Just_Super/iStock via Getty Images

Just_Super/iStock via Getty ImagesPreamble

These days, gold bugs are grinning merrily and will tell anyone with ears to hear that the metal is up around 20% over the last 12 months (c$1,950 in July 2023 v Current price $2,370); not bad. What would surprise many of those grinning bugs (which I am one) is that copper has also had a similar increase. Back in July 2023, the spot price of copper per pound was $3.77 and now it is $4.58, which also represents an increase of approximately 20%. Of course, this increase in copper prices has had a positive impact on the financials of Taseko Mines Limited (NYSE:TGB). And the rise in copper prices is not the only reason that makes Taseko such an attractive investment.

In my humble opinion, there are three data points to consider when contemplating an investment into a listed mining company; The jurisdiction of the operations, the financials and the quality of the company’s reserves. However, in the case of Taseko, there is also an underappreciated asset to consider; “Taseko’s 100%-owned Aley Project in northeast British Columbia is one of largest undeveloped niobium deposit in the world.”

I suspect that few investors have heard of niobium compared to those who are familiar with the term “rare earths.” And this cannot be because the element is about as useful as a chocolate teapot, and sparsely used, far from it in fact. According to some reports; “The Niobium Market size is estimated at 106.85 kilotons in 2024, and is expected to reach 171.49 kilotons by 2029, growing at a CAGR of 9.92% during the forecast period (2024-2029).”

This is not the first time I’ve covered niobium as I highlighted the importance of the metal in an article on NioCorp titled; “Time To Short This Overvalued Stock.” The reasons for my sell recommendation was due to the over valuation of the stock rather than the assets it controls.

As regards jurisdiction, I’ve written quite a few articles highlighting the increasing risks of investing in miners which have operations outside of the collective West. Most recently, I’ve covered the perils of locating operations in Bolivia, Columbia and Africa. In my article covering Barrick Gold, I explored the Pandora’s box of potential hazards associated with developing new deposits in Mexico. Needless to say, Taseko’s operations are all in North America, which is considered a “safe” jurisdiction.

Overview Of Operations

Taseko Mines holds significant copper deposits across North America, both in active production and in development stages.

Gibraltar Mine:

Described as the second-largest open-pit copper mine in Canada, Gibraltar is Taseko’s flagship operation and a major contributor to the company’s revenue. Located in British Columbia, it has been in operation since 1972 and is expected to continue producing until at least 2038. Recent figures show a 26% increase in copper production in 2023, reaching 123 million pounds. Taseko holds a 100% interest in the mine after acquiring the remaining 12.5% from partners in March 2024.

This mine also produces a significant amount of molybdenum, which was 247 thousand pounds in the last quarter. Given that the current price per pound is circa $20.00, the company gets around $5 million of extra revenue.

Florence Copper Project:

This fully permitted in-situ copper recovery project in Arizona represents Taseko’s strategic growth initiative. It is expected to begin commercial production in Q4 2025, promising to be one of the most efficient copper producers globally due to its low energy, water, and greenhouse gas intensity.

According to the company; “When fully operational, the facility will have a production capacity of 85 million pounds of LME Grade A copper metal each year and a mine life of 22 years.”

Yellowhead Copper Project:

This early-stage exploration project located in British Columbia demonstrates Taseko’s commitment to resource expansion. While not yet in production, it holds potential for future copper extraction and contributes to the company’s overall resource portfolio. The mine has 458 million metric tonnes of reserves together with the added bonus of extractable gold and silver. This deposit is understood to have a mine life of 25 years.

Despite the various hurdles that need to addressed, the company is making progress in developing the site; “The Company is preparing to advance into the environmental assessment process and is undertaking some additional engineering work in conjunction with ongoing engagement with local communities including First Nations. The Company is also collecting baseline data and modeling, which will be used to support the environmental assessment and permitting of the project.”

New Prosperity:

Whilst the company has defined a large porphyry gold-copper deposit at the New Prosperity site, hurdles remain due to the fact that it is located in an area of cultural significance for the local Indian population.

However, despite the sensitive nature of the location, discussions with interested parties appears to be progressing well. The company has suggested that an agreement is in the offing; “In March 2024, Tŝilhqot’in and Taseko formally reinstated the standstill agreement for a final term, with the goal of finalizing a resolution before the end of this year.”

Aley Project:

The Aley Project entered the Environmental Assessment Process back in 2014 and there are indications that the company expects very few hurdles to their plans going forward. During their last report, the company stated that the Aley Project is making progress on environmental monitoring and product marketing. The company further confirmed that there is an ongoing pilot test, which is gathering data to help design commercial facilities and generate samples of niobium and its oxides for marketing.

Clearly, this ongoing investment in pilots suggests that the project is moving slowly but surely towards development.

Financials

Given the more than nice rise in the price of copper, one can well believe that Taseko’s financials looked pretty good for the last quarter.

