Summary

- Copper’s long-term bullish trend remains intact, with higher lows and highs despite significant corrections, suggesting continued price increases.

- Southern Copper Corporation offers leveraged performance, outperforming copper prices during rallies and underperforming during corrections, making it an attractive investment.

- Green energy initiatives, inflationary pressures, and potential Chinese economic recovery support a compelling case for new highs in copper prices.

- SCCO’s strong profitability, positive factor grades, and attractive dividend yield enhance its appeal as a leading copper producer for portfolios.

- Looking for more investing ideas like this one? Get them exclusively at Hecht Commodity Report.

RiverRockPhotos/E+ via Getty Images

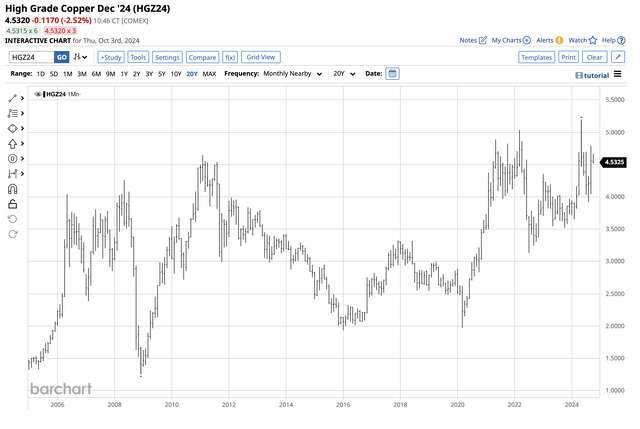

Copper’s (HG1:COM) bull market is nearly a quarter of a century old, and the prospects are for higher prices over the coming years. Since the November 2001 60.40 cents per pound low, copper has traded in a nearly perfect bullish path of higher lows and higher highs.

Long-Term COMEX Copper Futures Chart (Barchart)

The long-term COMEX copper futures chart highlights that pattern of higher, lows and higher highs that took the red nonferrous metal to its latest $5.1990 high in May 2024. While the bullish trend has been nearly perfect, copper has suffered its share of implosive corrections. Each new high has led to a significant decline:

- The rally to $4.04 per pound in May 2006 led to a 41% drop to $2.3850 in February 2007.

- The May 2008 $4.2605 peak gave way to a 70.5% correction to the December 2008 low of $1.2550.

- The February 2011 record $4.6495 high led to a 58.4% decline to $1.9355 in January 2016.

- Copper made a slightly higher $1.9725 low in March 2020 as the global pandemic gripped markets across all asset classes.

- Copper rose to $5.0395 in May 2022 and corrected by 37.9% to $3.1315 in July 2022.

- Copper’s latest all-time peak of $5.1990 in May 2024 led to a 24.6% decline to $3.9210 in August 2024.

Copper has been highly volatile for decades, but the pattern reflects the overall bullish long-term trend of higher lows and higher highs.

Shares of copper-producing companies that extract metal from the earth’s crust can exhibit leveraged performance compared to the metal. Southern Copper Corporation (NYSE:SCCO). SCCO is the fourth-leading mining company by market cap. At just below $115 per share, SCCO had an over $92 billion market cap. SCCO has a larger market cap than Newmont Mining (NEM) and Freeport-McMoRan. SCCO’s market cap is lower than diversified BHP Group (BHP) and Rio Tinto (RIO).

Copper’s latest correction took the price nearly 25% lower to another higher low. At below the $4.55 per pound level, SCCO could have lots of upside potential over the coming months and years.

Copper corrects and finds a higher bottom

Copper traded to its latest record high of $5.1990 per pound in March 2024, but it ran out of upside steam.

Monthly COMEX Copper Chart (Barchart)

The monthly chart highlights the 24.6% correction that took nearby COMEX copper futures to a $3.9210 low in August 2024. Copper found a higher bottom and was over the $4.50 per pound level in early October, as the decades-long bullish trend remains firmly intact.

The case for new highs in copper

The compelling case for higher highs in copper includes:

- The trend is always your best friend in markets across all asset classes, and remains bullish in copper.

