Summary

- December’s strong seasonality and sequential corporate earnings growth suggest continued market highs, supported by positive economic data and reduced borrowing costs from the Fed.

- ISM and S&P Global PMIs indicate service sector expansion, offsetting manufacturing declines, with overall business activity growth at a two-and-a-half-year high.

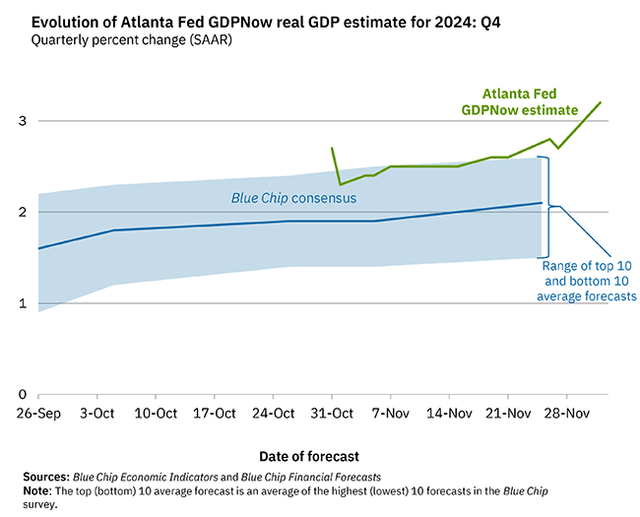

- The Atlanta Fed’s GDPNow model forecasts a robust 3.2% economic growth rate for Q4, the strongest since last year’s fourth quarter.

- Chairman Powell emphasizes a cautious approach to rate adjustments, remaining apolitical and data-dependent, crucial for navigating potential inflationary pressures from incoming policy proposals.

- This idea was discussed in more depth with members of my private investing community, The Portfolio Architect.

oakstudio22

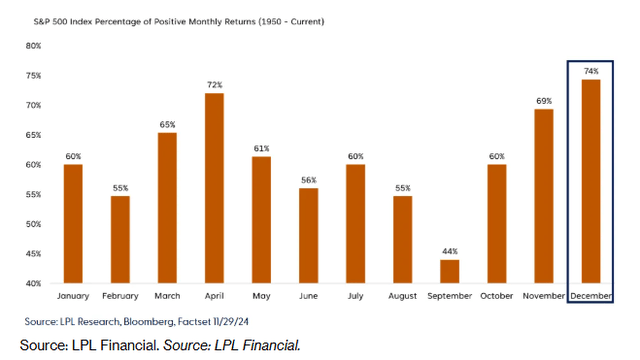

The bull is looking like he will continue to run through the end of this year, mounting more new all-time highs for the major market averages, as the month of December has posted a positive return more often than any other month of the year. This seasonality is a super strong tailwind in addition to the fact that we should see sequential growth in corporate earnings for the fourth quarter, the Fed is reducing borrowing costs, and the incoming economic data continues to look very strong. Chairman Powell affirmed as much yesterday during a speaking engagement in New York when he said that the economy is “in remarkably good shape.”

Further confirmation came from the November surveys of service sector executives conducted by the Institute for Supply Management (ISM) and S&P Global, both of which compute their own proprietary purchasing managers index or PMI. The indexes measure whether the service sector is expanding or contracting based on a reading above or below 50. They don’t always align because their surveys differ in terms of industry weights and executives who are surveyed. The ISM Services PMI fell from 56 to 52.1, while the S&P Global Services PMI rose from 55 to 56.1. The bottom line is that both reflect continued expansion. Chris Williamson, who is Chief Economist at S&P Global, noted that “improved service sector output offset a further decline in manufacturing during November, helping drive the overall pace of growth of business activity to the fastest for over two and a half years.” The economy is in remarkably good shape.

This strength is being reflected in the Atlanta Fed’s GDPNow real-time forecasting model, which is updated as new economic data is reported each week. The estimate has been gaining strength over the past six weeks to what is now a 3.2% rate of economic growth for the fourth quarter, which would be the strongest rate of growth since the fourth quarter of last year.

This is why Chairman Powell also stated yesterday that the Fed can afford to be cautious as officials lower their benchmark rate to a neutral level. The economy is not slowing, as most thought it would under the weight of tighter financial conditions, and there are legitimate concerns that policy proposals from the incoming administration could be inflationary, led by tariffs. I was extremely impressed with Powell’s response when asked about tariffs. He said, “we don’t know how big they’ll be, we don’t know their timing and their duration, we don’t know what country’s goods will be tariffed, we don’t know how that will play into prices, and we don’t know how people will react to that…” He also stipulated that he can’t start making policy adjustments until you know these things. This is the answer we should want to hear from our Fed Chairman. He clearly intends to remain apolitical and data dependent, which means he is the perfect man for the job of navigating us through 2025.

Shared by Golden State Mint on GoldenStateMint.com