By Seema Shah, Chief Global Strategist

Federal Reserve (Fed) Chair Jerome Powell has all but confirmed that the rate-cutting cycle will commence at the next FOMC meeting on September 18. Financial markets are currently pricing in 100 basis points (bps) of cuts this year-potentially equivalent to a 50bps cut in September and 25bps cuts in both November and December-as the Fed gears up to ward off recession. Its success in piloting a soft versus hard landing will play a key role in dictating the path for U.S. equities.

Equity market reactions over previous Fed cycles

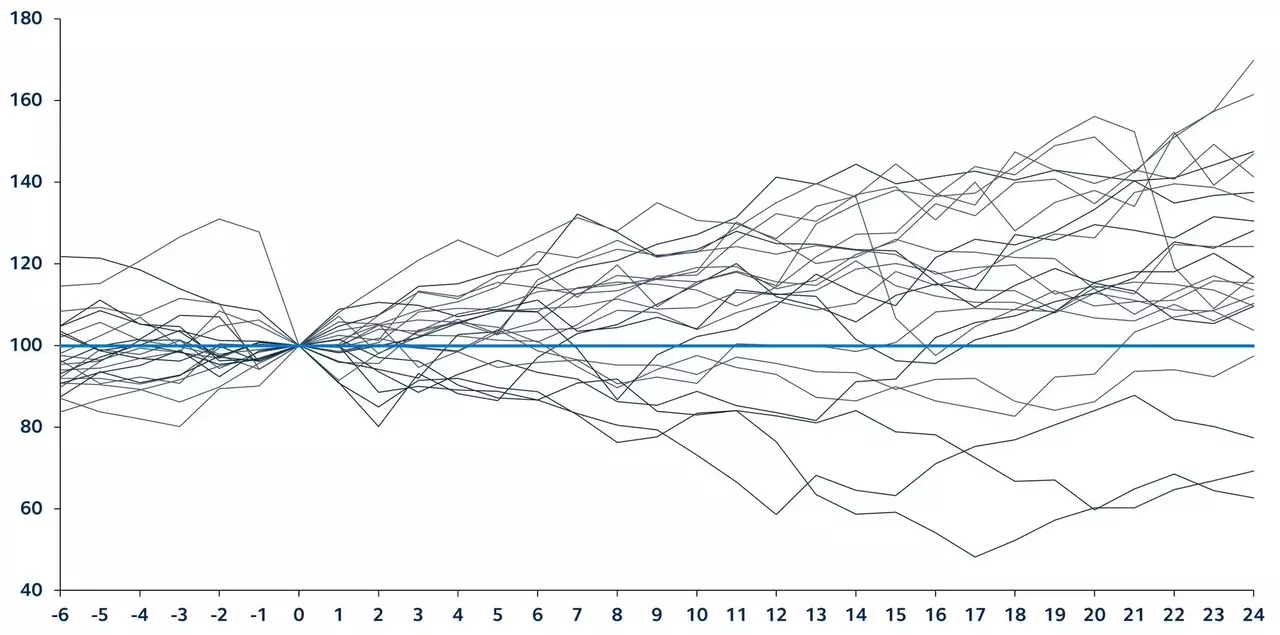

Popular belief appears to be that, historically, equities have struggled once the Fed begins to reduce interest rates. However, a closer look at the 23 Fed cutting cycles since 1970 reveals a more nuanced picture:(1)

- On seven occasions, Fed action sparked a market recovery within one month of the first cut.

- On two occasions, markets were already rallying in the run-up to the first cut as they started to price in imminent Fed action.

- On 16 occasions, markets were higher six months after the first Fed cut. On nine of those occasions, market gains were in double digits.

- On average, the market bottomed three months later and was 5% lower, after the first Fed cut.

However, solely looking at the average can be misleading. There has been a wide range of equity market reactions, with performance largely contingent on whether or not recession was avoided.

S&P 500 performance preceding and following the first Fed cuts across all cutting cycles since 1970

Month 0 = beginning of rate cutting cycle, rebased to 100 at month 0

Source: Bloomberg, Federal Reserve, Principal Asset Management. Data as of September 4, 2024.