Positives

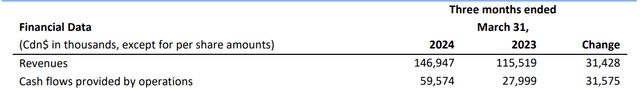

Revenues: From the graphic below, it can be seen that there was a huge up move in both revenues and cash flow, 27.21% and 112.77% respectively.

Cost Savings: The acquisition of additional concentrate offtake rights, combined with record low smelter treatment costs, is expected to result in cost savings of $10 million in the second half of 2024.

Progress at Florence Copper Project: Construction and wellfield development activities at the Florence Copper project are progressing well, with ten new production wells drilled. This indicates the project is on track for commercial operation.

Successful Refinancing: The refinancing of senior secured notes, pushing the maturity to 2030 and upsizing the offering, strengthens Taseko’s financial position and provides additional cash proceeds and flexibility.

Negatives

There were a few concerns in the report, some of which could be described as one-offs, while others have the potential to impact profitability in the future.

Lower Net Income: Taseko Mines Limited’s net income decrease from $33.8 million to $18.9 million, which was primarily attributed to an unrealized foreign exchange loss of $13.7 million, a $5.1 million increase in accretion and unrealized fair value adjustments for Cariboo and Florence royalty obligations, and higher finance expenses due to increased net borrowings, including Florence project financings.

Impact of Concentrator #2 Downtime: Copper production and mill throughput were negatively affected by planned maintenance downtime in January 2024.

Lower Copper Recoveries: Copper recoveries in the first quarter were lower than recent quarters due to lower head grades and increased milling of partially oxidized material.

Environmental Liabilities: The company has significant provisions for environmental rehabilitation, primarily for the Gibraltar and Florence Copper projects, which could represent a long-term financial liability.

The Future For Taseko Mines

If we consider the negatives of the quarterly report given above, in my opinion, net income is more than likely to recover. One hopes that foreign exchange losses will be less going forward, and funding is now in place for the Florence project.

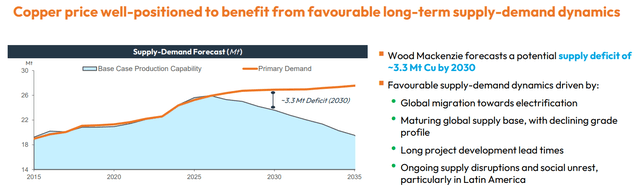

The company’s presentation paints a rosy picture of both the demand for copper and its continued upward trajectory in the price of this essential metal.

Graphic showing copper demand v supply (Obtained from Taseko presentation)

As early as 2025, the company will have Florence adding to revenues and profits. Not forgetting the additional substantial assets of Yellowhead, New Prosperity and Aley, all of which appear to be on track for development.

Valuation

Considering the growth in revenues and cash flow, a Price to Earnings ratio of 16.36 puts the company in bargain basement territory. And compared to peers, the stock could well be thought of as good value using this metric. For comparison, Freeport-McMoRan (FCX) has a P/E of 29.92 and Southern Copper’s (SCCO) P/E is 27.72.

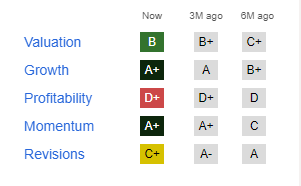

If we check Seeking Alpha’s Factor Grades and match it with the company’s P/E, again investors can appreciate that the stock looks attractive. Certainly, the profitability of the company is likely to improve for the reasons outlined in this piece.

Value of stock (Seeking Alpha)

There are other ratios that suggest that Taseko is pretty good value relative to its peers, as the table below illustrates.

| Ratio | Freeport-McMoRan | Southern Copper | Taseko Mines |

| Return on Equity | 10.00% | 29.97% | 16.55% |

| Net Income Margin | 6.97% | 24.20% | 12.19% |

As you might expect for a relative newcomer, the differences lie in the level of indebtedness of the three companies.

| Ratio | Freeport-McMoRan | Southern Copper | Taseko Mines |

| Debt-to-Equity Ratio | 33.54% | 92.20% | 140.46% |

| Current Ratio | 2.35 | 3.31 | 1.97 |

Summary

Taseko Mines has a diverse portfolio of copper and niobium projects. The company’s main producing asset, the Gibraltar Mine, is the second-largest open-pit copper mine in Canada. Taseko is also developing other copper projects that are expected to be online soon.

The company’s financials have been positively impacted by rising copper prices, but it has had lower net income due to foreign exchange losses and increased finance expenses, which are not expected to be repeated for the next quarter.

Finally, the company’s stock appears undervalued compared to peers based on various financial metrics.

I do believe that I have talked myself into buying more of the stock.

Shared by Golden State Mint on GoldenStateMint.com