Excerpt from this week’s: Technical Scoop: Market Tumble, Golden Rise, Job Weakness

Source: www.stockcharts.com

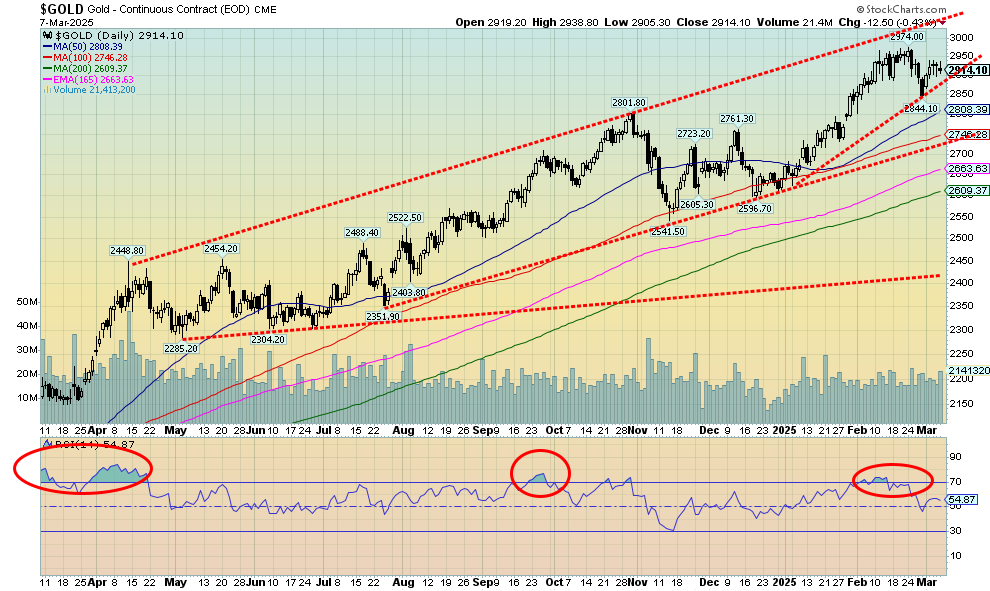

With a stock market in turmoil, trade wars with on again-off again tariffs (the yo-yo effect), huge uncertainty, the potential for the U.S. to fall into a steep recession, a breakdown in the West’s global order as the U.S. cozies up to Russia, potential loss of confidence in government, everything is being upended. Add in a sinking dollar and indications that the job market is tipping over and we have ideal conditions for gold as a safe haven. And this past week we got it with gold up 2.3%, even as the S&P 500 fell 3.1%. Gold up, stocks down. The new order of things?

At the recent high near $2,974 gold was somewhat overbought. The pullback has taken us back to neutral. No, we have not taken out the point where gold would be telling us we should take out the $2,974 high. That point comes to the fore over $2,944. Nonetheless, we have to be encouraged by the action. Elsewhere, silver gained 4.2% this past week, platinum was up 3.1%, while the near precious metals saw palladium gain 4.8% and copper up 3.5%. Copper, a leading indicator, closed at $4.71 and now $5 is in its sights.

Central banks continue to accumulate gold (but not the U.S.). They may be selling U.S. treasuries to pay for it. China’s central bank PBOC has been a steady buyer, continuing purchases for the fourth successive month.

Gold has also been flooding into the U.S. market, especially from London as buyers are looking to avoid tariffs on it going forward. It is not being imported for consumption purposes; rather, it’s being imported for stock piling and a safe haven. Gold, which is real, gives credence to a fiat currency knowing there is something there besides a promise (empty) to pay. And, no, cryptos are not the answer, despite the Trump administration’s attempt to create a crypto reserve. Cryptos, like fiat currencies, are merely a digital promise. They buy nothing (okay, little) and remain a favorite for money launderers and hackers looking to steal your cryptos.

