Last week, the Federal Reserve made a significant move by cutting its overnight lending rate by 50 basis points. This marks the first rate cut since 2020, signaling the Fed is aggressively supporting the economy amid a backdrop of softening economic data. For investors, understanding how similar rate cuts have historically impacted markets and which sectors tend to benefit is key to navigating the months ahead.

In this post, we will explore the historical market performance following similar 50-basis-point rate cuts, highlight the best-performing sectors and market factors after such cuts, and outline three critical risks investors should be aware of heading into year-end.

Historical Outcomes To Rate Cuts

A 50-basis-point rate cut, especially the first one, is an aggressive action by the Fed. The Fed historically uses such a sizable cut during economic slowdowns or rising recession risks. Here are a few notable examples:

- January 2001: Following the dot-com bubble bursting, the Fed cut rates by 50 basis points in January 2001 to stabilize the economy. While the S&P 500 initially rallied, the broader market eventually experienced continued declines due to the deepening tech recession.

- October 2007: In the early stages of the Global Financial Crisis, the Fed implemented a 50-basis-point cut to inject liquidity into the system. As credit markets imploded due to an accelerating mortgage crisis, the immediate response from the stock market was positive, but the underlying financial instability resulted in prolonged market weakness throughout 2008.

- July 2019: The Fed’s most recent rate cut was in July 2019, responding to concerns about global trade tensions and an economic slowdown. Again, the market initially rallied, with the S&P 500 posting positive returns in the months following the cut. That period is notable because the rate cut was more of a precautionary measure, as the most recent rate cut seems to be, rather than a reaction to an existing economic downturn.

This is just an analysis of the Federal Reserve’s most recent rate cuts. Reviewing the history of rate-cutting cycles back to 1960 reveals some interesting points. The table below shows the 3-month average of the Effective Fed Funds Rate, the total decrease during a rate-cutting cycle, and related market outcomes or events.

It is worth noting that while many analysts point to periods where the Fed cut rates and stocks initially rose over the next few months to a year, in many cases, those rate cuts preceded more significant events, as shown in the chart below.

The 1995 Analogy

For example, many analysts point to 1995 as a similar period to today, when the Fed initially cut rates, and the market continued to rise without realizing a recession. However, a difference between 1995 and today is the inversion of the yield curve. In 1995, the yield curve never inverted, signaling a healthy economy. As shown, the yield curve did not invert until 1998, and the Fed resumed its rate cuts with a recession following in 2000, triggering the “Dot.com” crisis.

It is not unusual for investors to see an initial positive response in the short term as they welcome the Fed’s efforts to stimulate economic growth. Furthermore, prevailing bullish sentiment and momentum continue pushing higher asset prices. As shown in the table above, the primary determinant of whether the market experiences a significant correction or not hinges on a recessionary impact.

Historically, performance over a six-month to two-year period is primarily dependent on whether the rate cut successfully stimulates the economy or if deeper economic issues persist. For example, in 2001 and 2007, the six-month performance following the rate cuts was negative due to underlying economic challenges, while in 2019, the market continued to perform well until the onset of the pandemic-related economic shutdown.

Given this background, where should investors focus their attention?

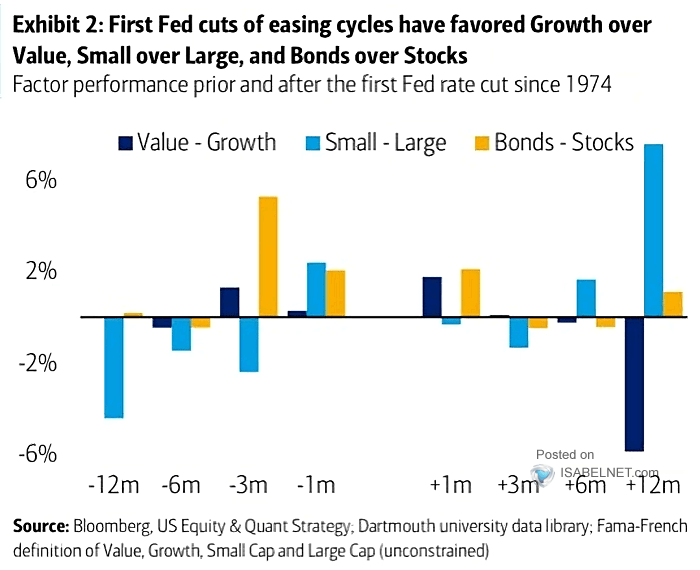

Best-Performing Sectors and Market Factors

When the Federal Reserve reduces interest rates, in this case by 50 basis points, the decline in borrowing costs tends to benefit different sectors and asset classes in varying ways. While there are many options, here are five areas to start your research based on historical trends.

