Silver has ripped 40% higher over the past year. It currently trades at $34.33 per ounce.

Despite the healthy price action, the thought of selling hasn’t crossed my mind.

Today I will lay out the case that silver could triple to over $100/oz over the next few years.

When pondering how high silver could go, historical prices are a logical place to start. To do so properly, however, we need to account for inflation.

Inflation-Adjusted Highs

Silver reached its all-time high of around $50 in 1980, but that was a special situation. Specifically, it was a scheme orchestrated by the Hunt brothers to corner the market.

So unfortunately, we can’t really use the 1980 $50 price as a benchmark. If we did, according to the BLS’ official inflation calculator, $50 in 1980 would equate to around $205 today.

However, I also don’t trust the official government inflation numbers. Many of us suspect that federal inflation data is severely understated.

You see, in both 1980 and 1990 the U.S. government changed the way inflation (CPI) was calculated. The new methods dramatically lowered the rate of price increases.

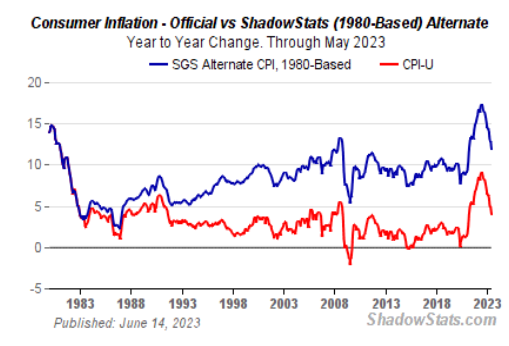

Shadowstats.com, operated by economist John Williams, offers an alternate inflation data set which attempts to re-create the pre-1980 methodology. As you can imagine, Shadowstats arrives at a wildly different inflation picture:

Source: Shadowstats.com

So instead of inflation peaking at around 9% in 2022, Shadowstats says it actually peaked at over 16%.

If we use Shadowstats data to adjust for silver’s historical prices, things start to get very interesting.

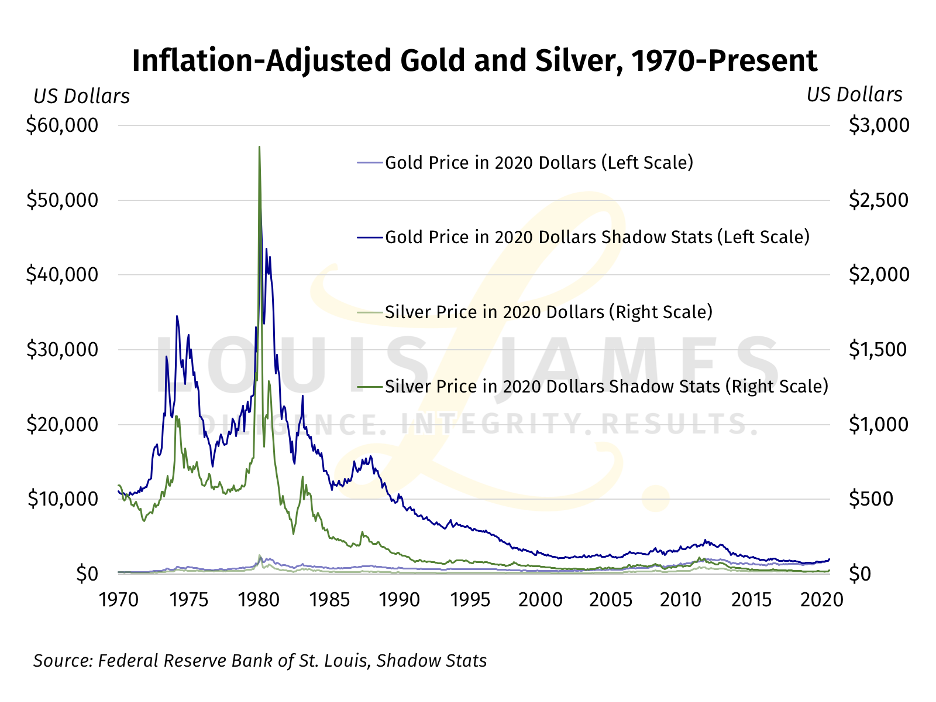

Back in 2020, Lobo Tiggre of the Independent Speculator did just that. He calculated historical precious metal prices, but adjusted for inflation using Shadowstats’ numbers. In the chart below, the Shadowstats-adjusted silver price is in green, and the Shadowstats-adjusted gold price is in blue.

As you can see, according to this version of precious metals history, silver’s 1980 high was equivalent to over $2,500/oz in today’s dollars. But as I said, we’re going to discard the 1980 high, because that was the result of unprecedented market manipulation.

But even when we discard the 1980 high, we still see that in 1983 silver’s inflation-adjusted price reached over $500 (according to this alternative inflation data). And gold reached a crazy $50,000/oz during the 1980 peak.

The numbers seem a bit high, even to me. The truth is probably somewhere in between the official numbers and Shadowstats. The BLS/government data is too low, and Shadowstats too high.

But even if we discount the Shadowstats-adjusted highs by 2/3rds, gold and silver’s inflation-adjusted prices are still shocking.

I’ll take $165/oz silver and $13,000 gold as aspirational targets any day. And when inflation rears its ugly head again, I think these numbers are entirely possible.

More Inflation to Come

It’s important to remember that our inflation story is ongoing. And we still have this nagging problem of $36 trillion of federal government debt, which is growing at a rate of $2 trillion a year.

What happens when a recession hits? Or a bank crisis?

Eventually the Fed will be forced to lower interest rates back to near zero, and restart money printing operations. Each successive round of QE is larger than the last, and this next one will be no different.

There will also be more stimulus checks to come as austerity hits and times get tough. And it’s quite possible that the government will eventually implement some form of universal basic income (UBI), as AI displaces white collar jobs.

So whatever the true inflation-adjusted highs are for gold and silver, every year they will continue to grow.

My point is simple. Both gold and silver have plenty of room to run. I continue to view any pullbacks as buying opportunities.

SilverSeek.com, Silver Seek LLC makes no representation, warranty or guarantee as to the accuracy or completeness of the information (including news, editorials, prices, statistics, analyses and the like) provided through its service. Any copying, reproduction and/or redistribution of any of the documents, data, content or materials contained on or within this website, without the express written consent of SilverSeek.com, Silver Seek LLC, is strictly prohibited. In no event shall SilverSeek.com, Silver Seek LLC or its affiliates be liable to any person for any decision made or action taken in reliance upon the information provided herein. Full disclaimer and disclosure on conflict of interests

© 2003 – 2025 SilverSeek.com, Silver Seek LLC

Shared by Golden State Mint on GoldenStateMint.com