- The Fed has reported consecutive annual losses for the first time ever, with a $114.3 billion loss in 2023 and an estimated $82 billion loss in 2024.

- The losses stem from the Fed’s shift to an Ample Reserves Regime and interest rate hikes, leading to a negative Net Interest Margin since 4Q22.

- The Fed’s cumulative loss of $220 billion is hidden in a deferred asset account, delaying remittances to the Treasury until at least 2029.

franckreporter

The Fed is usually remarkably consistent.

Every year during the second week of January, going all the way back to 1997, the Fed announces their earnings for the period just ended.

They issue a press release, “Federal Reserve Board announces Reserve Bank income and expense data and transfers to the Treasury” for the prior year.

January 2024’s press release was slightly different in that it did not include the “and transfers to the Treasury“ portion. The reason for this exclusion is because for the first time in 108 years, the Fed lost money for the full year in 2023. Consequently, there were no transfers to the Treasury.

This year, however, well into the fifth week of January, the Fed has broken tradition completely and has excluded the entire press release. That is because the Fed lost money for the second consecutive year, for the first time ever. Either the Fed forgot to make the announcement, or they chose not to highlight their operating loss.

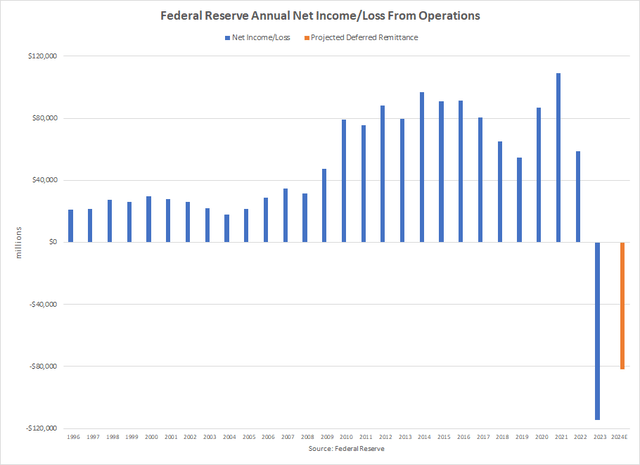

Federal Reserve Annual Net Income/Loss From Operations

During its long history, the Fed has been a money-making machine.

They have received a market rate of interest on their assets, and until recently, have not had to pay anything on their liabilities.

Over the twenty-seven-year period from 1996-2022, the Fed earned an average annual Net Income of $53.4 billion. By statute, net earnings are remitted to the US Treasury. This contribution to the Treasury’s coffers is recorded as a source of revenue to the Treasury, and is used to reduce the US Government’s fiscal deficit.

The Fed’s consistent earnings turned into an annual loss beginning in 2023. These are realized losses.

Why The Fed Is Losing Money

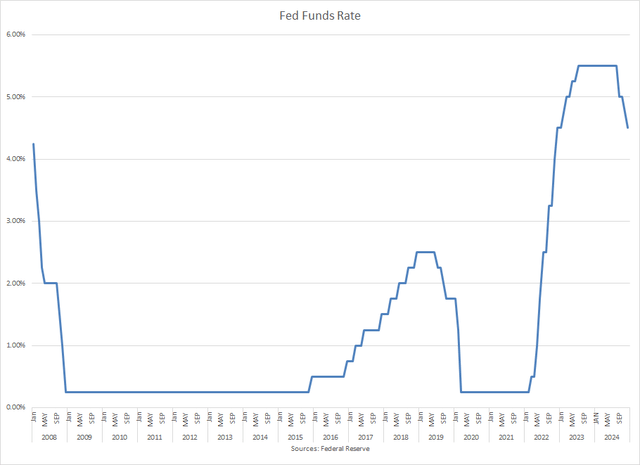

As I’ve discussed in previous articles, the Fed fundamentally changed their method of operations when they switched from their historical Scarce Reserves Regime, to their current Ample Reserves Regime, following the Great Financial Crisis of 2008. This was when they implemented Quantitative Easing (QE) One of the major changes was that the Fed began paying a variable rate of interest on some of their liabilities, namely their Bank Reserves and their Reverse Repurchase Agreements.

The other significant departure the Fed made was to start buying longer-term assets, such as Treasury Bonds and Mortgage-Backed Securities, instead of owning only short-term Treasury Securities.

These changes created an Asset/Liability Mismatch on the Fed’s Balance Sheet, whereby they owned fixed rate long-term assets, which were funded by variable rate liabilities. In implementing QE, the Fed took on significant interest rate risk, exposing themselves to a sharp rise in interest rates.

This risk was realized when the Fed began tightening in 2022 to combat the spike in inflation.

Their Net Interest Margin turned negative in 4Q22, and has remained negative ever since.

The consequence of the Negative Net Interest Margin is that the Fed lost $114.3 billion in 2023, and they lost an estimated $82 billion in 2024.