Gold is back over $2,900 and we’d like to see gold hold that level. New lows below $2,844 spell trouble so we do not want to see that. All signs point to higher gold prices. We still have targets up to $3,600, but let’s get through $3,000 first. Economic uncertainty and geopolitical uncertainty—these conditions are ideal for gold. No wonder it has been the best-performing asset (setting aside Bitcoin) since November 5, 2024.

Source: www.stockcharts.com

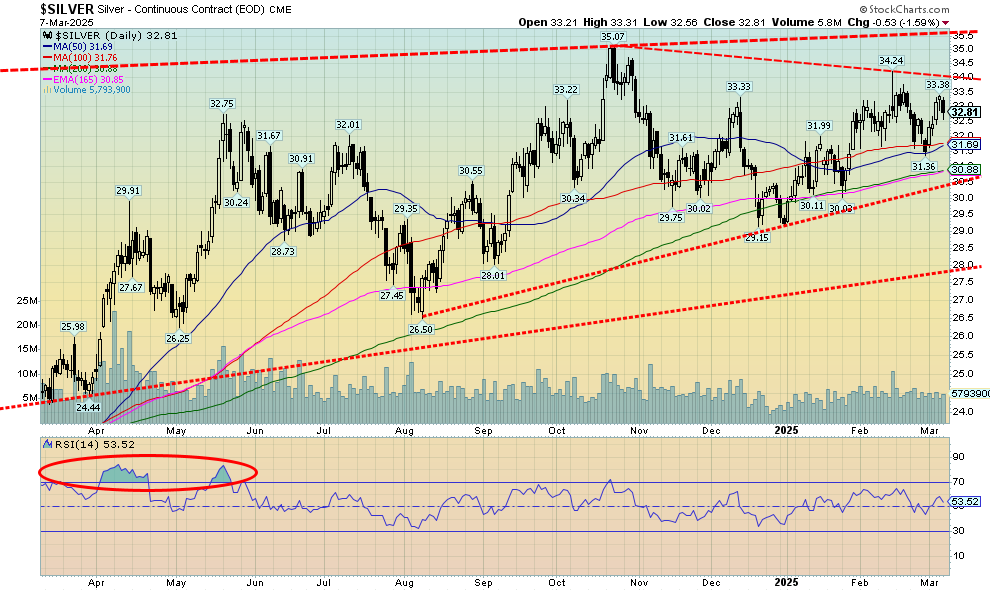

Silver continues to frustrate. That’s setting aside predictions from numerous pundits, including well-known mining guru Eric Sprott, that silver is set to explode with potential targets as high as $200. Right now, even the all-time high seen in 1980 and again in 2011 near $50 seems distant. Silver can’t get out of the way of itself. Stories of supply shortages and more seems to have little impact. Others say shortage, what shortage? When we adjust those two highs for inflation, silver needs to reach $70 to equal 2011 and $193 to equal the 1980 high.

No wonder Sprott and others are calling for $200 silver. All it is, is the equal of the 1980 high on an inflation-adjusted basis. The infamous gold/silver ratio currently sits at a lofty 89. That’s a lot closer to the all-time high of 120 seen during the pandemic scare in 2020 than to the low of 29 seen in 2011 when both gold and silver topped out at the time at record highs. We’ve talked about the potential top in the gold/silver ratio until we are blue in the face, but still the topping pattern has not proved fruitful. However, with gold at record prices near $3,000, silver becomes attractive on a relative basis. It also has more upside potential if it can get out in front of itself, given how expensive gold is. Silver needs to break above $34 to suggest new highs above $35. At the same time, we would not like to see a pullback that takes out $31. The most recent high was $34.24, and at $32.81 we still need to see a break above $33.55 to suggest new highs above $34.24. We’re waiting.

