AlexLMX

AlexLMXSilver is largely ignored, while gold has recently touched its multi-year highs. At the same time, the shiny gray metal is much more volatile and sometimes has greater potential to excel during crises and uncontrolled money-printing. I will explain why silver could perform better than gold and what advantages gold has over silver as an investment metal.

Previous analysis of silver

In my previous analysis of the silver market, I commented on silver breaking multi-year highs and outperforming gold. I wrote about silver’s possibility of continuing its strong performance despite the risk of higher interest rates. In the previous article, I wrote that AI technologies and green energy were all bullish factors for the precious metal.

According to Jerome Powell’s recent Jackson Hole speech, however, higher rates for longer will not endure. That is bullish for both gold and silver. But gold’s performance has been substantially better than silver’s. In the next section, I will explain why this has been happening.

Gold’s performance vs. silver’s

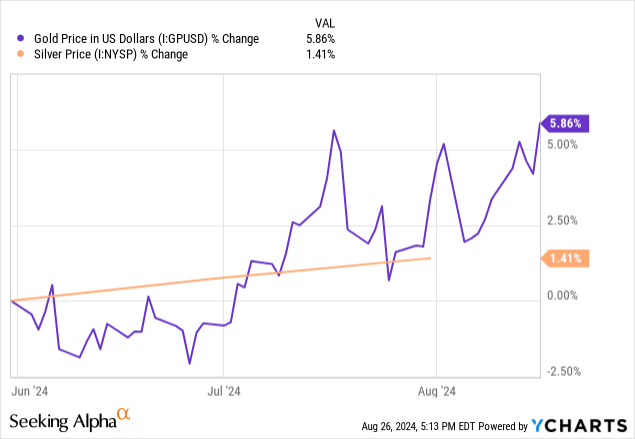

Below, I have prepared several graphs. The first shows gold and silver appreciating over the last three months. The difference between the two metals was quite considerable. While gold has gained almost 6%, silver has only added 1.41% of its value.

YCharts

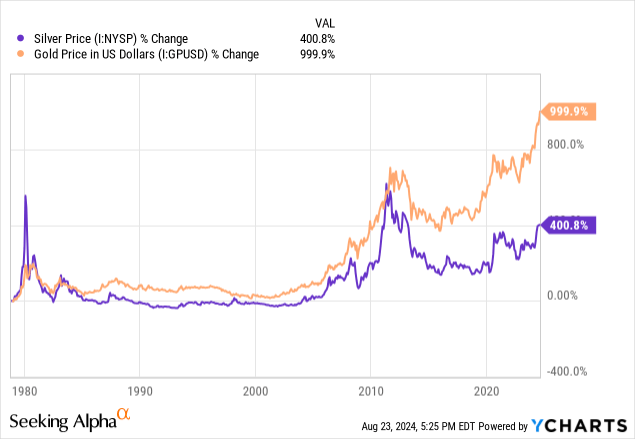

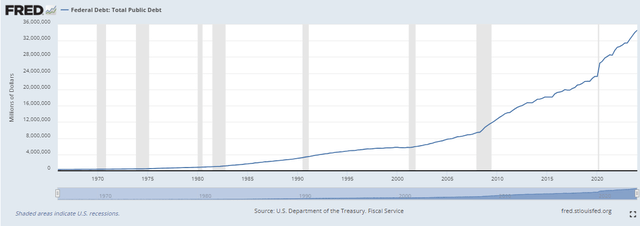

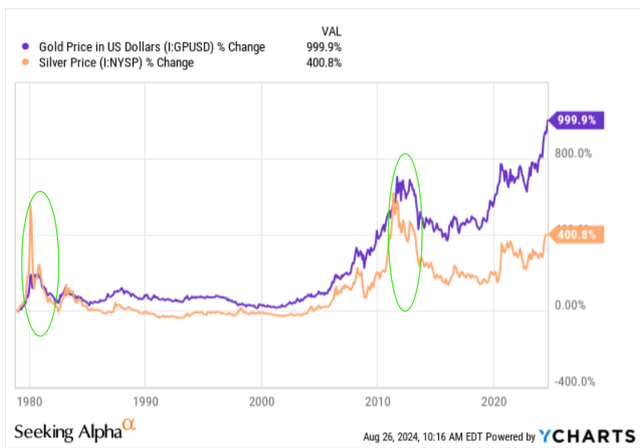

YChartsWe can also see this difference over a much longer time frame, namely more than 40 years. Gold has been performing much better than silver since 2011.

