LilliDay

You simply can’t raise rates the most in recent history at the fastest pace in recent history on the most debt outstanding in history and not face consequences.” – ZeroHedge

There has been a noticeable change in the tone of the markets and the economy over the past few days as the drums of recession are starting to bang louder despite investors continued dreams of a ‘soft landing’. Here are some items I was watching that seem to be screaming that the probability of an upcoming recession is much higher than the current market is pricing in.

Labor Market Is Rapidly Deteriorating:

Let’s take a look at some of the recent data points showing rapid deterioration in the labor market.

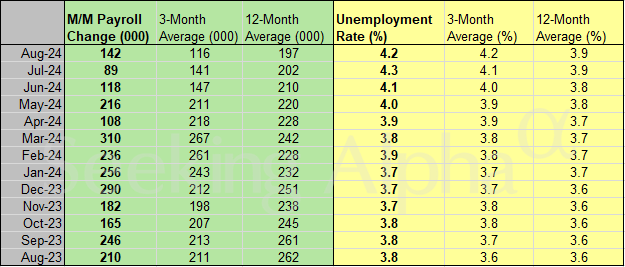

- Today’s BLS Jobs report came at 142,000 positions added, some 20,000 lower than the consensus. In addition, both June and July BLS jobs numbers were revised lower by some 86,000 positions in total.

Seeking Alpha

Seeking Alpha- The March 2023 through March 2024 job creation estimate was revised down late in August by the Bureau of Labor Statistics or BLS by 818,000 or 31% of their original estimation.

- Wednesday’s JOLTs report showed the fewest amount of job openings in the U.S. economy since January of 2021.

Federal Reserve Bank Of St. Louis

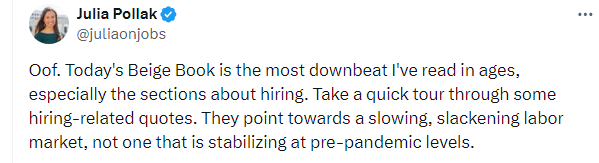

Federal Reserve Bank Of St. LouisA miserable Fed Beige Book Wednesday as it related to its labor component.

- Layoff announcements in August hit 15 year high for the month

- Hiring plans in August were down 21% from August 2023. YTD hiring plans of 80,000 lowest since 2005

- Thursday’s August ADP jobs report shows only 99,000 positions, far below the 140,000 consensus.

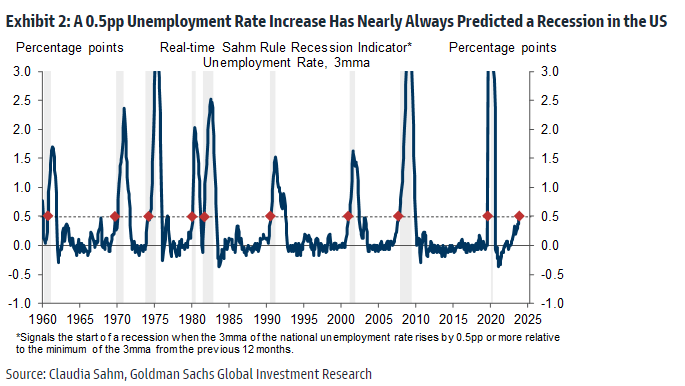

- Finally, the unemployment rate in July BLS jobs report ticked up to 4.3% from 4.1% in June and just 3.5% in June of 2023. It did tick down to 4.2% in August, but we are still in violation of the Sahm Rule, which has reliably happened before previous recessions.

Commodity Prices Falling:

Oil price per barrel – WTI (MarketWatch)

Oil price per barrel – WTI (MarketWatch)Commodity prices also appear to be signaling recession is dead ahead. Oil has sold off sharply recently and is now down for 2024, and right at its lows for the year. Not even a delayed in a planned OPEC production hike earlier in the week could bolster crude oil. And this is with continued tensions/conflict in Ukraine, Yemen and between Israel and Iran.

Copper price per lb. (MarketWatch)

Copper price per lb. (MarketWatch)‘Dr. Copper‘ is also signaling slowing economic growth, and the red metal is down some 20% from its recent highs in mid-May. Earlier this week, Goldman Sachs slashed its projection for the average FY2025 copper price by $5,000 a ton because of a slumping Chinese economy. Lumber prices have also tumbled.

Yield Curve Is Normalizing:

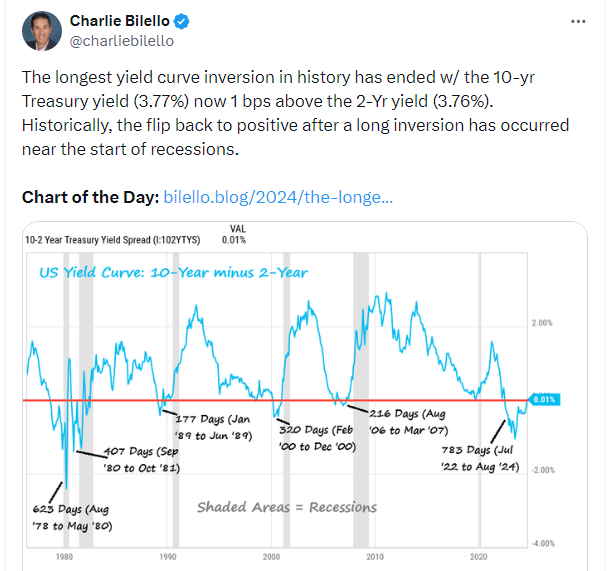

Charlie Biello (09/04) – Chief Market Strategist @ Creative Planning

Charlie Biello (09/04) – Chief Market Strategist @ Creative PlanningFinally, earlier this week, the spread between the two and 10-year Treasury yield ‘normalized‘ very briefly for the first time since June of 2022. This has been one of the longest yield inversions in U.S. history and this is something I am watching closely. It has signaled hard economic times are coming many times historically. One of the first articles I remember reading on Seeking Alpha back in early 2007 was around, warning how a prolonged inverted yield curve produces a subsequent recession. Let’s just say that observation was prescient and, unfortunately, largely ignored.

