The 2016 Presidential Election is looming near, giving rise to many questions about the future of the country. Election years are known to breed unrest and scrutiny of the country’s financial situation, and this tumultuous presidential election is proving to be no different. Investors never enjoy uncertainty, and election times offer more questions than answers, especially with two main candidates that have such differing views. There has previously been a trend showing gold prices that correlated with the election cycle. The 2016 presidential elections, and how they will affect the price of gold, is proving to be even less predictable.

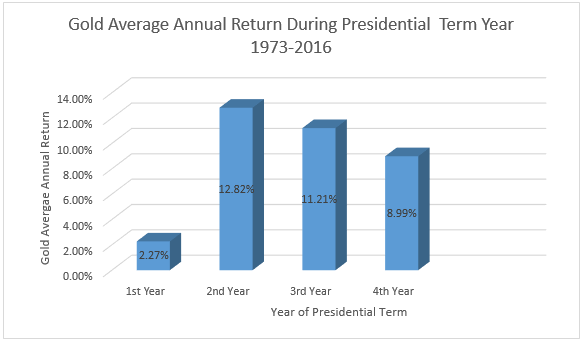

Historically, the price of gold has been seen to drop before an election, and then begin to rise in the following years. This “presidential election cycle theory”, which was explained by Yale Hirsch, a market historian, says that stock market trends can be predicted based on the four-year presidential term[i]. Even more specifically, markets tend to fall the most in the last year of a president’s second term. It is believed that one of the reasons for the trend is related to presidential policy. Unpopular reforms, such as spending cuts, and curbing inflation, are often implemented in the beginning of their term. Approval ratings are still high, and they are not campaigning for their next election. As their second-term election campaign approaches, incumbent presidents try to stimulate the economy and keep the public focused on good economic news to be reelected. This is often why stocks tend to see an above-average increase during the year preceding an election year, as increasing equity prices and a booming economy shed positive light on the incumbent political party. Moreover, as the predictability of government policy rises with time after the elections, investors are more eager to take risk.

Source: Federal Reserve Bank of St. Louis

In 2004, 2008 and 2012, the 12-month periods leading up to each election have all resulted in a drop in gold prices just prior to the election. In March of 2008, gold reached more than $1,000 an ounce and then dropped to $740 in the election month of November.[ii] In the final year of an election cycle, average market returns were 6.1%, falling to negative territory during a president’s final term[iii]. Overall, only 5 presidents in history have seen equities rise more than 50% during their term. The exclusive club includes recent Democratic leaders, Bill Clinton and Barack Obama. Meanwhile, Herbert Hoover and Richard Nixon saw the biggest drop-offs in presidential history largely due to the Great Depression and Watergate Scandal, respectively.

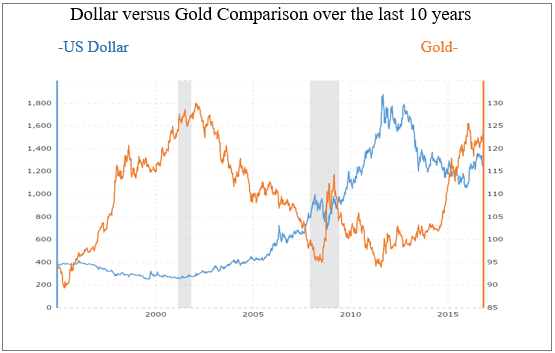

The price of gold is affected by many factors, not just election cycles. Gold is often viewed as being a hedge against volatile markets, and a good investment during inflation. There is often an inverse relationship with the U.S. dollar (as the dollar’s value rises, it takes fewer of those dollars to buy the same amount of gold); an inverse relationship with stocks, and an inverse relationship with bond yields.[iv] The strength of the US dollar, in these times of political uncertainty, is coming into question. Another factor that will affect the price of gold is the uncertainty surrounding the raising of interest rates. While Fed officials insist they are not considering the political consequences of increasing rates, it seems they are hesitant to act before the November election out of concern for the economic consequences of political turbulence. It is quite similar to the way they hesitated before Britain’s referendum in June on its membership in the European Union[v]. Following the referendum, gold jumped from US$1,268.60 an ounce on June 22nd to US$1,374.74 on July 10th. With the growing potential for a December interest-rate hike by the Federal Reserve, institutional investors are backing away from gold in favor of the potentially higher-yielding sovereign bonds.

Source: Daily LBMA fix gold price with the daily closing price for the broad trade-weighted U.S. dollar index over the last 10 years.

The election does not represent the sole factor in determining gold prices, but it can definitely play a huge role. Regardless of which candidate you side with, the election outcome will affect economic outlooks, which will have a direct impact on how the price of gold will fare.

[i] http://www.nasdaq.com/investing/glossary/p/presidental-election-cycle-theory

[ii] https://www.sec.gov/Archives/edgar/data/756894/000119312512137603/d320681dex991.htm

[iii] http://www.nytimes.com/2016/09/13/business/economy/fed-interest-rates-lael-brainard.html

[iv] http://www.nasdaq.com/article/how-presidential-elections-affect-the-stock-markets-cm586601#ixzz4Ne3dF0d8

[v] http://www.cnbc.com/2016/09/28/whom-is-gold-voting-for-a-market-puzzle.html

All data and information provided is intended solely for informative purposes and is not intended to be considered individualized advice or investment recommendations. You understand that you are using any and all information available on or through this site at your own risk.