YCharts

YChartsBut the biggest price surge of gold happened between 2022 and 2023. Let me also have a look at the gold-to-silver ratio used to judge the relative value of gold to silver.

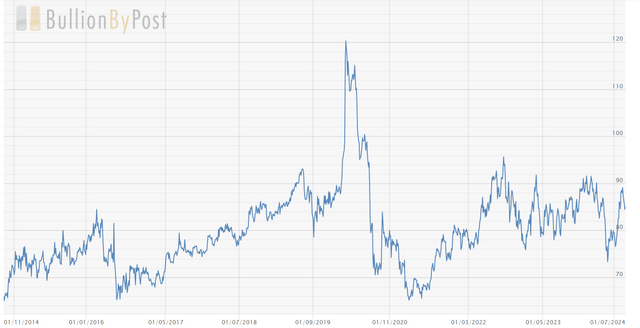

Gold-to-silver’s ratio

The gold-to-silver ratio is currently lingering around 90. This is relatively high and suggests that gold is quite expensive compared to silver. However, the all-time high of about 120 was reached in 2020 during the coronavirus-related lockdowns.

Bullion by post

Bullion by postLet me explain why gold can, in some instances, perform much better than silver.

Why is gold currently performing better than silver?

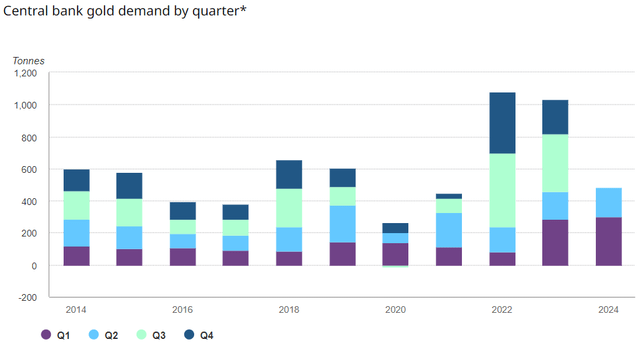

Gold is now being bought by major central banks. In fact, in the first half of 2024, gold purchases by major financial institutions reached their multi-year highs, as can be seen from the diagram below.

Gold.org

Gold.orgThat is because gold is a vital metal for the modern monetary system. As I have mentioned many times in my other articles, national currencies have been tied to the price of gold in many countries during different historical periods. In 1944, in Bretton Woods was established a system of payments based on the US dollar, which defined all currencies in relation to the dollar, itself convertible into gold, and, above all, equivalent to gold for trade. That simply meant that US dollars were convertible into gold at a fixed rate. Obviously, gold was also convertible into US dollars. That meant that it was impossible to issue too many USDs simply because gold supply was limited.

In 1971, under Nixon, this system was cancelled to enable uncontrolled money printing to finance the US government’s ballooning expenses. This led to accumulated budget deficits and rising national debt to compensate for the deficits.

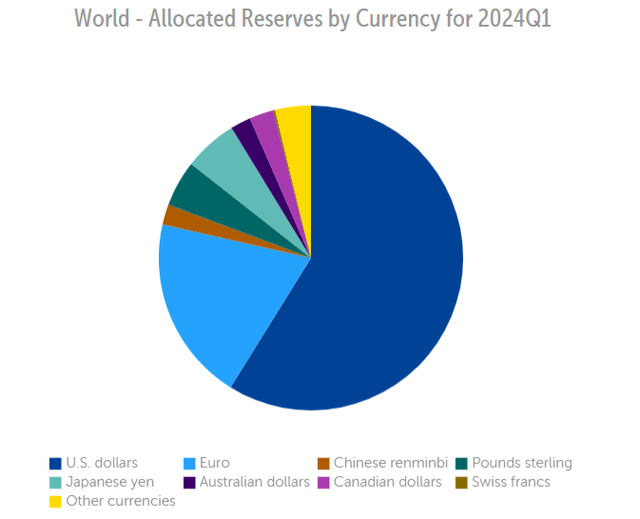

The Fed

The FedAs you can see from the graph above, after the 1970s, US debt started climbing fast.

In spite of the loss of gold’s backing, in the eyes of many governments and central banks, the dollar is still viewed as a medium of exchange in international trade.

