The major market averages rebounded during the first half of yesterday’s trading day on a better-than-expected GDP report for the second quarter, but the rally fizzled in the afternoon when technology stocks resumed their downtrend. The relentless selling in the sector that started the day after the Consumer Price Index (CPI) report for June was released on July 11 is probably closer to its end than just beginning. The sector was simply overbought, as the euphoria over the benefits of artificial intelligence (AI) reached a fever pitch, and the sector needed to revert to the mean.

Finviz

FinvizCoincidentally, investors were also looking for a good reason to broaden the bull market rally beyond technology, which came in the form of an extremely favorable inflation report, affirming the Fed will likely begin easing policy no later than September. That opened the floodgates to the ongoing rotation. The Magnificent 7 technology stocks and many other names in the sector that have been riding the AI wave were clearly exhibiting extreme valuations, but that is not the definition of a bubble, as many disgruntled bears are trying to claim. Nor is the correction in the sector a bubble bursting. Valuation is a horrible timing tool for markets, sectors, and stocks, as all can remain overvalued or undervalued for extended periods of time. To form a bubble, you need excesses in the economy and markets beyond the valuation of one sector, but they don’t exist.

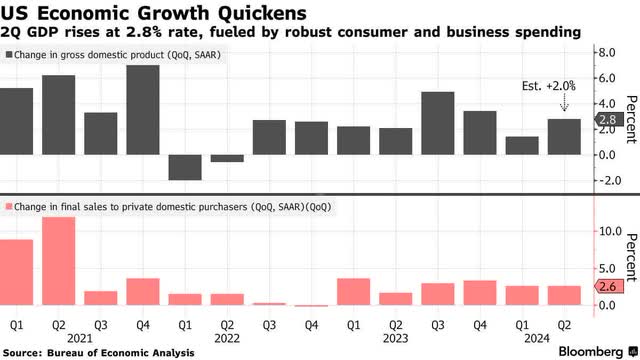

Bloomberg

BloombergThe economy proved its resilience once again by growing 2.8% in the second quarter, according to the initial estimate by the Bureau of Economic Analysis. That was well ahead of the consensus expectation for 2% growth, but it is important to note that inventory building contributed 0.8% to the overall number. Still, when we exclude inventories, government spending, and trade, which results in “core” growth, the number was a healthy 2.6%. Most importantly, consumer spending rose 2.3% and was the largest contributor to growth. Despite some signs of fatigue, the consumer is alive and well.

Bloomberg

BloombergThe GDP price index (inflation) increased at a 2.3% annual rate during the quarter, which should comfort the Fed as it embarks on an easing cycle, because it can ease for all the right reasons. The most important one is that the rate of inflation is gracefully falling to its target of 2% at a much faster rate than the Fed forecasted in its more recent Summary of Economic Projections.

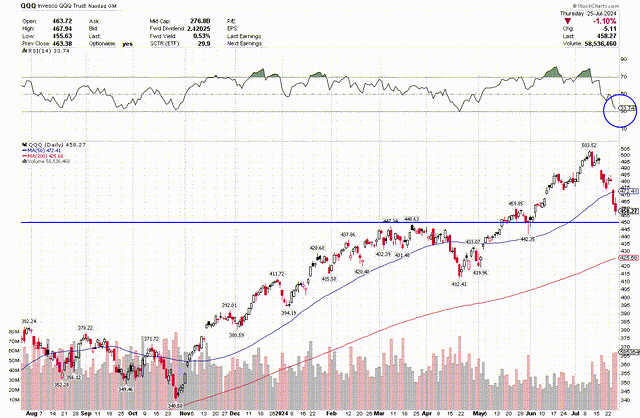

The soft landing taking place is the primary reason that the correction in the technology sector is probably nearing its end. I surmised last week that we would see a 10% decline in the Nasdaq 100 (QQQ), which would bring the index down to approximately $450 before we found support. That support would coincide with the Relative Strength Index (top of chart) falling from an extremely overbought 80-plus into oversold territory below 30. Yesterday, the index closed at $458, and the RSI fell to 33.

Stockcharts

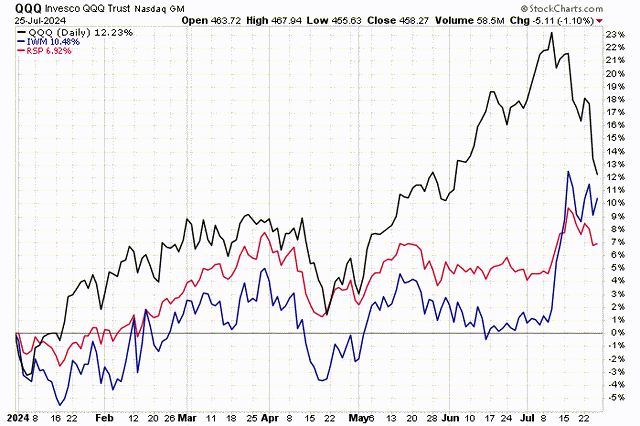

StockchartsWhile I think we are close, I am not inclined to load the boat on the largest technology names, and there is no guarantee we don’t see this index fall to a more deeply oversold level that tests the 200-day moving average at $425, although I see that as a low probability. Still, these companies need to grow earnings into what are still expensive stock prices, which means we probably see churn between here and their 52-week highs in the weeks and months ahead. Meanwhile, the rest of the market continues to narrow the performance gap, which has been my expectation all year long. This improvement in breadth is a sign of strength, reinforcing the foundation of the bull market. The Russell 2000 index (IWM) has nearly closed the gap with the Nasdaq 100 on a year-to-date basis. Portfolios that have been well diversified across market caps and sectors should be enjoying outsized gains as this rotation takes place.

Stockcharts

Stockcharts

Shared by Golden State Mint on GoldenStateMint.com