cemagraphics

cemagraphicsS&P 500 (SPX) investors were rattled in the trading week ending Friday, 19 July 2024. The index dropped two percent to close the week at 5,505.00.

That decline was triggered by the Biden-Harris administration’s announcement on Wednesday, 17 July 2024 that it was planning to expand its anti-free trade restrictions against China. The new sanctions would negatively affect U.S. advanced computer chip manufacturers, as well as Japanese and Dutch chipmakers that do large volumes of business with China.

The announcement sent the stock prices of U.S. chipmakers plunging, as the tech-heavy Nasdaq 100 index experienced its worst day since 2022, going on to lose 4.3% by the end of the week. The third-largest company in the S&P 500, AI chipmaker Nvidia (NVDA), lost $244 billion (8.75%) of its total value from the previous week as it dropped to a market capitalization of $2.9 trillion. Coincidentally, the size of that loss is about $1 billion less than the entire market cap of Advanced Micro Devices (AMD) after it shrank by 16.5% from its previous week’s market valuation.

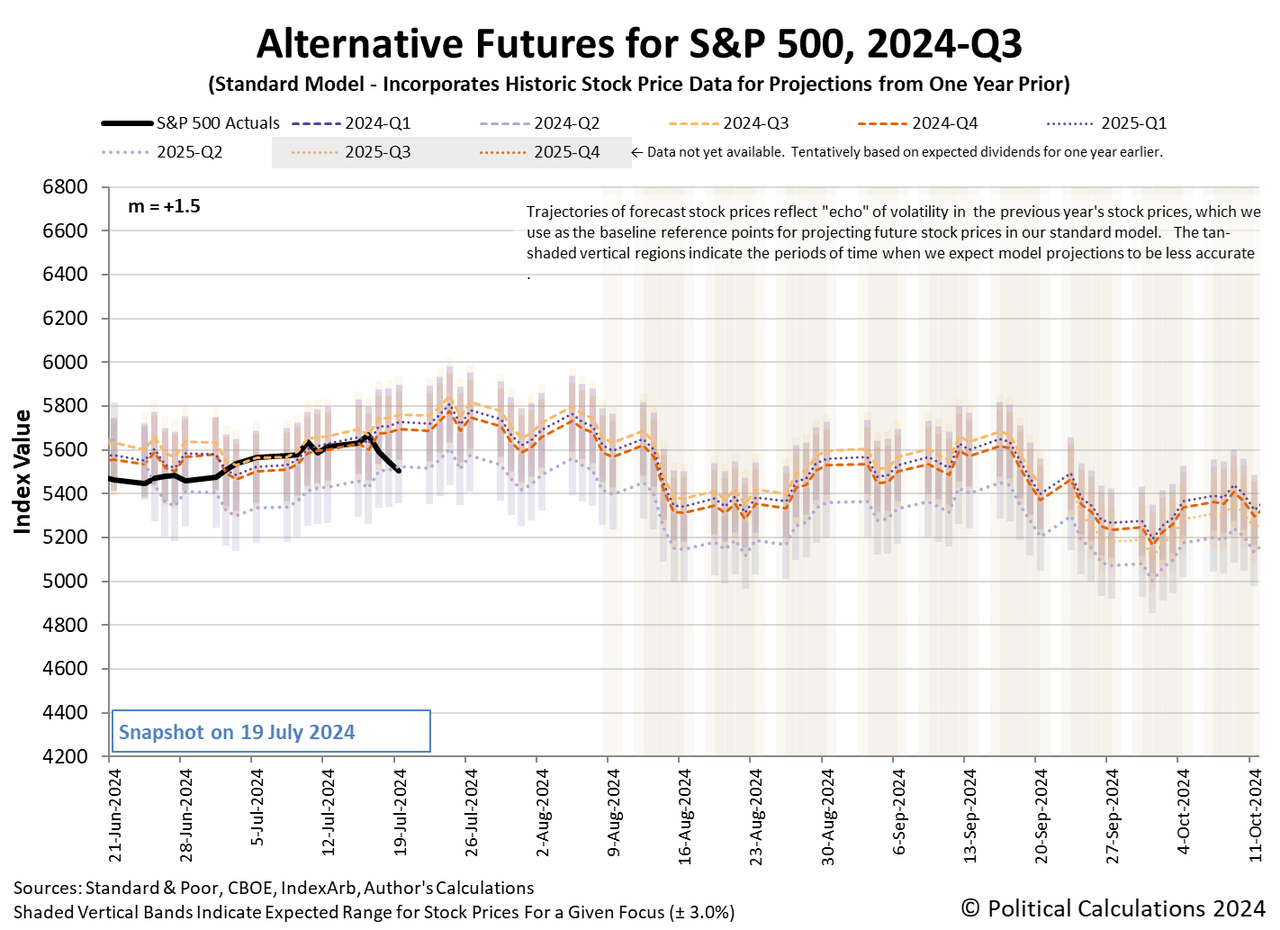

The dividend futures-based model’s alternative future chart shows what appears to be a new Lévy flight event, in which investors have shifted their investment time horizon from the current quarter of 2024-Q3 to the more distant future quarter of 2025-Q2, which may coincide with the timing of when the new export rules may take effect.

Trading during the week showed little sign of any impact from the Saturday, 13 July 2024 assassination attempt against former U.S. President Donald Trump. The change in stock prices for the S&P 500 on Monday, 15 July 2024 fell well below the threshold of a 2% change from the previous trading day’s close that would qualify as interesting.

With corporate earnings season getting underway, it’s quite possible that the random onset of new information it provides may soon prompt investors to shift their focus back to the current quarter. Or not. It depends on what new information comes out in the weeks ahead.

Speaking of which, here are the week’s market-moving headlines.

Monday, 15 July 2024

- Signs and portents for the U.S. economy:

- Fed officials say U.S. inflation is heading lower to their 2% target:

- Bigger trouble, stimulus, bailouts developing in China:

- Nasdaq, S&P, Dow end higher on first trading day since assassination attempt on Trump