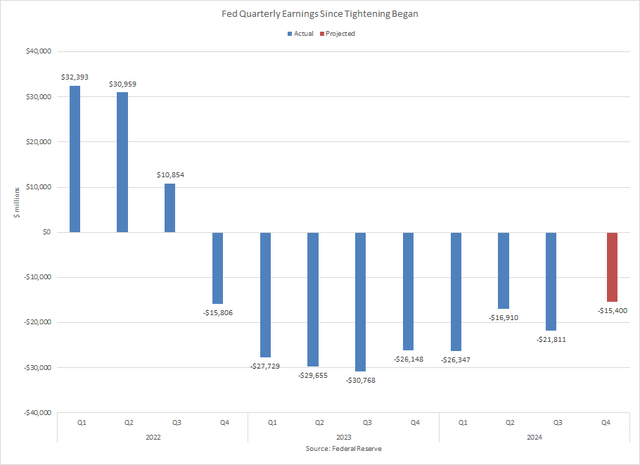

Quarterly Operating Results

The impact of the Fed’s changes in the Fed Funds rate can be seen in their quarterly earnings.

As the Fed began raising rates in early 2022, the Net Interest Margin began shrinking, and quarterly earnings started declining. In 4Q22, the Fed’s quarterly earnings turned negative.

As the Fed continued tightening through the first half of 2023, the Quarterly losses kept increasing. Throughout this period, the Fed was also shrinking their Balance Sheet as part of their Quantitative Tightening (QT) program. By the second half of 2024 when the Fed began cutting rates, the combination of lower rates and a smaller Asset/Liability Mismatch due to QT caused the Fed’s operating losses to also decline.

The Fed’s estimated $15.4 billion loss for 4Q24 is their smallest loss since they began losing money.

Deferred Asset Account

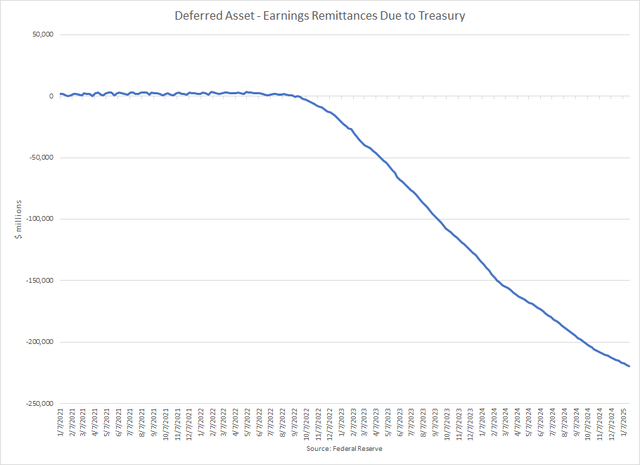

The Fed’s cumulative loss since they began losing money is currently $220 billion.

Since the Fed’s Total Capital is only $44 billion, the cumulative loss is large enough to completely wipe out the capital five times over.

The Fed is fortunate in that they use a very lenient accounting system that allows them to hide their losses in a deferred asset account called “Deferred Asset – Remittances to the Treasury.”

As the Fed’s operating losses accrue, the Deferred Asset account will only continue to grow.

When the Fed returns to profitability, the Net Income will be used to reduce the Deferred Asset Account. Only when the account turns positive will remittances to the Treasury resume.

Based on the Fed’s projections, this will not occur until 2029, at the earliest. As a result, the Treasury will be without the Fed’s contribution for at least another four years, and will have to make up for this loss of income. This cost is ultimately paid for by the taxpayers.

Conclusion

The Fed has been losing money on an operating basis for nine consecutive quarters, and these losses will continue for the foreseeable future.

In last year’s January press release, the Fed was very clear that “A Deferred Asset has no implications for the Federal Reserve’s conduct of monetary policy or its ability to meet its financial obligations.”

They have consistently remained sanguine that this is not a concern.

Yet, this year, the Fed has conveniently decided not to announce their losses.

While Chair Powell has tried to keep politics out of the Fed’s decision-making, his efforts have been strained recently due to the pressure the new administration has tried to exert on the Fed.

President Trump in the past has expressed his displeasure with Chair Powell, going so far as to indicate that he would like to fire Chair Powell. Although he has walked that back, President Trump, just last week in a speech before the World Economic Forum in Davos, demanded that interest rates “drop immediately.”

Perhaps the decision to not announce their 2024 operating loss is an attempt to keep this political pressure at bay.

Nonetheless, whether or not a preliminary earnings press release ever materializes, the Fed cannot hide their results. The Fed’s losses weaken their position as they fight to maintain their independence.

The Fed’s operating losses are significant, and may come to play a role in affecting their ability to conduct monetary policy.

Shared by Golden State Mint on GoldenStateMint.com