- Green energy initiatives require increasing amounts of copper. The demand side of copper’s fundamental equation continues to expand, supporting higher prices.

- Copper production will struggle to keep pace with rising requirements, putting upward pressure on prices.

- Copper remains in a bullish trend despite China’s economic malaise. China consumes over half of the world’s refined copper supplies annually, so any improvement in the Chinese economy could increase the red metal’s global demand.

- Worldwide inflationary pressures have increased copper’s production cost, putting upward pressure on prices.

Even the most aggressive bull markets rarely move in straight lines. Copper’s substantial correction stopped short of threatening the bullish trend, and the price action has turned bullish after briefly probing below the $4 per pound level in August.

SCCO is a leading producer with mining interests in the copper belt

Southern Copper Corporation’s company profile states:

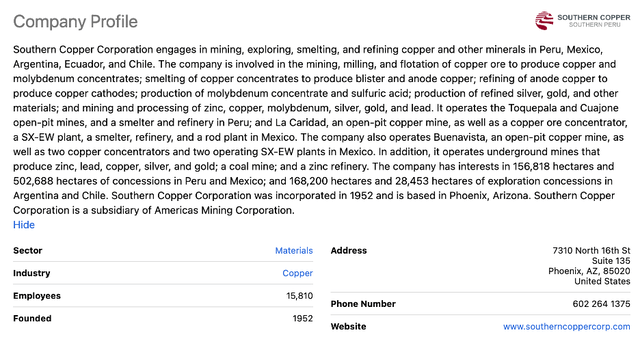

SCCO Company Profile (Seeking Alpha)

At $114.72 per share, SCCO had a $92.17 billion market cap. SCCO trades an average of nearly 1.2 million shares daily and pays shareholders a $2.39 annual dividend, translating to a 2.08% yield.

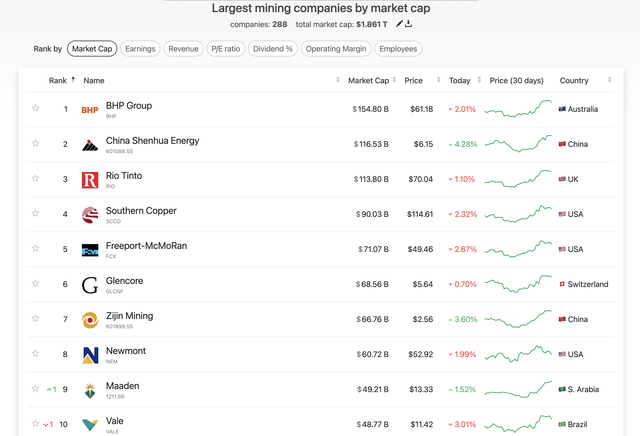

The Leading Publicly Traded Mining Companies by Market Cap (comapniesmarketcap.com)

The chart illustrates SCCO’s leadership role in base metals mining. The website highlights that SCCO has “the largest copper reserves in the world.”

Factor grades are primarily positive

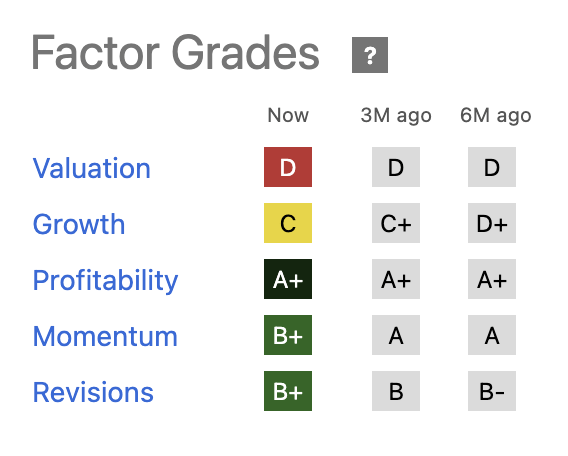

SCCO’s Seeking Alpha Factor Grades are:

SCCO Seeking Alpha Factor Grades (Seeking Alpha)

SCCO receives a D in valuation. The B+ in momentum reflects the correction in copper prices since the May 2024 high. While momentum and revisions receive B+ grades, the A+ in profitability makes SCCO a compelling copper producer.

