Historically, September is the worst month for the stock market and this year is no exception. The first week of September was quite negative. In fact, the S&P500 (SP500) dropped 4.25%, the worst performance since 1953.

A recovery has been in sight for a few days now, but investors remain doubtful about the future. In particular, September 18 will be a key date for understanding new monetary policy decisions, and this is likely to be the main market mover in the coming weeks.

Typically, when the Fed meeting is this close, analysts almost all agree on what the next move will be, but in this case, it is different. Everyone agrees on the first cut in September (later than other central banks), but not everyone agrees on the amount of the cut. It is the latter issue that this article will mainly focus on, since a 25 basis points cut would fuel the soft-landing scenario; a 50 basis points cut would increase the chances of a hard landing.

What to expect on September 18

As mentioned, at present the probability of rates remaining unchanged is 0%. No one expects monetary policy to remain tight, which is why I will not specifically discuss this scenario. Currently, there are too many red flags that have historically predicted past recessions, so it is important to loosen the grip on the cost of borrowing. The Sahm Recession Indicator is pointing above 0.50, while the yield on 10-year T-Bonds is back above 2-year T-Bonds.

Powell himself was clear during the Jackson Hole Symposium about a rate cut starting in September:

The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks. We will do everything we can to support a strong labor market as we make further progress toward price stability.

Rejecting the scenario that involves no rate cut, the most likely ones remain either a 25 basis points cut or a 50 basis points cut. While the difference between these two scenarios is minimal in numerical terms, the implications they may have on financial markets are potentially very different.

First scenario: a 25 basis points cut

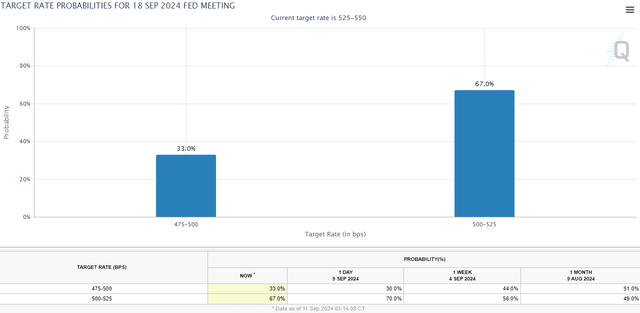

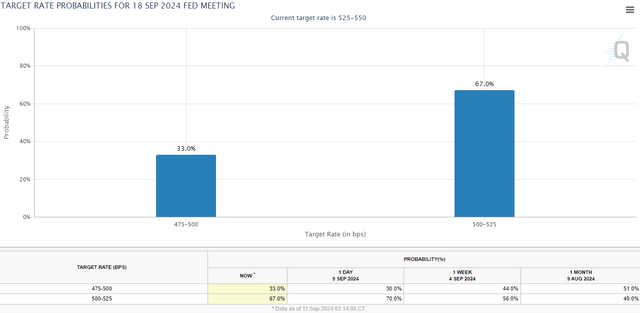

At the time I am writing this article (Sept. 11 03:00 CT), the probability of a 25 basis points cut is 67%: compared to last month there has been an increase of 18%.

The market is increasingly discounting this scenario and considers a 50 basis points cut less likely. The reason is attributed to the recent labor market data, which is slightly positive when compared to recent months.

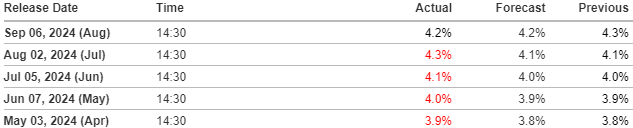

Investing.com

Investing.comFrom May to August, expectations for the unemployment rate were always too optimistic, but in September analysts’ estimates proved correct. The unemployment rate today is 4.20%, still higher than May’s 3.90% but slightly down from August.

This figure was enough to trigger a burst of enthusiasm in the financial markets and make the hard landing scenario less likely. If the unemployment rate does not rise, there cannot be a recession, but it is worth noting that the Sahm Rule Indicator still signals a potential deterioration of the economy in the coming months. The September figure may have been only a short-term improvement, and starting in October the negative trend of recent months may continue.

