anytime soon, and I suspect the 90-day moving average will also continue to serve as a strong supporting benchmark for the gold price.

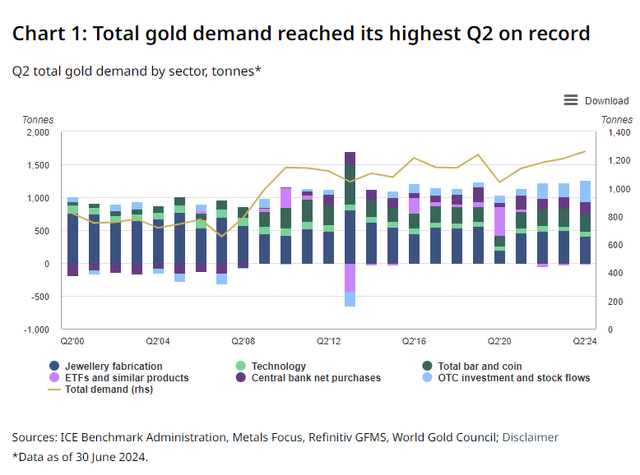

From a fundamental perspective, global gold demand remains “firm” according to the latest insights from the World Gold Council (WGC). The organization’s Gold Demand Trends for the second quarter of 2024 was released a couple of weeks ago, and it revealed that while there was a decline in retail bar and coin investment from western countries—along with lower jewelry sales—continued strength in central bank demand kept the total demand for gold trending higher.

In fact, gold demand reached its highest Q2 level on record, according to WGC, as shown in the graph below.

World Gold Council

World Gold CouncilThe WGC observed that, “Central bank net gold buying was 6% higher y/y at 183 [tons], driven by the need for portfolio protection and diversification.” Additionally, demand for bars, coins and ETFs was said to be “robust” in the East, despite declines in the West, while Western ETF investment flows have “started to return so far in Q3.”

The persistence of investment flows and central bank demand cannot be understated, as both factors are key reasons the metal has been able to maintain its longer-term upward trajectory since 2022 when the buying intensified. For the remainder of 2024, WGC sees revived Western investment flows balancing out weaker consumer demand. Meanwhile, central banks in emerging markets continue to support the gold bull market, particularly in Kazakhstan, Oman, Kyrgyzstan and Poland—mainly for political reasons, as several nations not currently allied with the U.S. are trying to diversify away from the dollar.

So, while I expect gold to continue facing headwinds from mixed investor sentiment in the near term, you may be asking, “What, then, could serve as the catalyst for gold’s next meaningful move higher?” My answer to that question is the growing expectation that the Federal Reserve will lower its benchmark interest rate by at least 25-basis points in September.

Falling rates are one of gold’s most important directional catalysts, and the commencement of declining rates has historically been followed by a converse reaction (i.e. rising prices) on gold’s part. And while some analysts argue that gold’s current price has already discounted a loose rate policy on the Fed’s part, I would disagree with this assessment as the Fed has consistently remained opaque in stating its rate cut intentions.

While Fed Chairman Powell recently told reporters that while “a reduction in our policy rate could be on the table at the September meeting,” he hasn’t fully confirmed it. Thus, a rate cut on September 18 would likely carry enough of a relief factor that investors would almost certainly pivot more decisively toward owning gold once the Fed has confirmed its rate intentions.

All told, while the current investor sentiment backdrop suggests gold will continue to struggle to rally in a sustained fashion in the near term, ongoing institutional demand should keep the big-picture bullish case for gold fully intact. What’s more, the long-awaited commencement of a more dovish interest rate policy—likely starting next month—should provide a stimulus for higher prices this fall. For now, I continue to assign a “hold” rating on gold for investment purposes.

Shared by Golden State Mint on GoldenStateMint.com