Tuesday, 16 July 2024

- Signs and portents for the U.S. economy:

- IMF says Fed officials shouldn’t rush to cut U.S. short term interest rates:

- Bigger stimulus, bailouts developing in China:

- BOJ, JapanGov officials secretly involved in propping up Japan’s currency, letting failing businesses finally go under:

- Possible growth signs developing in Eurozone:

- Dow jumps more than 700 points on UnitedHealth boost; rotation into small-caps continue

Wednesday, 17 July 2024

- Signs and portents for the U.S. economy:

- Fed officials “optimistic” inflation will drop to their 2% target, thinking about cutting rates:

- Bigger trouble, stimulus developing in China:

- Global chip sell-off slams Nasdaq, which notches worst day since 2022; Dow tops 41K

Thursday, 18 July 2024

- Signs and portents for the U.S. economy:

- Fed officials say they’re not okay yet with inflation, pitch new way for banks to tap into bailout money:

- Bigger trouble, stimulus developing in China:

- BOJ officials seeking ways to keep stimulus alive:

- ECB officials choose to sit on hands, will think about cutting rates later:

- Nasdaq, S&P slip, Dow sheds 500 points as tech rotation intensifies; Netflix in focus

Friday, 19 July 2024

- Signs and portents for the U.S. economy:

- Fed officials looking forward to getting inconclusive data:

- Bigger trouble, stimulus developing in China:

- BOJ officials to hold rates steady despite inflation pressure:

- ECB officials thinking about cutting Eurozone interest rates after passing on cuts this month:

- Wall Street posts worst week in three months; focus turns to upcoming earnings deluge

The CME Group’s FedWatch Tool forecast is mostly unchanged this week. It continues to anticipate the Fed will hold the Federal Funds Rate steady in a target range of 5.25-5.50% until 18 September (2024-Q3), at which time, the Fed is expected to start a series of 0.25% rate cuts that will occur at 6- to-12-week intervals at least into mid-2025.

The Atlanta Fed’s GDPNow tool’s forecast of the annualized real GDP growth rate during 2024-Q2 continued rising to +2.7% from the +2.0% growth projected a week earlier. When the BEA’s official first estimate of GDP in 2024-Q2 is released near the near of July 2024, the GDPNow tool will shift to start forecasting 2024-Q3’s real GDP growth rate.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Shared by Golden State Mint on GoldenStateMint.com