- Large-Cap Stocks: Large-cap stocks, and in particular, the “Mega-cap” stocks, tend to benefit the most immediately after a rate cut. With strong balance sheets and the ability to access cheaper capital, they can expand operations, boost profit margins, and, most importantly, buy back shares. Furthermore, these companies are highly liquid and benefit more from passive indexing flows than small and mid-cap companies.

- Small-Cap Stocks: Speaking of small-cap stocks, they tend to see a delayed response. These companies primarily use floating-rate debt; lower borrowing costs improve their financial strength. However, they are more sensitive to economic cycles, so recessions remain an important risk. Investors favor large-cap stocks, but small-caps may gain momentum once economic conditions stabilize.

- Treasury Bonds: Bonds tend to perform well during interest rate cuts. Bond prices typically rise as rates fall, providing investors with capital appreciation. Longer-duration Treasury bonds historically perform as lower interest rates drive demand for fixed-income assets.

- Real Estate Investment Trusts (REITs): REITs benefit significantly from rate cuts, as lower interest rates reduce borrowing costs for real estate acquisitions and development. Additionally, REITs provide steady income through dividends, which become more attractive as bond yields decline.

- Gold: Gold tends to perform well during an interest rate-cutting cycle when the economy slips into a recession and the dollar weakens. However, gold has already had a tremendous run in anticipation of the Fed’s most recent rate cut, so much will depend on the strength or weakness of the dollar and economic outcomes.

Some Areas To Consider

With that information, and given the historical performance of various sectors and market factors following rate cuts, here’s how investors might consider positioning their portfolios:

- Large-Cap Stocks: Focus on high-quality, large-cap stocks that can benefit from lower borrowing costs and have a strong track record of weathering economic uncertainty. Companies in consumer staples, technology, and healthcare tend to perform well in rate-cut environments.

- Fixed Income: To capitalize on rising bond prices, consider adding exposure to long-term bonds or bond ETFs. Fixed-income investments provide stability and income, which can be particularly attractive in a low-rate environment.

- REITs and Income-Producing Assets: Look for opportunities in REITs and other income-generating assets, which benefit from lower interest rates and provide reliable cash flow through dividends.

- Small/Midcap Companies: Consider selective exposure to small and mid-capitalization companies that have low debt levels and strong balance sheets and pay a dividend.

Three Key Risks for Investors Post Rate-Cut

While there are potential benefits to a Fed rate cut, there are also risks:

- Presidential Election: Given the disparity between the current candidate’s economic policies, particularly around tax rates and deficit spending, there is a risk of market participants derisking ahead of the outcome. One key issue to focus on is the outcome of the congressional races. A bifurcated outcome between control of the House and Senate would be most favorable for Wall Street as it would limit any drastic changes to current economic and regulatory policies.

- Economic Recession: As noted above, the most significant determinant between rate-cutting cycles, market corrections, and bear markets is the onset of a recession. The markets will likely respond negatively if upcoming data shows significant deterioration, particularly in employment and services-related data. In such an event, sectors such as financials and cyclicals are particularly vulnerable to prolonged economic downturns, as banks may face higher loan defaults and reduced demand for their services.

- Geopolitical Risks: Geopolitical tensions, particularly around trade, energy supply, or global conflicts, can exacerbate market volatility. External shocks such as escalating trade wars or energy supply concerns can weigh on investor sentiment and disrupt global markets even with lower rates. For instance, disruptions in the oil market or increased trade tensions with major economies could derail the positive effects of rate cuts.

- The Japanese Yen: In August, we discussed the impact of the “Yen Carry Trade” on the financial markets. That risk has not subsided, particularly should the Bank of Japan continue to hike interest rates while the rest of the world is cutting them. Such a move by the Bank of Japan would likely create another spike in the Japanese yen, creating another “margin call” for those highly levered positions held by Wall Street.

Conclusion: Navigating the Market Post-Rate Cut

The Federal Reserve’s 50-basis-point rate cut signals a proactive effort to support the economy amid potential risks. Historically, the S&P 500 and various sectors have responded positively to rate cuts in the short term, with large-cap stocks and bonds often leading the way. However, investors should remain cautious of risks such as the upcoming election, recession, geopolitical tensions, and the Japanese Yen that could impact market performance in the coming months.

At RIA Advisors, we remain allocated to the equity markets as momentum, relative strength, and the overall trend remain bullishly biased. However, we continue to regularly implement risk management protocols, evaluate opportunities, and closely watch the incoming economic data.

While everyone is trying to guess how this turns out, history suggests exercising some caution seems prudent. For us, it is always preferable to err on the side of caution. While it is easy to reallocate cash into equities, it is much more difficult to recoup losses.

Trade accordingly.

Shared by Golden State Mint on GoldenStateMint.com