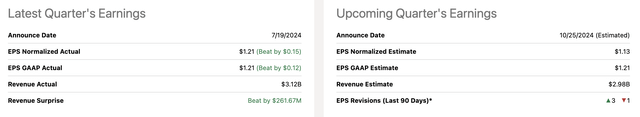

Latest SCCO Earnings and Forecasts (Seeking Alpha)

As the chart shows, SCCO announced its latest quarterly earnings on July 19, 2024, beating on both EPS and revenue forecasts. The market expects lower earnings and revenues for the next quarter, which could set the stage for another bullish surprise.

An attractive yield

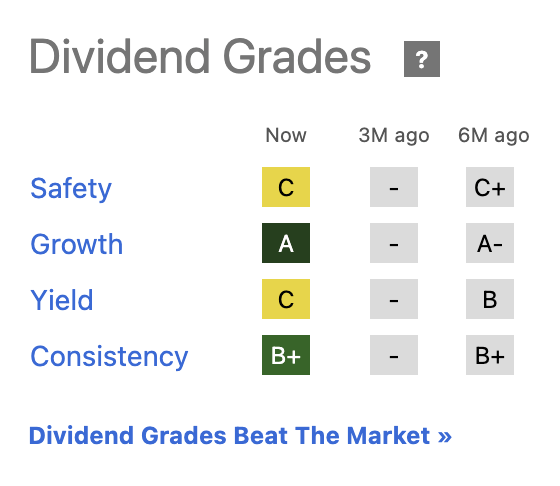

SCCO pays shareholders over a 2% dividend. Seeking Alpha Dividend Grades are:

SCCO Seeking Alpha Dividend Grades (Seeking Alpha)

SCCO receives all passing grades for its dividend policy, but the growth stands out.

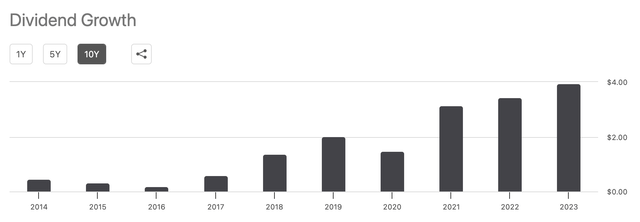

SCCO Dividend Growth (Seeking Alpha)

The chart illustrates the bullish dividend trend over the past decade.

SCCO outperformed copper on a percentage basis from the 2020 low to the 2024 high

COMEX copper futures prices rose 66% from $3.1315 in July 2022 to $5.1990 in May 2024. The 24.6% decline took copper futures to $3.9210 in August 2024. Copper has recovered 15.7% from the August low to the $4.5350 level.

Monthly Chart of SCCO Shares (Barchart)

Meanwhile, SCCO shares rose 206% from $42.42 in July 2020 to $129.79 per share in May 2024. The correction took SCCO 30% lower to $90.85 in August 2024. At $114.86 in early October, SCCO was 26.4% higher than the August bottom. Like most mining companies, SCCO offered leverage to the copper futures price on the up and downside, outperforming the red metal on rallies and underperforming during downside corrections.

There is a compelling case for new and higher highs in copper. Southern Copper Corporation’s leverage could make it an attractive addition to portfolios.

The Hecht Commodity Report is one of the most comprehensive commodities reports available today from a top-ranked author in commodities, forex, and precious metals. My weekly report covers the market movements of over 29 different commodities and provides bullish, bearish, and neutral calls, directional trading recommendations, and actionable ideas for traders and investors. I am offering a free trial and discount to new subscribers for a limited time.

Andrew Hecht is a 35-year Wall Street veteran covering commodities and precious metals.

He runs the investing group The Hecht Commodity Report, one of the most comprehensive commodities services available. It covers the market movements of 20 different commodities and provides bullish, bearish and neutral calls; directional trading recommendations, and actionable ideas for traders.

Shared by Golden State Mint on GoldenStateMint.com