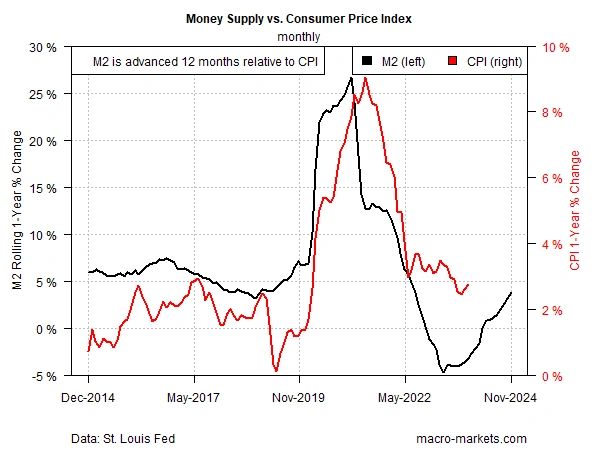

Year-over-year growth in US broad money supply continued to accelerate through November. The 3.7% annual pace marks the fastest pace in nearly 2-1/2 years. Although the upside trend is still below the pre-pandemic growth rate, momentum appears set to push the annual change higher still in the near term. The rebound in money supply growth comes at a tricky moment for the Federal Reserve, which is attempting to navigate between two conflicting trends: slowing economic growth and sticky if not rising inflation.

The Consumer Price Index ticked higher for a second straight month in November, advancing 2.7% vs. the year-ago level. Although there’s room for debate about whether CPI will continue to march higher, hold steady or resume its recent slide, this much is clear: the Fed has yet to achieve its 2% inflation target. Using the M2 trend as a forecasting tool suggests that inflation will likely hold steady or edge higher in the months ahead.

A complicating factor that potentially strengthens reflationary headwinds this year: the Trump 2.0 economic-policy agenda, which is expected to potentially prioritize sharply higher tariffs, tax cuts, deregulation and deporting millions of immigrant workers. It’s unclear how aggressively the incoming administration will pursue each of the items on its agenda, but economists advise that the overall mix is expected to be inflationary in some degree.

Another potentially problematic development is rising government debt, which could also fan inflationary winds.

Notably, the US Treasury market seems increasingly focused on these risks. As of this writing (mid-afternoon trading on Jan. 7), the benchmark 10-year yield rose to roughly 4.7%, the highest since May. Recalibrated inflation expectations to the upside are reportedly a key factor.

Fed funds futures appear to be pricing in high odds that the central bank will leave its target rate unchanged at a 4.25%-4.50% range at the next policy meeting on Jan. 29. The question is whether incoming inflation data will persuade the Fed to start raising interest rates again? Using the one-year M2 money trend as a guide suggests that inflation looks increasingly likely to hold steady or edge higher, which implies that the Fed will be forced to pause on rate cuts for the foreseeable future.

If a firmer inflation forecast proves accurate, and employment growth continues to downshift, the Fed will find itself between a monetary rock and hard place in the months ahead, which is to say that it will be forced to choose between prioritizing a more robust period of inflation-taming decisions vs. supporting a softening labor market.

Shared by Golden State Mint on GoldenStateMint.com