After reaching new highs, the U.S. stock markets have gone into a period where the results are less than satisfactory.

The front page of the Wall Street Journal carried this headline for the article by Jack Pitcher:

“Stocks Close Out Year’s Worst Week“.

Mr. Pitcher begins his article with, “Stock indexes posted steep weekly losses after weaker-than-expected data reignited fears about the health of the U.S. economy.”

The latest statistic seemingly causing this drop… the latest jobs numbers:

The turbulence began when traders returned from the Labor Day holiday to data suggesting continuing gloom in the manufacturing sector.”

And, so, the stock market declined.

Lately, I have been more optimistic than this.

Real economic growth seems to be doing alright. In the previous quarter, real GDP grew by 3.1 percent, year-over-year. This is above the compound rate of growth achieved by the economy during the economic recovery following the Great Recession.

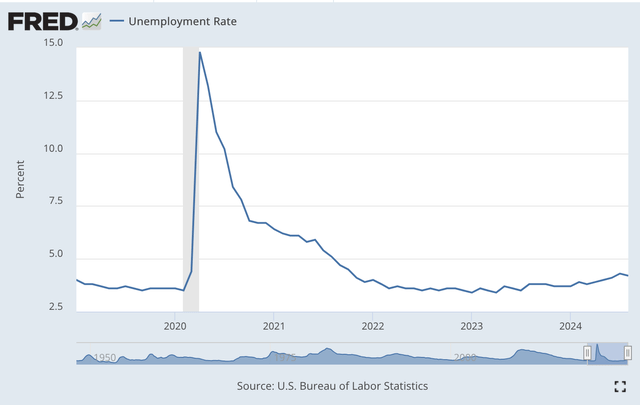

Unemployment dropped to 4.2 percent last month and is at levels maintained through much of the previous period of economic expansion.

There may be some “soft” labor market data these days, but there is nothing really that really stands out. Yes, the unemployment rate has risen recently, but the labor market seems to be stable and the level over the past two years seems to be consistent with a modestly growing economy.

And, of course, inflation seems to be coming down to where the Federal Reserve wants it.

The Big Question Mark

To me, what is going on in the stock market these days is that two things are on the calendar for the next two months, and what happens during that time period will have a “long” effect on where things go in the stock market in the near future.

Right now, there is a great deal of uncertainty about what is going to happen with respect to these two things.

And, what are these two things?

The first thing concerns what the Federal Reserve is going to do at its next Federal Open Market Committee meeting.

At his Jackson Hole, Wyoming speech, Chairman Jerome Powell said that it was time for the Fed to adjust its policy efforts.

The major one of these “policy efforts” has to do with what the Fed might do with its policy rate of interest.

Although the number changes almost daily, the investment community believes that there is a high probability that the Fed will reduce its policy rate of interest at the next FOMC meeting, to be held on September 17 and 18.

Then there is a discussion about how large the reduction in the policy rate will be.

Will the reduction amount to twenty-five basis points?

Will the reduction amount to fifty basis points?

There are also concerns about whether or not the Fed will change its current policy relating to the quantitative tightening going on.

The Fed does not talk about this much at all, but it will be important to see if the central bank changes what it is doing now.

The Fed has been engaged in a policy of quantitative tightening for some 30 months now, although the Fed reduced the amount it was reducing the securities portfolio by in June 2024.

Will the Fed change how fast it is allowing its securities portfolio to change… or not?

This is a major question because the Fed increased its securities portfolio by over $4.0 trillion in its efforts to combat the disruptions caused by the Covid-19 pandemic and the following recession.

So far, the Fed’s quantitative tightening has reduced its securities portfolio by only about $2.0 trillion. The Fed still has a ways to go to get its securities portfolio back to a manageable size.

Will the Federal Reserve alter its thrust of monetary tightening at the September meeting of the FOMC?

This, to me, is a very, very important decision the Fed needs to make.

The second major “thing” coming up in the next two months is the U.S. presidential election.

Will an adjustment in the Fed’s policy rate of interest impact the election?

Many analysts believe that it will.

The upcoming presidential election may be one major reason why the Fed has not changed its policy rate of interest up to this time.

But, now, it seems as if the Federal Reserve is going to have to do something, and so near to the election, which will be less than a month away.

So, what is the Federal Reserve going to do? And, what will be the impact of the Fed’s action?

The Future

To me, the uncertainty surrounding these two “things” is behind the uncertainty that investors are having to deal with at this time.

This uncertainty is resulting in fairly substantial swings in stock market prices. And, volatility, I believe, will continue through the election.

Mr. Powell and the Federal Reserve have tried to keep the Federal Reserve out of the discussion taking place in the presidential election.

I think that they have done a very good job and that is why stocks have hitting or have been near to hitting new historical highs in the past couple of weeks.

The last “new” historical high was reached by the Dow Jones Industrial Index on August 29th. The S&P 500 was within 32 points of its historic high on August 23rd. And, the NASDAQ index was also close to its historic high on August 23rd.

As I have mentioned above and in many recent articles, the U.S. economy is not in a real bad spot. In fact, it has a lot going for it.

However, whoever gets elected is going to have a major impact on U.S. economic policy in the future. And, what the Fed does at its next FOMC meeting is going to have an impact on the election.

We shall see.

Investors will see.

Right now, the uncertainty level is pretty high!

Written by Matteo Colombo

Shared by Golden State Mint on GoldenStateMint.com