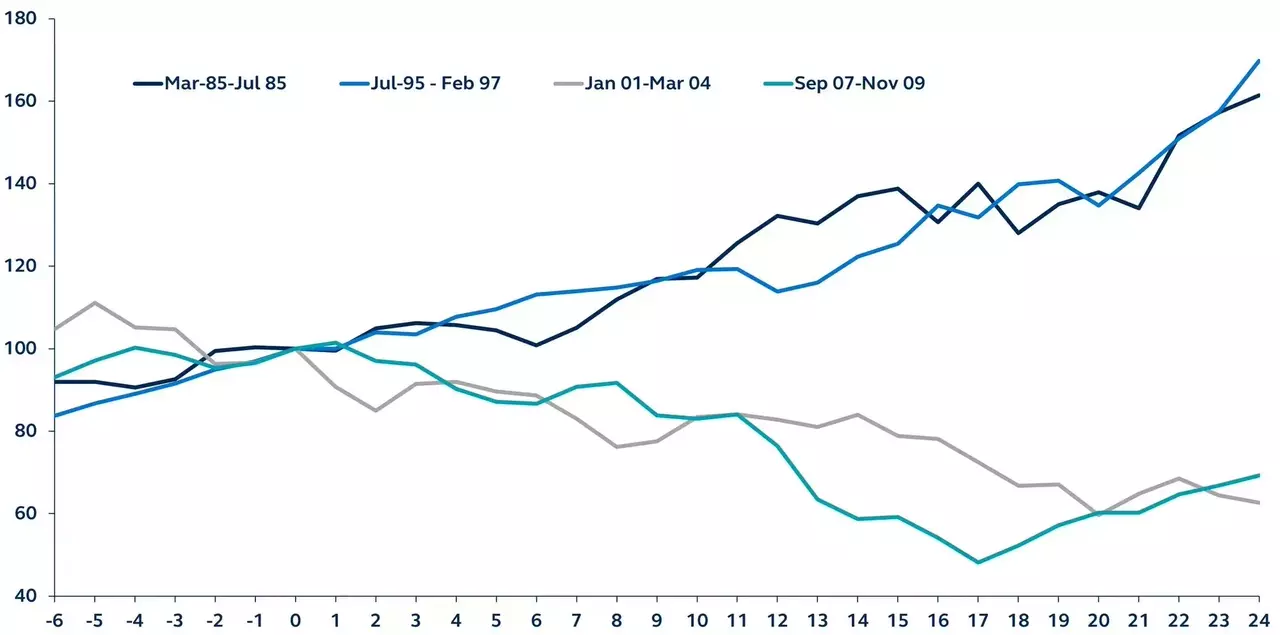

Source: Bloomberg, Federal Reserve, Principal Asset Management. Data as of September 4, 2024.In the 2001 and 2007 cutting cycles, spiking recession risk prompted the Fed to cut policy rates aggressively. Yet, despite the significant monetary easing, the U.S. economy could not avoid recession. In the 2007 cycle, 12 months after the first Fed cut, S&P 500 earnings per share were down 15%, and the market was down 24%. It took the S&P 500 around 17 months from the time of the first Fed rate cut to bottom, a few months before the U.S. economy exited recession.

By contrast, the 1995 cutting cycle was fairly shallow, with just 75 basis points of easing. The U.S. economy was beginning to show signs of cooling, but the unemployment rate was relatively low. Inflation pressures were contained, permitting the Fed to reduce the restrictiveness of monetary policy. One year after the first policy rate cut, the Fed had successfully navigated a soft landing and the U.S. economy had continued to expand. The S&P 500 earnings per share had risen just 6%, but this was enough to fuel a 14% gain in the overall S&P 500 Index. The 1985 cutting cycle followed a similar path, with the U.S. economy avoiding recession and the S&P 500 delivering a 32% gain within 12 months of the first Fed cut.

S&P 500 performance preceding and following the first Fed cuts in four select cutting cycles

Month 0 = beginning of rate cutting cycle, rebased to 100 at month 0

Source: Bloomberg, Federal Reserve, Principal Asset Management. Data as of September 4, 2024.

Source: Bloomberg, Federal Reserve, Principal Asset Management. Data as of September 4, 2024.These historic experiences suggest that, in Fed easing cycles where the economy continues to soften, unemployment rises, and earnings growth struggles, the market tends to struggle. Yet, during easing cycles where recession has been avoided and, as a result, earnings growth remains fairly robust, equity markets generally react positively.

The imminent Fed cycle

So far, the S&P 500 has responded fairly positively to expectations for imminent Fed rate cuts, supported by a recent stream of solid economic data, raising hopes that Fed action will be sufficient to ward off recession. However, a weak August payrolls report (released on September 6) could damage investor sentiment, leading markets to believe that the Fed has been too slow to ease monetary policy and has made a policy error.

Our analysis confirms that both economic activity and the labor market are undoubtedly slowing, and recession risk has increased. Yet, without any glaring household or corporate balance sheet vulnerabilities, Fed easing should be enough to prevent recession-there does not seem to be anything intrinsically broken that policy stimulus cannot fix.

If recession is avoided, history suggests that equities can extend their recent rally. Since 1985, five of the best 10 years for the S&P 500 came when the Fed was cutting interest rates without recession. The historical perspective should provide investors some optimism for the future of the market.

Footnote

[1] Only Fed cycles which lasted a minimum of four months were included.

Shared by Golden State Mint on GoldenStateMint.com