The gold price took two steps higher in early Globex trading until a few minutes after 11 a.m. in Shanghai on their Friday morning — and from there it was forced to trade sideways until a rally began around 9:45 a.m. in London. That ran into ‘da boyz’ at the COMEX open in New York — and again at its high tick, which was set minutes before 10:30 a.m. EST. It was engineered quietly lower in price from there until the market closed at 5:00 p.m.

The low and high ticks in gold were reported by the CME Group as $2,761.00 and $2,794.80 in the February contract…and intraday move of about 34 dollars. The February/April price spread differential at the close in New York yesterday was $27.60…April/June was $25.70…June/August was $23.80 — and August/October was also $23.80 an ounce.

Gold was closed in New York on Friday afternoon at $2,770.60 spot…up only $17.80 on the day — and 15 bucks off its Kitco-recorded high tick. Net volume was very quiet at a bit under 110,500 contracts — and there were just about 91,000 contracts worth of roll-over/switch volume out of February and into future months…mostly April of course, but with noticeable amounts into March, June and August as well.

I saw that another 1,593 gold, plus 112 silver contracts were traded in January yesterday — and we’ll find out later tonight just how much of that shows up in the Daily Delivery and Preliminary Reports…along with who the short/issuers and long/stoppers are![]()

Silver‘s rally began at 9 a.m. China Standard Time on their Friday morning — and continued on and off until the not-for-profit sellers/short sellers of last resort appeared in force at 8:45 a.m. in COMEX trading in New York. It was engineered lower in price until the 10 a.m. EST afternoon gold fix in London — and then had a broad and quiet [and equally managed] up/down move centered around 11:30 a.m. EST — and ending ten minutes or so before trading ended at 5:00 p.m. EST.

The low and high ticks in silver were recorded as $30.825 and $31.685 in the March contract…an intraday move of 86.0 cents. The March/May price spread differential in silver at the close in New York yesterday was 32.0 cents…May/ July was 29.6 cents — and July/September was 27.9 cents an ounce.

Silver was closed on Friday afternoon in New York at $30.54 spot…up only 16.5 cents on the day — and a hefty 51 cents off its Kitco-recorded high tick. Net volume was certainly on the lighter side at at 45,500 contracts — and there were a bit over 4,000 contracts worth of roll-over/switch volume out of March and into future months in this precious metal…mostly into May, July and September.

Platinum‘s initially rally, like silver and golds’, ran into ‘something’ around 11 a.m. in Globex trading in Shanghai — and it then struggled a bit higher until shortly after Zurich opened. Then ‘da boyz’ appeared….selling it unevenly lower until it was back below unchanged by 2 bucks at its 12 o’clock noon low in COMEX trading in New York. It struggled a bit higher until the 1:30 p.m. COMEX close — and didn’t do a thing after that. Platinum was closed at $947 spot…up 3 dollars from Thursday — and 13 bucks off its Kitco-recorded high tick.

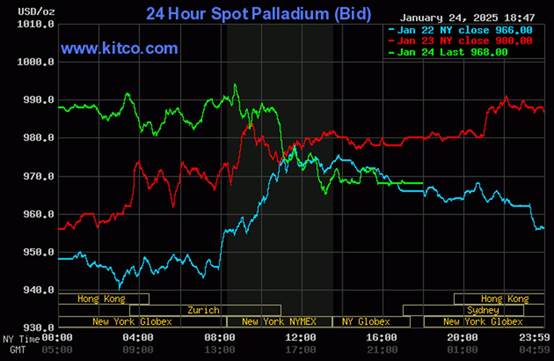

Palladium rallied five bucks or so between 10 and 11 a.m. China Standard Time in Globex trading on their Friday morning — and then had a broad, quiet and uneven down/up move centered around 10:45 a.m. in Zurich — and ending when ‘da boyz’ appeared around 8:40 a.m. in COMEX trading in New York. It was stair-stepped/engineered lower from that juncture until around 1:05 a.m. EST — and didn’t do much of anything after that. Palladium was closed at $968 spot….down 12 bucks on the day — and 16 bucks off its Kitco-recorded high tick.

Based on the kitco.com spot closing prices in silver and gold posted above, the gold/silver ratio worked out to 90.7 to 1 on Friday…compared to 90.6 to 1 on Thursday.

Here’s the 1-year Gold/Silver Ratio Chart…courtesy of Nick Laird.

For more on Ed’s report, view the full article here: https://silverseek.com/article/silver-gold-continue-pile-comex

Shared by Golden State Mint on GoldenStateMint.com