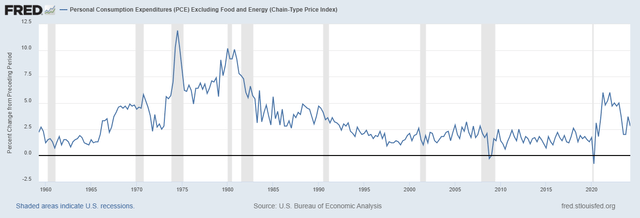

Personally, I also consider a 25 basis point cut the most likely scenario. Inflation is headed toward the 2% target, but it has not yet been fully beaten, which is why I don’t think the Fed will venture a 50 basis points cut.

Typically, inflation cycles have several rebounds over the years, and to avoid what happened in the 1980s I think the Fed wants to reduce rates gradually:

Inflation is now much closer to our objective, with prices having risen 2.50% over the past 12 months. After a pause earlier this year, progress toward our 2% objective has resumed. My confidence has grown that inflation is on a sustainable path back to 2%.

Chair Jerome H. Powell, Jackson Hole Economic Symposium.

Overall, the scenario of a 25 bps cut is both the most likely and the most positive. In fact, the Fed would give the market a signal that it has everything under control, both in terms of inflation and the labor market. Gradual approaches are always the best, but at the same time, they are very difficult to implement.

Historically, the rate cut is a complicated period because mistakes are not allowed, even in communication. A more alarming tone during conference calls may suggest an out-of-control situation and potential panic-cutting. From this point of view, I expect that on Sept. 18 the tone will be very calm and the 25 basis point cut will be intended as a precautionary measure to avoid the economy weakening too much. Monetary policy is done more with words than actions, so every single statement Powell makes will be immediately discounted by the market. The rate cut will probably not have a linear pattern, so I expect the Fed to follow the ECB from this point of view: there may be meetings with no cuts.

TradingView

This statement is supported by the futures market: by the end of 2025, the Fed Funds Rate is expected to be 2.78%, about 10 cuts of 25 basis points each. Typically, the FOMC holds 8 meetings a year, so we are talking about 10 cuts of 25 basis points each over the next 11 meetings.

Finally, what will happen to the S&P500 should this scenario materialize? I don’t have a crystal ball, but I think a strong rally is unlikely since the market has already discounted much of this optimism in current prices.

Second scenario: a 50 basis points cut

The scenario of a 50 basis points cut is less likely, about a 33% chance. This is 18% lower than in the previous month.

CME Group

At first glance, this scenario could be intended as the more optimistic, after all, cutting rates more means giving a bigger boost to economic growth. In reality, it is exactly the opposite, and we noticed this in the disastrous early days of August when this scenario was the more likely of the two.

The problem with cutting rates so much in September lies in the underlying message the Fed would give to the market: a 25 basis point cut is meant to be precautionary, and a 50 basis point cut is meant to be curative. There is an abysmal difference between the two concepts because the former does not shift the equilibrium, while the latter does.

To better grasp the concept, you can compare restrictive monetary policy to a car about to run into an obstacle. If the braking is done gradually and well in advance, there will be no harm to the passengers, but if the braking happens at the last second someone will be hurt.

When a central bank cuts rates quickly it means that something is broken in the economy and an immediate change of direction is needed. At that point, the problem of inflation would be put on the back burner and the main economic indicators such as GDP and unemployment rate would be the main aspects influencing market performance.

Although the probability of this scenario is not that low, I, personally, consider it highly improbable. I do not think the Fed will make the mistake of starting the restrictive monetary policy with a 50 basis point cut, as this would complicate this month even more. As mentioned in one of my previous articles, I still hold the view that the first cut is coming a little too late, and we risk panic cutting in early 2025.

Overall, should this scenario play out, I expect a negative reaction from the market and we may touch early August levels. Of course, this is just my expectation and not an encouragement to sell everything before September 18. My strategy remains unchanged no matter what: hold great companies in the portfolio for the long term.

