It would be concerning if it weren’t so predictable. When disinflation stalled during the first quarter of this year, the bear camp insisted that the Fed would have to keep short-term interest rates higher for longer. They raised doubts about any rate cuts this year, due to “sticky” inflation and an economy that was far too strong. The signs that growth would slow, and that the disinflationary trend had reasserted itself were clear then, but not convenient for those who had a more negative outlook for the markets and economy.

Fast-forward to today, when both have come to pass, and the bearish narrative has pivoted to assert that the Fed has waited too long. Overnight, the economy is weakening so rapidly that a recession may have already started, and the summer pullback in stock prices is the beginning of a bear market. I could not disagree more, so let me persuade you otherwise, as I warned several months ago that fearmongering about inflation fears would shift to warnings about economic growth on the cusp of the Fed’s first rate cut.

Finvitz

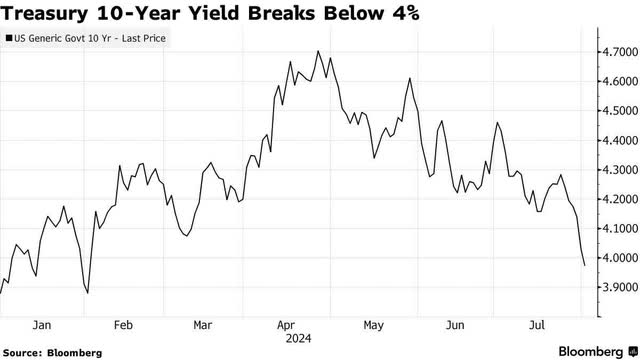

On Wednesday, investors celebrated the fact that Chairman Powell did not push back on market expectations for rate cuts to begin in September, and the major market averages soared. Yesterday, the major market averages gave back all those gains, plunging over concerns that the Fed did not cut rates this week. Bond yields also plunged, with the 10-year Treasury yield (US10Y) falling below 4%, while the 2-year (US2Y) fell to just 4.16% in response to two economic reports that were weaker than expected.

Bloomberg

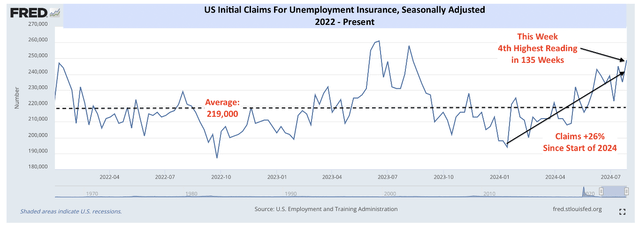

Initial unemployment claims rose last week by 14,000 to 249,000, which was 5% above the four-week moving average of 235,000 and the highest number since last summer. Additionally, continuing claims rose by 33,000 to 1.877 million. This caused major concerns, but claims have been rising, as we should expect with a softening economy, which is necessary to bring the rate of inflation down to target. Regardless, this number instigated fears that the economy is now weakening too rapidly.

DataTrak

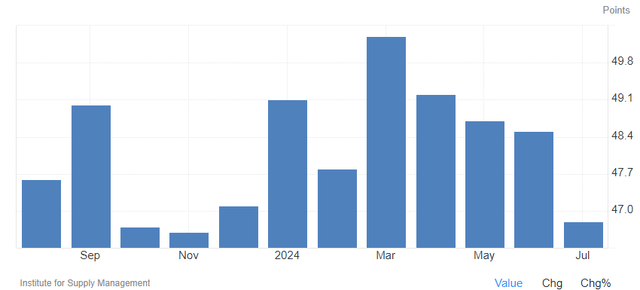

DataTrakThose fears were compounded by another dismal reading on the manufacturing sector, which has been idle for months. The ISM Manufacturing Purchasing Managers Index (PMI) fell from 48.5 to 46.6 in July, which takes it back down to levels last seen in October and November of last year. This reflects contraction in the sector, but it only represents 10% of economic activity, and it has been below the 50 level that marks growth for 20 of the past 21 months. I don’t see this as a fresh warning sign of impending doom for the economy.

TradingEconomics

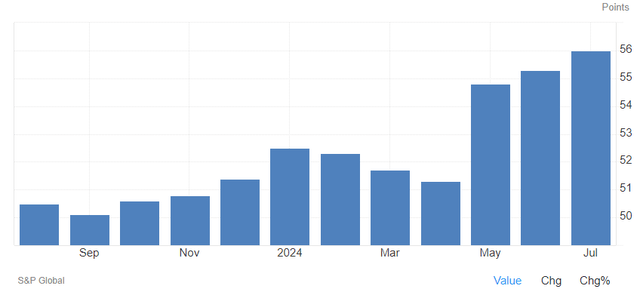

TradingEconomicsTo the contrary, the S&P Global Services Purchasing Managers Index (PMI) rose to a 28-month high of 55.3 in June, and the service sector dwarfs manufacturing in terms of its importance to the economy.

TradingEconomics

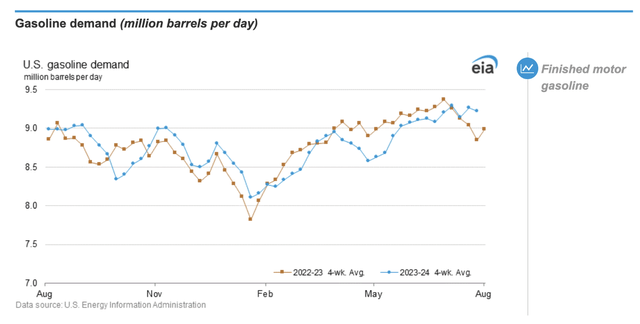

TradingEconomicsLastly, I’d rather focus on real economic activity to gauge strength than the surveys that are conducted. On that note, consider that the four-week average of gasoline demand in the US is running 4% higher than it was a year ago. That is a real-time pulse on consumer activity, and it shows strength rather than weakness. It also falls in line with the service sector survey conducted by S&P Global for July.

EIA

EIAWe are still in the process of a summer pullback instigated by the exodus from overbought technology stocks, due to disappointing earnings reports and outlooks from the Magnificent 7, as well as other AI-fueled momentum plays. This is coming at the same time the Fed is about to ease monetary policy, which is raising fears that the central bank has made a policy mistake and waited too long to ease. Yet, the selloff in technology stocks is not indicative of an economy in trouble, as investors have rotated from growth to value where earnings growth rates are just starting to improve.

This morning’s jobs report carries tremendous weight in the short term, given the concerns about economic growth. Yet, this initial estimate of how many jobs were created last month is far less important than the consuming activities of the existing labor force of 168 million.

Shared by Golden State Mint on GoldenStateMint.com