Source: www.stockcharts.com

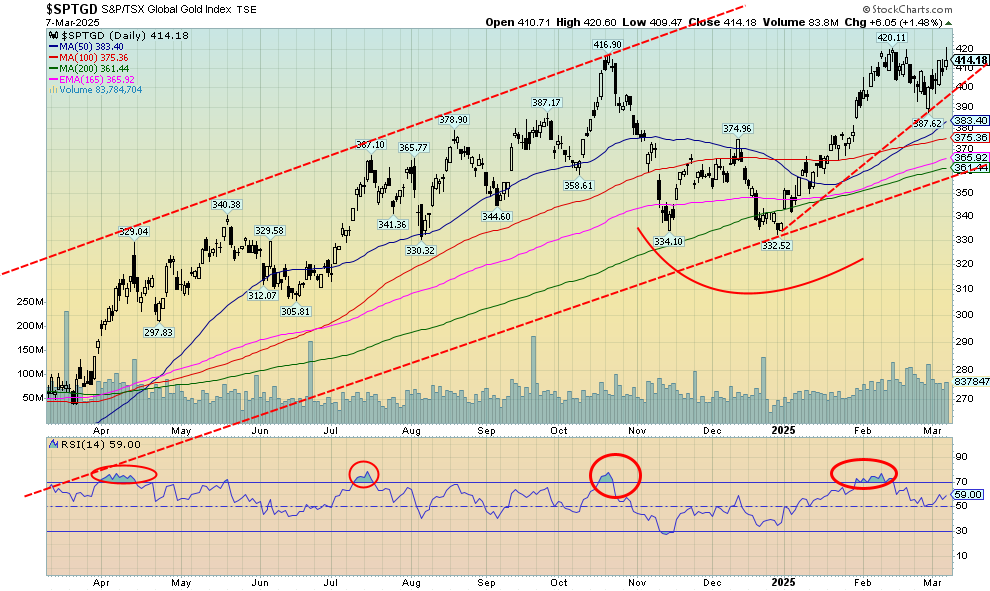

Gold stocks on the move? We have already passed the point that would suggest we should see new highs soon. Despite the weakness in the stock market, gold and gold stocks were up on the week. The TSX Gold Index (TGD) gained 3.5% while the Gold Bugs Index (HUI) did better, up 4.5%. They are now up 23% and 18.6% respectively so far in 2025. Hardly anyone is close. The recent pullback has helped create a potential uptrend line. It breaks if we go back under 400. The pullback took the TGD from overbought back to neutral. It never got oversold. That could be a positive development. Nonetheless, we need to see new highs, hopefully this coming week. We are only 9% under the 2011 now. But that’s on a nominal basis. On an inflation-adjusted basis we remain almost 34% under the 2011 high. We’ve already passed the point that suggests we should make all-time highs above the nominal basis top of 455 seen in 2011. So, there is lots to be optimistic about. We’re even seeing some signs of life in the junior gold mining stocks that dominate the TSX Venture Exchange (CDNX). What we haven’t seen is a wholesale move towards them. Any strong move towards these junior stocks could quickly result in doubles, triples, and even 10-baggers in a hurry. It’s a thin market. But they have what the seniors need: more resources.

Disclaimer

David Chapman is not a registered advisory service and is not an exempt market dealer (EMD) nor a licensed financial advisor. He does not and cannot give individualized market advice. David Chapman has worked in the financial industry for over 40 years including large financial corporations, banks, and investment dealers. The information in this newsletter is intended only for informational and educational purposes. It should not be construed as an offer, a solicitation of an offer or sale of any security. Every effort is made to provide accurate and complete information. However, we cannot guarantee that there will be no errors. We make no claims, promises or guarantees about the accuracy, completeness, or adequacy of the contents of this commentary and expressly disclaim liability for errors and omissions in the contents of this commentary. David Chapman will always use his best efforts to ensure the accuracy and timeliness of all information. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor or portfolio manager such as Enriched Investing Incorporated before proceeding with any trade or idea presented in this newsletter. David Chapman may own shares in companies mentioned in this newsletter. Before making an investment, prospective investors should review each security’s offering documents which summarize the objectives, fees, expenses and associated risks. David Chapman shares his ideas and opinions for informational and educational purposes only and expects the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor such as Enriched Investing Incorporated. Performance is not guaranteed, values change frequently, and past performance may not be repeated.

Shared by Golden State Mint on GoldenStateMint.com