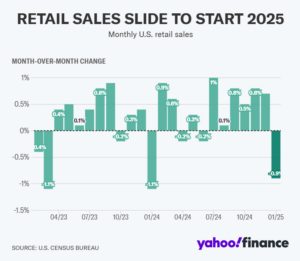

New data out Friday showed retail sales declined more than expected in the first month of 2025.

Headline retail sales fell 0.9% in January, more than the 0.2% decline economists had expected, according to Bloomberg data. This marked the largest month-over-month decline in retail sales since January 2024.

Retail sales in December were revised up to 0.7% from a prior reading that showed a 0.4% increase in the month, according to Census Bureau data.

“The traditional holiday hangover and a nasty winter freeze combined to cool topline retail sales,” RSM chief economist Joe Brusuelas wrote in a post on X.

The control group in Thursday’s release, which excludes several volatile categories and factors into the gross domestic product (GDP) reading for the quarter, declined by 0.8%. Economists had expected a 0.3% increase.

January sales, excluding auto and gas, fell 0.5%, also below consensus estimates for a 0.3% increase. A 4.6% decline in sporting goods and hobby sales led the declines while sales at motor vehicle and parts dealers fell 2.8%.

Friday’s retail sales data wrapped up a busy week of economic data releases. Earlier in the week, two fresh inflation readings for the month of January showed prices increased more than Wall Street had expected but economists found positive news for markets and the Federal Reserve within the details

When evaluating categories from both the Consumer Price Index (CPI) and Producer Price Index (PPI) that feed into the Fed’s preferred inflation gauge, the Personal Consumptions Expenditures (PCE) index, economists argue price increases likely slowed in the month of January. “Core” PCE, which excludes the volatile categories of food and energy, is expected to clock in at 2.6% in January, down from the 2.8% seen in December.

As of Friday morning, markets see less than a 50% chance the Federal Reserve cuts interest rates until at least its July meeting, per the CME FedWatch tool.

Josh Schafer is a reporter for Yahoo Finance. Follow him on X @_joshschafer.

Shared by Golden State Mint on GoldenStateMint.com