In late August, I put out a piece entitled ‘Five Market Predictions For September‘. One of these was that the Federal Reserve would be forced to cut the Fed Funds rate by 50bps because of a fast-deteriorating labor market. That was a bit of an outlier as far as predictions go at the time. However, according to futures this week, it is basically a coin flip whether Chairman Powell will cut 25bps or 50bps at the upcoming FOMC meeting.

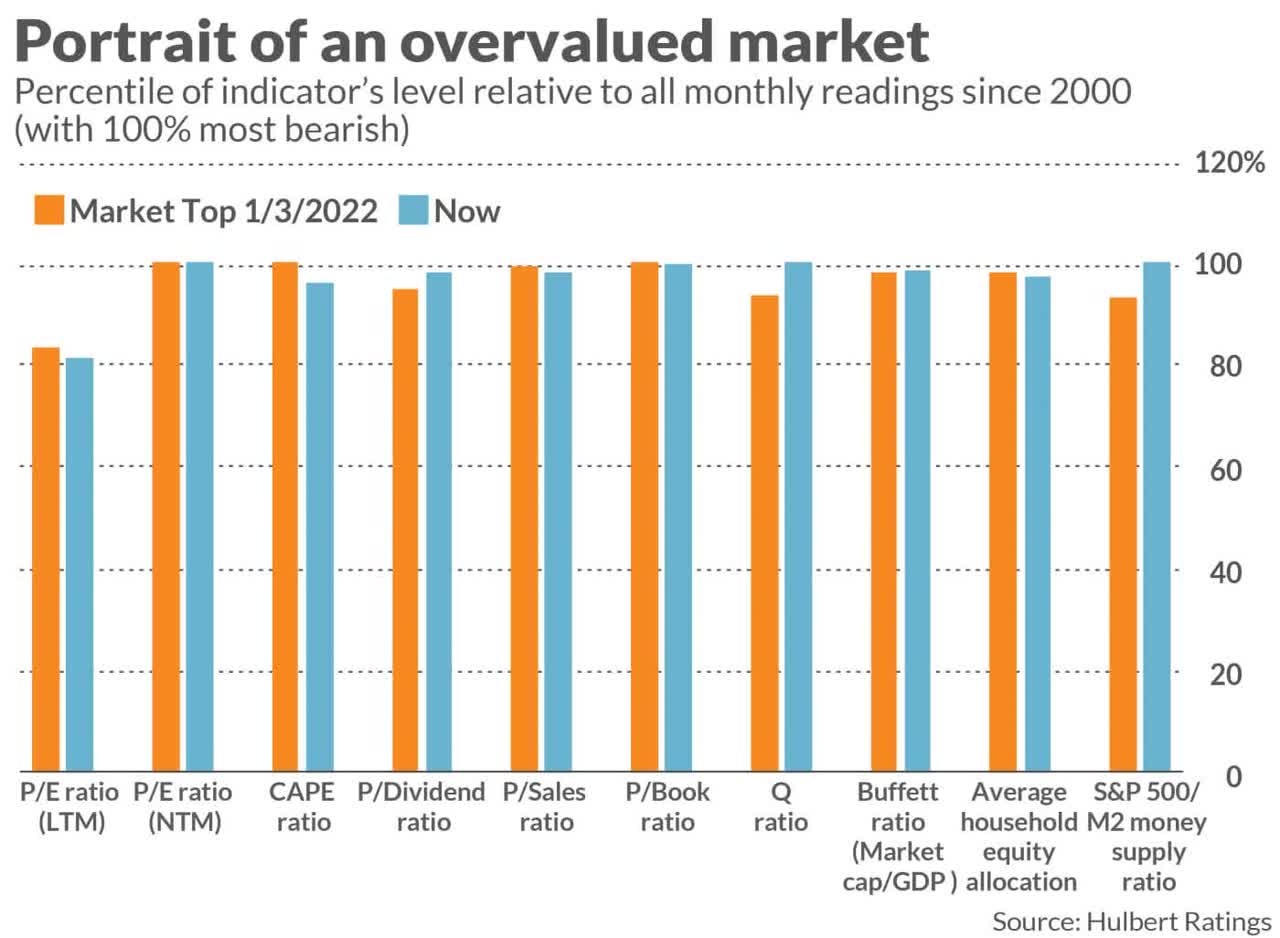

In summary, the chances of a recession have grown significantly in recent weeks. And with the market trading at some of the same extreme valuation metrics it was at the beginning of 2022, before a huge whoosh down for equities that year, investors are not probably pricing in this potential scenario.

Shared by Golden State Mint on GoldenStateMint.com