The International Monetary Fund

The International Monetary FundThat is why many countries hold the USD as the largest part of their international monetary reserves. As you can see from the pie chart above, more than half of the world’s allocated reserves are held in USDs. Gold is also held as a substantial part of monetary reserves.

The US is the largest owner of gold reserves. According to the World Gold Council’s Q2 2024 data, the country held 8,133.46 tons of precious metal. There are 35,274 ounces in one ton. As I am writing this, one ounce of gold is worth $2,523. So, multiplying 35,274 ounces by $2,523 gives us $88,996,302. Multiplying this by 8,133.46 gives us $723,847,862,465, or $723.85 billion.

World Gold Council

World Gold CouncilAs I have mentioned above, gold is now being actively purchased by most central banks. Meanwhile, many governments have stopped using the USD as a medium of exchange in international trade. For example, Saudi Arabia is moving away from the USD in the oil trade as it looks at alternative markets, thus ending a long-standing “petrodollar” agreement. According to the Atlantic Council, a think tank, the end of the “petrodollar” agreement would end the dollar’s dominance. But attempts to move away from the dollar do not end here. Russia has also recently announced that its trade with China has almost completely moved away from using the USD, highlighting the two countries’ commitment to reducing their reliance on the US-led economic system.

I am not saying that the USD would completely stop existing as the world’s reserve currency. But due to the fact that gold is an alternative to the USD, as a result of all these news and announcements, the yellow metal has been rallying enormously. Silver, meanwhile, is not part of the global financial system. So, these bullish factors do not directly affect the silver market. However, there were instances when silver performed much better than gold.

Historical periods when silver performed better than gold

Indeed, there were periods when silver performed much better than gold. Generally speaking, silver often outperformed gold during periods of strong economic growth during which industrial economies expanded and tended to perform worse than gold during periods of economic stress.

On the graph below, I have circled the time periods when silver outperformed gold.

YCharts

YCharts

The first period was in 1970–1980, when the brothers Hunt intervened in the silver market to boost the precious metal’s prices. So, the price surge was rather artificial. The second was after the Great Recession when the commodity reached its all-time highs. The unexpected surge in the prices of silver was mostly due to the global financial crisis, which made market players panic and increased private investors’ demand for small silver bars and coins. In contrast to gold, not much money was needed to invest in silver. So, at the time, investors rushed to buy relatively small quantities of silver. At the time, it has also been noted that silver’s photovoltaic use by the solar industry was a significant factor in the metal’s massive uptick. So, the major gray metal’s price upticks were due to the economic crisis, rising industrial demand for the commodity, and market manipulations.

Why can silver soar?

The same bullish factors could work for silver in the future.

First of all, the Fed could decrease interest rates more than initially planned if macroeconomic factors deteriorate further. I also previously wrote that both gold and silver should trade much higher than they are trading now due to the excessive money supply in the US. Well, if the money supply rises even further thanks to easy monetary conditions, silver prices should rise even further.

Then, silver, an industrial metal, can soar thanks to AI and green energy technologies. Green energy technologies encompass the EV sector and solar batteries. The demand for AI servers and switches is expected to soar by double digits over the next several years to keep up with the evolution of AI algorithms. This should lead to a rise in demand for silver-palladium Ag-Pd multi-layer ceramic capacitors in high-power components. In plain terms, it means that silver usage will only increase.

Risks

However, there are some risks to my rather bullish thesis.

First, silver prices can decrease if the Fed does not ease as fast as the market is hoping. But for the sake of objectivity, it will be a problem for most asset classes because it will likely provoke a recession.

Then, silver can remain largely ignored if other assets like the high-tech sector and cryptocurrencies get more of investors’ attention. Moreover, there are many more silver ETFs and other ways to invest in silver. So, the silver market is not as volatile as it used to be. That is why there is a risk that the silver price surge will not be as dramatic as it was in the 1970s or 2011.

Conclusion

Overall, the future looks bright for silver. Gold has outperformed the shiny gray metal due to its considerable role in the global financial system. However, silver is also sensitive to any changes in the central bank’s monetary policies. Moreover, the gray metal has many industrial uses, including AI and green energy. Higher rates for longer and investors’ attention towards other asset classes seem to be the major risks for silver.

Shared by Golden State Mint on GoldenStateMint.com