Conclusion

In my view, the Fed Funds Rate will be cut by 25 basis points on September 18 and the market reaction will be flat/slightly positive. No rate cut is out of the question, while a 50 basis point cut would fuel market concerns in a month that is already off to a bad start.

What is certain is that the Fed will follow the other central banks and start cutting rates, but interestingly, the bond market is already far ahead.

By the end of 2025 futures expect total cuts of 250 basis points, which is quite controversial. To date, the stock market valuation discounts primarily a soft landing scenario, but the bond market thinks differently. An overall rate cut of 250 basis points in just over a year I think coincides more with a recessionary period rather than a soft landing, yet this does not worry investors.

We are all hoping for a solid and growing economy in the coming months, but there are some issues to be clarified, many of which will be the subject of the September 18 meeting. I expect Powell to give more guidance on the change in monetary policy, so as to give the market something to believe in. At that point, the challenge will be to fulfill the promises.

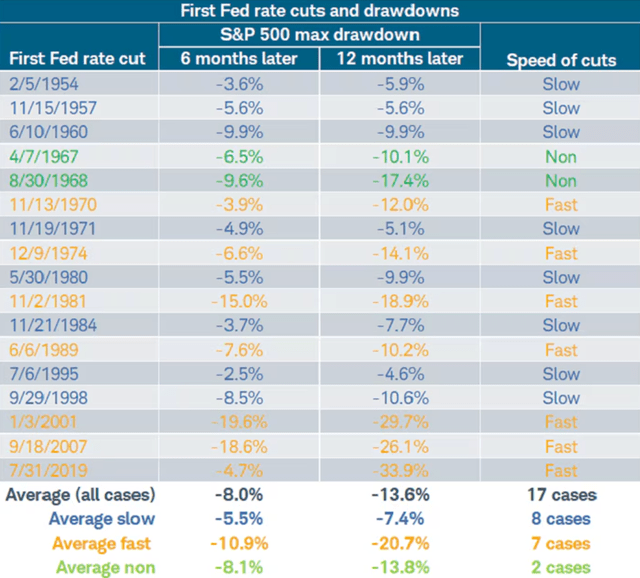

Finally, I conclude this article with an interesting statistic. Before long there will be the first rate cut, but how has the S&P500 performed in similar periods? As already stated, it depends on the speed with which the rate cut took place.

Charles Schwab, Bloomberg, Federal Reserve, Ned Davis Research Inc.

When it was slow and gradual, the average maximum drawdown was 5.50% and 7.40%, respectively in the 6 months and 12 months following the first cut. When there was panic-cutting, the average maximum drawdown was 10.90% and 20.70%, respectively in the 6 months and 12 months following the first cut.

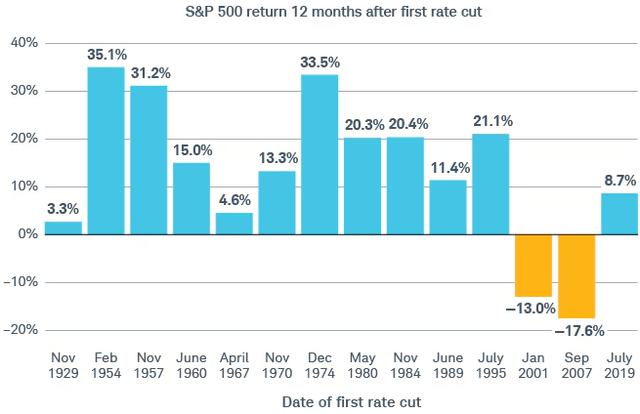

Should there be a 50 basis points cut on September 18, it would increase the chances of a double-digit collapse over the following months. In all this, however, there is good news: the S&P500 tends to perform positively in the 12 months following the rate cut.

Charles Schwab, Bloomberg, and the Federal Reserve.

So, there might be a drawdown, but in the past, the S&P500 (except in 2001 and 2007) has always recovered its losses within the year. This may not necessarily be the case this time as well, but it is certainly a statistic in favor of the most optimistic.

Shared by Golden State Mint on GoldenStateMint.com